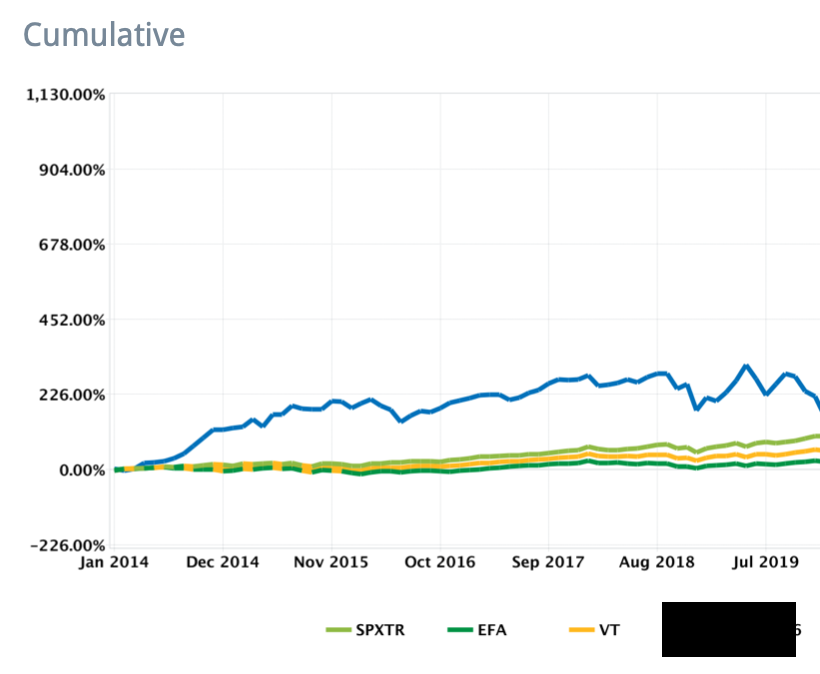

$690.DE $6690.HK UPDATE - I am giving up on the spread trade (last ~49% discount on the D-share).

Obvi this is a v disappointing outcome as the discount never closed to the levels I thought appropriate (20%).

I will try to unpack a little my thought process...maybe useful 🙇♂️

Obvi this is a v disappointing outcome as the discount never closed to the levels I thought appropriate (20%).

I will try to unpack a little my thought process...maybe useful 🙇♂️

When I wrote it up I expected two things to happen over the course of the year:

1) some less liquidity-sensitive portion of the natural HK/Asian shareholder base to gravitate towards the German line, and exchange liquidity for cheapness; and

2) some progress to be made from..

1) some less liquidity-sensitive portion of the natural HK/Asian shareholder base to gravitate towards the German line, and exchange liquidity for cheapness; and

2) some progress to be made from..

...the company towards closing the discount (via accretive buybacks/purchase by the parent Haier topco/maybe even the allowal of fungibility).

Looking back on it, I suppose it was perhaps presumptive to conclude the company/Haier topco would care about the discount...

Looking back on it, I suppose it was perhaps presumptive to conclude the company/Haier topco would care about the discount...

...even though they gave initial signs of doing so, by reinstating the topco purchase intention, before abruptly canceling it.

But I was more confident some Asian $$ would rather own the D-shares at a 40%+ discount for the exact same economic exposure.

This was just wrong.

But I was more confident some Asian $$ would rather own the D-shares at a 40%+ discount for the exact same economic exposure.

This was just wrong.

Whilst there may be hope here given the German IR has left the co, and there is some rumbling that the Ceinex may be shut down, I am simply unable to directly catalyze a fungibility event given the China topco here so am moving on to fresher pastures.

GLTA still involved 🙏🙏👊

GLTA still involved 🙏🙏👊

• • •

Missing some Tweet in this thread? You can try to

force a refresh