@CGasparino @EleanorTerrett

@LizClaman

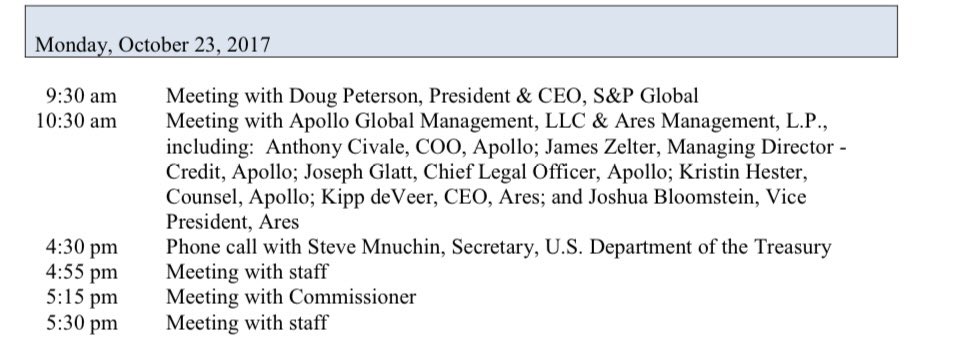

We know for a fact that Hinman met with @ConsenSys’ lawyers & the co-founder of @ethereum and founder of @ConsenSys, @ethereumJoseph, on Dec. 13, 2017.

This meeting took place during the very height of the ICO prosecutions by the SEC.

@LizClaman

We know for a fact that Hinman met with @ConsenSys’ lawyers & the co-founder of @ethereum and founder of @ConsenSys, @ethereumJoseph, on Dec. 13, 2017.

This meeting took place during the very height of the ICO prosecutions by the SEC.

We know for a fact that Ether held the world’s first ICO in 2014 - 3 years prior to the first Hinman meeting. We know that there were 3-4 more meetings before the Hinman Speech, including on June 8, 2018. We know Ether investors helped write ✍️ the speech (we have the videos).

We know on June 8, 2018, AFTER meeting the SEC, Joe Lubin PREDICTED that some projects were going to receive bad news from the SEC.

We know @Ripple was one of those “projects.” But a year before the SEC sued Ripple, it filed its most successful ICO enforcement action.

We know @Ripple was one of those “projects.” But a year before the SEC sued Ripple, it filed its most successful ICO enforcement action.

In October 2019, the SEC sued #Telegram over its ICO and sought and won a preliminary injunction completely shutting down all activity.

Quite frankly, Telegram attempted a similar crowd-sale as Ether but was shut down completely. This isn’t my opinion b/c even Lubin agrees. 👇

Quite frankly, Telegram attempted a similar crowd-sale as Ether but was shut down completely. This isn’t my opinion b/c even Lubin agrees. 👇

https://twitter.com/digitalassetbuy/status/1445083402852573207

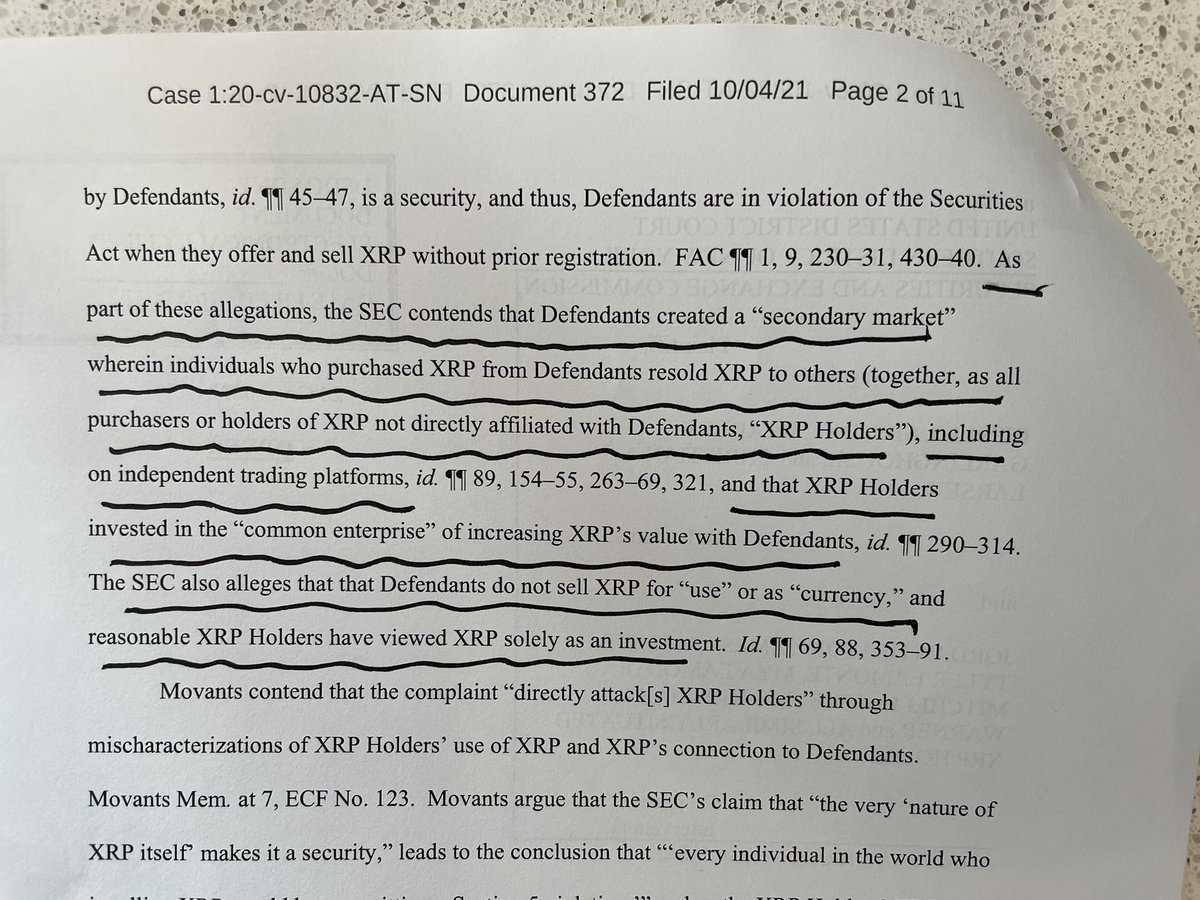

Just like the Ether crowd-sale, in Telegram, the blockchain technology had not yet been built at the time of the token sale. In Telegram (and other ICOs), every token (ie #Gram) constitutes a security because it cannot yet be used within a fully functional network.

The SEC won. More significant, the SEC won a preliminary injunction against Telegram. In the Ripple case, however, we know #XRP was traded for over 7 years on a fully functional distributed ledger technology. Despite this utility (unlike #Gram) the SEC argues the same theory.

It argues #XRP tokens are all unregistered securities. Yet, it DID NOT seek an injunction against Ripple, it’s executives, or anyone else - as it did against Telegram.

Why not?

Ripple, @bgarlinghouse and @chrislarsensf have been allowed to sell XRP since the case was filed.

Why not?

Ripple, @bgarlinghouse and @chrislarsensf have been allowed to sell XRP since the case was filed.

They are literally allowed to sell #XRP in order to pay for legal fees associated with fighting the @SECGov. If the SEC truly believed #XRP itself was a security, why would it allow this? Why would a co-founder also be allowed to sell over $2B in #XRP SINCE THE LAWSUIT?👇

https://twitter.com/RuleXRP/status/1461426211062693889

In Telegram the SEC wouldn’t stand for the ongoing sale of illegal securities and sought an injunction. Maybe 🤔 you’re thinking, “Deaton, it could be that different SEC attorneys handled Telegram.” NOPE!

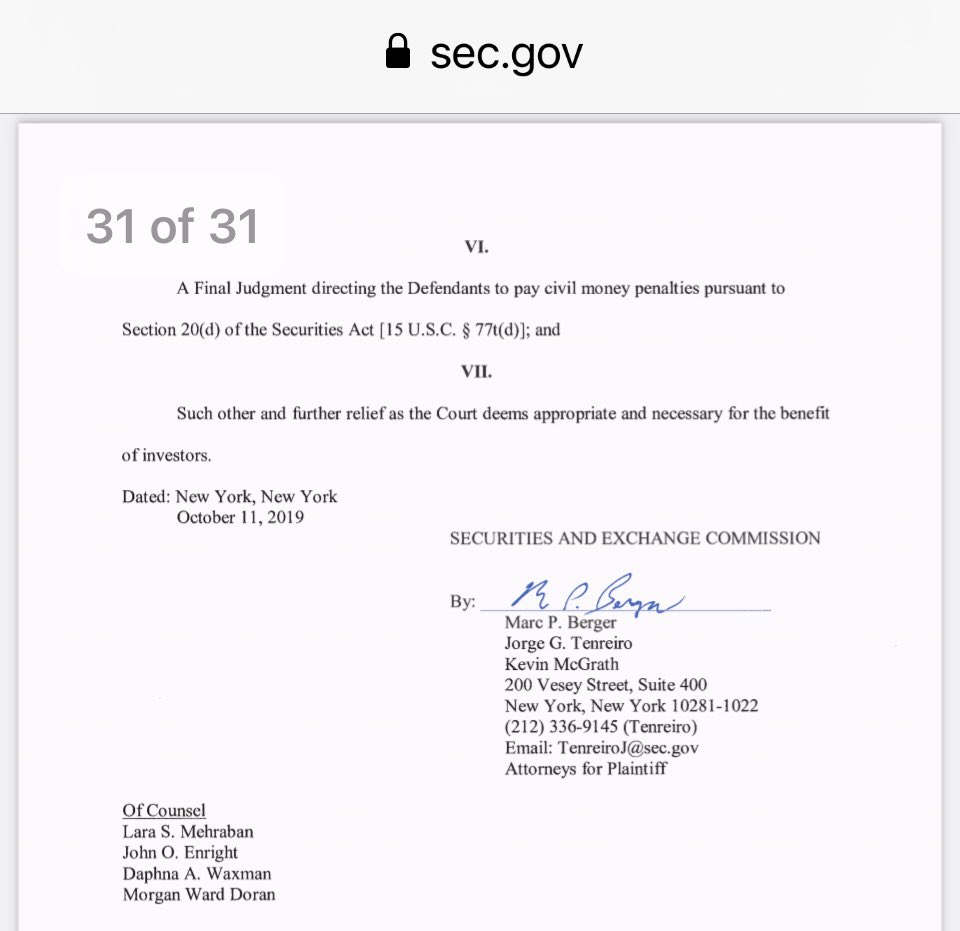

Take a look at the names on Telegram. 👇

Take a look at the names on Telegram. 👇

You should recognize the two top names: Marc Berger and Jorge Tenreiro. Everyone knows that Jorge Tenreiro is the lead SEC attorney on the Ripple case.

Marc Berger was part of the Enforcement Division at the SEC and he signed the Telegram Complaint. 👆

Marc Berger was part of the Enforcement Division at the SEC and he signed the Telegram Complaint. 👆

“Berger played a major role in the SEC’s action against Ripple Labs after he was named deputy director in August 2020 and acting director of the Division of Enforcement at the SEC in December.”

mosttraded.com/2021/01/13/the…

mosttraded.com/2021/01/13/the…

“Although Berger’s time at the helm of the division was rather short, he used it to lead the enforcement of the securities lawsuit against Ripple Labs and its co-founders.”

Those aren’t John Deaton quotes.

Those aren’t John Deaton quotes.

Why didn’t Berger pursue an injunction similar to Telegram? Could it be that he knew he would flat out lose if he approached the case the same way? Or, was it b/c the case theory didn’t matter? What mattered, was the lawsuit itself b/c the lawsuit was both the means and the end.

Hinman resigned a few weeks before the #XRP lawsuit. He collected $15m while at the SEC from Simpson Thacher - a member of the Enterprise Ethereum Alliance. He was allowed to collect this 💰 b/c he “retired.” After resigning, Hinman “un-retired”, returning to SImpson Thacher.

As I said, we know that Ether investors helped write ✍️ the Hinman speech and the only Crypto mentioned in the Safe Harbor Proposal was Ether. We also know in addition to the $15m he collected while at the SEC, Hinman is now a partner at Andreesen Horowitz’s a16z $2.2B fund.

We know after filing the Ripple case on his last full day at the SEC, Clayton went to advise One River who had made a $1B bet on #Bitcoin and #Ether two months prior to the lawsuit.

But what about Marc Berger? Someone at the top stayed around to see this case through, right?

But what about Marc Berger? Someone at the top stayed around to see this case through, right?

Berger joined his good friend Hinman at Simpson Thacher - the law firm on the Board of the Enterprise Ethereum Alliance - “whose objective is to drive the use of Enterprise Ethereum and Mainnet Ethereum blockchain technology as an open-standard to empower ALL enterprises.”

Before the critics claim these are just coincidences and I must be a conspiracy theorist, learn the facts. A case of this magnitude is filed as the top people are walking out the door to go work for the competition. I’m sure there nothing to 👀 here.

#facts👇

#facts👇

https://twitter.com/JohnEDeaton1/status/1447400529534066692

• • •

Missing some Tweet in this thread? You can try to

force a refresh