Any CFA’s want to make $1000 doing a few hours of work? I will etransfer the first person to complete this a detailed will referenced model of cameco’s contract book. $ccj $cco #uranium #CFAchallenge

Here’s the md&a read and follow the thread

s3-us-west-2.amazonaws.com/assets-us-west…

Here’s the md&a read and follow the thread

s3-us-west-2.amazonaws.com/assets-us-west…

Here’s how cameco management and board thinks. They are assuming only 2% inflation. But the dramatic realization here is they are basing there uranium contract strategy on the last 25yrs where I we likely had max 7-8yrs bull and mostly bear market or near flat years.

They crunched the numbers and found that over the last 25yrs the long term price was 21% higher than the spot price. No shit.. it’s mostly been a nasty bear market. This analysis is the basis for their contracting policy.

Seems they don’t think they can predict bull and bear markets and have designed a contracting approach that will work well over 25 years. Lol. Also with a low inflation assumption. My god. It’s like the federal reserve staff is modelling and running this company.

Look at this table closely. They speak of having 60/40 upside to the spot price and it think making that statement makes them at risk of litigation in the future if the uranium price spikes and stays high in the near term. Note how as the price rises they get less and less if it

In 2024 they get $2 of the move from $100 to $140 and only $4 of that move in 2025.

In 2024 they get only if the get only $10 on a spot move from $60 to $140 or $10 of and $80 move. Yuck!

2025 they get $16 of that $80 move.

In 2024 they get only if the get only $10 on a spot move from $60 to $140 or $10 of and $80 move. Yuck!

2025 they get $16 of that $80 move.

It’s one thing to cap the upside. But what many are not understanding is the number of lbs they need to buy in the market for the next few years to fulfill the Mcarthur River contract obligations. They shut the mine but still had contract obligations.

This means they must buy/borrow lbs and deliver into those contracts and either potentially burn huge sums of cash or give up further upside to the price buy kicking the can down the road by borrowing uranium.

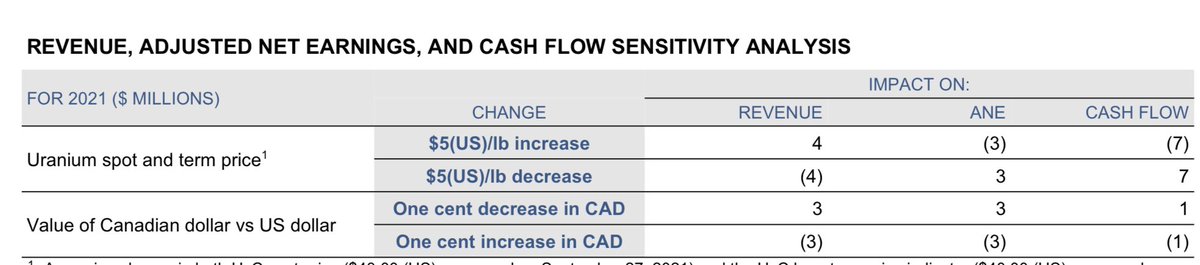

They put out this cash flow sensitivity analysis. But again, I think it’s very misleading. Basically says a $5/lb increase will result in a $7mm dollar cash burn. But, I think most get them impression from this that a $10 move would be $14mm and a $20 move would be $28mm etc

But when you look at the contracting table it’s not linear like that. The more the price rises the less upside they get for lbs they produce and sell out of cigar and the more losses they create from having to buy in the market and deliver into these terrible contracts.

They deflect all questions on this and have referred to them as gotcha questions..lol. They said of late that it the price goes to $100/lb it will be a be for a short time etc. Like a week or what ever (I don’t know the exact wording off hand but it was something akin to that)

What needs to be modelled here the revenue they will get based on Cigar’s production as the prices rises to $80 $100 $120 $140 $160 $180 and $200. Why not at least model to the all time high on an inflation adjusted basis. They likely stopped at $140 cause it was the nominal ath

Then model the cash flow impact of buying in the market at those uranium prices and delivering into the contract book. Need to try to estimate the number of lbs they are on the hook for the next few years above there expected production level.

I’d love to know if the deals they signed this year were 5 or 10 year deals as well. How long should we expect these sorts of contracts to be in place ? Analysts that cover the stock should know ? But I don’t see anyone going there…

Next model is how long they will be forced to buy in the market and deliver into these contracts? How long will it take to restart Mcarthur River? They say 18-24 months. But giving supply chain issues and labour shortages we should range 18-36 months.

So assume possibility of high uranium prices averaging 80 100 140 180 for 2-3 years and what will the effect in cash flow be. Then add cash burn to start up of $250-350mm. Add it all up. I think the market will be shocked at the cash crunch risk

Hope someone takes up this challenge. I’ll pay you $1000 and introduce you to some institutions that many want to hire you.

Please make the model clear and footnote assumptions from the quarterly reports. So that it’s irrefutable.

Please make the model clear and footnote assumptions from the quarterly reports. So that it’s irrefutable.

I think all offer a $500 second prize. The first to models of quality I see shared on this thread will compete in an online pole that I will create here on Twitter. Model with the most votes wins $1000. Second $500

For those that post a model early, I will engage vs dm to help

For those that post a model early, I will engage vs dm to help

I’ll assist you to complete it as best I can. Thanks

@Convertbond love to see you put one of your analysts on this and comment?

• • •

Missing some Tweet in this thread? You can try to

force a refresh