0 - It’s been a long time coming. Today I am announcing @FoliusVentures / 一叶创投 dedicated to investing in, evangelizing, and buidling the Web3 future w/ a global mandate (APAC focus to start).Ping me on twitter / Telegram with the same handle if you wanna jam!

https://twitter.com/fintechfrank/status/1428341545242091525

1 - By way of background, I graduated from CMU way back in 2012 and spent the past 8-9 years in NYC TradFi, first at DB, then at a family office doing mostly US equities investing, then at a global non-US Tiger grandcub focused on small-cap equities….

2 - …where I covered mainly China-related and software businesses. The deep dive into crypto didn't really start until early 2018 (later than a lot of you!) and MLC was really a spur-of-the-moment moniker which I will be keeping (but unfortunately I'm not Canadian =/)

3 - In my opinion, the industry's future ultimately relies upon (a) value networks scaling without sacrificing security; (b) real businesses flourishing beyond speculation on top of the Web3 tack, and (c) the ability to co-exist amicably with regulation.

4 - To that end, whirlwind of scaling + alternative L1s, burgeoning #DeFi ecosystem & infinite composability w/ business ecosystems (Gaming & NFT currently), increasingly logical & open policies in select countries, and infusion of top-tier talents had far exceeded my expectation

5 - In other words, I think the odds of a, b, and c all went from "maybe" to "possibly/ likely", while E[a,b,c] now in my mind tilts definitively & materially positive (as opposed to more uncertain back in 2017-18). I think window for infra / foundation will close within 3 years.

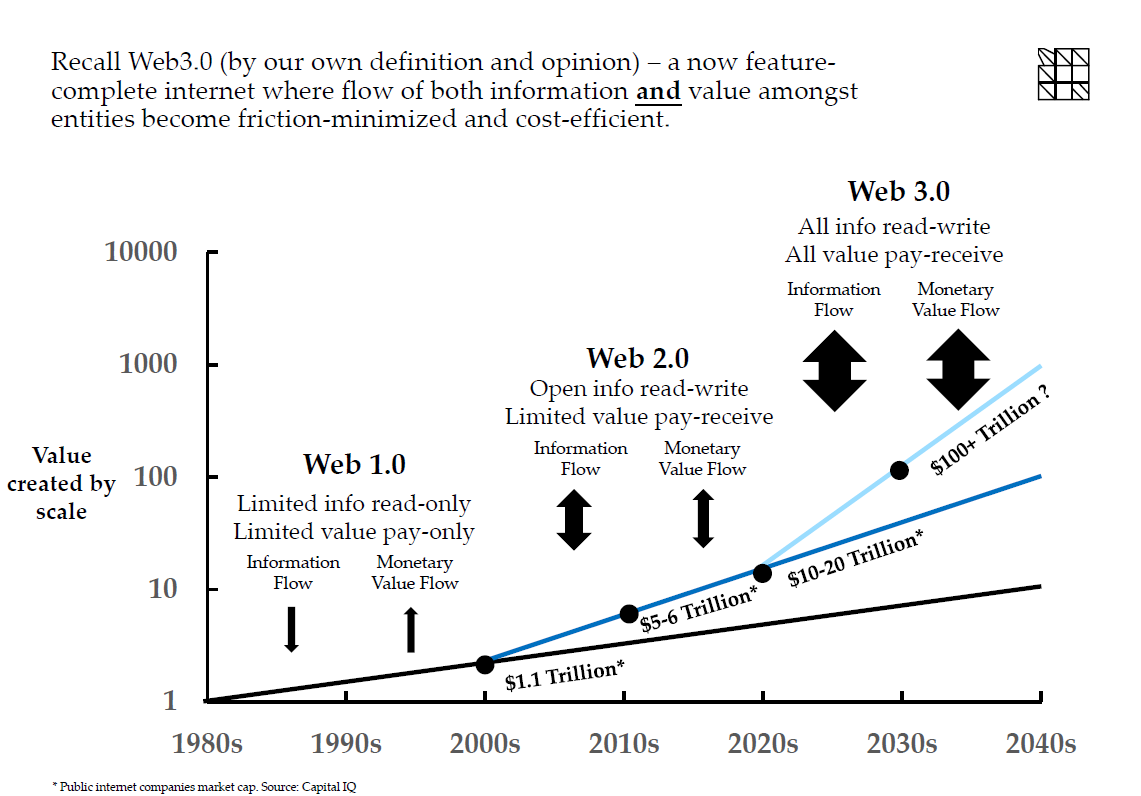

6 - …whereby Web3 will be a 10-15 year megatrend spanning 2-4 cycles going from infra -> web2+ -> web3 -> part of our daily life. If this vision works, then we are just slogging through the internet equivalent of 1H 1990s, now entering 1995-2000 of use-case and applications.

7 - Success of Web3 vision to me would = "feature-complete" internet where both info & value flow cost-efficiently & frictionlessly across space, time, amount, & complexity -- i.e. Web2 bottle lost its genie but caught some lightning (@genie_xyz plz pay me for this slogan kek).

8 - So I took the plunge in May 2021. The support has been overwhelming and I wouldn't have been able to do it without strategic support from partners like @paraficapital @dragonfly_cap @alpackaP @pythianism @im_manderson @rleshner @jdh and my former colleagues at BCM.

9 - Special kudos goes to @santiagoroel who drove it home -- logic is along the lines of "Do you want to keep playing the same game with the rules set in the 70s-90s, or do you want to be a part of the most profound socio-economic transformation since the industrial Revolution?"

10 - Don't get me wrong, my prior firm Briarwood was phenomenal. I learned a ton on how to invest in a rigorous bottoms-up, fundamentals-driven way. But as those in Web3 already knew, where we are heading cannot be more obvious, and is growing only more obvious by the day.

11 - In short, I can taste that future NOW, and I HAVE TO be a part of it NOW.

12 - For Folius, the initial focus on APAC reflects our belief that not only the region would become a Web3 powerhouse with high caliber founders (if not already), but also that they deserve access to long-term focused insti. capital just like the same founders do in US and EU.

13 - In particular, for the Chinese founders out there, 我个人坚信,优秀的团队在这个行业深耕时一定会倾向于与坚持长期主义的伙伴为伍。任何带着机会主义入局,急功近利,甚至心术不正的参与者,都将随着行业发展而被逐渐淘汰。日拱一卒无有尽,功不唐捐终入海,希望能与各位一起努力。

14 - If you made it this far, Folius is the Latin suffix for "one leaf" -- which goes with 2 idioms in Chinese: 一叶知秋 and 一叶障目. The former means being foresightful and is a play on my real Chinese name, and the latter serves as a keen reminder to look beyond the short-term

15 - I am deeply humbled by the trust and support, feel incredibly lucky to be able to dedicating my career to this industry, and cannot wait to spend 100% of my time working with you all.

• • •

Missing some Tweet in this thread? You can try to

force a refresh