As India races to open up, booming indices and asset prices have catalysed optimism about the promise of the potential. That though is not the complete picture, writes @ShankkarAiyar. #BQOpinion

bit.ly/3BWoQqA

bit.ly/3BWoQqA

@ShankkarAiyar The decoupling of cost and valuation fuelled by public monies triggered a transfer of gains to private wealth, with billionaires globally adding over a trillion dollars to their wealth in just in the last 12 months.

Read @ShankkarAiyar in #BQOpinion: bit.ly/3BWoQqA

Read @ShankkarAiyar in #BQOpinion: bit.ly/3BWoQqA

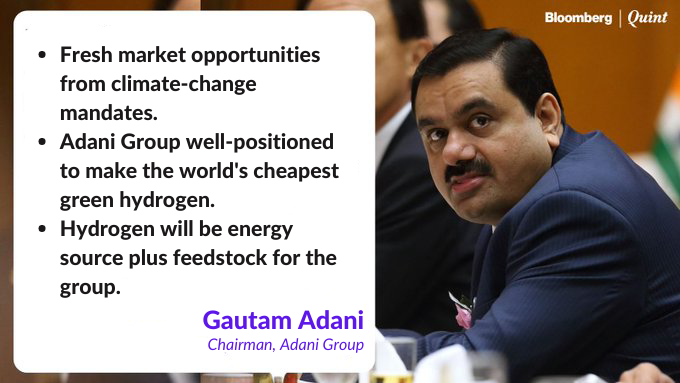

@ShankkarAiyar Of the $130 billion added by 19 Indian billionaires, Mukesh Ambani and Gautam Adani added $65 billion, nearly the wealth of Jim Walton, the heir to Walmart, in just one year.

Read @ShankkarAiyar in #BQOpinion: bit.ly/3F7Slru

Read @ShankkarAiyar in #BQOpinion: bit.ly/3F7Slru

@ShankkarAiyar To appreciate the magnitude of the gain, consider this: $65 billion is roughly Rs 4.8 lakh crore – more than the defence budget for 2021-22 or the total subsidy bill for the year, writes @ShankkarAiyar.

Read his #BQOpinion column: bit.ly/3BWoQqA

Read his #BQOpinion column: bit.ly/3BWoQqA

@ShankkarAiyar The rise in billionaire wealth was catalysed by stock valuations. Between March 2020 and October 2021, #Sensex doubled from sub-30,000 to over 61,000 and #Nifty from 8,000 to over 18,000.

Read the #BQOpinion column here.

bit.ly/3qoTmXW

Read the #BQOpinion column here.

bit.ly/3qoTmXW

@ShankkarAiyar Meanwhile, data from the IMF reveals that the per capita income of Indians dipped from $2,098 to $1,929 and is at $2,116 in 2021, writes @ShankkarAiyar.

Read more in #BQOpinion: bit.ly/3BWoQqA

Read more in #BQOpinion: bit.ly/3BWoQqA

@ShankkarAiyar Then there is the rural-urban divide. The per capita NVA (based on 2011-12) for rural areas is Rs 40,925 and for urban areas it is Rs. 98,435. Those who had jobs had incomes, those who didn't, struggled.

Read @ShankkarAiyar in #BQOpinion.

bit.ly/3bXIR5t

Read @ShankkarAiyar in #BQOpinion.

bit.ly/3bXIR5t

@ShankkarAiyar #BQOpinion | The divergence triggered by the K-shaped recovery is represented at the individual and institutional level with the performance of corporates improving despite circumstances, writes @ShankkarAiyar.

Goliaths consolidated as Davids struggled.

bit.ly/3oay3Xq

Goliaths consolidated as Davids struggled.

bit.ly/3oay3Xq

@ShankkarAiyar The government and RBI have taken measures ranging from emergency credit to restructuring of loans. But despite the measures, stress persists, writes @ShankkarAiyar.

Read more in #BQOpinion: bit.ly/3BWoQqA

Read more in #BQOpinion: bit.ly/3BWoQqA

@ShankkarAiyar Through the year, #GST collections have averaged over Rs 1 lakh crore. The collection in October 2021 at Rs 1.30 lakh crore was 24% higher than the same month a year ago and 36% over the pre-pandemic levels of 2019.

Read @ShankkarAiyar in #BQOpinion: bit.ly/3BWoQqA

Read @ShankkarAiyar in #BQOpinion: bit.ly/3BWoQqA

@ShankkarAiyar #BQOpinion | It is true that existing comorbidities of income and wealth in the political economy were aggravated by the pandemic. Equally, the faultlines reveal a need for public policy intervention, writes @ShankkarAiyar.

bit.ly/31PcYdE

bit.ly/31PcYdE

• • •

Missing some Tweet in this thread? You can try to

force a refresh