This one hits home. Turns out the moments one tend to remember are the paths not taken:

- Out of college my friend/ roommate ask me to join him as cofounder of a new lending solution. I passed wanting to hold on to my banking job. It’s now one of the largest in this space.

- Out of college my friend/ roommate ask me to join him as cofounder of a new lending solution. I passed wanting to hold on to my banking job. It’s now one of the largest in this space.

https://twitter.com/cmsintern/status/1432397191230984204

- During my second gig on WS, a good friend of mine is heading back to China to join some news tech company startup and asked if I want to join him via referral. I had a decent HF job at the time and was like nahhhh. That business was called Bytedance.

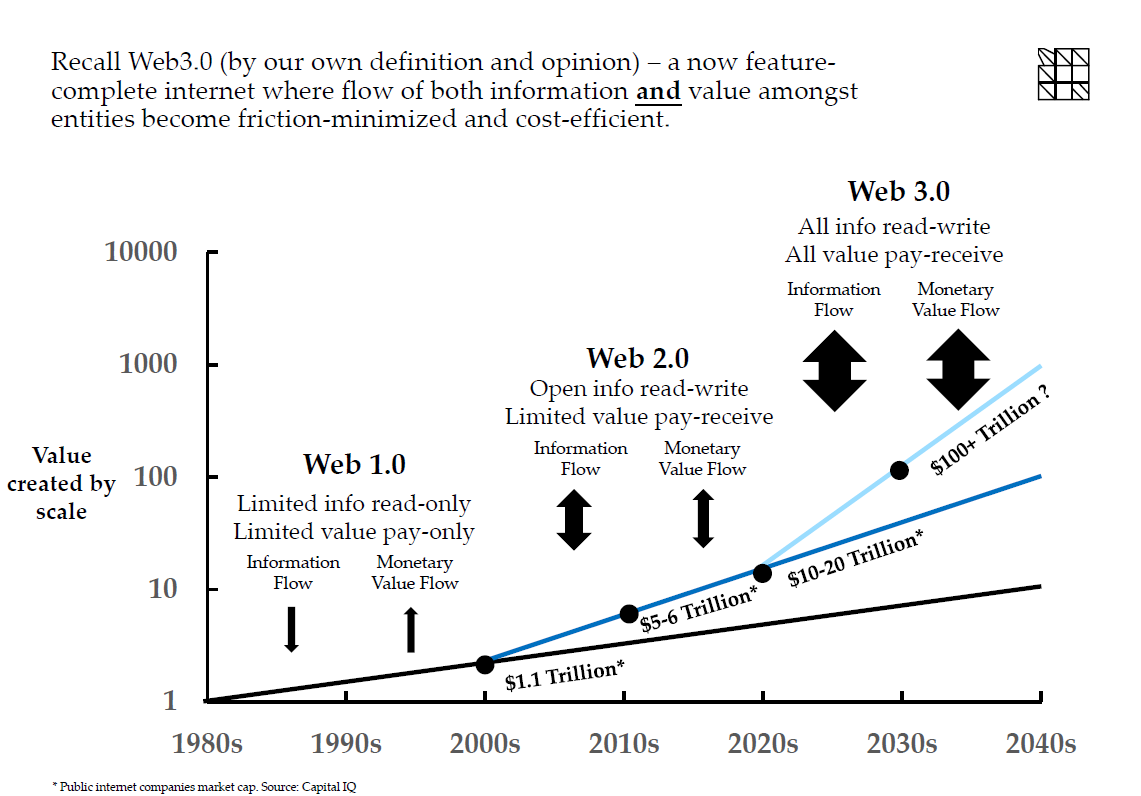

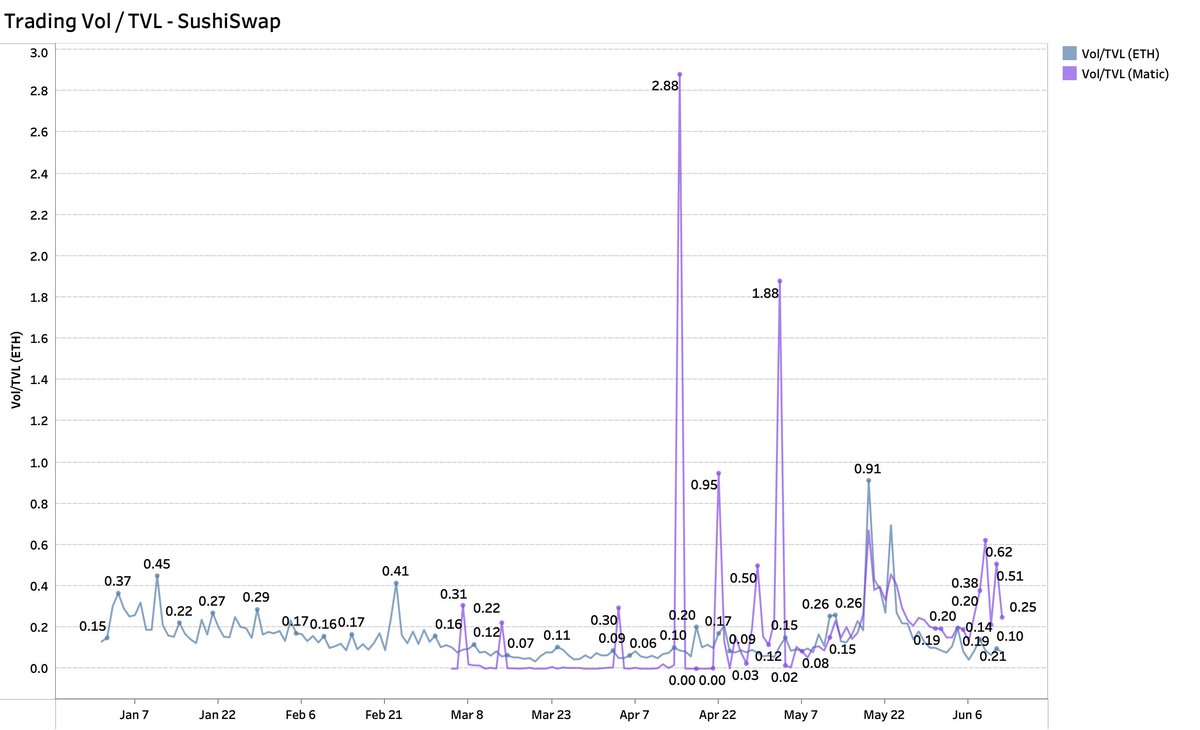

- and this one is even more recent. I remember learning about Delphi working on some “axey” thing in their WS WeWork and had sushi with another Chad in Taipei as recent as jan 20 about this Dee-Fi stuff. Was like hmmm but I’m still sceptical. You all know what happened next.

My point is, I wish I explored more and took more risk. One’s ability to do so after even 30 diminishes drastically as responsibility really piles up.

They say do not go gentle into that good night. Why not go balls to the wall when it’s gm?

They say do not go gentle into that good night. Why not go balls to the wall when it’s gm?

Ape responsibly :)

• • •

Missing some Tweet in this thread? You can try to

force a refresh