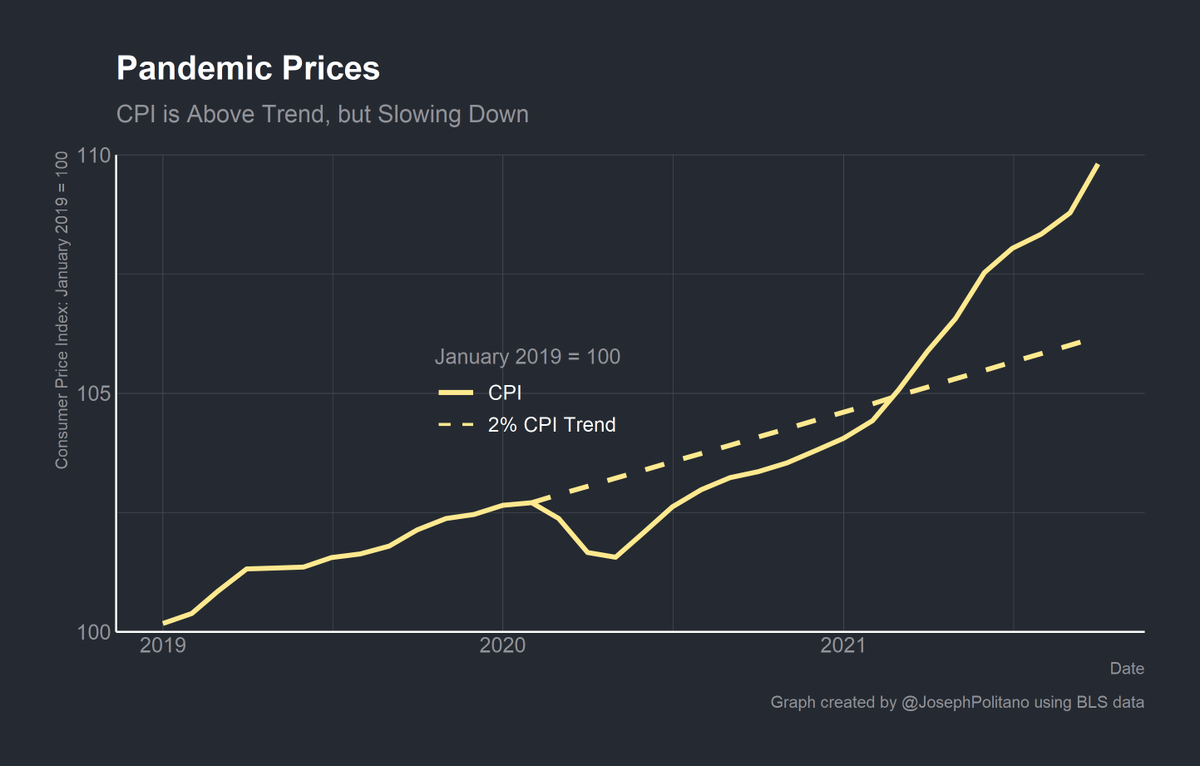

The Consumer Price Index (CPI) rose by 0.9% in October, making the year-on-year CPI inflation 6.2%.

I did a full break down of this month's CPI data in a the blog post below.

Here's a short thread with the important takeaways: 🧵

apricitas.substack.com/p/cpi-inflatio…

I did a full break down of this month's CPI data in a the blog post below.

Here's a short thread with the important takeaways: 🧵

apricitas.substack.com/p/cpi-inflatio…

The CPI is currently running well ahead of its pre-COVID 2% growth trend, although it is worth acknowledging that the Personal Consumption Expenditures Price Index (which the Federal Reserve targets) has shows significantly lower readings.

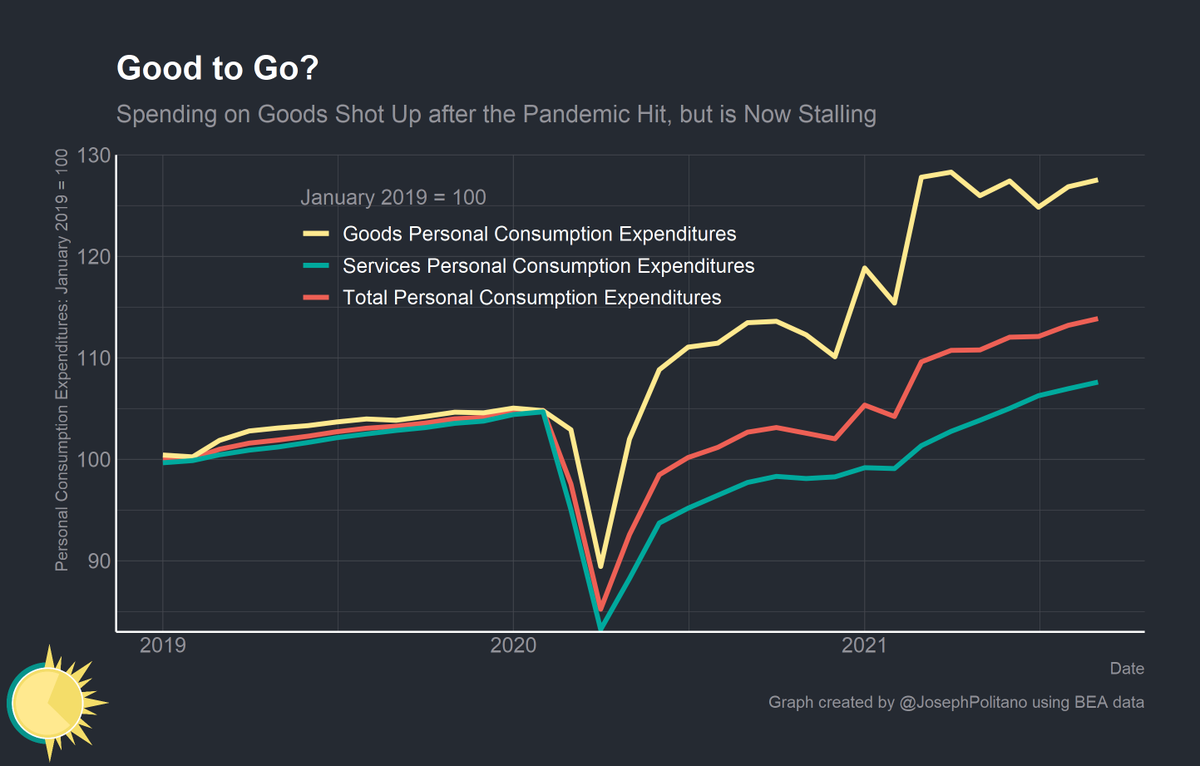

The pandemic has driven spending that would have gone to services into additional consumer and durable goods. Supply chains appear strained are operating under unprecedented order volumes. In other words, this is a crisis of abundance rather than a crisis of scarcity.

Today, goods prices tell a different story. Car prices have stalled, with used car and truck prices growing 2.5% after shrinking in August and September. This is partly because rising prices choked demand and partly because vaccinations are enabling additional services spending.

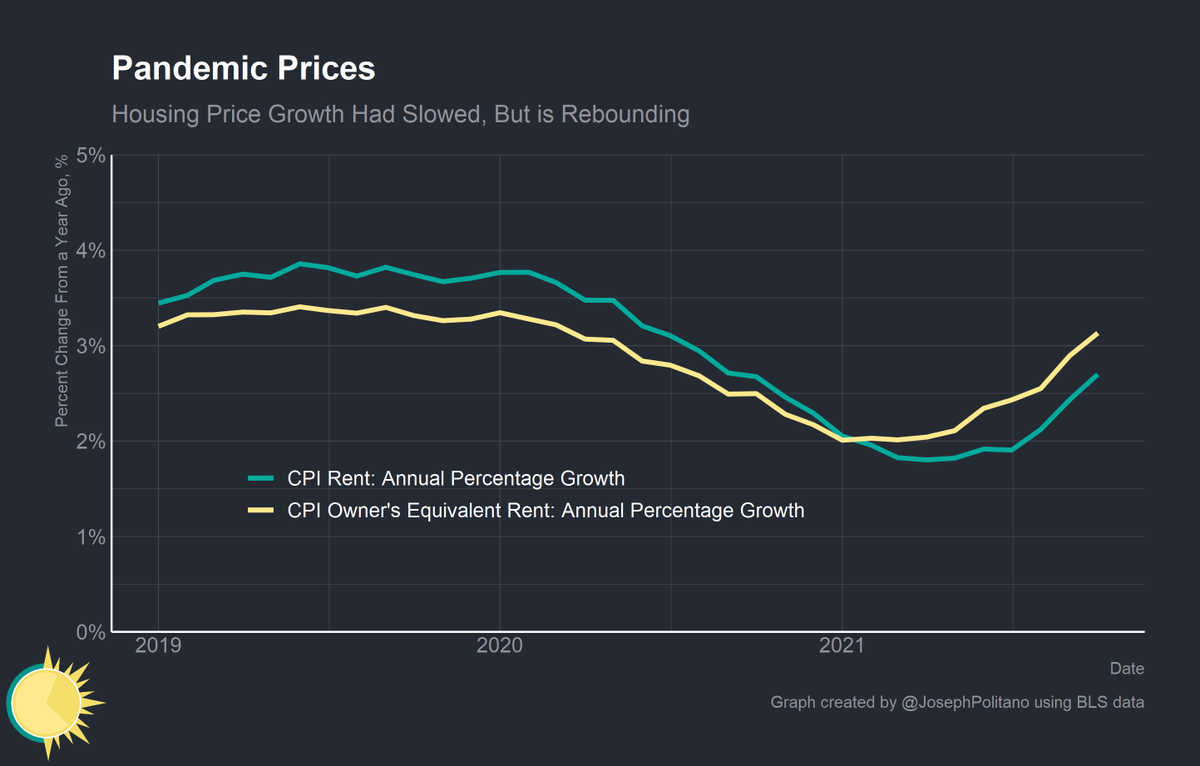

The rise in services spending has started to pull service sector prices back up to pre-pandemic growth rates. Take housing: As the economy strengthens and COVID abates, rent growth is climbing as workers return to cities and household formation starts up again.

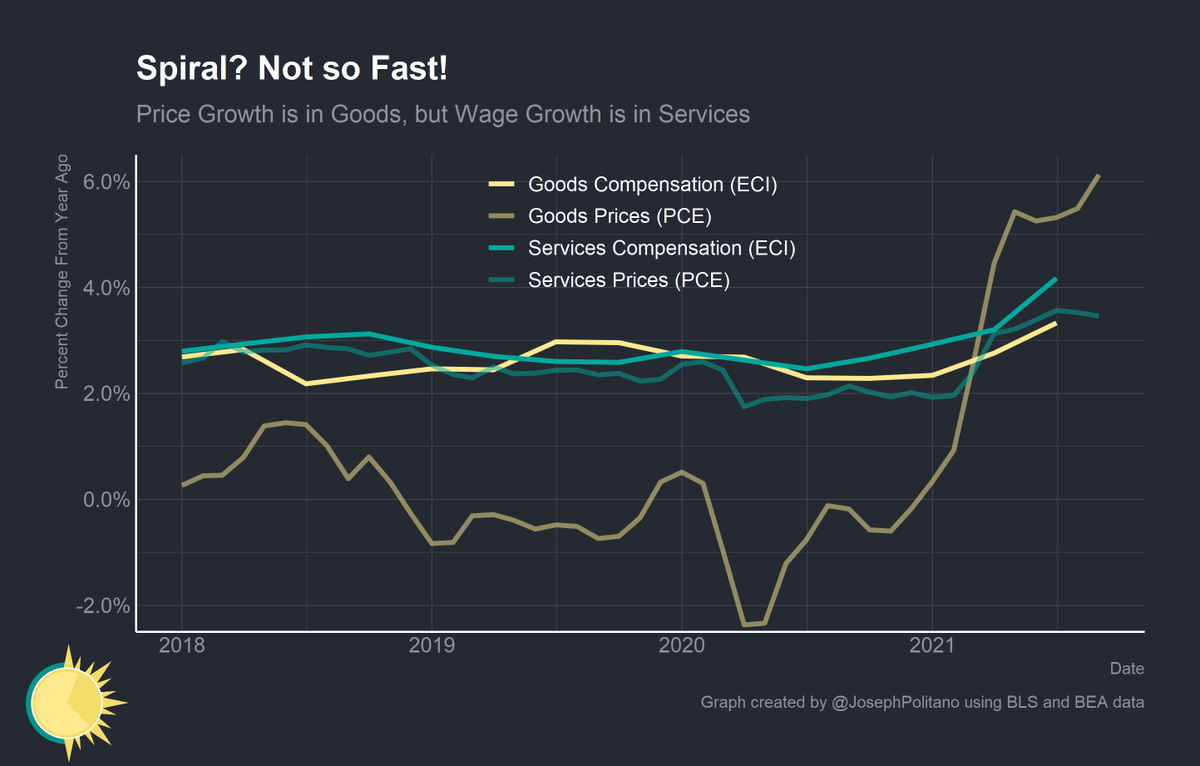

However, to have sustained inflation, rising labor costs would have to be passed on to consumers by businesses across industries.

Current evidence contradicts this: price increases are concentrated in the goods sector while wage increases are concentrated in the service sector.

Current evidence contradicts this: price increases are concentrated in the goods sector while wage increases are concentrated in the service sector.

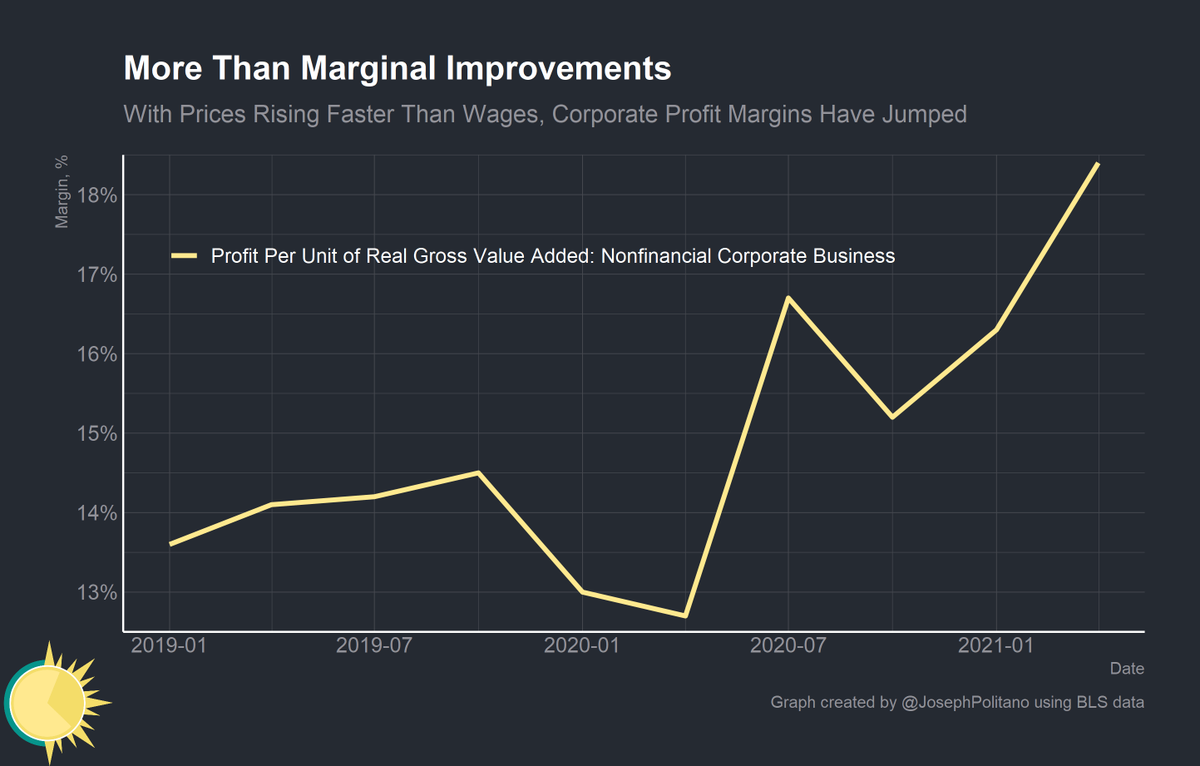

In addition, corporate profit margins have been increasing as prices rise faster than labor costs.

The widening spread between sales prices and unit labor costs indicate that large corporations are flexing their pricing power and have not suffered under tighter labor markets.

The widening spread between sales prices and unit labor costs indicate that large corporations are flexing their pricing power and have not suffered under tighter labor markets.

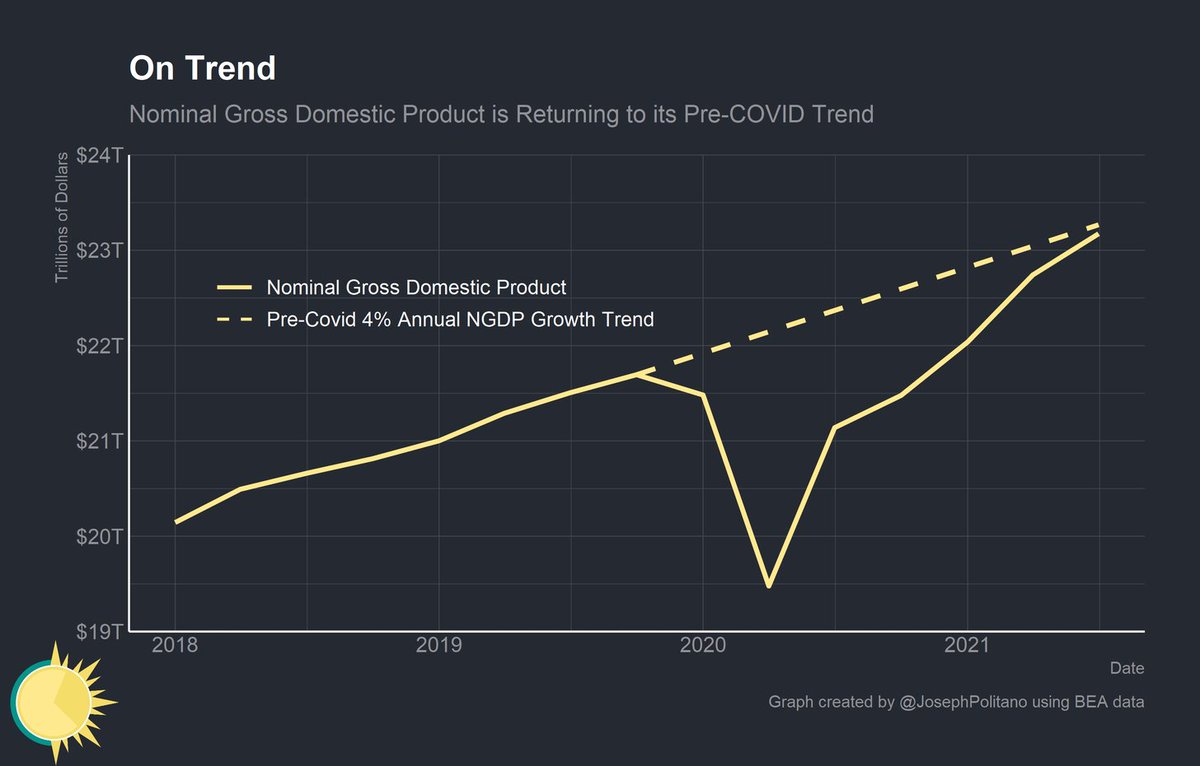

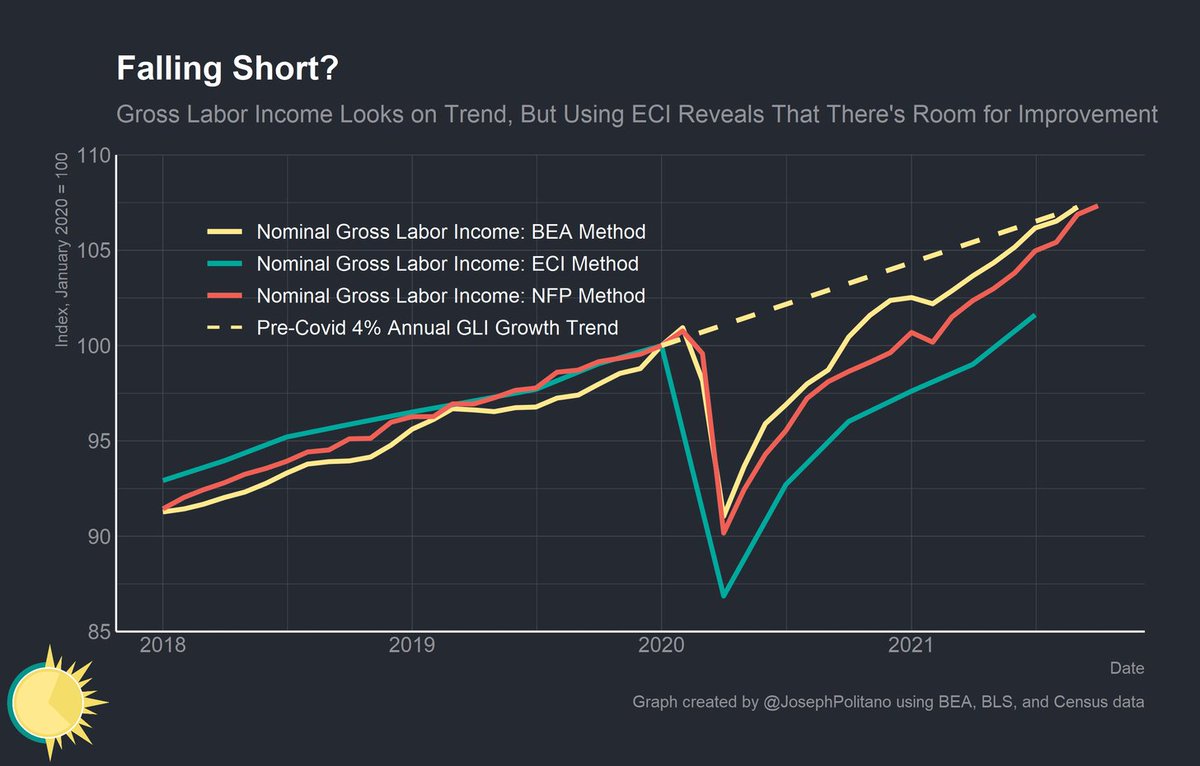

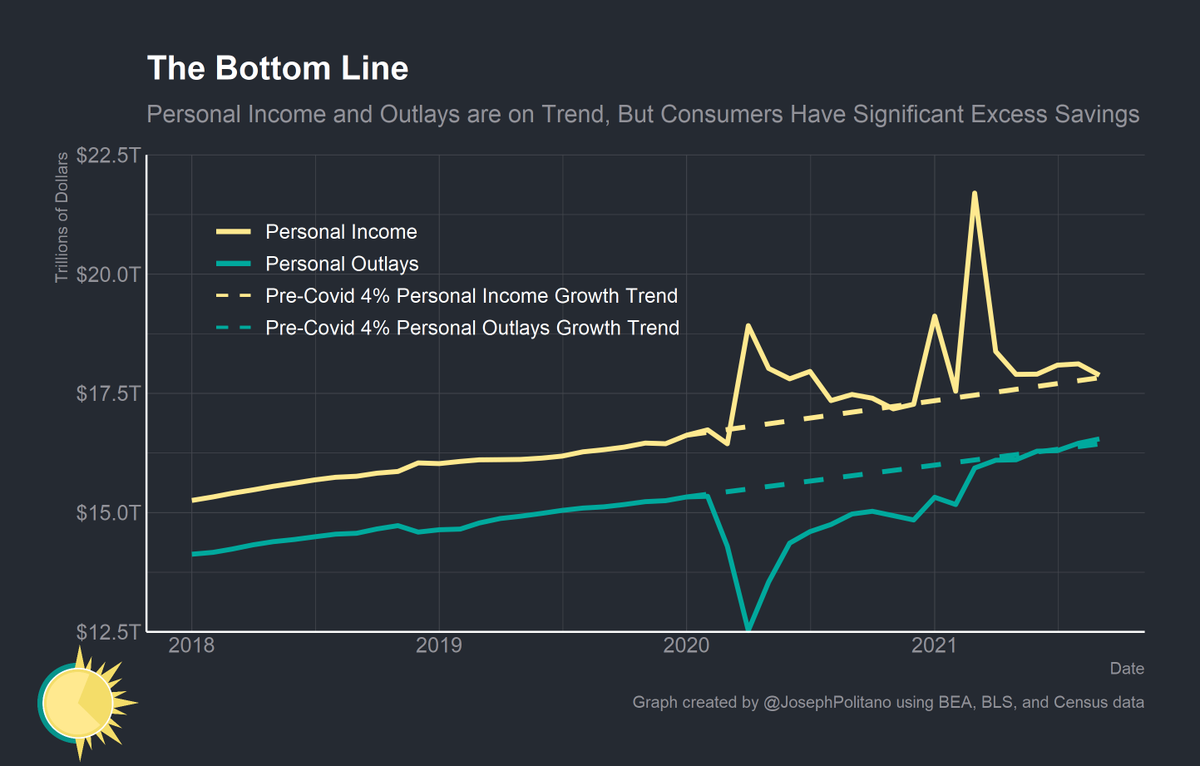

Fundamentally, sustained inflation cannot occur without above-trend income and spending growth. As of right now, both personal incomes and personal spending remain on-trend.

As long as nominal income growth remains on-trend inflation will slide back down to normal levels.

As long as nominal income growth remains on-trend inflation will slide back down to normal levels.

If you want more economic news and analysis, consider subscribing! It's free, and helps me out a ton.

These posts are part of a new series where I am breaking down regular data releases. All input is truly appreciated as these are a work-in-progress.

apricitas.substack.com

These posts are part of a new series where I am breaking down regular data releases. All input is truly appreciated as these are a work-in-progress.

apricitas.substack.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh