It's kind of funny, but I left my phone on silent and slept in today.

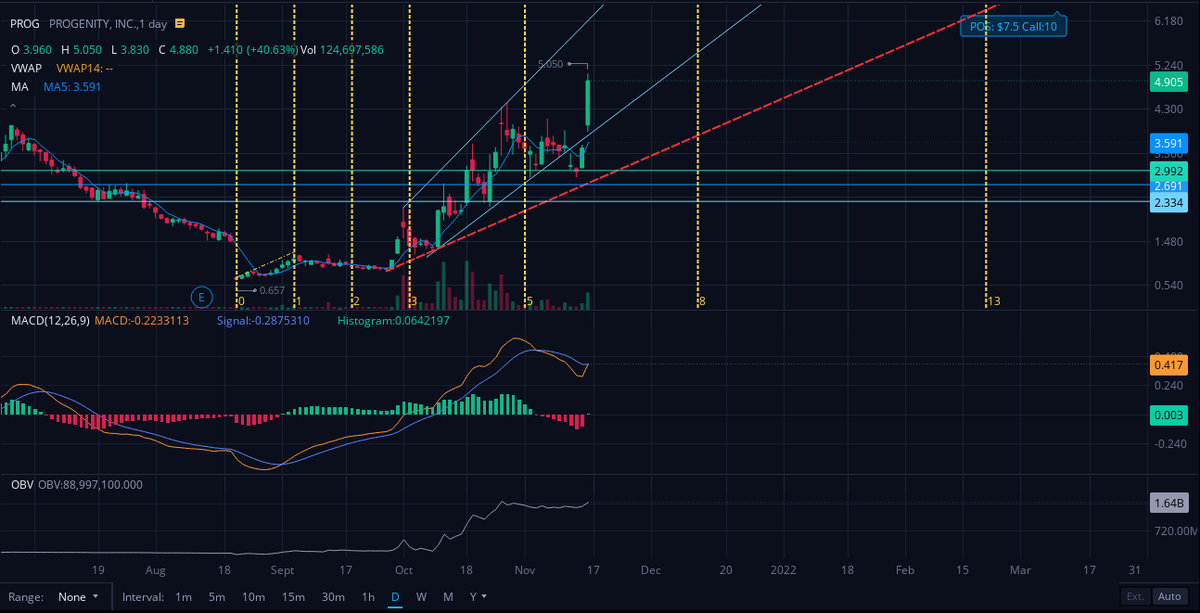

Glad I did. Seeing $PROG at $5 when I finally woke up was immensely satisfying.

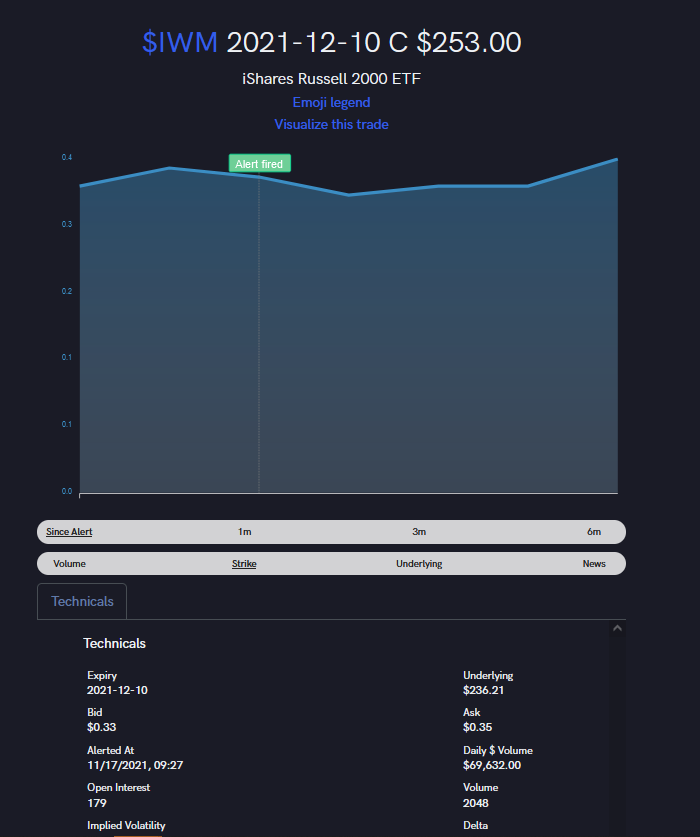

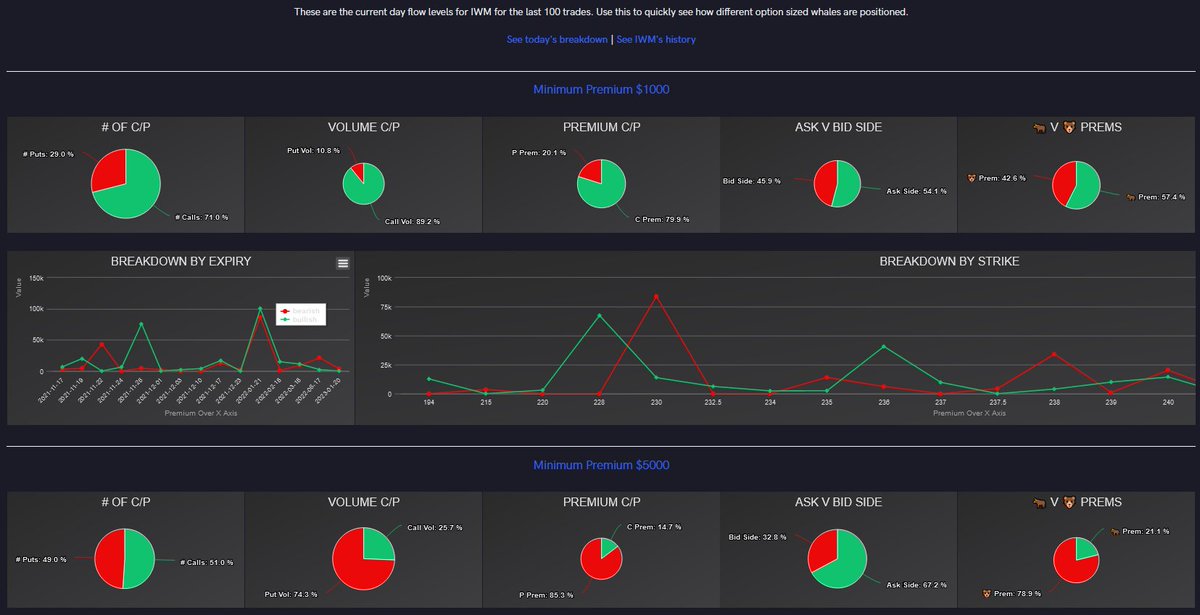

Gamma still incoming. We need to hold $4.20 today and maintain the momentum. More options have been bought and exercised ITM.

Glad I did. Seeing $PROG at $5 when I finally woke up was immensely satisfying.

Gamma still incoming. We need to hold $4.20 today and maintain the momentum. More options have been bought and exercised ITM.

I actually sold 50% of my $5/$7.5 that I was holding for 11/19 & waited for a dip, full disclosure.

As it turns out, I now have an even BIGGER position in $PROG because of these calls, and I have enough buying power in all my accounts to exercise all my ITM calls for Fri.

As it turns out, I now have an even BIGGER position in $PROG because of these calls, and I have enough buying power in all my accounts to exercise all my ITM calls for Fri.

Reason why I sold those OTM calls is because we had a huge volatility spike, so I know that I can sell them for profit and buy them back cheaper when the stock relaxes, which it did down to $4.25

Just a little lesson in day trading.

Fibonacci extensions are awesome btw.

Just a little lesson in day trading.

Fibonacci extensions are awesome btw.

The gamma ramp on $PROG for 11/19 is still massive.

We now have 154,305 calls ITM at $4.50 and below.

That's MASSIVE! 12% of the float is ITM! That's just incredible!

Expect the options chain to open up for December and January, at which point, the gamma ramp could grow.

We now have 154,305 calls ITM at $4.50 and below.

That's MASSIVE! 12% of the float is ITM! That's just incredible!

Expect the options chain to open up for December and January, at which point, the gamma ramp could grow.

The options chain for DEC is rapidly growing, so expect a lot of these options to start rolling over.

I want to remind everyone that OTM options are still risky and you should be very careful if you choose to buy them, especially this close to expiration.

I want to remind everyone that OTM options are still risky and you should be very careful if you choose to buy them, especially this close to expiration.

As for the stock itself, if this price continues running, and all these options expire ITM, those $7.50 Nov puts that are being targeted to go OTM will absolutely crush shorts.

Those puts have fallen by 15% already. If they go down another 10%, short risk will be astronomical

Those puts have fallen by 15% already. If they go down another 10%, short risk will be astronomical

If those puts bleed to nothing, shorts will lose every penny they've invested on the options chain, not to mention stocks sold short plummetting to a 500% loss.

Power hour is coming, and #Proggers are hungry to #SQUEEZEPROG

I'm ready to exercise 100% of my 11/19 calls.

LFG!

Power hour is coming, and #Proggers are hungry to #SQUEEZEPROG

I'm ready to exercise 100% of my 11/19 calls.

LFG!

• • •

Missing some Tweet in this thread? You can try to

force a refresh