Noodling on this a bit more. $RE4.SI Geo Energy

One way to think about what the 'reasonable' valn is for any name w/ idiosyncratic risk like this (Indo tycoon taking away your assets, etc), is benchmark the asset against itself. Ie what have ppl been willing to pay in the past?

One way to think about what the 'reasonable' valn is for any name w/ idiosyncratic risk like this (Indo tycoon taking away your assets, etc), is benchmark the asset against itself. Ie what have ppl been willing to pay in the past?

https://twitter.com/puppyeh1/status/1445234228883382277

Then think, is the same company better or worse (credit, cap allocation, cap returns, governance, etc) versus the average past?

$RE4.SI traded at ~3.8x LTM EV/EBITDA in early 2021 on the basis of FY20 numbers. Last yr they still put up $57mm of EBITDA but no real net earnings...

$RE4.SI traded at ~3.8x LTM EV/EBITDA in early 2021 on the basis of FY20 numbers. Last yr they still put up $57mm of EBITDA but no real net earnings...

...and they still carried a bit of gross USD debt ($60mm) - a decent risk for a small-cap Indo co.

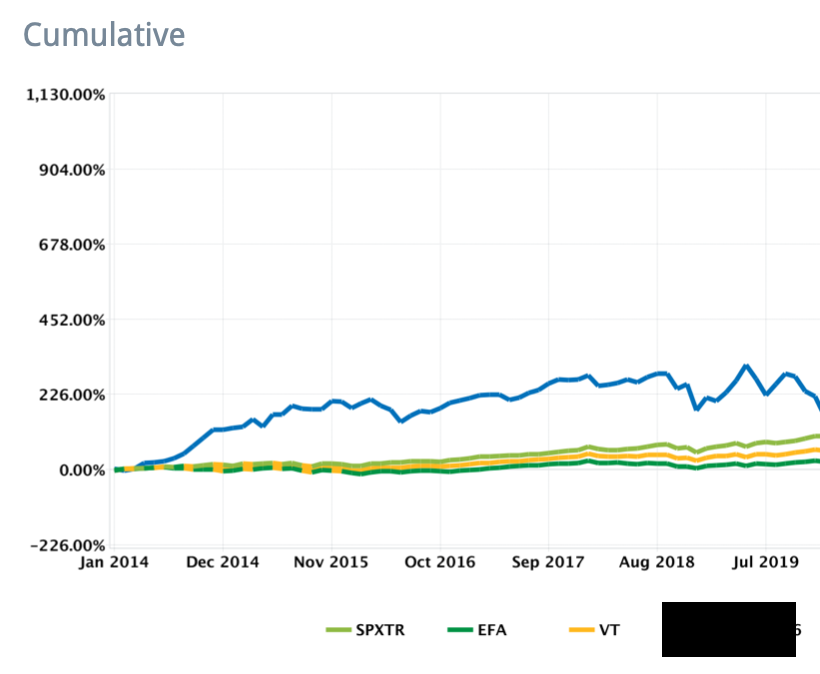

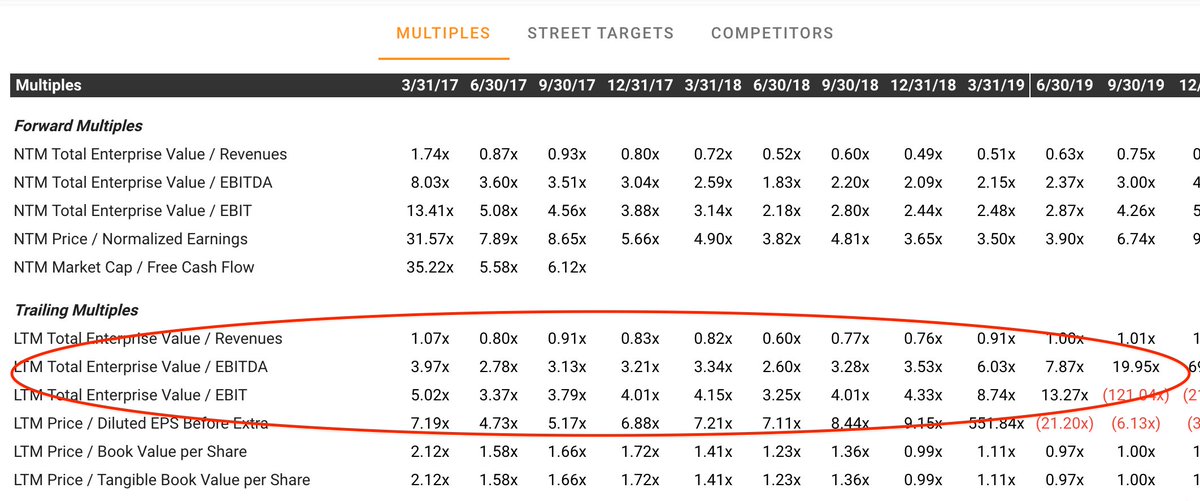

Simply using TIKR data, it looks like this shitco has generally traded 2.5-4x EV/EBITDA, on a LTM trailing basis. Avg looks like ~3-3.5x EV/EBITDA:

Simply using TIKR data, it looks like this shitco has generally traded 2.5-4x EV/EBITDA, on a LTM trailing basis. Avg looks like ~3-3.5x EV/EBITDA:

The point is, on its own merits, the mkt seemed willing to pay 3x EV/EBITDA or so, in isolation, when this co was much more levered (going back a cpl yrs).

Note also that during last coal bull mkt (late 2017/2018) this was also the case.

Note also that during last coal bull mkt (late 2017/2018) this was also the case.

It stands to reason, 3x EV/EBITDA on 'normalized' earnings power is a decent starter for valuation.

The Q ofc is what is normalized earnings and - more importantly - how long does it take to get there.

The Q ofc is what is normalized earnings and - more importantly - how long does it take to get there.

Going back to 2020. It was obvi a pretty shit yr, avg prices (for $RE4.SI coal which is v low quality) was $37/t, they made $57mm EBITDA on $307mm revs (18% margins). You can call that normal if you like...so say $165mm 'reasonable' base case valn. Prob vvv punitive, but OK.

But the EV today all-in is only $270mm and even w/ prices 50% lower ($60s/t ASP vs $120/t current spot) they were printing $26mm EBITDA in a month. At current spot MONTHLY EBITDA is very likely $50mm+

Meaning ofc you need just 2-3 months of prices >$60/t to make it work.

Meaning ofc you need just 2-3 months of prices >$60/t to make it work.

This is not an argument for $RE4.SI specifically. There are MANY coal, oil, gas names that look like this, of various stripes. but for the ones totally delevered and epically minting cash I think the mkt is wildly missing how quickly they can generate value to the equity.

There's a very real chance $RE4.SI makes 1/3 its mkt cap in cash before Xmas.

And they do have a 30% payout ratio, which implies a 25%+ div yield at the moment. They also mentioned buybacks...

And they do have a 30% payout ratio, which implies a 25%+ div yield at the moment. They also mentioned buybacks...

Proof is in the pudding I suppose. I'm all ears to hear cheaper implementations too.

But if you are bullish energy and think there are real shortages this winter (something I'm coming around on) - a basket of these seems v interesting...

DYODD, GLTA 🙏🙏

But if you are bullish energy and think there are real shortages this winter (something I'm coming around on) - a basket of these seems v interesting...

DYODD, GLTA 🙏🙏

• • •

Missing some Tweet in this thread? You can try to

force a refresh