$PLTR: Palantir’s 3Q Report:

Below is a short thread of my article on the important metrics I’ll be tracking. I'm fairly neutral.

+ 3Q Rev beat: $396M; >35% YoY

+ FY guidance

+ Foundry & Gotham business lines

+ Ent. Product GTM.

Let me explain: 1/n

seekingalpha.com/article/446637…

Below is a short thread of my article on the important metrics I’ll be tracking. I'm fairly neutral.

+ 3Q Rev beat: $396M; >35% YoY

+ FY guidance

+ Foundry & Gotham business lines

+ Ent. Product GTM.

Let me explain: 1/n

seekingalpha.com/article/446637…

2/

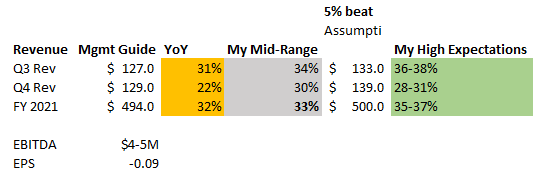

- Q3: 40% YoY would be Net $30M, 35% ideal

- Q4 Rev: $405M (>27% YoY) is a minimum.

- FY 2021: $1.6B which would be roughly 40% YoY would be great.

- Sadly, I expect high SBC Costs

- Gov't contracts should boost FY 21 based on recent contracts (Army, IDIQ)

Metrics below

- Q3: 40% YoY would be Net $30M, 35% ideal

- Q4 Rev: $405M (>27% YoY) is a minimum.

- FY 2021: $1.6B which would be roughly 40% YoY would be great.

- Sadly, I expect high SBC Costs

- Gov't contracts should boost FY 21 based on recent contracts (Army, IDIQ)

Metrics below

3/ Enterprise Clients is a BIG PART of my thesis:

Acceleration in the commercial would be HUGE. In Q2, they added 20 net new clients (booked $925M of contracts (175% YoY): Could we get around 190+ in Q3?

I'll watch Billings, RPO Growth, and Total Contract Value, ideally $4.0B+>

Acceleration in the commercial would be HUGE. In Q2, they added 20 net new clients (booked $925M of contracts (175% YoY): Could we get around 190+ in Q3?

I'll watch Billings, RPO Growth, and Total Contract Value, ideally $4.0B+>

4/ Enterprise Product GTM:

+ Foundry for Builders and Cryptocurrencies: Any plan to monetize after the recent beta's?

+ Channel partners?

+ Progress on Edge AI within existing enterprise clients?

I added some metrics to the metrics I'll be watching below

+ Foundry for Builders and Cryptocurrencies: Any plan to monetize after the recent beta's?

+ Channel partners?

+ Progress on Edge AI within existing enterprise clients?

I added some metrics to the metrics I'll be watching below

5/ Overall, I'd expect that considering the strong SaaS tailwinds in AI eg. $CFLT, $PLTR should show some of it

This article was focused on metrics, after the report, I'll write more on Tech & share thoughts. I'm neutral, we'll see what Q3 delivers🤞

Ty!

seekingalpha.com/article/446637…

This article was focused on metrics, after the report, I'll write more on Tech & share thoughts. I'm neutral, we'll see what Q3 delivers🤞

Ty!

seekingalpha.com/article/446637…

• • •

Missing some Tweet in this thread? You can try to

force a refresh