0 – Got involved w/ @rct_ai; after YC-funding + years of hard work in AI generated content, it’s now leveraging its R&D to explore 3 interesting (& lucrative) GameFi primitives:

- Bots-as-a-service for P2E

- Matrix of NFT-enabled casual games

- AAA Open-world & MMO & FPS title

- Bots-as-a-service for P2E

- Matrix of NFT-enabled casual games

- AAA Open-world & MMO & FPS title

https://twitter.com/rct_ai/status/1457710918612045829

1 – rct’s “botting” arm @DeterrenceAI basically aims to automate in-game actions specifically targeting P2E games. In other words, instead of needing actual real people to “farm” say $SLP in Axie, there’s no reason why rct’s bot can’t do it.

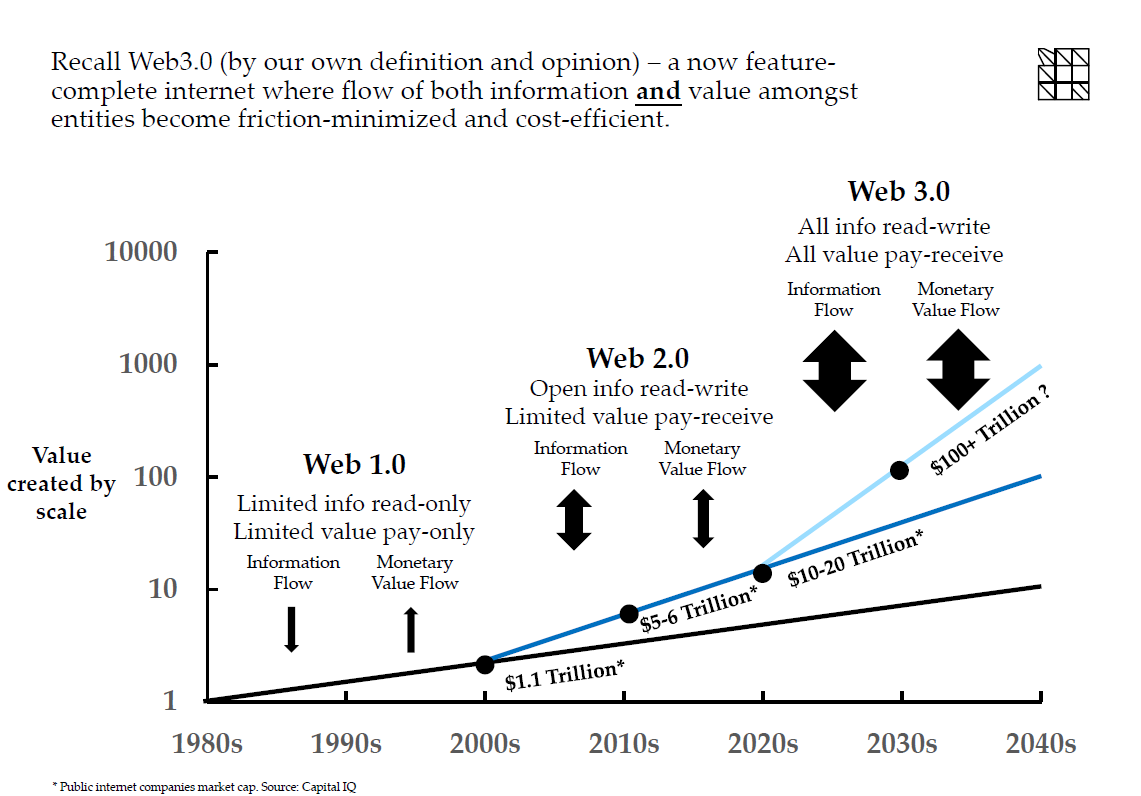

2 – Machines already automate most of our lives today, & it seems likely that players, DAOs, and guilds will soon “employ” them in P2E games – I could see game devs hating it, but it’s probably best to embrace & tweak in-game econ than to fight the inevitable.

3 – Similar to transport cost likely collapsing towards cost of production & capital when vehicle autonomy approaches level 5 / 6 + cutting labor out of equation, the bots here can collapse player take-rate and dominate market share (it'd be most economic for capital to "hire").

4 - …so the future of GameFi guilds will likely not be mostly real players, but small group of capital owners & programmers, unless the games are highly complex where bots can’t be trained easily (but then again, AI is already crushing Go, poker, and Starcraft pros).

5 – thus, the leading “botting AI” staying on the frontier (best R&D = highest ROI on subscription = most adoption = can reduce take rate + hire best R&D) can be insanely lucrative when the Web3 gaming space takes off (and should way outperform pure-human guilds).

6 – rct’s 2nd initiative @joinmirrorworld (MW) is I think to (a) showcase its AI and (b) test how causal game series can be built around AI-enabled NFTs (powered by Deterrence). I view this as mostly just buidling to understand how the Web3 gaming space works + funding mechanism.

7 - Namely on point b, how rct's AI know-how can get integrated with Web3 GameFi remains fuzzy at the moment (rct's clients would ask: "but what can it do?"), so MW as a testfield to showcase the findings (botting, dialogues, etc) seem most reasonable.

8 – rct’s 3rd initiative is this (unannounced) AAA shooter title named project Odyssey which had been in development over the past 2-3 years. The game had a storied past where you can dig up via the internet (search for Code: Odyssey or 代号:奥德赛)

9 - …which as far as we know is testing / partial release in 1-2Q 2022. More details should be out very soon - judging by the 5-40 Bn token valuation in GameFi market, won’t be surprised to see similar path of launching a token. Decent trailer as well ;)

10 – we do worry a bit about @xiankunwu and @Sergio2Chan taking on too many things at once (significant execution risk), so #1 key currently would be to fundraise / hire top talent to focus on what’s at hand. The grit, ambition, and pace of execution had been impressive so far.

11 – We wish the team all the best and will be working with them on (a) marketing / messaging / community communication and (b) thinking through the narrative + tokeneconomics as well as jamming on Web3 trends in general.

0.1 - AIGC here is not really AI generated images, videos, etc, but actually in-game mechanics such as battle AI, in-game dialogues, dynamic narrative / reaction based on environments, etc. Not every studio is Rockstar games and can spend millions on every single NPC!

• • •

Missing some Tweet in this thread? You can try to

force a refresh