How late are we in the current business cycle? The market and the Fed seem to have different opinions on that. (THREAD)

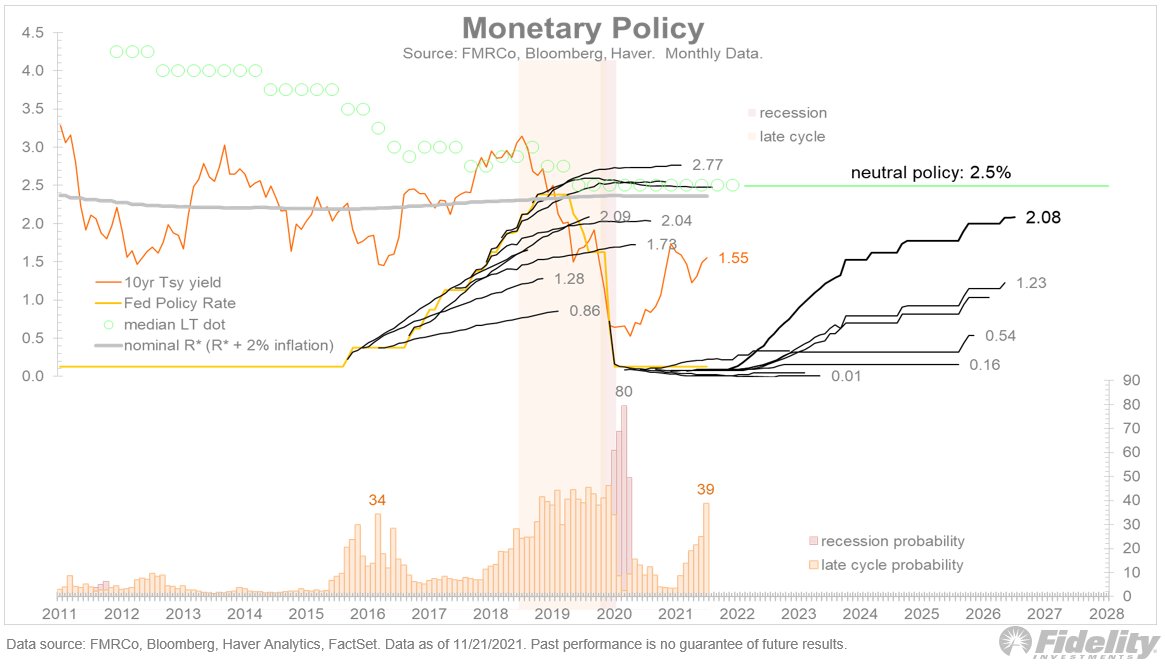

As the chart above shows, the market is on board with the Fed regarding its rate trajectory in 2022 and 2023, but is underpricing the Fed’s intended return all the way back to neutral (R-Star) in the out years. /2

The dot plot is at 2.5% as the terminal point and the market is at 2%. It’s not a huge difference, but it’s a difference. /3

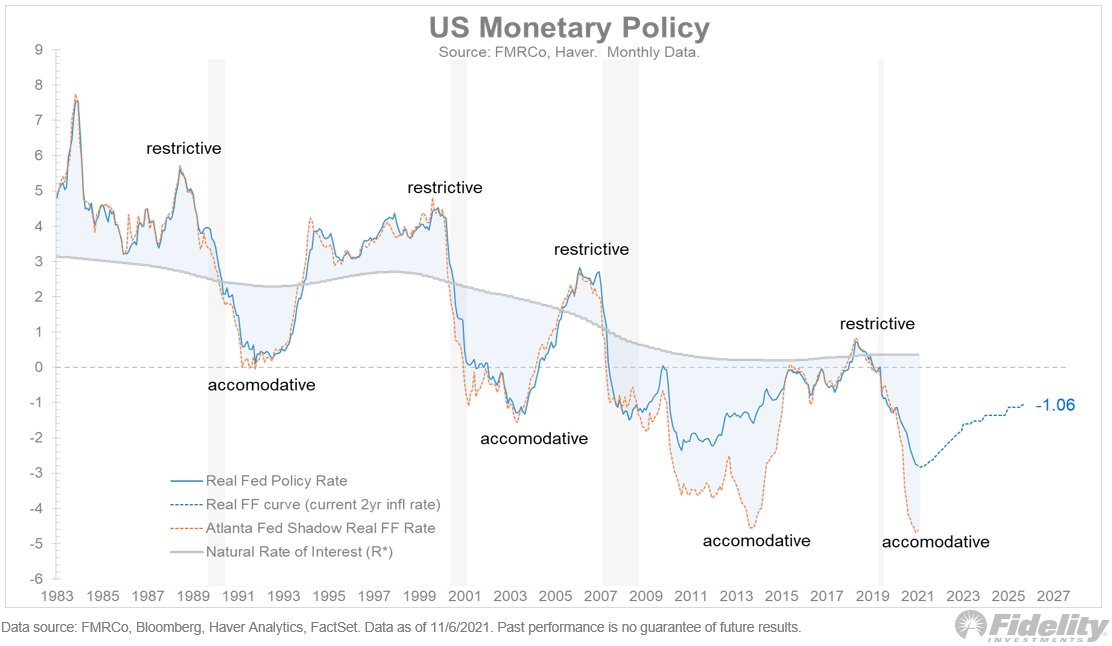

Next, we see the picture in real terms. At today’s fed funds forward curve, and assuming 3% inflation (which seems increasingly generous), the fed funds curve will not come even close to R-Star for years to come. /4

If R-Star rises (which seems likely) and/or inflation remains above 3% (also plausible), the Fed will be even farther below neutral. That may keep financial conditions loose (preventing a hard landing), but it could also fan the inflation flames. /5

Is the market wrong? Or is the Fed too ambitious in its intended return to neutral? My guess is that the market is wrong and will need to adjust as we progress further into this rate cycle. The next chart shows that such an outcome is actually very typical. /6

Below, we see the fed funds forward curve taken at quarterly intervals amid tightening cycles in 1994, 1999-2000, 2004-06, 2016-18, and currently. The market always is slow to adjust to the Fed. When it catches up, the yield curve flattens and often eventually inverts. /7

Typically the Fed begins its policy normalization towards the end of mid-cycle and keeps tightening throughout late-cycle. Then the curve inverts and the recession begins and the next easing cycle starts. It’s as natural as the changing of the seasons. /8

The 1994 rate cycle was the last time that policy tightening did not eventually lead to a recession (although it’s likely unfair to say that the Covid recession was the product of the 2016-2018 rate cycle). /9

Most the time, the Fed tightening cycle is the orange phase, which eventually leads to the red phase. But the current late-cycle reading is coming just from the tight labor market and not a broader tightening of financial conditions. /10

In that regard, perhaps the current reading is more like the false positive signal in 2016 than the “end-is-near” signal preceding most recessions. /END

• • •

Missing some Tweet in this thread? You can try to

force a refresh