Nifty 50(w) structure

At RSI front Index given continue some weakness but still we respected 17700 and Monday if some panic same can move towards 17570-17600..

Next weekly closing below 17570 will put more pressure of consolidation.

At RSI front Index given continue some weakness but still we respected 17700 and Monday if some panic same can move towards 17570-17600..

Next weekly closing below 17570 will put more pressure of consolidation.

If we try to observe Nifty 50 stock wise charts most of counters give comfort that we should hold & respect the 17600-17700 zone once as solid support.

Further looking on same chart clear visible that same consolidation may take more time till we not break 18300 towards high.

Further looking on same chart clear visible that same consolidation may take more time till we not break 18300 towards high.

Bank Nifty Structure...

Index almost correct 4000 point one way,hence same is also near 38K psycological as well as technical support zone,hence same also indicative that a bounce back is clearly due in BN as well,hence don't panic if some pressure as Hap down etc in monday.

Index almost correct 4000 point one way,hence same is also near 38K psycological as well as technical support zone,hence same also indicative that a bounce back is clearly due in BN as well,hence don't panic if some pressure as Hap down etc in monday.

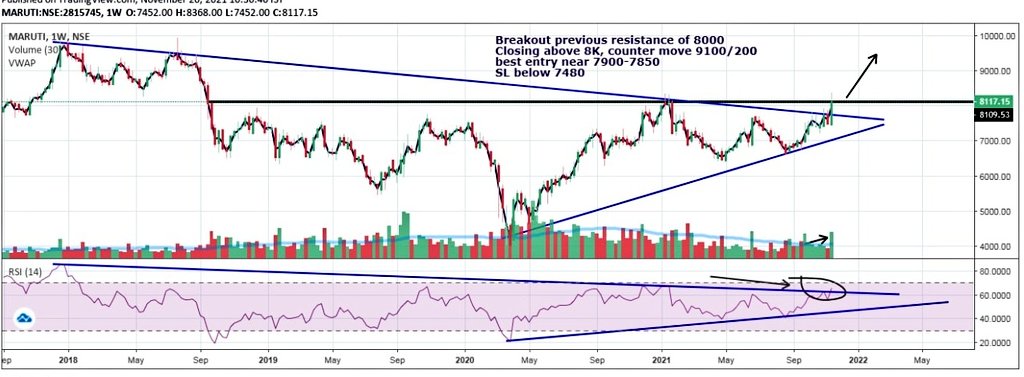

#Maruti The counter which should support the Nifty in positive side and expiry ahead can seen short covering more in same..

Triangle breakout visible in terms of price wise as well as RSI wise also..

Volume also supportive,good counter for long in small dips for Dec series.

Triangle breakout visible in terms of price wise as well as RSI wise also..

Volume also supportive,good counter for long in small dips for Dec series.

#BajajAuto..Counter have weakness at RSI front but price action wise support visible in same near 3500 zone as earlier also twice supported same zone,Maruti lead by Auto hence same can also pullback possibilities as RSI also in channel

However It's out from index in next series.

However It's out from index in next series.

#ACC (Monthly) seems no any weakness at technical front and seems breakout player as well above 2500 Monthly closing with volume..

Counter have to retest multiyear long resistance trend line which will act as solid support now near 2050-2100

Counter looks more stronger.

Counter have to retest multiyear long resistance trend line which will act as solid support now near 2050-2100

Counter looks more stronger.

#IciciBank(W) should give solid support to Bank nifty as well as overall Market..

Multiple attempt to pullback but not crossed 784 back,hence 784 new resistance short term and 815/820 above same.

Lower side 750 zone is level to take long side risk with 2% SL for 4-6% gain.👍👍

Multiple attempt to pullback but not crossed 784 back,hence 784 new resistance short term and 815/820 above same.

Lower side 750 zone is level to take long side risk with 2% SL for 4-6% gain.👍👍

#bhartiairtel weekly another counter which shows no major weakness...can consolidate more but not at all any sign of weakness in same..

If came near 670-680 zone best risk reward possibilities in dips as RSI front also good comfort.

If came near 670-680 zone best risk reward possibilities in dips as RSI front also good comfort.

#HDFCBANK(W)

Counter also near support of 1520-1525 zone at weekly frame..

However at RSI front some sign of weakness visible as early sign but still till holding 1520 zone seems will bounce towards 1580-85 once before any breakdown if same to be done,in big horizon well comfort

Counter also near support of 1520-1525 zone at weekly frame..

However at RSI front some sign of weakness visible as early sign but still till holding 1520 zone seems will bounce towards 1580-85 once before any breakdown if same to be done,in big horizon well comfort

#BPCL(w) counter also near 400 phsycological support and like make or break zone...

Again same need to break this support also,first it should pull back and than next attempt it can try to break 400 zone to move towards 362/360 next support,but bounce is due and HPCL strength.

Again same need to break this support also,first it should pull back and than next attempt it can try to break 400 zone to move towards 362/360 next support,but bounce is due and HPCL strength.

ONGC(weekly) Crude also cool off but it's not like that production will be increased in every possible manner one way,hence demand supply mismatch remain continue ahead and ONGC strong counter cool off towards 145 good risk reward opportunity.

#Tatasteel #Metal counters across the Metal counter after results profit booking clear visible as same lead the rally same way,hence first profit booking also there,hence bounce back due in same counter before more profit booking n Tata Steel stand also make or break kind zone.

#SBIlIFE also taken swing from support of 1125 and if breakdown 1000 still as rock solid support in same as previous resistance become support.

#ITC weekly...No weakness at all..counter slowly going ready for big move as well...

Triangle formation at larger time frame and above 260 this time ready for next 20% sharp move towards 300/322

Triangle formation at larger time frame and above 260 this time ready for next 20% sharp move towards 300/322

#GAIL(Weekly) seems correction coming to end and counter reached near supportive zone of 140 as well

#NMDC weekly...

As seen across metal profit booking same visible in NMDC as well,but same also near support of 130 zone where weekly Trendline supportive hence before major breakdown pull back should be due..

As seen across metal profit booking same visible in NMDC as well,but same also near support of 130 zone where weekly Trendline supportive hence before major breakdown pull back should be due..

#coalindia same story correction seems complete and support seems to be hold..

RSI also gives comfort

All are weekly time frame support hence respect not to be broken easily in one way.

RSI also gives comfort

All are weekly time frame support hence respect not to be broken easily in one way.

#SBIN the way structure n move started seems PSU Bank still huge rally is due and all seems great after decent correction from big one side move...

Trendline well maintained

RSI well comfort

Near support zone

485-490 best possible entry zone

Trendline well maintained

RSI well comfort

Near support zone

485-490 best possible entry zone

#DLF

This is Monthly chart of DLF

Almost ready to give 10-11 year breakout on monthly set up...

Counter lead by volume support

RSI also well comfort

This is Monthly chart of DLF

Almost ready to give 10-11 year breakout on monthly set up...

Counter lead by volume support

RSI also well comfort

#Sunpharma (weekly)

#Divislab (weekly structure)

#Drreddy (weekly)

#Powergrid at weekly...

Respect Trend at price action

Volume comfort

Well bounced from support

RSI well placed

Reversal at RSI also from support.

Respect Trend at price action

Volume comfort

Well bounced from support

RSI well placed

Reversal at RSI also from support.

#NTPC (weekly)

Well placed support and coming near support zone and RSI front also possibilities that we'll respect support.

Well placed support and coming near support zone and RSI front also possibilities that we'll respect support.

#Reliance Weekly...Does not feel will break 2400 on recent news reaction....if break 2400 zone than another 8-10% possible correction..

• • •

Missing some Tweet in this thread? You can try to

force a refresh