NEXT DESTINATION OF MONEY FLOW IN #SOLANA?

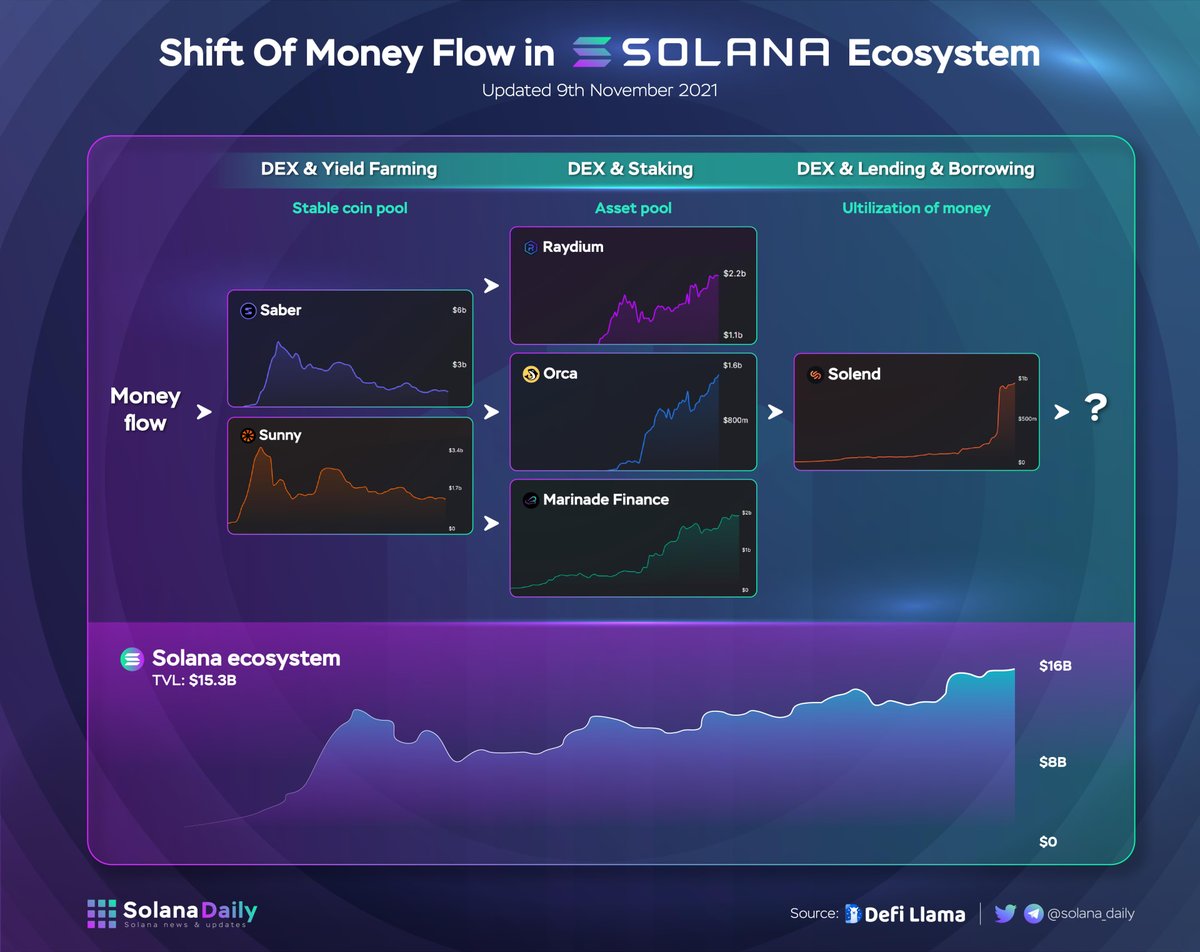

1. Each sector of Solana has been filled up with money lately. And you guys want to have an overview of the next destination of money in Solana. Let’s check this thread.

#Solanaszn #money #next

1. Each sector of Solana has been filled up with money lately. And you guys want to have an overview of the next destination of money in Solana. Let’s check this thread.

#Solanaszn #money #next

NEXT DESTINATION OF MONEY FLOW IN #SOLANA?

2. In theory, the money flow would be described: $ -> Layer 1 -> DEX -> L&B -> Yield Farming/ Staking -> Infrastructure -> Oracle -> Other trend -> $

#Solanaszn #money #next

2. In theory, the money flow would be described: $ -> Layer 1 -> DEX -> L&B -> Yield Farming/ Staking -> Infrastructure -> Oracle -> Other trend -> $

#Solanaszn #money #next

NEXT DESTINATION OF MONEY FLOW IN #SOLANA?

3. However, the practical is not the same as the theory.

After filling out our layer 1 - $SOL, the money flow continued to find a new destination.

#Solanaszn #money #next

3. However, the practical is not the same as the theory.

After filling out our layer 1 - $SOL, the money flow continued to find a new destination.

#Solanaszn #money #next

NEXT DESTINATION OF MONEY FLOW IN #SOLANA?

4. At this time, the DEX, Yield Farming, Launchpad and the short trend of memes tokens is the sector to take this flow.

Some projects took advantages of this phase and the reason behind they are: ...

#Solanaszn #money #next

4. At this time, the DEX, Yield Farming, Launchpad and the short trend of memes tokens is the sector to take this flow.

Some projects took advantages of this phase and the reason behind they are: ...

#Solanaszn #money #next

NEXT DESTINATION OF MONEY FLOW IN #SOLANA?

5. @Saber_HQ , @SunnyAggregator (attract with incentive programs for stable pool)

@TulipProtocol -the leverage yield farming

@solanium_io -with several IDO at that time

@xMoonLana @SolanaCATO -the meme trends

#Solanaszn #money

5. @Saber_HQ , @SunnyAggregator (attract with incentive programs for stable pool)

@TulipProtocol -the leverage yield farming

@solanium_io -with several IDO at that time

@xMoonLana @SolanaCATO -the meme trends

#Solanaszn #money

@Saber_HQ @SunnyAggregator @TulipProtocol @solanium_io @xMoonLana @SolanaCATO NEXT DESTINATION OF MONEY FLOW IN #SOLANA?

6. Then the money continued to find the other sector. The 2nd phase, the money found in the DEX and Staking sector. This time, it mostly concentrated on the asset pool.

Please check the old tweet of ours.

#Solanaszn #money #next

6. Then the money continued to find the other sector. The 2nd phase, the money found in the DEX and Staking sector. This time, it mostly concentrated on the asset pool.

Please check the old tweet of ours.

#Solanaszn #money #next

@Saber_HQ @SunnyAggregator @TulipProtocol @solanium_io @xMoonLana @SolanaCATO NEXT DESTINATION OF MONEY FLOW IN #SOLANA?

7. The projects take advantages in this phase:

@RaydiumProtocol @orca_so @ProjectSerum @MarinadeFinance

#Solanaszn #money #next

7. The projects take advantages in this phase:

@RaydiumProtocol @orca_so @ProjectSerum @MarinadeFinance

#Solanaszn #money #next

@Saber_HQ @SunnyAggregator @TulipProtocol @solanium_io @xMoonLana @SolanaCATO @RaydiumProtocol @orca_so @ProjectSerum @MarinadeFinance NEXT DESTINATION OF MONEY FLOW IN #SOLANA?

8. There was a short trend of Meme tokens between the two phases. Thanks to the growth of SHIB and the intrinsic value of the meme in Solana, all achieved incredible growth in the short period of time @samoyedcoin @WoofSolana

#Solanasz

8. There was a short trend of Meme tokens between the two phases. Thanks to the growth of SHIB and the intrinsic value of the meme in Solana, all achieved incredible growth in the short period of time @samoyedcoin @WoofSolana

#Solanasz

@Saber_HQ @SunnyAggregator @TulipProtocol @solanium_io @xMoonLana @SolanaCATO @RaydiumProtocol @orca_so @ProjectSerum @MarinadeFinance @samoyedcoin @WoofSolana NEXT DESTINATION OF MONEY FLOW IN #SOLANA?

9. Then it came to the 3rd phase - the utilization of money. Staking - @MarinadeFinance continued to attract the money thanks to the various use case mSOL.

#Solanaszn #money #next

9. Then it came to the 3rd phase - the utilization of money. Staking - @MarinadeFinance continued to attract the money thanks to the various use case mSOL.

#Solanaszn #money #next

@Saber_HQ @SunnyAggregator @TulipProtocol @solanium_io @xMoonLana @SolanaCATO @RaydiumProtocol @orca_so @ProjectSerum @MarinadeFinance @samoyedcoin @WoofSolana NEXT DESTINATION OF MONEY FLOW IN #SOLANA?

10. Other L&B projects with incentive programs bring a win-win situation for users - the borrower got less interest and the supplier got more rewards. These projects are @solendprotocol @ApricotFinance

#Solanaszn #money #next

10. Other L&B projects with incentive programs bring a win-win situation for users - the borrower got less interest and the supplier got more rewards. These projects are @solendprotocol @ApricotFinance

#Solanaszn #money #next

@Saber_HQ @SunnyAggregator @TulipProtocol @solanium_io @xMoonLana @SolanaCATO @RaydiumProtocol @orca_so @ProjectSerum @MarinadeFinance @samoyedcoin @WoofSolana @solendprotocol @ApricotFinance NEXT DESTINATION OF MONEY FLOW IN #SOLANA?

11. Above all, the money flow still respects the theory with little differences. If so, the next destination of money flow would be the other projects in the Lending and Borrowing sector, Yield Farming or Staking sector

#Solanaszn

11. Above all, the money flow still respects the theory with little differences. If so, the next destination of money flow would be the other projects in the Lending and Borrowing sector, Yield Farming or Staking sector

#Solanaszn

@Saber_HQ @SunnyAggregator @TulipProtocol @solanium_io @xMoonLana @SolanaCATO @RaydiumProtocol @orca_so @ProjectSerum @MarinadeFinance @samoyedcoin @WoofSolana @solendprotocol @ApricotFinance NEXT DESTINATION OF MONEY FLOW IN #SOLANA?

12. Some projects could be found in the below landscape for your own research.

#Solanaszn #money #next

12. Some projects could be found in the below landscape for your own research.

#Solanaszn #money #next

@Saber_HQ @SunnyAggregator @TulipProtocol @solanium_io @xMoonLana @SolanaCATO @RaydiumProtocol @orca_so @ProjectSerum @MarinadeFinance @samoyedcoin @WoofSolana @solendprotocol @ApricotFinance NEXT DESTINATION OF MONEY FLOW IN #SOLANA?

13. Or even, the money could skip to the next sector - The Infrastructure. Without the infrastructure, the ecosystem would no longer develop comprehensively.

#Solanaszn #money #next

13. Or even, the money could skip to the next sector - The Infrastructure. Without the infrastructure, the ecosystem would no longer develop comprehensively.

#Solanaszn #money #next

@Saber_HQ @SunnyAggregator @TulipProtocol @solanium_io @xMoonLana @SolanaCATO @RaydiumProtocol @orca_so @ProjectSerum @MarinadeFinance @samoyedcoin @WoofSolana @solendprotocol @ApricotFinance NEXT DESTINATION OF MONEY FLOW IN #SOLANA?

14. This is only the author's perspective. Please do your own research before making any investment decision.

#Solanaszn #money #next

14. This is only the author's perspective. Please do your own research before making any investment decision.

#Solanaszn #money #next

• • •

Missing some Tweet in this thread? You can try to

force a refresh