Everyone knows about Dan Sundheim, who is among the best investors of the past 20 years. His fund D1 runs $30bn+ w/ stakes in Stripe, Ramp, etc

What's less known is that Dan used to post his research on VIC in his early 20s ('02-'04)

A few takeaways from those writeups below 👇

What's less known is that Dan used to post his research on VIC in his early 20s ('02-'04)

A few takeaways from those writeups below 👇

Young Sundheim was focused on small caps/microcaps. Many of the best investors start out this way. Simpler businesses to understand, less competition, higher likelihood of massive mispricing.

He was not a "quality at any price" investor. Re-orgs, biz emerging from Chapter 11, etc. were common themes

As such, he wasn't going after compounders or looking to make multiples of money. He was looking for re-rates.

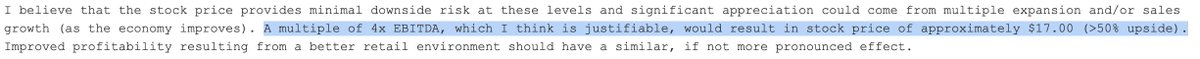

But still... can you imagine finding a legit business in today's environment where you just need it to re-rate up to 4x EBITDA to make 50%?

But still... can you imagine finding a legit business in today's environment where you just need it to re-rate up to 4x EBITDA to make 50%?

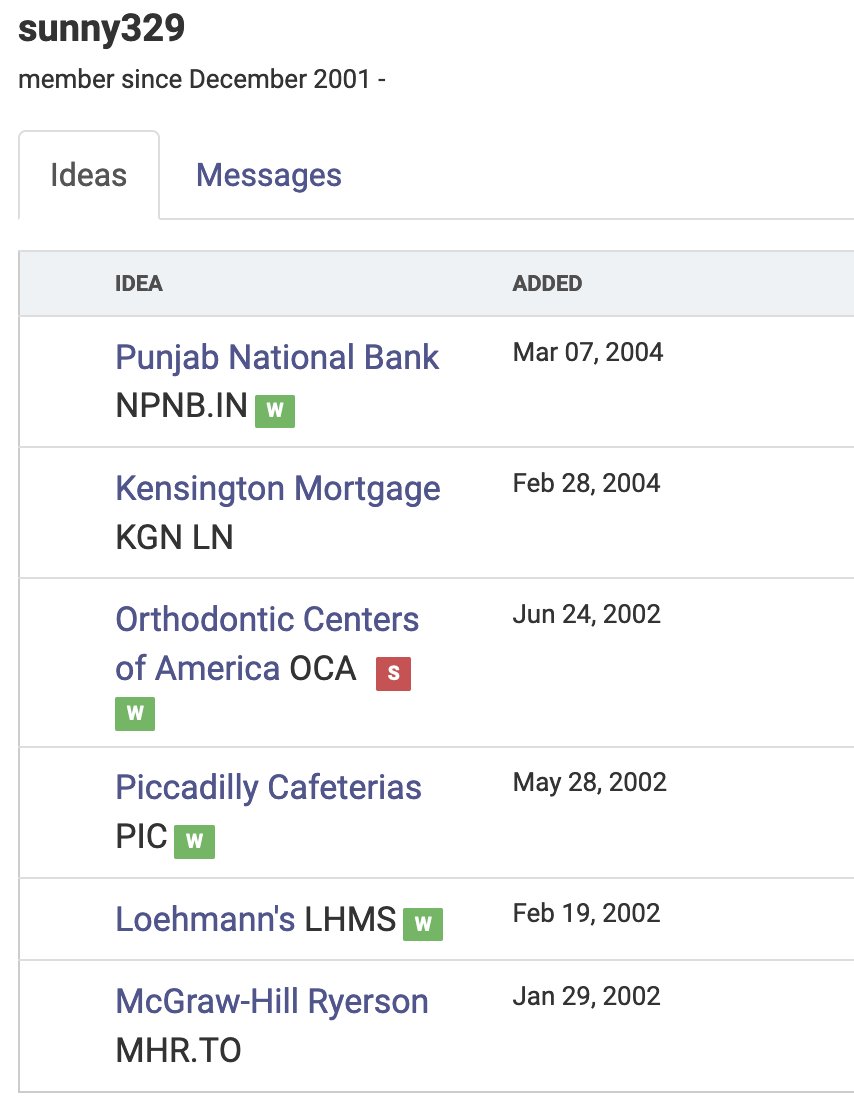

He was not focused on tech at all. His six VIC writeups are below.

An Indian state-owned bank, a mortgage originator, a cafeteria operator, a retailer, a textbook publisher, and of course, his short on Orthodontic Centers of America (OCA)

An Indian state-owned bank, a mortgage originator, a cafeteria operator, a retailer, a textbook publisher, and of course, his short on Orthodontic Centers of America (OCA)

Vs. D1's public book today, in which the top positions are:

Expedia, JD, Amazon, Microsoft, Datadog, Carvana, Snowflake, etc.

Expedia, JD, Amazon, Microsoft, Datadog, Carvana, Snowflake, etc.

Without getting into the details of his writeups, there are a few things that stick out to me:

(1) Microcaps --> larger biz pathway; microcaps are a great learning ground. Buffett, Lynch, Greenblatt, etc. all started in microcaps

(1) Microcaps --> larger biz pathway; microcaps are a great learning ground. Buffett, Lynch, Greenblatt, etc. all started in microcaps

(2) Flexibility --> good investors can go from paying 2.5x levered FCF for a so-so cafeteria operator to paying huge multiples for a biz like Ramp today

They can precisely tailor the premium they're willing to pay to the quality of the biz, and evolve their style to the time

They can precisely tailor the premium they're willing to pay to the quality of the biz, and evolve their style to the time

Many of Sundheim's Tiger Cub peers like Chase Coleman and Philippe Laffont were tech guys all along: they only ever picked tech names.

Unlike them, Sundheim pivoted into tech.

This is important b/c unless you're Coleman or Laffont and started in tech right before a 20-year supercycle, you'll need to pivot your approach to have a great 20 year record. This is much easier said than done.

This is important b/c unless you're Coleman or Laffont and started in tech right before a 20-year supercycle, you'll need to pivot your approach to have a great 20 year record. This is much easier said than done.

(3) Value of sharing your work. Dan got his job at Viking as a result of his VIC short report on OCA. Ten years prior, when VIC didn't exist, this couldn't have happened.

Great investing talent can come from anywhere, and the Internet is a great equalizer -- use it wisely.

Great investing talent can come from anywhere, and the Internet is a great equalizer -- use it wisely.

The writeups are available here: valueinvestorsclub.com/member/sunny32…

I highly recommend reading. You don't often get to peer inside the mind of a great investor so early in their career.

I highly recommend reading. You don't often get to peer inside the mind of a great investor so early in their career.

• • •

Missing some Tweet in this thread? You can try to

force a refresh