Really liking this Wyckoff pattern here. $PROG is still on it's way to greatness. This little retest of $4.80-$5 is just confirmation.

Even if $5 - $7.50 calls expire OTM, this was a massive victory.

I've closed/rolled/exercised all of my 11/19 call positions.

Even if $5 - $7.50 calls expire OTM, this was a massive victory.

I've closed/rolled/exercised all of my 11/19 call positions.

Most of my remaining contracts are set up for January for safety reasons. (Always give yourself more time than you think you need.)

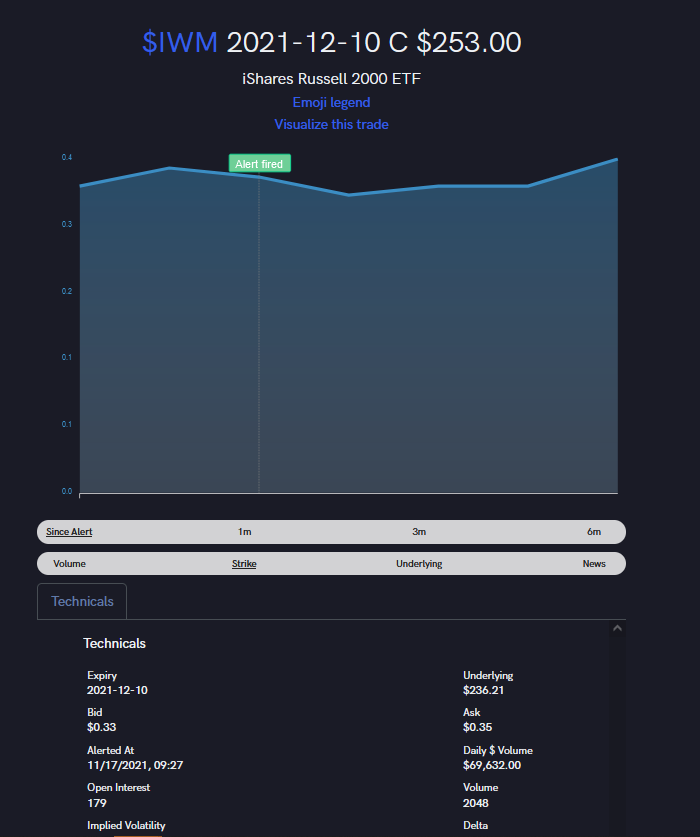

But the pattern looks like it's going to play out to completion before Dec 17, so I bought a big load of calls on the dip for 12/17 too.

But the pattern looks like it's going to play out to completion before Dec 17, so I bought a big load of calls on the dip for 12/17 too.

At this point, bulls have done so much damage to shorts this month that I have supreme confidence that the squeeze is coming soon.

And while I do not recommend FOMO-ing into any stock for any reason, $PROG is showing the strongest signs of squeezing of any other play this week.

And while I do not recommend FOMO-ing into any stock for any reason, $PROG is showing the strongest signs of squeezing of any other play this week.

Inevitably, as we start to show strength again, whether it comes sooner or later, FOMO will certainly follow as it always does with these types of plays.

I'm no stock genius, so I'm sticking to the buy-and-hold strategy until I'm happily, stupidly wealthy when we #squeezeprog

I'm no stock genius, so I'm sticking to the buy-and-hold strategy until I'm happily, stupidly wealthy when we #squeezeprog

I really want to thank everyone that trusted my analysis on this play. I know it broke all the tenants of responsible/safe trading, but it would appear that we were all right all along.

The difference is that we banked/predicted the greed of wall street and bet accordingly.

The difference is that we banked/predicted the greed of wall street and bet accordingly.

Because of our conviction, I have the utmost faith and confidence that we are about to change thousands of lives with an incredible squeeze.

As soon as we all stopped being scared of dips, crashes, and hedgie scare tactics, suddenly we started winning, and we are winning big!

As soon as we all stopped being scared of dips, crashes, and hedgie scare tactics, suddenly we started winning, and we are winning big!

A close above $5 on Friday is still in the cards, and would absolutely smash the shorts irreparably.

Provided that #PROGGERS continue holding tight, expect us to consolidate around $5 tomorrow.

Shorts may try to hammer us again early in the AM. Don't let it scare you.

Provided that #PROGGERS continue holding tight, expect us to consolidate around $5 tomorrow.

Shorts may try to hammer us again early in the AM. Don't let it scare you.

I intend to embrace any and every dip that comes tomorrow, and I will be tempering my expectations for Friday.

Holding strong is what's most important here. We have established VERY strong support at $4.80 & shorts are gonna probably throw everything they have at us to break it.

Holding strong is what's most important here. We have established VERY strong support at $4.80 & shorts are gonna probably throw everything they have at us to break it.

I'm not interested in anymore talk of paper hands, crashes, or "the squeeze is over" because it's all bullshit.

We all know who is playing games with $PROG and it ain't retail. We are simply investing in what we believe is an undervalued stock.

That's all it ever was.

We all know who is playing games with $PROG and it ain't retail. We are simply investing in what we believe is an undervalued stock.

That's all it ever was.

I'm expecting a sleepy AH session today and maybe tomorrow as well.

But be ready for MMs and shorts to push back to try to shake those convictions.

Victory is close at hand, but the week isn't over yet.

Don't waver.

See you all tomorrow.

But be ready for MMs and shorts to push back to try to shake those convictions.

Victory is close at hand, but the week isn't over yet.

Don't waver.

See you all tomorrow.

@threadreaderapp unroll please & thank you

• • •

Missing some Tweet in this thread? You can try to

force a refresh