1/12

In the last month, markets are pricing in more aggressive tightening of monetary policy across the globe, sending short rates higher. This move accelerated in the last week. Is this signaling the end of the “transitory” inflation era?

A thread to explain

In the last month, markets are pricing in more aggressive tightening of monetary policy across the globe, sending short rates higher. This move accelerated in the last week. Is this signaling the end of the “transitory” inflation era?

A thread to explain

2/12

The last two weeks have seen short-term interest rates around the globe shoot higher, as the following series of charts show.

The last two weeks have seen short-term interest rates around the globe shoot higher, as the following series of charts show.

3/12

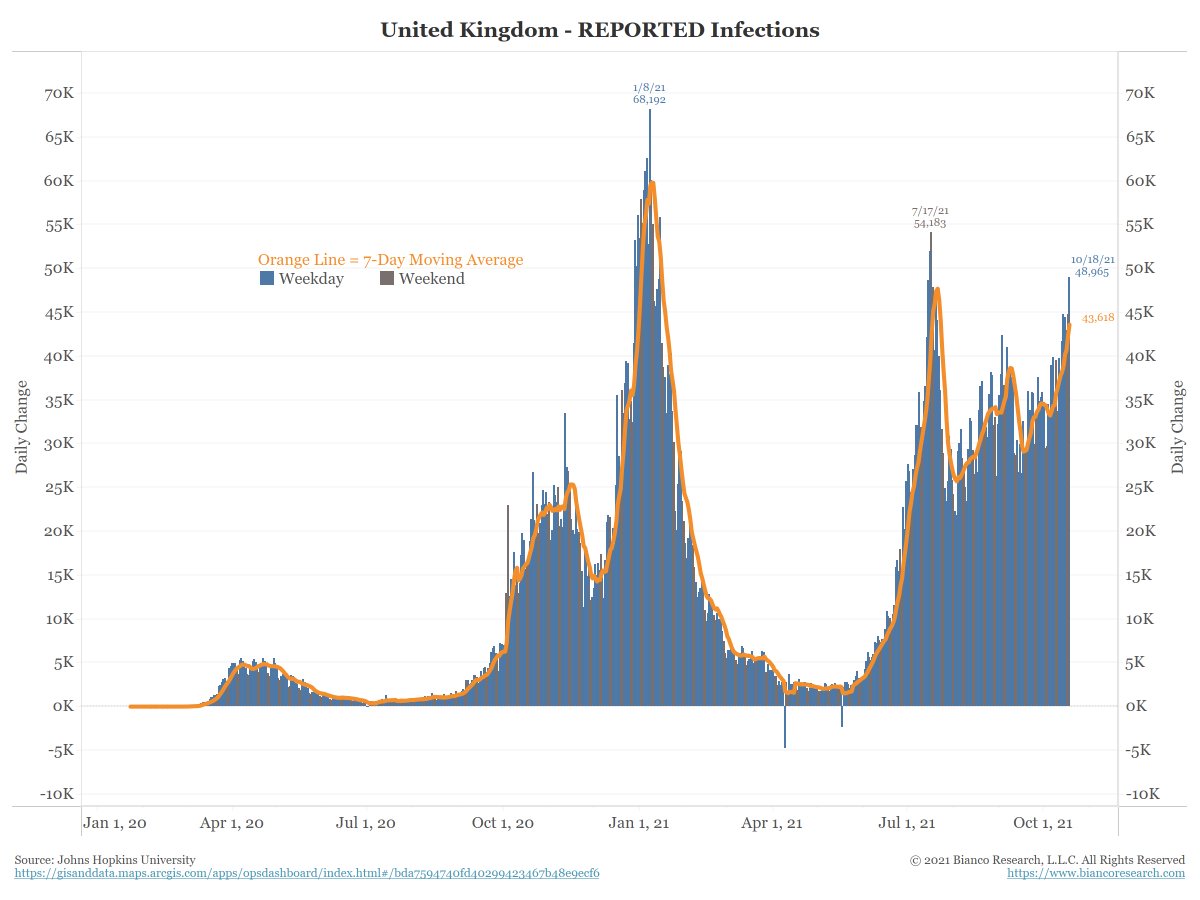

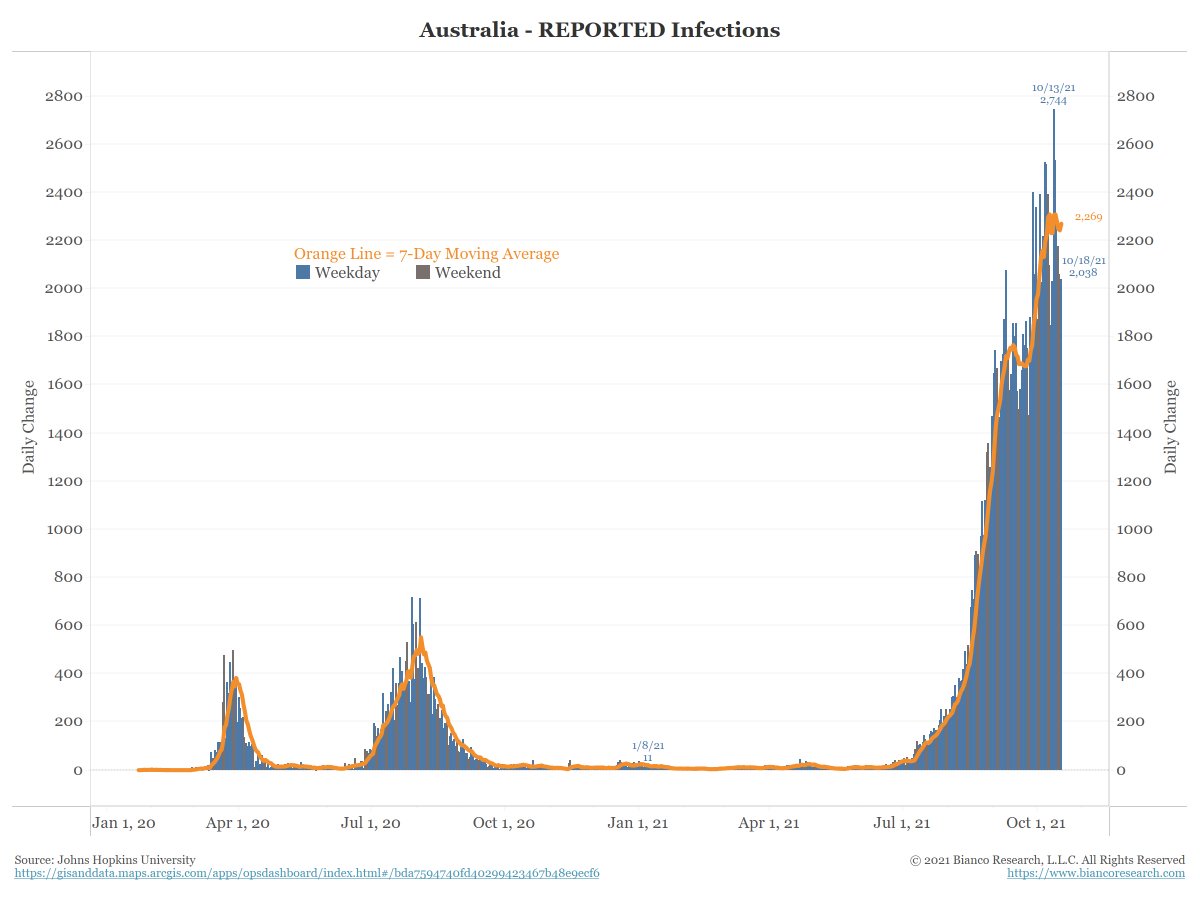

This trend is most acute in Australia where it appears yield curve control is blowing up. The Reserve Bank of Australia cannot maintain its target of 0.10% (blue line).

This trend is most acute in Australia where it appears yield curve control is blowing up. The Reserve Bank of Australia cannot maintain its target of 0.10% (blue line).

4/12

Our analogy from earlier this year. Central banks are a post and the markets are a horse tethered to that post. When the horse is spooked, it can rip the post out of the ground.

It seems the horse in Australia not only ripped the post out of the ground, but the entire fence!

Our analogy from earlier this year. Central banks are a post and the markets are a horse tethered to that post. When the horse is spooked, it can rip the post out of the ground.

It seems the horse in Australia not only ripped the post out of the ground, but the entire fence!

5/12

Below below shows when the first US rate hike is priced in, to 0.25%-0.50%.

Cyan is the odds at the July 27, 2022 FOMC meeting first moved above 50% a few weeks ago.

Green shows the odds of a hike by the June 15, 2022, FOMC meeting, moved above 50% about 10 days ago.

Below below shows when the first US rate hike is priced in, to 0.25%-0.50%.

Cyan is the odds at the July 27, 2022 FOMC meeting first moved above 50% a few weeks ago.

Green shows the odds of a hike by the June 15, 2022, FOMC meeting, moved above 50% about 10 days ago.

6/12

Red shows the odds of a second US hike by the September 21, 2022, FOMC meeting, is now at 52%.

Based on the charts above and below, the market is essentially pricing in a June 2022 rate hike followed by another in September 2022.

Red shows the odds of a second US hike by the September 21, 2022, FOMC meeting, is now at 52%.

Based on the charts above and below, the market is essentially pricing in a June 2022 rate hike followed by another in September 2022.

7/12

Finally, a 3rd US hike, putting the fed funds rate at 0.75%-1.00%, is also a possibility in 2022. Blue below shows the odds of a 3rd hike by the Feb 1, 2023, FOMC meeting crossed above 50% last week. The odds of a 3rd hike by the Dec 14, 2022 meeting are a coin toss at 48%.

Finally, a 3rd US hike, putting the fed funds rate at 0.75%-1.00%, is also a possibility in 2022. Blue below shows the odds of a 3rd hike by the Feb 1, 2023, FOMC meeting crossed above 50% last week. The odds of a 3rd hike by the Dec 14, 2022 meeting are a coin toss at 48%.

8/12

And what is driving these rate and market expectations of more hawkish policy?

Ever higher expectations of inflation.

And what is driving these rate and market expectations of more hawkish policy?

Ever higher expectations of inflation.

9/12

Central banks set monetary policy. But we would caution the market is a powerful voice in the room with these central bankers.

Right now that voice is sending a clear signal that they need to get more aggressive in its view of rate hikes.

Central banks set monetary policy. But we would caution the market is a powerful voice in the room with these central bankers.

Right now that voice is sending a clear signal that they need to get more aggressive in its view of rate hikes.

10/12

The longer the market stays at these levels, which it only reached in the last week or so, the louder that voice becomes.

History shows the Fed and economists often go through the five stages of grief before they accept a message from the market.

The longer the market stays at these levels, which it only reached in the last week or so, the louder that voice becomes.

History shows the Fed and economists often go through the five stages of grief before they accept a message from the market.

11/12

Right now that message appears to be that the era of transitory inflation is over. We are now entering an era of more persistent inflation.

Right now that message appears to be that the era of transitory inflation is over. We are now entering an era of more persistent inflation.

12/12

If the market stays priced this way, expect Central Banks to go through denial, anger, bargaining, depression, and then finally acceptance.

The market is offering its opinion of concern that central bankers are behind the curve and will need to catch up quickly in 2022.

If the market stays priced this way, expect Central Banks to go through denial, anger, bargaining, depression, and then finally acceptance.

The market is offering its opinion of concern that central bankers are behind the curve and will need to catch up quickly in 2022.

• • •

Missing some Tweet in this thread? You can try to

force a refresh