REPEAT Project update: Since 10/20 release of our Preliminary Report, the House passed the Infrastructure Investment & Jobs Act on 11/6 + introduced a new version of Build Back Better on 11/3.

Today we're publishing this brief Addendum to our report: dropbox.com/s/gckss8qyzfle…

Today we're publishing this brief Addendum to our report: dropbox.com/s/gckss8qyzfle…

There are a significant number of changes to the Build Back Better Act, which the REPEAT Project has carefully documented along with a thorough catalog of all climate and clean energy provisions in the final Infrastructure Bill at bit.ly/REPEAT-Policies.

This new Addendum compiles emissions results from our original analysis of ‘BBB 1.0’ (from 9/27) WITHOUT the Clean Electricity Performance Program (the most substantive single change from BBB 1.0 to BBB 2.0) + our initial analysis of the Infrastructure Bill impacts.

The REPEAT Project is currently hard at work modeling the updated version of Build Back Better (‘BBB 2.0’) and conducting a final analysis of the Infrastructure Bill, which will supersede results in our preliminary report and this addendum and will be released as soon as possible

To be clear, the Build Back Better Act results in this analysis do not capture all changes in the current legislation (only removal of the CEPP), and should be viewed as approximate estimates of the impact of the current (Nov 3, 2021) version of the Build Back Better Act.

Other significant changes to Build Back Better (11/3 v 9/27 versions) besides removal of the Clean Electricity Performance Program that are NOT captured in this analysis (but will be in our forthcoming results) are deatiled in this thread

https://twitter.com/JesseJenkins/status/1456707982553587713and include...

1. Significant reductions in funding for energy efficiency, building electrification and electric vehicle charging grants.

2. New funding programs to support U.S. wind, solar and semiconductor manufacturing, industrial decarbonization grants, soil carbon sequestration in agricultural lands, and clean energy and climate resilience workforce development.

3. An increase in the 45Q tax credit for carbon dioxide capture and storage or use to $85/ton for geologic storage of CO2 and $60/ton for industrial uses of CO2.

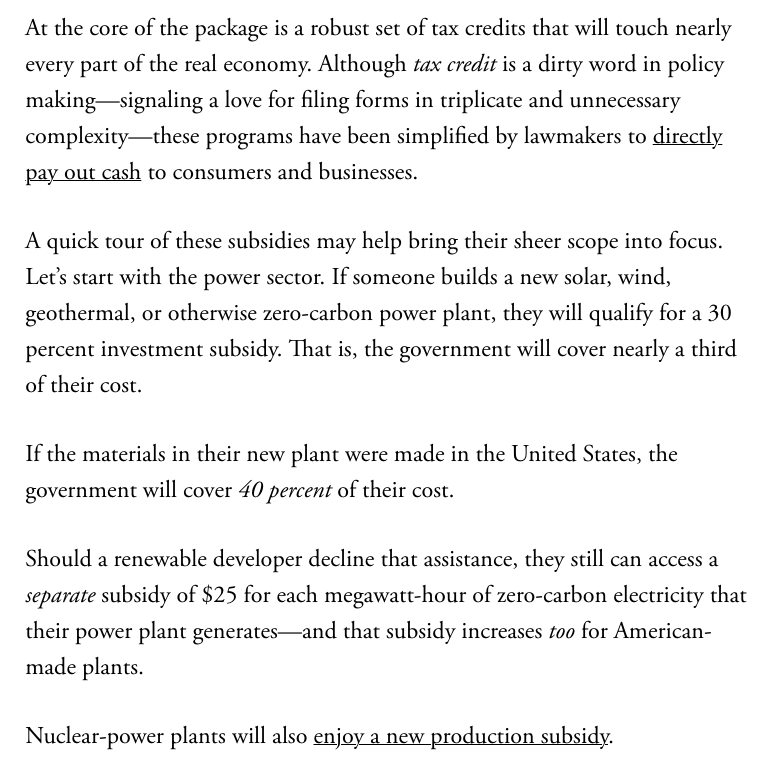

4. A switch from technology-specific tax credits for renewable electricity and biofuels to a set of new, technology-neutral tax credits for all zero-emissions electricity sources and low-carbon fuels.

Net effects of these changes on emissions outcomes is unclear, and we look forward to sharing our modeling. I would expect the results to be of a similar magnitude however to the BBB 1.0 without CEPP results in this Addendum (+/- ~100 MMT). Stay tuned at repeatproject.org!

• • •

Missing some Tweet in this thread? You can try to

force a refresh