(1) A thread on Producer Prices, useful because *tomorrow* the Consumer Price index will be released.

It's important to know how they interplay and why one being higher than the other is a key indicator.

It's important to know how they interplay and why one being higher than the other is a key indicator.

(2) The “producer price index” is essentially the tracking of wholesale prices at 3 stages: Origination (commodity), Intermediate and Final. The final product inflation rate in July (reported in Aug) was alarming at 7.8%. We warned of more inflation flowing into the supply chain.

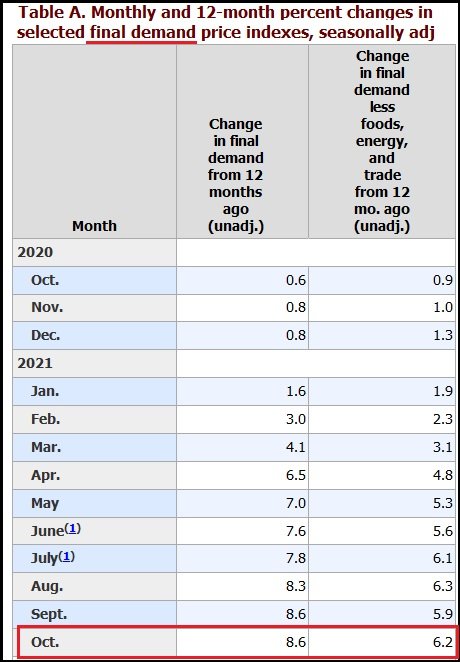

(3) Today, The Bureau of Labor and Statistics (BLS) released stunning price data for October, showing a dramatic 8.6% price increase in Final Demand products at the wholesale level.

bls.gov/news.release/p…

bls.gov/news.release/p…

(4) I modified Table A (final demand product pricing) taking out some of the noise to make it a little easier to see the big picture of what is happening.

(5) When you see the wholesale level of prices almost double the increase in consumer level inflation rate, you can predict that consumer prices will likely go even higher. Future finished goods at a retail level will carry the current wholesale price increase.

(6) Stuff costs a lot now… and because the inbound stuff to make the finished goods is still climbing in price…. stuff is about to cost even more.

(7) You can see from Table A that finished good prices are still climbing. That’s the higher price inflation you are feeling when you buy a product.

(8) However, even more alarming is to look at the “intermediate demand” products [Table B below] as they flow through the manufacturing system.

Two types of products are at the intermediate wholesale level: Processed Goods, and Unprocessed goods.

Two types of products are at the intermediate wholesale level: Processed Goods, and Unprocessed goods.

(9) I have again modified Table B to remove the noise.

Here is where you focus on two specific metrics:

Here is where you focus on two specific metrics:

(10) Prices for both types of products are still climbing in the manufacturing process. Compare Aug, Sept, Oct, noticing how prices are still climbing.

(11) Some of that has to do with energy and fuel costs still climbing. The increasing prices for gasoline build into each part of the transportation process

(12) Notice the scale of the increase in the prices from prior months. The trend line is not leveling off, instead it’s doing the opposite. The rate of inflationary climb (price increase), at the intermediate level of goods coming into the system, is getting even more steep.

(13) The stuff coming into the manufacturing process is not only costing more, it is costing much more than before.

(14) That more expensive stuff will be reflected in the price of finished goods that make their way to retail shelves. It is a precursor to seeing more inflation coming at us.

(15) The wholesale prices of products coming into the system -that end up at the retail level- is still through the roof. In a major way, this is being driven by massive increases in energy costs throughout the entire supply chain.

(16) If Consumer Prices (released tomorrow) are in the 6% range year-over-year (rate of inflation), that still means there is an almost 3% lag in the wholesale inflation rate which stands at 8.6%.

Meaning consumer inflation will keep climbing.

Meaning consumer inflation will keep climbing.

Even if wages jumped in price 5% overnight (single month), which would be a large increase in wages, those wage increases are nowhere near enough to deal with this level of price increase at a consumer level.

(18) A nickel more per dollar earned is futile against a loaf of bread costing $1 more, or gasoline at $4.00/gal.

At the current rate of increase, regular unleaded gasoline will hit $6/gal (National Average) by Easter.

At the current rate of increase, regular unleaded gasoline will hit $6/gal (National Average) by Easter.

(19) Watch the CPI release tomorrow. Then compare that number to the 8.6% PPI released today.

Take the difference between the two as a percentage, and then multiply that percent against the price of any current product and it will tell you what is coming.

Take the difference between the two as a percentage, and then multiply that percent against the price of any current product and it will tell you what is coming.

(20) Example (rough approx):

PPI 8.6%

CPI 5.8%

RAW Diff: 2.8%

% Diff = 32.55%

Current Bread $3.69 + 32.55% = Future Bread $4.89

Current gas $4.00 + 32.55% = Future gas $5.30

PPI 8.6%

CPI 5.8%

RAW Diff: 2.8%

% Diff = 32.55%

Current Bread $3.69 + 32.55% = Future Bread $4.89

Current gas $4.00 + 32.55% = Future gas $5.30

(21) The FIRST STEP in defending against this onslaught is to stop excusing it by saying they don’t know what they are doing, or any version of the incompetency argument.

They know exactly what they are doing.

/END

They know exactly what they are doing.

/END

• • •

Missing some Tweet in this thread? You can try to

force a refresh