Current and quick thoughts on $BTC #bitcoin Low Time Frame wise

Agenda:

- FVG

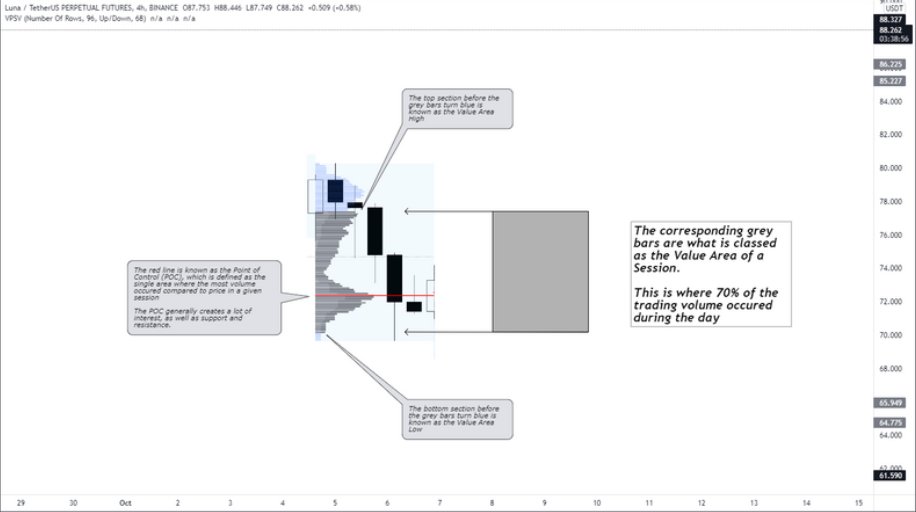

- nPOC's

- Liquidity Runs

- Confluence

- Targets

- Conclusion

Agenda:

- FVG

- nPOC's

- Liquidity Runs

- Confluence

- Targets

- Conclusion

FVG

We have a Fair Value Gap that is presented to us in the form of a bullish $500 candle, where a portion of the candle's body has no exploratory wick or body from another immediate candle to balance price.

We have a Fair Value Gap that is presented to us in the form of a bullish $500 candle, where a portion of the candle's body has no exploratory wick or body from another immediate candle to balance price.

Liquidity

Note the liquidity in the form of buyside liquidity has been claimed also from the range high already.

We'd typically expect that with a range, that we alternate between range high and low for liquidity.

Assuming here that range low is up next

Note the liquidity in the form of buyside liquidity has been claimed also from the range high already.

We'd typically expect that with a range, that we alternate between range high and low for liquidity.

Assuming here that range low is up next

Confluence

From a confluence perspective, we have the 0.382 overall fib level resting below the FVG, that is also acting as support from recent PA

From a confluence perspective, we have the 0.382 overall fib level resting below the FVG, that is also acting as support from recent PA

Targets

A possible play could be up for the nPOC that is just above current price, that also rests right at the 0.618 level of the overall fib move.

Confluence is key after all, and would make sense for a move like this

A possible play could be up for the nPOC that is just above current price, that also rests right at the 0.618 level of the overall fib move.

Confluence is key after all, and would make sense for a move like this

Conclusion

Reckon that we could see price take the range low, nab the liquidity, and ten tap the nPOC and hit the 0.618 resistance?

Only time will tell!

Let's keep an eye on this one hey?

Cheers guys

Reckon that we could see price take the range low, nab the liquidity, and ten tap the nPOC and hit the 0.618 resistance?

Only time will tell!

Let's keep an eye on this one hey?

Cheers guys

• • •

Missing some Tweet in this thread? You can try to

force a refresh