People seem to want my opinion on the Stanmore $SMR.AX BHP coal deal so I will give it.

I hate this transaction for a junior name like SMR.

1) SMR gets no benefit from crazy high current prices (ownership passes at closing). Diff than GLEN.LN deal for Cerrajon, etc....

I hate this transaction for a junior name like SMR.

1) SMR gets no benefit from crazy high current prices (ownership passes at closing). Diff than GLEN.LN deal for Cerrajon, etc....

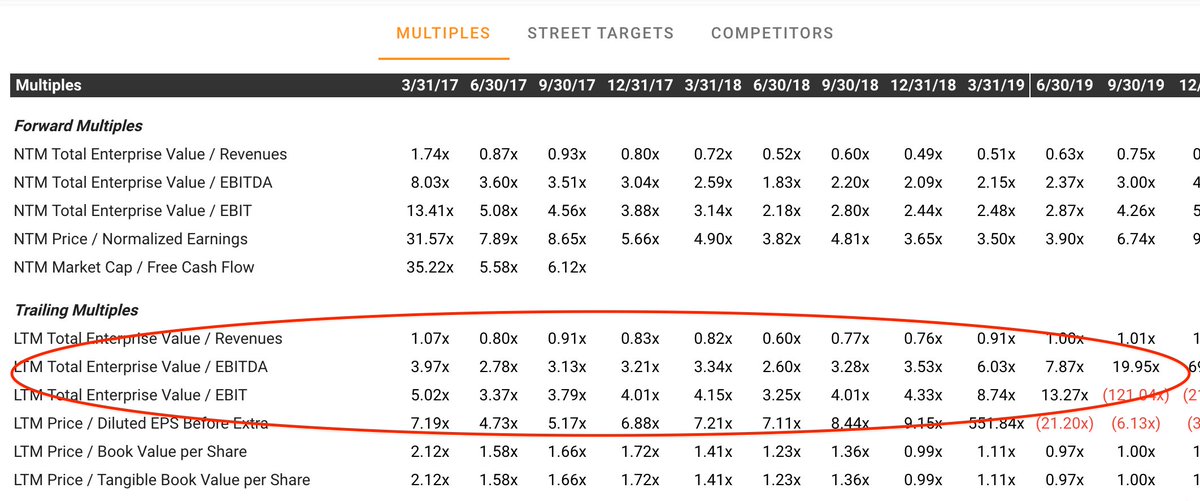

...so low multiple on current earnings power (2x run-rate EV/EBITDA) is illusory. Multiple is more like 4x+ avg EBITDA. Not cheap (for coal) and certainly a lot richer than $SMR.AX equity...

2) they are levering this w/ $625mm of debt against the asset. Maybe 2x normal EBITDA...

2) they are levering this w/ $625mm of debt against the asset. Maybe 2x normal EBITDA...

...which given the Indo topco owners, prob won't be cheap. 8% cost of debt? pretty decent chunk of normalized EBITDA less capex (say <$300mm)

3) FIRB review: this may be significant given Indo owners. If $SMR.AX can't close, seems like theres a break fee (undisclosed) but...

3) FIRB review: this may be significant given Indo owners. If $SMR.AX can't close, seems like theres a break fee (undisclosed) but...

...at say customary 2% of transaction would be ~$25mm USD. This is a big chunk of $SMR.AX mkt cap today so represents real risk.

4) Why is no one bigger buying these assets? I get the synergy argument but it feels like $SMR.AX paid up to get scale. Not sure why...

4) Why is no one bigger buying these assets? I get the synergy argument but it feels like $SMR.AX paid up to get scale. Not sure why...

In other words this smacks of Indo magnate empire building and a good deal for BHP (if they can close it).

No way Elliot would have paid 4-5x normalized EBITDA, let alone agreed to not get paid for W/C in the interim.

No position in $SMR.AX. Stock reaction today seems - wrong.

No way Elliot would have paid 4-5x normalized EBITDA, let alone agreed to not get paid for W/C in the interim.

No position in $SMR.AX. Stock reaction today seems - wrong.

• • •

Missing some Tweet in this thread? You can try to

force a refresh