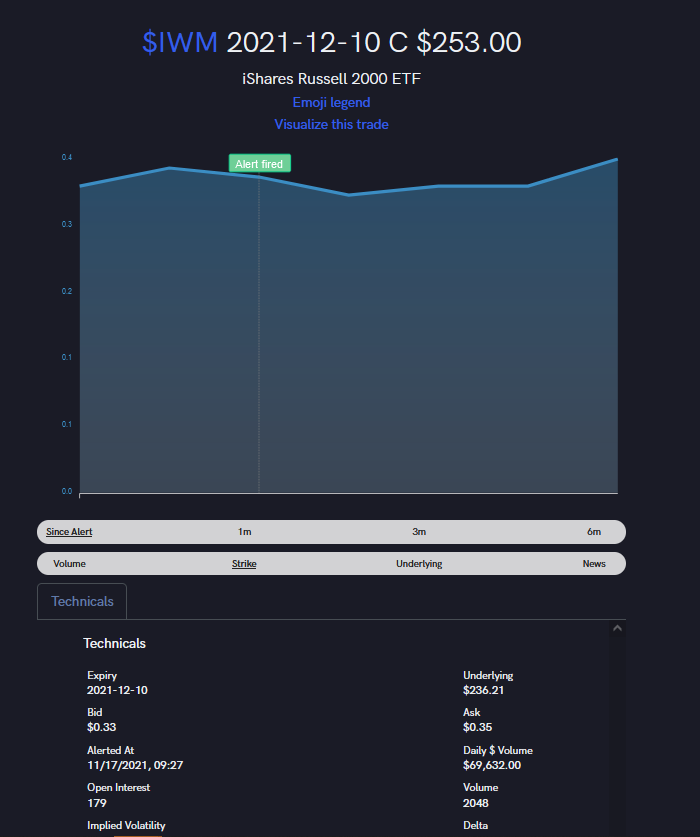

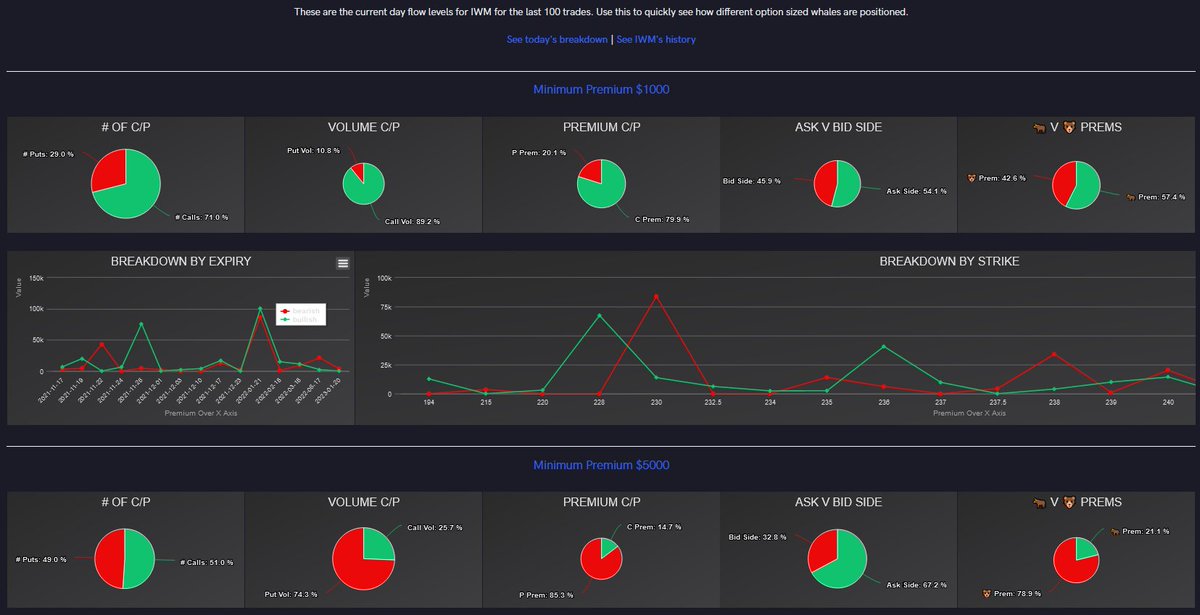

I'm going to cover one last item on $PROG today. I was looking at the Unusual Whales FLOW that Hootmoney posted, and there is definitely something happening here.

The OI on $5 and $7.5 calls for $PROG went absolutely nuts in the afternoon today, and I only just noticed.

The OI on $5 and $7.5 calls for $PROG went absolutely nuts in the afternoon today, and I only just noticed.

https://twitter.com/HootmoneyYT/status/1461032038333665280

Almost all of the bearish volume came from selling call options at the end of the day, which I STRONGLY suspect is being done in order to quickly secure premium and scalp some cash before the options expire.

This is a very common action, but for it to happen in these numbers...

This is a very common action, but for it to happen in these numbers...

... holy shit. There are 111,295 calls OTM on $PROG between $5 and $7.50

That's a combined 11.13M shares on the table.

Those weren't there this morning.

A fair amount of these may be retail, but many times more are likely coming from market makers & HFs.

That's a combined 11.13M shares on the table.

Those weren't there this morning.

A fair amount of these may be retail, but many times more are likely coming from market makers & HFs.

There is a very slim possibility that we could see a run tomorrow or Friday.

If that happened, and these options ran ITM, it would bring the total ITM calls up to 225k calls or 22.5M shares...

24% of the float.

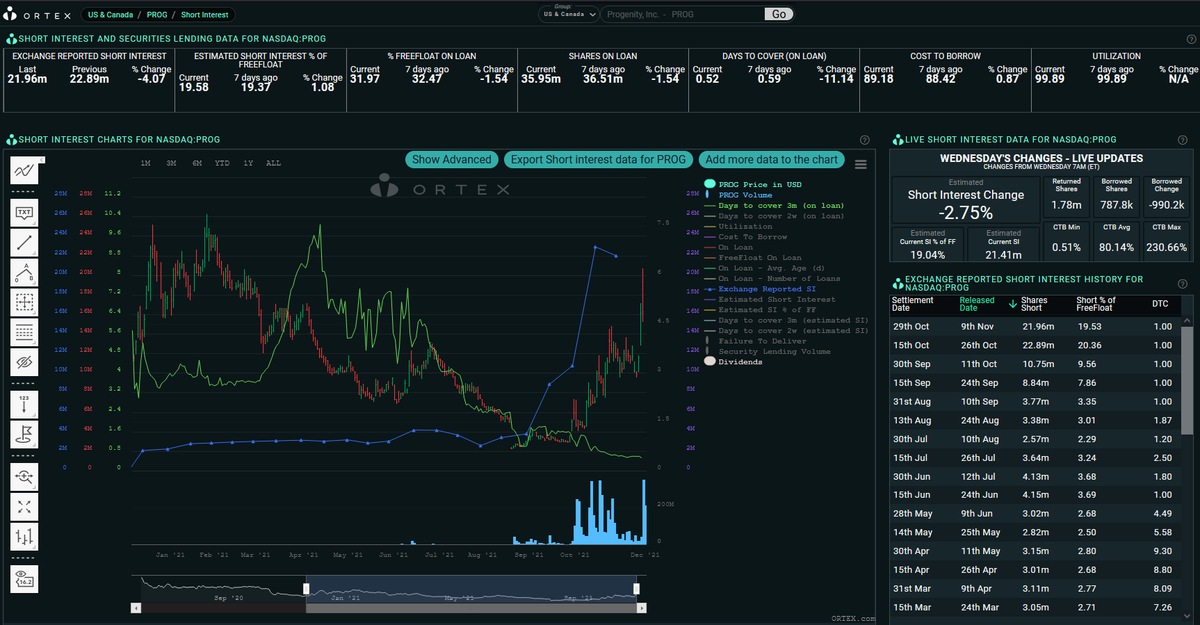

SI is still 19% of the FF

This creates a potential supply crisis.

If that happened, and these options ran ITM, it would bring the total ITM calls up to 225k calls or 22.5M shares...

24% of the float.

SI is still 19% of the FF

This creates a potential supply crisis.

Again... this is a very, very, VERY slim possibility, but ...

if #PROGGERS build enough momentum to send $PROG to $7.51+ by Friday close, the number of shares to cover would rival that of Athyrium's majority holding on the #PROG itself.

if #PROGGERS build enough momentum to send $PROG to $7.51+ by Friday close, the number of shares to cover would rival that of Athyrium's majority holding on the #PROG itself.

I talked about $90M in pure buying volume on Sunday before we opened the week being the amount needed to send $PROG beyond $5.

We more than achieved those numbers and hit our goal. We absolutely crushed it.

But this is a chance to achieve total victory.

We more than achieved those numbers and hit our goal. We absolutely crushed it.

But this is a chance to achieve total victory.

Right now, I am estimating approximately 3.8M-4M shares of selling is what caused $PROG to break below that $5 support level.

That's approximately $19M - $20M in money required to buy back that whole dip.

If that happens, then the price can slingshot straight back past $5

That's approximately $19M - $20M in money required to buy back that whole dip.

If that happens, then the price can slingshot straight back past $5

This kind of momentum is extremely difficult if not completely impossible to predict, but it's worth pointing out that this week isn't over yet.

I've got a little dry powder coming in tomorrow, so here's the strategy I'm gonna be looking for.

I've got a little dry powder coming in tomorrow, so here's the strategy I'm gonna be looking for.

There is massive stored potential in $PROG right now below $4.50.

The purpose of pushing the price down AH was to set up for accumulation tomorrow, on top of trying to push calls OTM.

If #PROGGERS don't get scared, don't waver, and don't flinch, this can backfire on shorts. 🚀

The purpose of pushing the price down AH was to set up for accumulation tomorrow, on top of trying to push calls OTM.

If #PROGGERS don't get scared, don't waver, and don't flinch, this can backfire on shorts. 🚀

I am NOT telling anyone what to do. This is absolutely not financial advice.

Hell... it's an extremely risky decision, but I'm setting a limit-buy order for $0.05 bid on $5.5 calls for $PROG

There is at least a 90% chance these will expire totally worthless so DO NOT COPY ME

Hell... it's an extremely risky decision, but I'm setting a limit-buy order for $0.05 bid on $5.5 calls for $PROG

There is at least a 90% chance these will expire totally worthless so DO NOT COPY ME

I am expecting shorts to attack hard early tomorrow. This will cause OTM call value to fall.

On the off chance that $PROG squeezes beyond $5.50 before Friday, not only would these calls multiply in value by 2000% (from $0.05 to $1.00 premium), but it would also annihilate shorts

On the off chance that $PROG squeezes beyond $5.50 before Friday, not only would these calls multiply in value by 2000% (from $0.05 to $1.00 premium), but it would also annihilate shorts

I'm planning to buy a fuck-ton of extremely stupid $5.50 calls expiring this Friday.

Again.... 90%+ chance these expire worthless. Total gamble

Nobody should ever do this unless they are prepared to lose every single penny.

I am banking on the price to slingshot before Friday

Again.... 90%+ chance these expire worthless. Total gamble

Nobody should ever do this unless they are prepared to lose every single penny.

I am banking on the price to slingshot before Friday

I am fully expecting to lose every single penny I'm betting on this play. Can't stress this enough...

That being said, I see a remarkable possibility that if bulls take control before Friday again, that it could carry $PROG beyond $7.50 with all this gasoline on the logs.

That being said, I see a remarkable possibility that if bulls take control before Friday again, that it could carry $PROG beyond $7.50 with all this gasoline on the logs.

The match that can light this candle? $20M

That's it.

There are over 133k investors following #PROG on WeBull alone.

That's $150 per investor.

So I'm gonna buy some calls and shares to try to do my part to push this thing over the cliff.

That's it.

There are over 133k investors following #PROG on WeBull alone.

That's $150 per investor.

So I'm gonna buy some calls and shares to try to do my part to push this thing over the cliff.

This is just what I'm doing with my money. As far as I'm concerned, every dollar I throw down on those $5.50 calls might as well be flushed down the toilet.

That's how slim this possibility is.

Everyone should do what they think is right for them.

That's how slim this possibility is.

Everyone should do what they think is right for them.

As always, do what's right for you.

Never bet the farm.

Don't risk more than you're willing to lose.

Have a trading plan.

Stick to it.

Don't change anything just because some jackass on twitter has some math and pretty charts.

Especially me.

This is MY YOLO...

Wish me luck

Never bet the farm.

Don't risk more than you're willing to lose.

Have a trading plan.

Stick to it.

Don't change anything just because some jackass on twitter has some math and pretty charts.

Especially me.

This is MY YOLO...

Wish me luck

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh