1/6

60 Minutes did a segment on the Supply Chain

As I have been saying for weeks now ... What is the worst day of the supply chain problem? Answer, today. And tomorrow should be a new extreme.

cbsnews.com/news/supply-ch…

60 Minutes did a segment on the Supply Chain

As I have been saying for weeks now ... What is the worst day of the supply chain problem? Answer, today. And tomorrow should be a new extreme.

cbsnews.com/news/supply-ch…

2/6

This gives the impression is the chain is at 100% and it will take years to expand it. And that assumes everyone wants to invest the big $$$ to do it.

So, to repeat myself, how do you fix this? Zoom prices much higher so we stop buying stuff.

See the latest CPI report

This gives the impression is the chain is at 100% and it will take years to expand it. And that assumes everyone wants to invest the big $$$ to do it.

So, to repeat myself, how do you fix this? Zoom prices much higher so we stop buying stuff.

See the latest CPI report

2/6

Transcript:

Peterson: If they can't get their products in in time for the holiday season. And of course it also means consumers are going to pay really high prices for everything.

Whitaker: So this is what inflation looks like?

Peterson: Yeah, this is inflation first-hand.

Transcript:

Peterson: If they can't get their products in in time for the holiday season. And of course it also means consumers are going to pay really high prices for everything.

Whitaker: So this is what inflation looks like?

Peterson: Yeah, this is inflation first-hand.

3/6

Feightwaves story saying the backlog of container ships anchored off LA/Long Beach is at a new record today.

It is not getting better.

freightwaves.com/news/clock-tic…

Feightwaves story saying the backlog of container ships anchored off LA/Long Beach is at a new record today.

It is not getting better.

freightwaves.com/news/clock-tic…

4/6

New anchorage record … again

According to the Marine Exchange of Southern California, 111 container ships were in the port on Tuesday, a new high. Of those, 30 were at the Los Angeles/Long Beach berths, 32 at anchor and a record 49 “loitering” (in holding patterns).

New anchorage record … again

According to the Marine Exchange of Southern California, 111 container ships were in the port on Tuesday, a new high. Of those, 30 were at the Los Angeles/Long Beach berths, 32 at anchor and a record 49 “loitering” (in holding patterns).

5/6

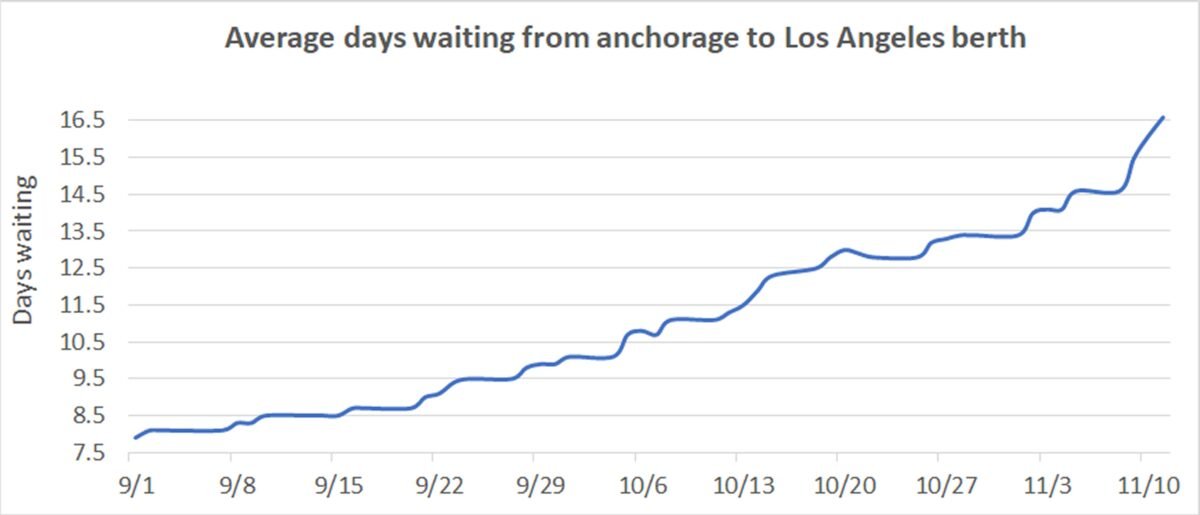

Meanwhile, the waiting time at anchorage continues to escalate. The Port of Los Angeles said that the average wait for anchorage to berth was an all-time-high 16.6 days as of Thursday. The wait time has trended sharply upward over the past week.

Meanwhile, the waiting time at anchorage continues to escalate. The Port of Los Angeles said that the average wait for anchorage to berth was an all-time-high 16.6 days as of Thursday. The wait time has trended sharply upward over the past week.

• • •

Missing some Tweet in this thread? You can try to

force a refresh