$UPWK Q3 Earnings Review:

The report was mixed. They laid the foundation for future growth opportunities amongst freelancers & enterprise clients.

Below is my full analysis after digesting the report:

The report was mixed. They laid the foundation for future growth opportunities amongst freelancers & enterprise clients.

Below is my full analysis after digesting the report:

1/ If you missed my initial pre-earnings analysis.

You can find out the key metrics that I was watching before hitting the thread -

You can find out the key metrics that I was watching before hitting the thread -

https://twitter.com/InvestiAnalyst/status/1453240079292452867?s=20

2/ The report was mixed. Let's begin with the negatives:

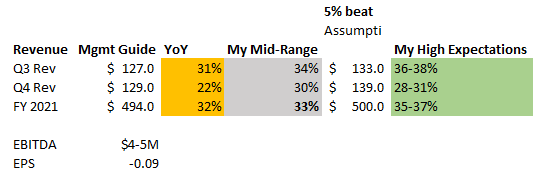

Top-line Revenue:

They were mostly in-line with expectations on the lower end. Weak boost

+38% GSV YoY

+31% Rev YoY

+Slow-down QoQ

+ No major $ Rev adds to Q4 & Full-year guidance.

Technically 1% beat. Disappointing.

Top-line Revenue:

They were mostly in-line with expectations on the lower end. Weak boost

+38% GSV YoY

+31% Rev YoY

+Slow-down QoQ

+ No major $ Rev adds to Q4 & Full-year guidance.

Technically 1% beat. Disappointing.

3/ Context to the weak Top-line Revs:

+ Q3 is summer for vacations, so most freelancers are not actively dealing with companies

+ Tough comps for guidance, but not strong

+ As a result of freelancers falling into a lower fee tier, this slowed down marketplace rev (Exhibit 2)

+ Q3 is summer for vacations, so most freelancers are not actively dealing with companies

+ Tough comps for guidance, but not strong

+ As a result of freelancers falling into a lower fee tier, this slowed down marketplace rev (Exhibit 2)

4/ Bottom-line metrics:

Though they posted strong Adj EBIT

Margins and Profitability are going to be weak for sometime primarily and the good thing is that they plan to aggressively spend on branding and improving unaided awareness.

This is crucial as UPWK lags in branding.

Though they posted strong Adj EBIT

Margins and Profitability are going to be weak for sometime primarily and the good thing is that they plan to aggressively spend on branding and improving unaided awareness.

This is crucial as UPWK lags in branding.

5/ Some of the bright spots:

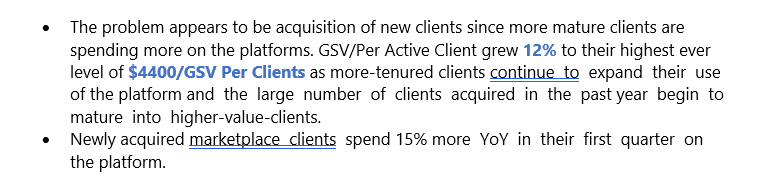

a/Retention and Spending are going higher.

Clients acquired from 2020 and past, are increasing their spend on the platform. I noticed this trend when they used to report retention metrics.

I wrote down a few notes:

a/Retention and Spending are going higher.

Clients acquired from 2020 and past, are increasing their spend on the platform. I noticed this trend when they used to report retention metrics.

I wrote down a few notes:

6/ Enterprise is getting a BOOST!

This Q3: They added 34 clients (143% YoY)– 17% QoQ

- From Q2, picked up 29 clients (100% YoY)

- They are guiding for 25+ clients in Q4

- Revenue from enterprise clients are up 70% YoY as 11% QoQ increase in spending.

Their GTM Sales is working!

This Q3: They added 34 clients (143% YoY)– 17% QoQ

- From Q2, picked up 29 clients (100% YoY)

- They are guiding for 25+ clients in Q4

- Revenue from enterprise clients are up 70% YoY as 11% QoQ increase in spending.

Their GTM Sales is working!

7/ Product development & rollout is fully active:

They have been innovating and releasing many new products.

The challenge is that it will take time for revenue from these products to materialize. But it is highly encouraging to see the innovation by @SamuelRBright & @hydnbrwn

They have been innovating and releasing many new products.

The challenge is that it will take time for revenue from these products to materialize. But it is highly encouraging to see the innovation by @SamuelRBright & @hydnbrwn

8/ Biggest takeaway:

a) Product release velocity /energy is back

b) Client spend ✅& huge wins in enterprise $1M+ clients are setting a foundation for H-growth in early 2022

c) $600M Cash (M&A?)

d) Importantly, they've figured out a GTM sales motion that is driving key results.

a) Product release velocity /energy is back

b) Client spend ✅& huge wins in enterprise $1M+ clients are setting a foundation for H-growth in early 2022

c) $600M Cash (M&A?)

d) Importantly, they've figured out a GTM sales motion that is driving key results.

9/ Transforming $UPWK from previous Mgmt legacy pre-2020 b4 Hayden took over will take time for shareholders to see the impact.

Internal metrics are pointing in the right direction. I expect to see fruits by H1 2022. Hope to speak to someone internally.

Hope this helps. Cheers.

Internal metrics are pointing in the right direction. I expect to see fruits by H1 2022. Hope to speak to someone internally.

Hope this helps. Cheers.

For transparency, I've reduced my $UPWK holdings taking some losses, and reallocated cash into other businesses w/ faster growth and accelerating metrics.

I will give a portfolio update next week.

Fr now, I'll give UPWK till Q1 2022, If nothing changes, I'll be completely out.

I will give a portfolio update next week.

Fr now, I'll give UPWK till Q1 2022, If nothing changes, I'll be completely out.

• • •

Missing some Tweet in this thread? You can try to

force a refresh