#RS is an indicator which helps in finding strong stock or index in the market.

This learning thread would be on

"𝙐𝙨𝙚𝙨 𝙤𝙛 𝙍𝙚𝙡𝙖𝙩𝙞𝙫𝙚 𝙎𝙩𝙧𝙚𝙣𝙜𝙩𝙝"

Shared some strategy.

Like👍 & Retweet🔄for wider reach and for more such learning thread in the future.

1/22

This learning thread would be on

"𝙐𝙨𝙚𝙨 𝙤𝙛 𝙍𝙚𝙡𝙖𝙩𝙞𝙫𝙚 𝙎𝙩𝙧𝙚𝙣𝙜𝙩𝙝"

Shared some strategy.

Like👍 & Retweet🔄for wider reach and for more such learning thread in the future.

1/22

Most of us would confuse it with Relative Strength Index (RSI) but Relative Strength is a different indicator.

We have already covered about "Uses of RSI" in below thread👇

One can go through this if you haven't.

2/22

We have already covered about "Uses of RSI" in below thread👇

https://twitter.com/YMehta_/status/1451526006536167424

One can go through this if you haven't.

2/22

Now coming to Relative Strength (RS).

It is basically a strategy used in momentum investing which shows strength or weakness between two asset classes (two stocks, index, commodity).

One can read about this in below link👇

investopedia.com/terms/r/relati…

3/22

It is basically a strategy used in momentum investing which shows strength or weakness between two asset classes (two stocks, index, commodity).

One can read about this in below link👇

investopedia.com/terms/r/relati…

3/22

As of now, I am using this indicator on .@tradingview platform.

It's free and one can add it in their Tradingview account as well, using this link👇

in.tradingview.com/script/OhSlks3…

There are multiple variants in this as well. Some traders use multiple time frame RS.

4/22

It's free and one can add it in their Tradingview account as well, using this link👇

in.tradingview.com/script/OhSlks3…

There are multiple variants in this as well. Some traders use multiple time frame RS.

4/22

RS basically compares returns of one stock/index with the returns of benchmark stock/index at a particular time horizon.

Let's say, I want to analyze TCS and Benchmark Index is Nifty.

5/22

Let's say, I want to analyze TCS and Benchmark Index is Nifty.

5/22

TCS gave 13% returns and Nifty gave returns of 10% in 1 month. Then RS would of TCS would be 13%-10% ~ 3% (approximated).

Actual value/forumula be ((1+13%)/(1+10%)-1) = 2.7%.

This means TCS had outperformed Nifty in one month by 2.7%.

5/22

Actual value/forumula be ((1+13%)/(1+10%)-1) = 2.7%.

This means TCS had outperformed Nifty in one month by 2.7%.

5/22

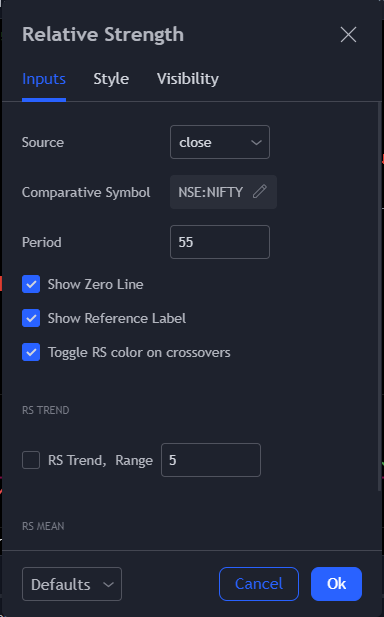

Let's see how this indicator looks and how it functions.

This is the general inputs for RS.

Two important inputs here are:

1. Comparative Symbol- This means which would be the benchmark index/stock one want's to compare their stock/index.

6/22

This is the general inputs for RS.

Two important inputs here are:

1. Comparative Symbol- This means which would be the benchmark index/stock one want's to compare their stock/index.

6/22

In Indian stock market, use Nifty as a benchmark as it includes all the major sectors.

2. Period: This is the time horizon over which one wants to compare the strength or weakness.

General period that is used is:

55- (3 months)

123- (6 months)

252 - (1 year)

7/22

2. Period: This is the time horizon over which one wants to compare the strength or weakness.

General period that is used is:

55- (3 months)

123- (6 months)

252 - (1 year)

7/22

Comparative Symbol and Period are highly customizable and use the values that suit your style.

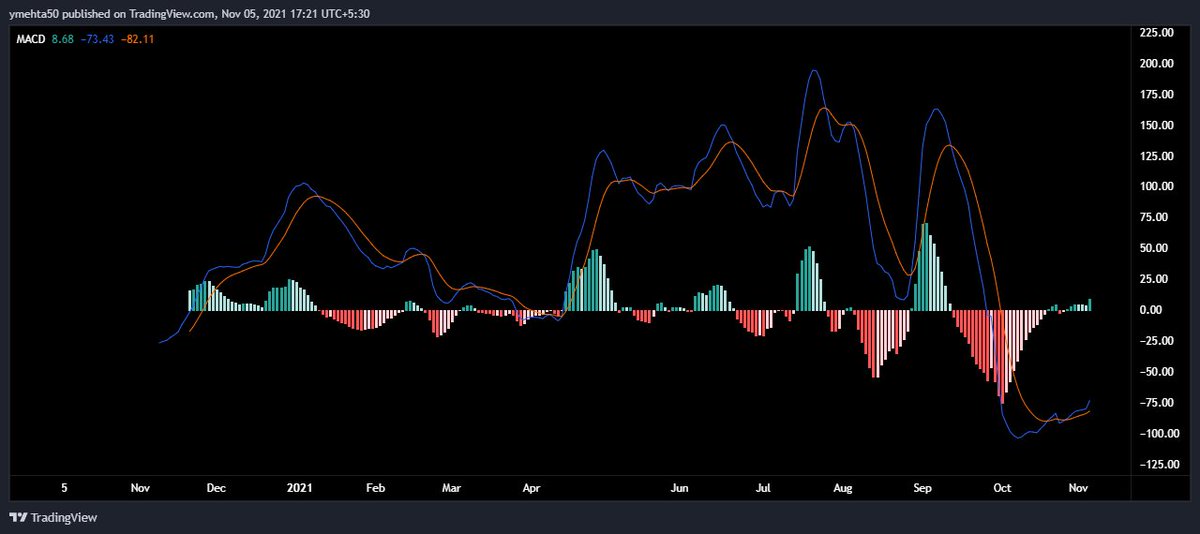

This is a sample RS chart of Asian Paints v/s Nifty.

Green RS means stock has outperform and Red RS indicates underperformance.

Pink line is 0 line which is highly important.

8/22

This is a sample RS chart of Asian Paints v/s Nifty.

Green RS means stock has outperform and Red RS indicates underperformance.

Pink line is 0 line which is highly important.

8/22

General definition of RS says:,

If RS line is above 0, then it shows stock will outperform and if RS is below 0, then it shows stock will underform.

Let's look at the same example:

When RS line closed below 0 line, Asian Paint stock went down from 2600 to 2200 (-15% down).

9/22

If RS line is above 0, then it shows stock will outperform and if RS is below 0, then it shows stock will underform.

Let's look at the same example:

When RS line closed below 0 line, Asian Paint stock went down from 2600 to 2200 (-15% down).

9/22

Similarly, for bullish setup.

When RS closes above 0 line, price of Asian Paints moved up from 2550 to 3000 (18% up).

Simple Rule of RS is:

1. Buy if RS > 0

2. Sell/Exit if RS < 0

This looks easy, but this is not that easy.

10/22

When RS closes above 0 line, price of Asian Paints moved up from 2550 to 3000 (18% up).

Simple Rule of RS is:

1. Buy if RS > 0

2. Sell/Exit if RS < 0

This looks easy, but this is not that easy.

10/22

Above setup that was shared was only when RS worked well.

There can be a lot of whipsaws in real life and using RS as a standalone will give you a lot of entry and exit in a stock. This will lead to minor loss plus additional trading cost.

What can be done now?

11/22

There can be a lot of whipsaws in real life and using RS as a standalone will give you a lot of entry and exit in a stock. This will lead to minor loss plus additional trading cost.

What can be done now?

11/22

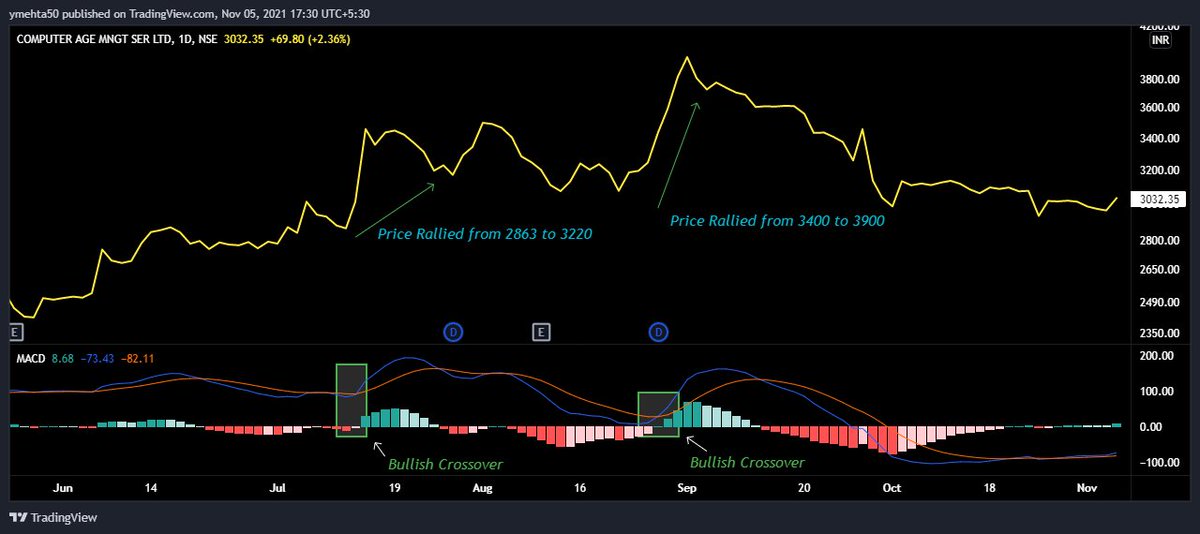

One of the setup that I am using and practicing based on Relative Strength was gifted by @vivbajaj sir.

One can watch the video as he had explained everything about simple Relative Strength setup in detail👇

12/22

One can watch the video as he had explained everything about simple Relative Strength setup in detail👇

12/22

Setup is simple. Use following indicators:

1. Relative Strength (RS) - Period = 55, Benchmark = Nifty

2. Supertrend - Default Setting

3. Relative Strength Index (RSI) - Default Setting

Price Action is used as it is the supreme indicator in trading.

13/22

1. Relative Strength (RS) - Period = 55, Benchmark = Nifty

2. Supertrend - Default Setting

3. Relative Strength Index (RSI) - Default Setting

Price Action is used as it is the supreme indicator in trading.

13/22

Buying Setup (Daily Time Frame):

1. RS above 0

2. Price above Supertrend

3. RSI > 50

Once all these conditions satisfy, then wait for price action confirmation.

Price should give a breakout on closing basis above previous swing high with good volumes.

14/22

1. RS above 0

2. Price above Supertrend

3. RSI > 50

Once all these conditions satisfy, then wait for price action confirmation.

Price should give a breakout on closing basis above previous swing high with good volumes.

14/22

Exit Setup:

Use 2 hour time frame chart.

If any two of the buying condition gets violated on closing basis, then exit immediately.

Why exit is done based on 2 hour chart?

Reason is fear in market spreads faster, so if lower time frame is bearish then exit.

15/22

Use 2 hour time frame chart.

If any two of the buying condition gets violated on closing basis, then exit immediately.

Why exit is done based on 2 hour chart?

Reason is fear in market spreads faster, so if lower time frame is bearish then exit.

15/22

Re-enter again if on 2 hours time frame setup becomes bullish and daily setup is also bullish.

Daily and 2 hours combination is for short-term trading.

One can use Weekly and Daily combination for positional trading.

16/22

Daily and 2 hours combination is for short-term trading.

One can use Weekly and Daily combination for positional trading.

16/22

Let's see some case/examples now:

Infosys (daily chart)

After satisfying all the conditions, entry got triggered at 960 and price rallied from 960 to 1120.

Up by 16% in the short term.

17/22

Infosys (daily chart)

After satisfying all the conditions, entry got triggered at 960 and price rallied from 960 to 1120.

Up by 16% in the short term.

17/22

Second example is Pidilite Industry.

After fulfilling all the conditions, entry got triggered at 1930 and price rallied from 1930 to 2220.

Up by 12% in the short term.

18/22

After fulfilling all the conditions, entry got triggered at 1930 and price rallied from 1930 to 2220.

Up by 12% in the short term.

18/22

One example of Positional Trading Setup:

Laurus Lab (Weekly Chart)

All the conditions got satisfied and price moved from 100 to 530. Stock up by 430%.

There would be many examples for this, so I would suggest to check this setup on other stocks and index chart as well.

19/22

Laurus Lab (Weekly Chart)

All the conditions got satisfied and price moved from 100 to 530. Stock up by 430%.

There would be many examples for this, so I would suggest to check this setup on other stocks and index chart as well.

19/22

Another setup I am practicing was given by .@premalparekh. I would suggest that everyone watch these two face-to-face videos of Premal Sir as well.

Link 1:

Link 2:

20/22

Link 1:

Link 2:

20/22

Strategy is easy only if one follows all the rule.

Key point is to sit with the patience for the returns.

As quoted by Livermore: "Sit tight when you are Right"

21/22

Key point is to sit with the patience for the returns.

As quoted by Livermore: "Sit tight when you are Right"

21/22

I hope everyone understood how Relative Strength can be used.

These are not a universal rules one must follow. One can create their rule or follow someone else rules.

Only important thing is one must follow a fix rule instead of tweaking or changing setup frequently.

22/22

These are not a universal rules one must follow. One can create their rule or follow someone else rules.

Only important thing is one must follow a fix rule instead of tweaking or changing setup frequently.

22/22

• • •

Missing some Tweet in this thread? You can try to

force a refresh