$UPWK reports a crucial Q3 Report:

It's one of my largest positions. I'm positioned for both the good and the worst.

Here are the key metrics & my pre-earnings drill for this report (a sneak-peak into how I prepare for earnings):

It's one of my largest positions. I'm positioned for both the good and the worst.

Here are the key metrics & my pre-earnings drill for this report (a sneak-peak into how I prepare for earnings):

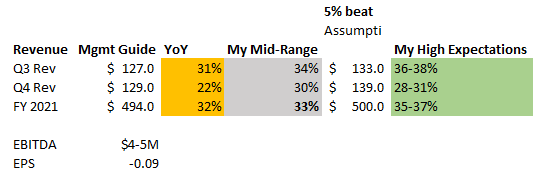

1/ Rev Estimates:

@hydnbrwn hired a new CFO less than a year ago (Ex $FB Exec). Historically, Jeff beats estimates at 3-4% range.

Below are my expectations using historical metrics I've modelled: At 5%,

+ Yellow will be "OK"

+ Mid-range will be good

+ If we get any of the green

@hydnbrwn hired a new CFO less than a year ago (Ex $FB Exec). Historically, Jeff beats estimates at 3-4% range.

Below are my expectations using historical metrics I've modelled: At 5%,

+ Yellow will be "OK"

+ Mid-range will be good

+ If we get any of the green

2/ Key Metrics that drive a freelance platform like $UPWK

a) GSV Per Active Client

b) GSV v Marketplace Growth

c) Monitor cohort stickiness

Importantly, last Q; They added 29 New Enterprise Clients that are spending >$1Million (100% YoY).It'll be interesting to see their impact

a) GSV Per Active Client

b) GSV v Marketplace Growth

c) Monitor cohort stickiness

Importantly, last Q; They added 29 New Enterprise Clients that are spending >$1Million (100% YoY).It'll be interesting to see their impact

3/ Key Products:

Below are the 4 major products to watch and their traction this quarter.

As of last Qtr, over 10% of new clients were being onboard less than 6-months of launching project catalog.

They also mentioned some success in GTM & Sales motion amongst Ent, so watch

Below are the 4 major products to watch and their traction this quarter.

As of last Qtr, over 10% of new clients were being onboard less than 6-months of launching project catalog.

They also mentioned some success in GTM & Sales motion amongst Ent, so watch

4/ Other key Metrics to monitor:

Talent Marketplace's global leadership:

$UPWK's platform is home to 10K skills with $10M in annual GSV. This was 3.5x larger than their next largest talent platform.

$UPWK holds the largest global network of freelancers across the world.

Talent Marketplace's global leadership:

$UPWK's platform is home to 10K skills with $10M in annual GSV. This was 3.5x larger than their next largest talent platform.

$UPWK holds the largest global network of freelancers across the world.

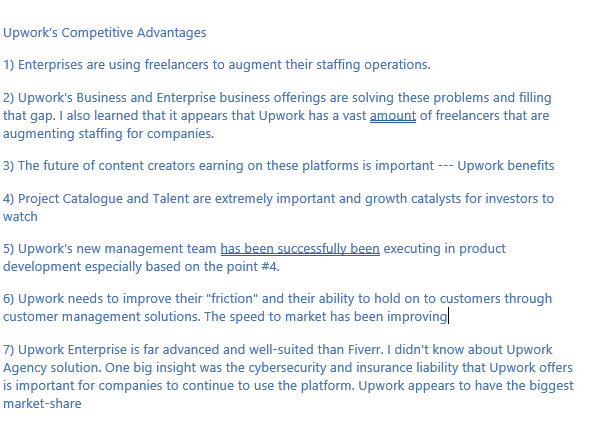

4i) Courtesy of this generous man @gabrielkaplan (give a follow!), I got to dive deep into an expert transcript and analysis on why $UPWK continues to be a leader.

*Warning* - These notes are very rough., but give you the gist.

*Warning* - These notes are very rough., but give you the gist.

5/ My bet on $UPWK is a transformational one. Its hard!

I feel as tho as the world's leading freelance platform combined with a fresh & hungry mgmt led by @hydnbrwn..top growth will come. I've seen the evidence - $UPWK is completely different from 2-yrs ago. Every Qtr, new Adj

I feel as tho as the world's leading freelance platform combined with a fresh & hungry mgmt led by @hydnbrwn..top growth will come. I've seen the evidence - $UPWK is completely different from 2-yrs ago. Every Qtr, new Adj

6/ I'm not betting on "hope" or a story. The numbers are ticking higher. With their new CTO from $AMZN Alexa, I'm betting on *higher growth by Q1 2022*. The new changes will take a couple Qtr's to play.

I provide lots of evidence to back my thesis below:

I provide lots of evidence to back my thesis below:

https://twitter.com/InvestiAnalyst/status/1444824629089026050?s=20

7/ Anyways, $UPWK is my 2nd/3rd behind $UPST and $AFRM.

I'm a big believer in the content creator and freelancing economy. I like all the changes by CEO and I'm a long-term believer in @hydnbrwn vision and I've heard it from industry & expert calls, the platform has changed.

I'm a big believer in the content creator and freelancing economy. I like all the changes by CEO and I'm a long-term believer in @hydnbrwn vision and I've heard it from industry & expert calls, the platform has changed.

8/The business result & stock will be either be *negative!* or good. Can't fight it. I'm ready.

Just thought I'll be transparent and show my process for preparing for an earnings report. With this level of pre-work, I get little surprises in the AH.

Goodluck to all investors!

Just thought I'll be transparent and show my process for preparing for an earnings report. With this level of pre-work, I get little surprises in the AH.

Goodluck to all investors!

What's the #1 or 2 metrics you folks are watching on the call today?

@AznWeng @gabrielkaplan @buccocapital @siyul

@AznWeng @gabrielkaplan @buccocapital @siyul

• • •

Missing some Tweet in this thread? You can try to

force a refresh