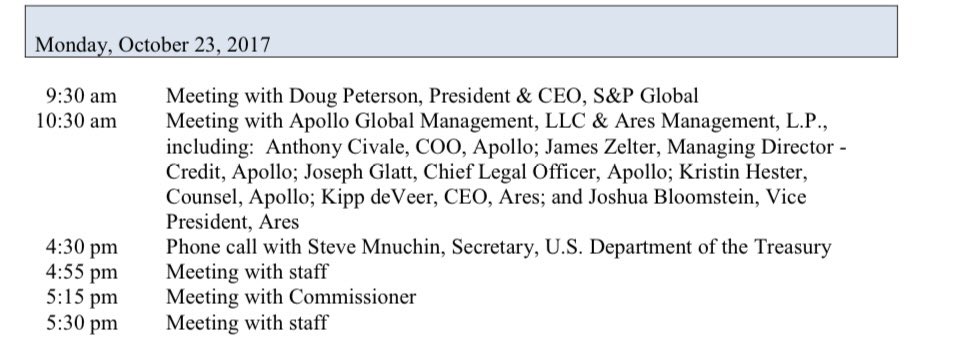

MORE PROOF THAT THE SEC CASE 🆚 @Ripple IS DANGEROUS TO ALL CRYPTO: 👇

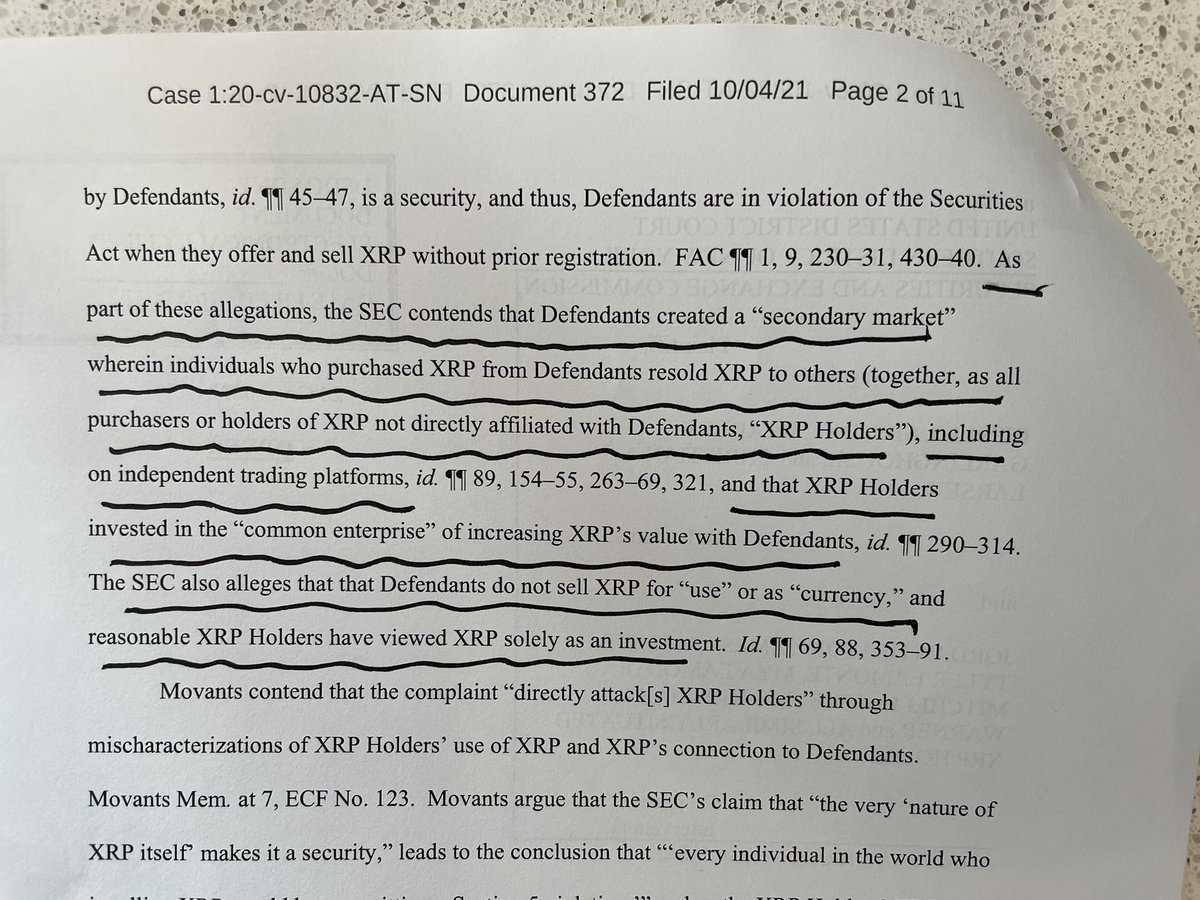

The above language is not John Deaton’s interpretation of the SEC’s Complaint. The above is from Judge Torres herself. She acknowledges that the SEC claims Ripple created the secondary market for #XRP - including all sales - whether between individuals or sold on exchanges.

Judge Torres recognizes the SEC’s claim that b/c Ripple undertook efforts to create a secondary market for XRP, that, therefore, ALL #XRPHolders must have entered into a common enterprise with Ripple - regardless of whether they acquired #XRP directly from Ripple.

It is b/c of this over-broad far-reaching allegation related to secondary sales that allowed the Court to grant #XRPHolders amicus curiae status. IMO it’s why she said she wanted to hear our “meaningful perspective.”

Could the SEC claim @VitalikButerin @ethereumJoseph or the @ethereum foundation helped create a secondary market for #ETH? What about the Stellar Foundation and #XLM? What about #ALGO? #ADA? Hell, one could make the same claim against the #BTC foundation in 2012-2015.

Wake up!

Wake up!

• • •

Missing some Tweet in this thread? You can try to

force a refresh