$QQQ, #tech. I’m starting to get increasingly nervous on just how overbought markets are.

https://twitter.com/suburbandrone/status/1457800714034376706

These charts from @themarketear show just how much hate there is towards puts, and a strategy called “Texas Hedge” going long calls funded by selling puts (or in HF lingo called risk reversals) has gained in popularity. Problem is this is super super risky.

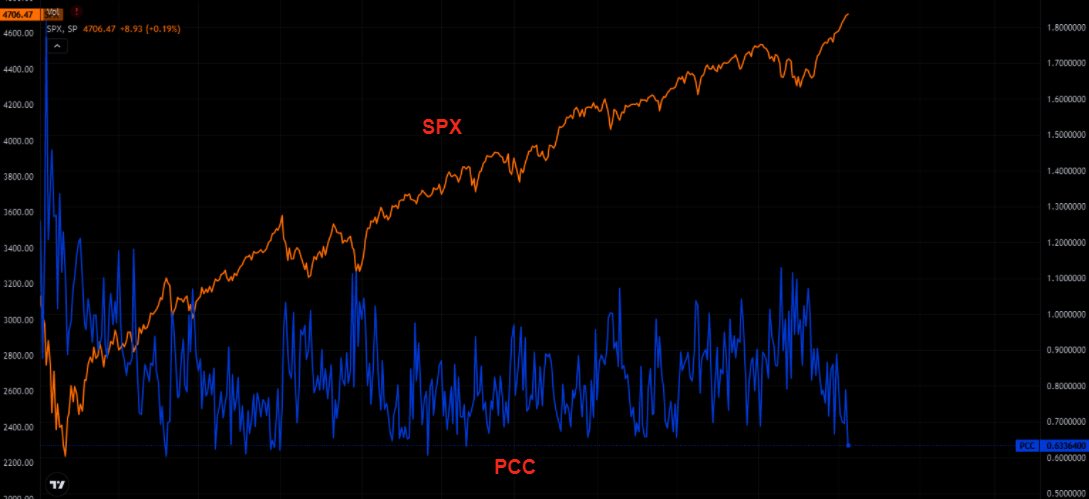

Retail spec activity as we know is off the charts. Equity put/call ratios have totally diverged from index put/call- again showing no one wants to short.

There are a bunch of possible catalysts that could finally crack this freight train. 1 removal of liquidity with TGA rebuild. 2 Biden’s insistence of the vac mandate which would really create havoc for any biz with over 100 employees

https://twitter.com/cnbc/status/1457826114198544391

And lets not forget that the Chinese financial system is undergoing tremendous stress with their HY bond market imploding.

https://twitter.com/tracyalloway/status/1457949954018734082

Not sure if any of these catalysts would create a sell of but with cnn fear and greed index at highest point this year, it wont take much.

I’m hedging with Tqqq 145 strike puts out to Jan 21 2022 as a way to sleep better at night. If i piss away the premium it would still be a drop in the bucket of a tremendous year. And if not, then thankfully i had the foresight to start getting nervous when everyone is convinced

we have a melt up into year end.

• • •

Missing some Tweet in this thread? You can try to

force a refresh