the dirty business behind financing clean energy [thread]

global coal capacity is responsible for 40% of electricity generation globally driven heavily by India, China, Indonesia & Vietnam

in SA, 87% of our electricity comes from coal*

*this excludes coal used for hookah & braais

in SA, 87% of our electricity comes from coal*

*this excludes coal used for hookah & braais

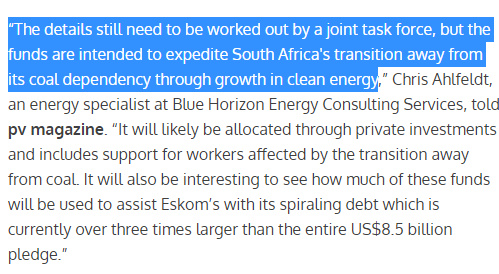

SA just locked in $8.5bn* in funding to transition away from coal from the US, EU & UK. Whenever developed nations are cheering on for Africa, it's worth pausing

*This buys you roughly 2x bottles of Armand de Brignac at KONKA or a double popcorn combo at Ster Kinekor

*This buys you roughly 2x bottles of Armand de Brignac at KONKA or a double popcorn combo at Ster Kinekor

Wait, so does $8.5bn get to us? Is it even $8.5bn? Does someone eWallet funding across?

Funding is structured across different tiers

(i) Multilateral & bilateral loans

(ii) Concessional loans

(iii) Grants

(iv) Guarantees

(v) Private investments

Is this free money? 100% No

Funding is structured across different tiers

(i) Multilateral & bilateral loans

(ii) Concessional loans

(iii) Grants

(iv) Guarantees

(v) Private investments

Is this free money? 100% No

(i) Multilateral & bilateral loans

Straight up loans you need to pay back. So the developed economies do their best to help emerging economies by lending them cash

Except they lend to countries who can pay them back at some pretty juicy interest rates. Private school mashonisas

Straight up loans you need to pay back. So the developed economies do their best to help emerging economies by lending them cash

Except they lend to countries who can pay them back at some pretty juicy interest rates. Private school mashonisas

(ii) Concessional loans

This is "below rate finance". Sounds attractive right? Except, lenders frequently convert exposure into equity in projects "cheaper" than initial cost of debt funding

Simply: we lend you money for a power plant & we will own a piece of the power plant

This is "below rate finance". Sounds attractive right? Except, lenders frequently convert exposure into equity in projects "cheaper" than initial cost of debt funding

Simply: we lend you money for a power plant & we will own a piece of the power plant

(iii) Grants

This is the promised land. The cheapest funding available. The problem? Grants are hard to come by.

There are no free lunches

This is the promised land. The cheapest funding available. The problem? Grants are hard to come by.

There are no free lunches

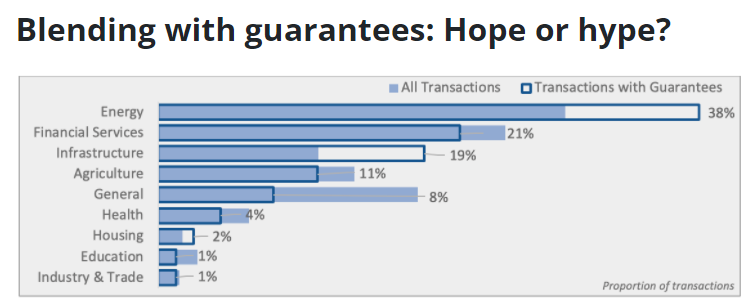

(iv) Guarantees

This is where Cyril goes in front of developed nations & says "hey guys if we can't pay you back, you can take ownership of all the Cubana's in our country"

You provide collateral in the event you default. Again. Can't pay for power plant? You give up ownership

This is where Cyril goes in front of developed nations & says "hey guys if we can't pay you back, you can take ownership of all the Cubana's in our country"

You provide collateral in the event you default. Again. Can't pay for power plant? You give up ownership

(v) Private investments

The top tier mafia knee breakers of development finance. Think private equity... but for energy. Private investors usually have the highest IRR (returns) expectations.

These are institutions, high net worth funds, dedicated energy funds.

The top tier mafia knee breakers of development finance. Think private equity... but for energy. Private investors usually have the highest IRR (returns) expectations.

These are institutions, high net worth funds, dedicated energy funds.

So how much of each tier is SA receiving? Surely it's mostly grants and attractive financing?

Answer: they're still working it out

What this means: given historic funding structures, there's a very decent chance we get screwed here

Answer: they're still working it out

What this means: given historic funding structures, there's a very decent chance we get screwed here

Burning issue #1: No hugh (huge) grants

wow that was bad...

Grants are a very low % of overall funding - meaning funding we receive will be repaid through a combination of agreed interest rates, exchanges for equity (ownership) & terms which may not be that attractive..

wow that was bad...

Grants are a very low % of overall funding - meaning funding we receive will be repaid through a combination of agreed interest rates, exchanges for equity (ownership) & terms which may not be that attractive..

Burning issue #2: Impact of assistance is wildly overstated

Worse... a large part of funds received go towards adaptation. The effective cash that ends up getting used to effect change is a fraction of the headline reported figures

Worse... a large part of funds received go towards adaptation. The effective cash that ends up getting used to effect change is a fraction of the headline reported figures

Burning issue #3: Developed countries are issuing grants MUCH lower than they're reporting

Grants are a low % to start with, the figures made publicly available are likely overstated. This means we're effectively taking on more interest bearing debt than we think we are.

Grants are a low % to start with, the figures made publicly available are likely overstated. This means we're effectively taking on more interest bearing debt than we think we are.

Burning issue #4: Clean energy could be a smokescreen for lending out money for other reasons

There's a gap between cash used for climate funding & the capital actually lent. Developed countries are able to get loans off their books much easier by tagging them as "climate loans"

There's a gap between cash used for climate funding & the capital actually lent. Developed countries are able to get loans off their books much easier by tagging them as "climate loans"

Burning issue #5: Cash simply isn't used effectively

adaptation is a crucial step to set up effective mitigation

countries that can barely keep the lights on are focusing on ineffective transition methods - aiming to drive Ferrari's without first making sure roads are built

adaptation is a crucial step to set up effective mitigation

countries that can barely keep the lights on are focusing on ineffective transition methods - aiming to drive Ferrari's without first making sure roads are built

Burning issue #6: Greenwashing

Private investors, banks & instos are able to structure portfolios to still maintain healthy exposure to coal & oil thanks to very loose ESG guidelines

Indexes, funds & portfolios are increasingly guilty of slapping on a "green" tag for compliance

Private investors, banks & instos are able to structure portfolios to still maintain healthy exposure to coal & oil thanks to very loose ESG guidelines

Indexes, funds & portfolios are increasingly guilty of slapping on a "green" tag for compliance

Burning issue #7: Talk to me dirty... energy

The opportunity cost of rebalancing portfolios towards renewables in a raging energy bull market is increasingly difficult & amplifies the risks of "greenwashing"

The opportunity cost of rebalancing portfolios towards renewables in a raging energy bull market is increasingly difficult & amplifies the risks of "greenwashing"

Burning issue #8: Government can't run a bath

In a country plagued with misadministration, widespread corruption & evaporating funds it's either brave or naïve to believe in efficient allocation of capital, fair tender allocation & actual project delivery

In a country plagued with misadministration, widespread corruption & evaporating funds it's either brave or naïve to believe in efficient allocation of capital, fair tender allocation & actual project delivery

Burning issue #9: Colour of money is green

It's fascinating to watch developed economies shift the emissions burden onto emerging market economies & portray them as villains for coal use when developed markets have beeeeeen pumping out emissions since the industrial revolution

It's fascinating to watch developed economies shift the emissions burden onto emerging market economies & portray them as villains for coal use when developed markets have beeeeeen pumping out emissions since the industrial revolution

Burning issue #10: The West are hypocrites

Poorer countries are effectively subsidizing the carbon emissions of developed nations by spending large amounts of public funds combating climate change... despite having considerably lower carbon emissions than the US

Poorer countries are effectively subsidizing the carbon emissions of developed nations by spending large amounts of public funds combating climate change... despite having considerably lower carbon emissions than the US

Do we need to move towards a cleaner, sustainable future - unequivocally yes

Should we also be deeply skeptical of "magic" financing packages, be smart enough to form solutions bespoke to Africa's challenges & take full ownership over our own path to sustainability?

Also yes

Should we also be deeply skeptical of "magic" financing packages, be smart enough to form solutions bespoke to Africa's challenges & take full ownership over our own path to sustainability?

Also yes

Great additional resources:

1. Oxfam climate shadow report

oxfam.org/en/research/cl…

2. Playbook for climate finance

nature.org/en-us/what-we-…

3. Climate finance concessions

worldbank.org/en/news/featur…

1. Oxfam climate shadow report

oxfam.org/en/research/cl…

2. Playbook for climate finance

nature.org/en-us/what-we-…

3. Climate finance concessions

worldbank.org/en/news/featur…

A quick oil price explainer

https://twitter.com/iamkoshiek/status/1252328581742637062?s=20

Shout-out for making it to the end. I appreciate you!! Check out @Banker__X for more finance explainers, dope threads & stock/ crypto updates 🔥🔥

• • •

Missing some Tweet in this thread? You can try to

force a refresh