1/🍇 DeFi Pulse Drop: @NotionalFinance 🍇

Want to see a real-world use case for #crypto fixed rates?

Imagine a fintech app like Wealthfront hooking up their vast user bases to fixed rate products, with notional.finance fixed rates providing the yields under the hood...

Want to see a real-world use case for #crypto fixed rates?

Imagine a fintech app like Wealthfront hooking up their vast user bases to fixed rate products, with notional.finance fixed rates providing the yields under the hood...

2/ This is the future of fixed rates!

Whether you want fixed rates for your own portfolio, these stable rates move #DeFi forward, which benefits EVERYONE.

The ability to plan future cash flows / calculate capital costs for the long-term = new use cases, new users.

Whether you want fixed rates for your own portfolio, these stable rates move #DeFi forward, which benefits EVERYONE.

The ability to plan future cash flows / calculate capital costs for the long-term = new use cases, new users.

3/ What comes next then?

Maybe protocols & #DAOs use fixed rates to borrow against their treasuries to fund operations & expansion!

This is but a taste of what’s to come, & soon enough Notional’s fixed rate pools with deep liquidity may become base infra for fueling DeFi.

Maybe protocols & #DAOs use fixed rates to borrow against their treasuries to fund operations & expansion!

This is but a taste of what’s to come, & soon enough Notional’s fixed rate pools with deep liquidity may become base infra for fueling DeFi.

4/ DeFi will push into new design spaces in the years ahead, for sure.

Yet if there’s *any* TradFi instrument we need, it's fixed-rate interest. The future is increasingly fixed, and these rates can be force multipliers for propelling #DeFi into the mainstream!

Yet if there’s *any* TradFi instrument we need, it's fixed-rate interest. The future is increasingly fixed, and these rates can be force multipliers for propelling #DeFi into the mainstream!

5/ In the meantime, prepare for the future by learning how to use Notional now!

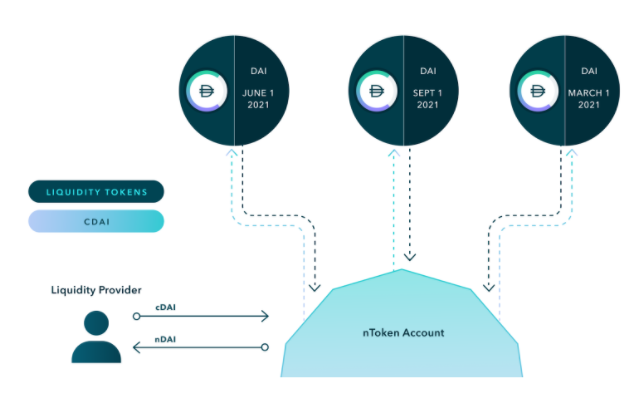

A good starting point is to start understanding how & why Notional serves both borrowers *and* lenders with fixed rates:

A good starting point is to start understanding how & why Notional serves both borrowers *and* lenders with fixed rates:

https://twitter.com/defipulse/status/1458158969826983941

6/ This is a paid promotion as part of our DeFi Pulse Drops series where DeFi Pulse works with projects to launch their new features and builds. If you want us to work with you, please get in touch!

• • •

Missing some Tweet in this thread? You can try to

force a refresh