It's been fast & furious around here, so I've not had time to share some fun news: as of this month, I've joined the Advisory Board of @Eavor, developer of advanced closed-loop geothermal energy technology. Clean, firm, flexible power, widely available. eavor.com

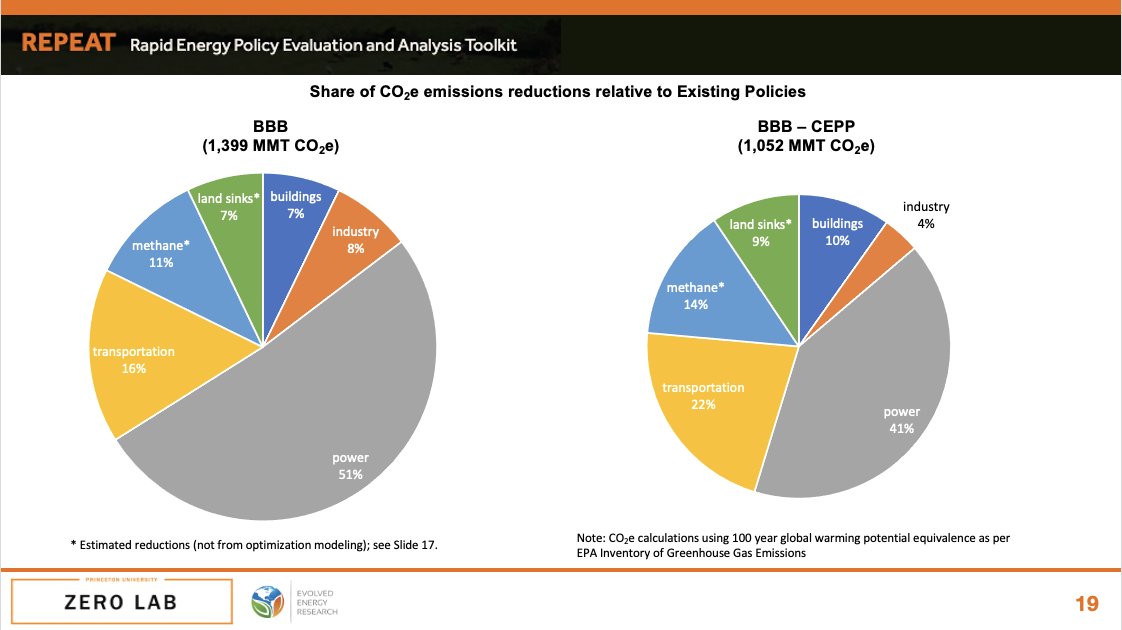

My research has consistently illustrated the value of 'clean firm power' -- available any time of the year, as long as needed -- as critical complement to 'fuel saving' variable renewables & energy-limited 'fast burst' batteries or demand flexibility. eg: sciencedirect.com/science/articl…

Furthermore, we find that FLEXIBLE firm resources are more valuable than those that operate constantly as always-on "baseload" generation. When prices are zero much of the time, producing flat out all the time isn't as valuable as shifting your output to the most vaulable times.

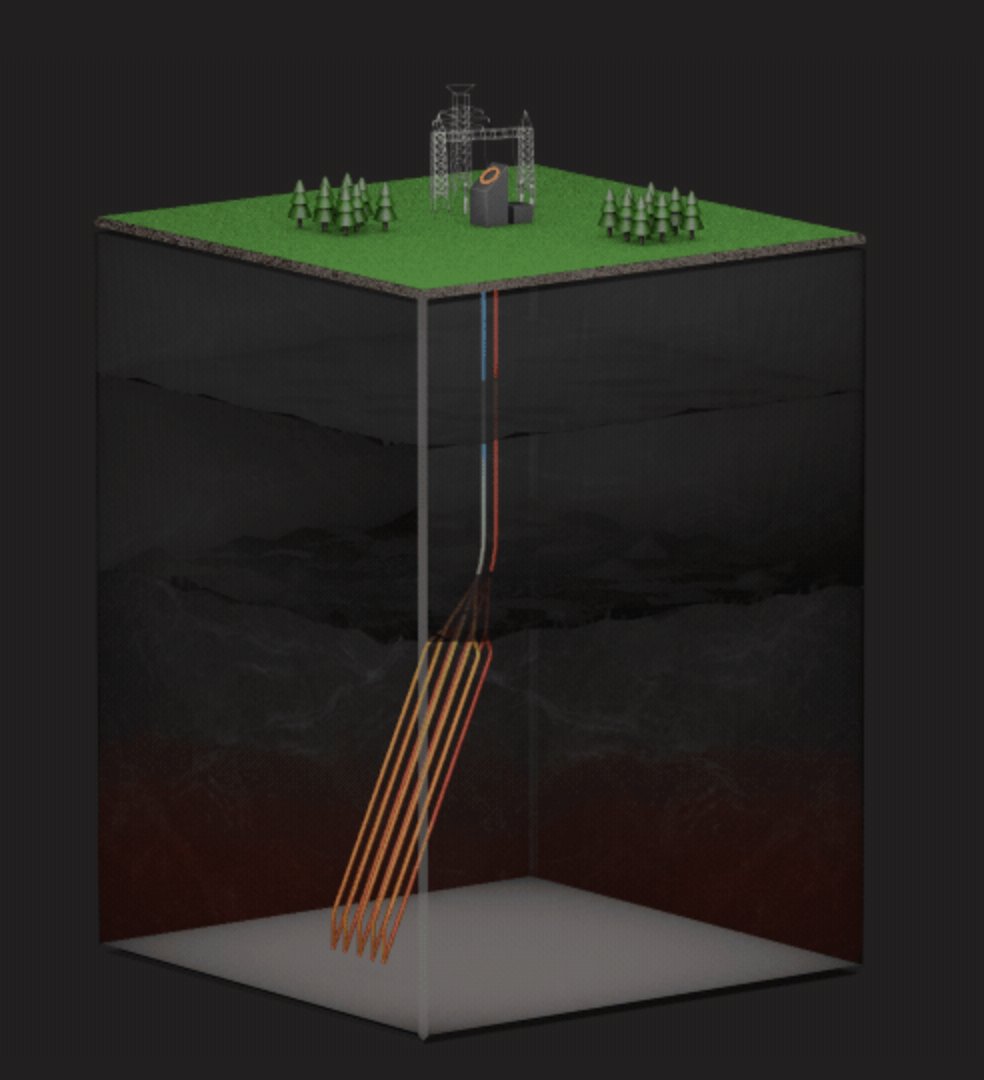

@Eavor's EavorLoop technology is one (of several) promising options for clean firm and flexible power. EavorLoop is a fully-contained, closed-loop system of deep wells that 'mine' heat from deep hot rocks like a massive subsurface radiator. eavor.com/technology/

The challenge: EavorLoop involves a huge area of multi-lateral wells in order to create a large enough 'heat exchanger' to produce usable power. That means @Eavor has to drop the cost of drilling in deep, hot, hard rock ~90% vs conventional methods. Big task! But @Eavor is on it.

Additionally, EavorLoop has 'built-in' energy storage capability: by slowing down the circulation of working fluid in the closed-loop system, they can build up heat and store it for later, then speed up flow rate to produce more power at the most valuable times. Firm AND flexible

In my consulting 'side hustle,' DeSolve LLC, @nsepulvedam and I worked with @Eavor's @MikeHolmesYYC to model the potential and value of flexible EavorLoops in a future Western US grid. The work was shared at Geothermal Rising Last week. Check it out here: dropbox.com/s/nb4h9yb7ywzw…

Like most early-stage technology ventures, @Eavor has to prove themselves to the world, tackling big technical challenges in their first commercial projects. Those are coming soon, and I'm excited to see what their engineers can do!

In the meantime, as a member of the Advisory Board (eavor.com/our-people/ including fellow #EnergyTwitter personality @MLiebreich) to advise Eavor on energy systems, markets, and policy as they advance their clean, firm, flexible power technology to market.

Full disclosure: Advisory Board membership involves an equity interest in @Eavor. Consider this the Twitter version of Conflict of Interest transparency.

For reference, all of my roles, including past consulting clients,kept up to date on my LinkedIn: linkedin.com/in/jessedjenki…

For reference, all of my roles, including past consulting clients,kept up to date on my LinkedIn: linkedin.com/in/jessedjenki…

Ack! Important clarification! @Eavor needs to cut cost per kilowatt of electric generation capacity from deep closed-loop geothermal by 90+%, NOT the cost of drilling specifically. Several ways to get that overall cost down, INCLUDING reducing drilling costs a lot.

@threadreaderapp unroll please

• • •

Missing some Tweet in this thread? You can try to

force a refresh