CONNECT TO CONGRESS

I think it’s time to Connect to Congress again. The crypto industry is floating many proposals for clarifying the federal rules, but U.S. digital asset holders have a more fundamental question for our lawmakers. Let’s put them on the spot. (1/5)

I think it’s time to Connect to Congress again. The crypto industry is floating many proposals for clarifying the federal rules, but U.S. digital asset holders have a more fundamental question for our lawmakers. Let’s put them on the spot. (1/5)

(2/5)

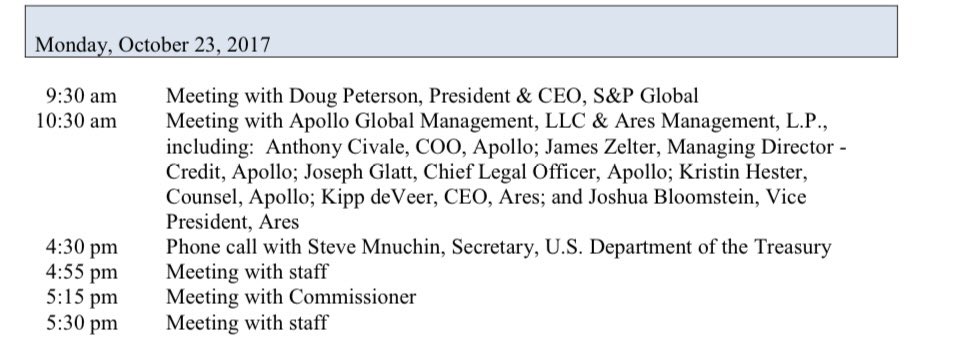

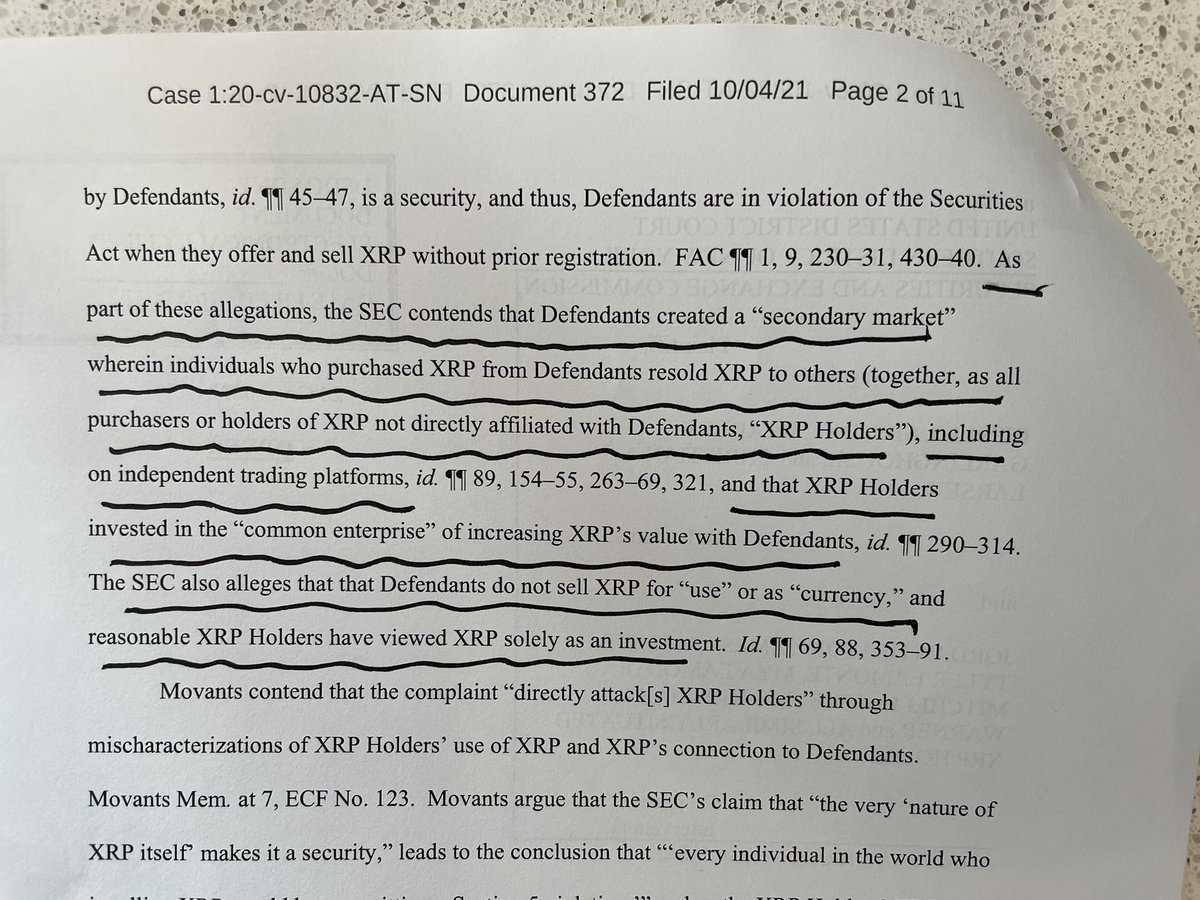

The SEC is practicing regulation by enforcement, setting policy with lawsuits and picking winners and losers rather than leveling the playing field. It’s unclear for investors and unfair to everyone.

The SEC is practicing regulation by enforcement, setting policy with lawsuits and picking winners and losers rather than leveling the playing field. It’s unclear for investors and unfair to everyone.

(3/5)

To do this, the SEC is relying on a 1940s court case to set crypto policy. This is like using horse & buggy rules to regulate jet planes. It makes no sense, and it needs a solution.

To do this, the SEC is relying on a 1940s court case to set crypto policy. This is like using horse & buggy rules to regulate jet planes. It makes no sense, and it needs a solution.

(4/5)

As a U.S. constituent, you should conclude by asking your lawmaker to respond to a simple question:

Do you think political appointees should be setting the rules on crypto, or should Congress write the rules?

As a U.S. constituent, you should conclude by asking your lawmaker to respond to a simple question:

Do you think political appointees should be setting the rules on crypto, or should Congress write the rules?

(5/5)

Connect to Congress today, explain the problem this country is facing, and ask your lawmakers to respond to you with their answer.

Let’s get it on the record who is ready to do their job, and who isn’t. 👇

crypto-law.us/connect-to-con…

Connect to Congress today, explain the problem this country is facing, and ask your lawmakers to respond to you with their answer.

Let’s get it on the record who is ready to do their job, and who isn’t. 👇

crypto-law.us/connect-to-con…

• • •

Missing some Tweet in this thread? You can try to

force a refresh