1/22

I first read this book in 2009 after losing 80% of my monies on Penny stocks as a student when the 2008 drawdown happened.

Thought it was too simple !

Now in 2021, I think this is one of the best books to absorb & implement.

A 🧵

#BookTwitter

#BookRecommendations

I first read this book in 2009 after losing 80% of my monies on Penny stocks as a student when the 2008 drawdown happened.

Thought it was too simple !

Now in 2021, I think this is one of the best books to absorb & implement.

A 🧵

#BookTwitter

#BookRecommendations

2/22

Investing means different things to different people - Be it health/ career/external assets with an intent to reap benefits in future.

So then is everyone an Investor ?

No.

When people do different things with even same investment products we give it a different name.

👇

Investing means different things to different people - Be it health/ career/external assets with an intent to reap benefits in future.

So then is everyone an Investor ?

No.

When people do different things with even same investment products we give it a different name.

👇

3/22

Investing is a PERSONAL Plan .

It's NOT a product . NOT a procedure.

One needs to have a clear picture of one's financials BEFORE making an investment plan.

Investment products comprise of items with distinct characteristics DESIGNED to satisfy a particular need.

👇

Investing is a PERSONAL Plan .

It's NOT a product . NOT a procedure.

One needs to have a clear picture of one's financials BEFORE making an investment plan.

Investment products comprise of items with distinct characteristics DESIGNED to satisfy a particular need.

👇

4/22

Nothing is permanent except CHANGE.

Same applies for market cycles.

Different Asset Classes help us in that.

By smart movement one can increase the velocity of one's money.

It is NOT about timing the markets.

It's ABOUT the trends in an asset class.

Few pointers

👇

Nothing is permanent except CHANGE.

Same applies for market cycles.

Different Asset Classes help us in that.

By smart movement one can increase the velocity of one's money.

It is NOT about timing the markets.

It's ABOUT the trends in an asset class.

Few pointers

👇

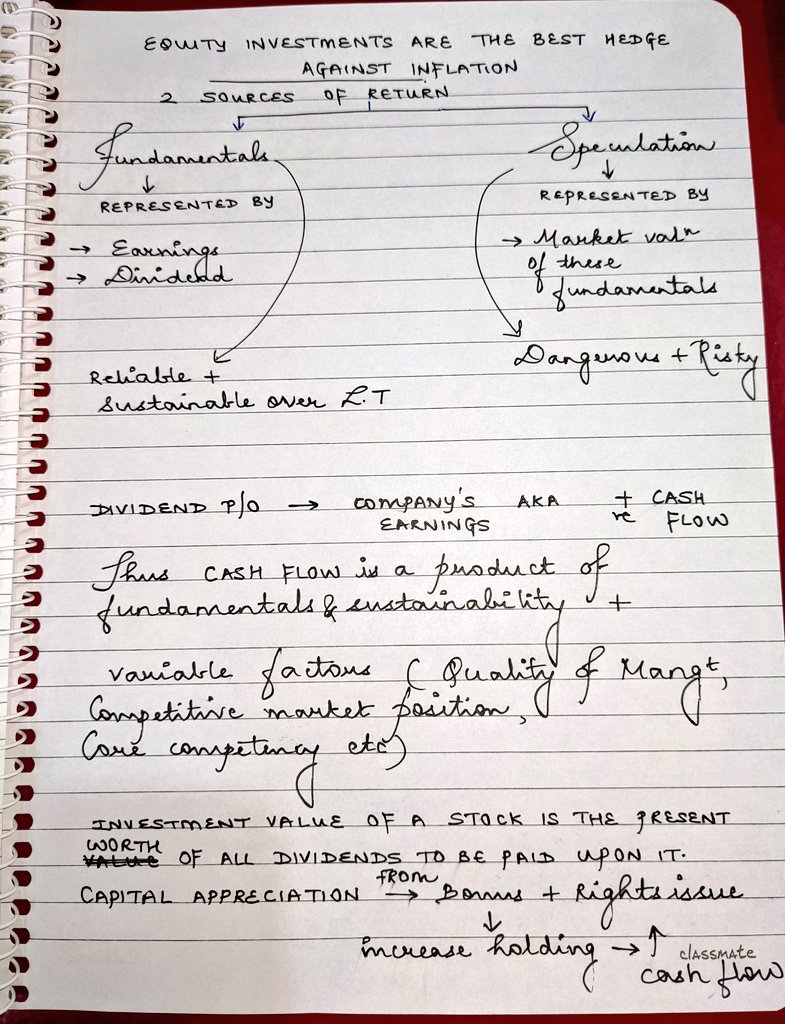

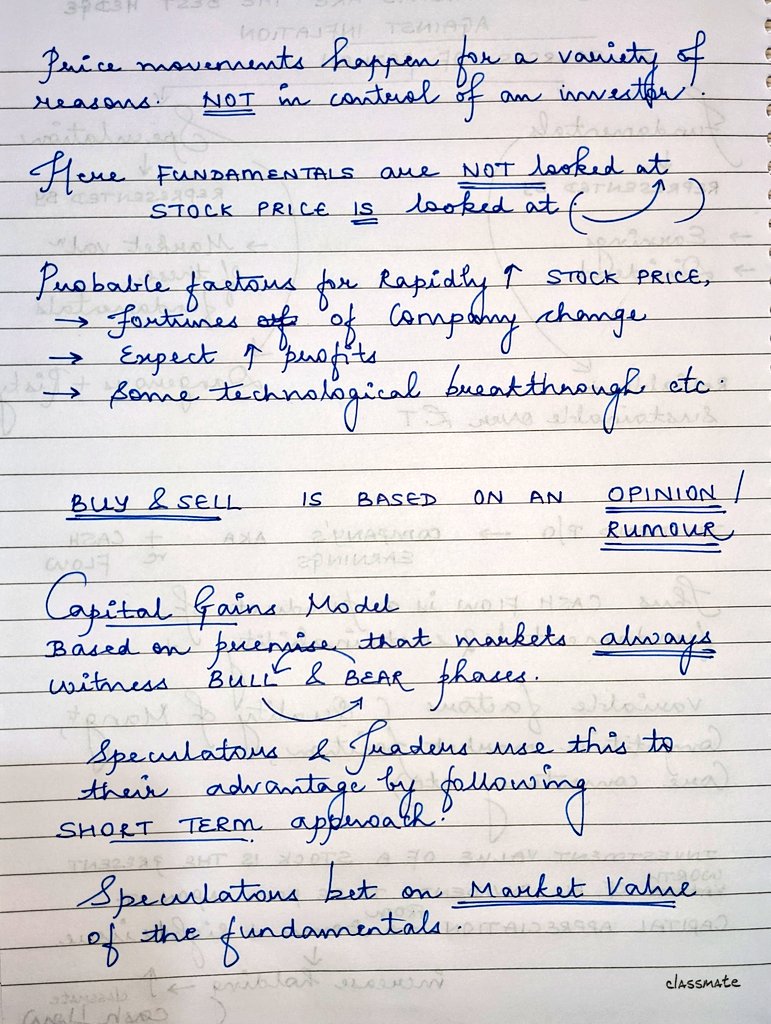

5/22

Many folks acquire Speculative habits mistakenly thinking they are Investing. ☠️

L.T Investing is central for optimum returns.

Markets will be volatile.

But in long run shall only go ⬆️

Some notes on Cash Flow & Capital Gains Model , Speculation & Law of The Farm

👇

Many folks acquire Speculative habits mistakenly thinking they are Investing. ☠️

L.T Investing is central for optimum returns.

Markets will be volatile.

But in long run shall only go ⬆️

Some notes on Cash Flow & Capital Gains Model , Speculation & Law of The Farm

👇

6/22

Difficult to say which strategy is good. Even good speculators make money.

It depends on the individual's attitude, discipline , risk taking ability & patience.

Too much UNCERTAINTY is making markets the bedrock of speculation & HENCE the volatility.

Difficult to say which strategy is good. Even good speculators make money.

It depends on the individual's attitude, discipline , risk taking ability & patience.

Too much UNCERTAINTY is making markets the bedrock of speculation & HENCE the volatility.

7/22

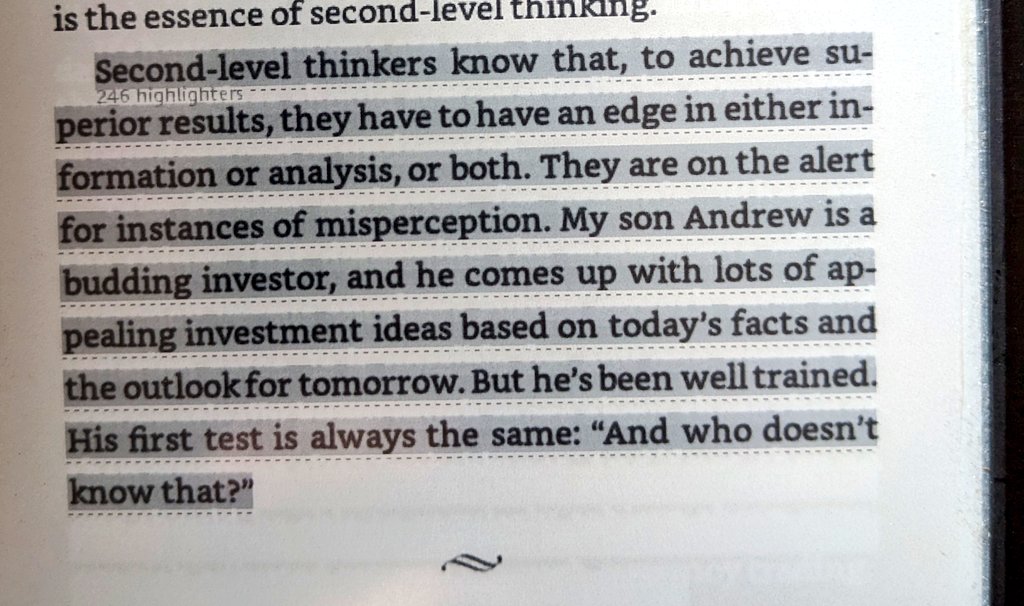

3 paths to achieve superior results.

🔸 The Intellectually difficult path - Admired in HINDSIGHT

🔸 The Physically difficult path - SELF complicated

🔸The Emotionally Difficult path - Deceptively Straightforward & Best suited for most

More explanation here

👇

3 paths to achieve superior results.

🔸 The Intellectually difficult path - Admired in HINDSIGHT

🔸 The Physically difficult path - SELF complicated

🔸The Emotionally Difficult path - Deceptively Straightforward & Best suited for most

More explanation here

👇

8/22

Onto the most important part : *Behavioural Finance*

Most investors make decisions with their hearts.

Our WAVERING emotions (FOMO/Panic/Greed- IPO investments etc) define us.

Our logic & rationale takes a backseat & only retrospectively justify these decisions.

👇

Onto the most important part : *Behavioural Finance*

Most investors make decisions with their hearts.

Our WAVERING emotions (FOMO/Panic/Greed- IPO investments etc) define us.

Our logic & rationale takes a backseat & only retrospectively justify these decisions.

👇

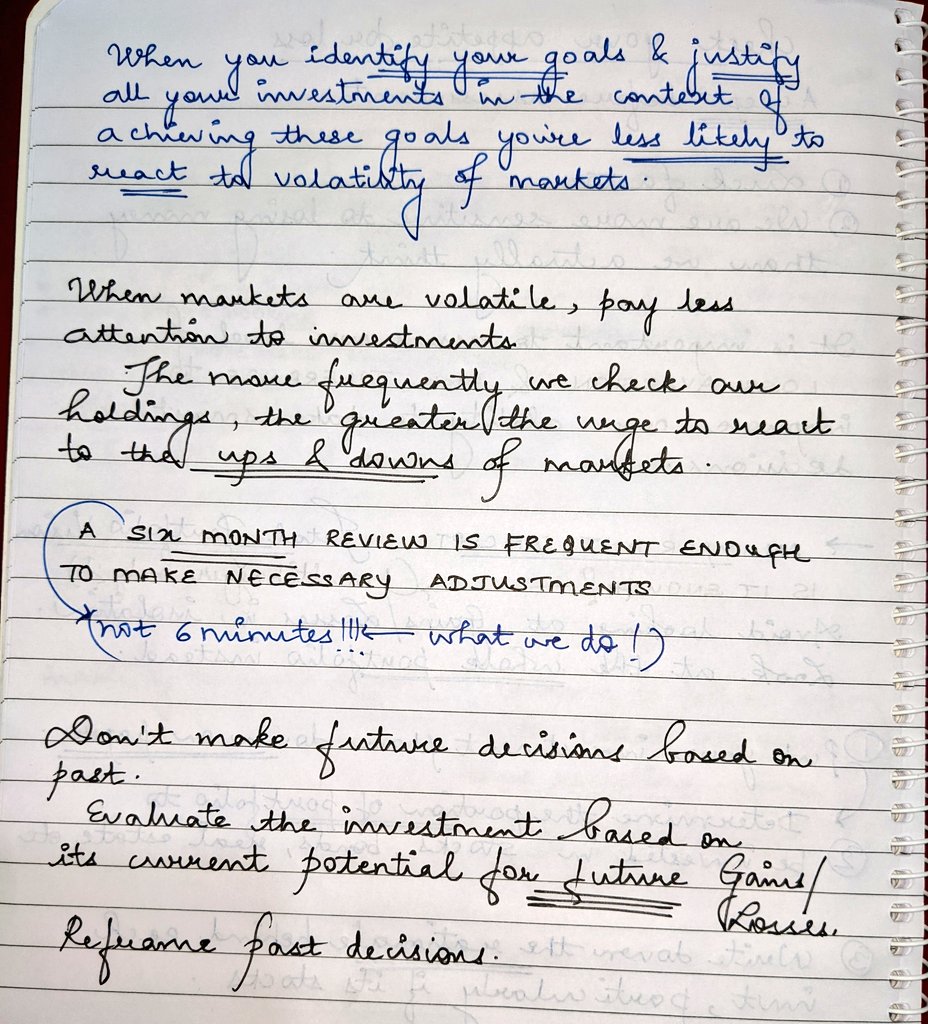

9/22

🔸Check if you are a victim of Loss Aversion & Sunk Cost fallacy.

Work upon it to make wiser investment decisions in future.

🔸Diversify wisely WITHIN assets ACROSS asset classes to avoid reacting impulsively.

🔸Avoid looking at gains & losses in isolation.

More here 👇

🔸Check if you are a victim of Loss Aversion & Sunk Cost fallacy.

Work upon it to make wiser investment decisions in future.

🔸Diversify wisely WITHIN assets ACROSS asset classes to avoid reacting impulsively.

🔸Avoid looking at gains & losses in isolation.

More here 👇

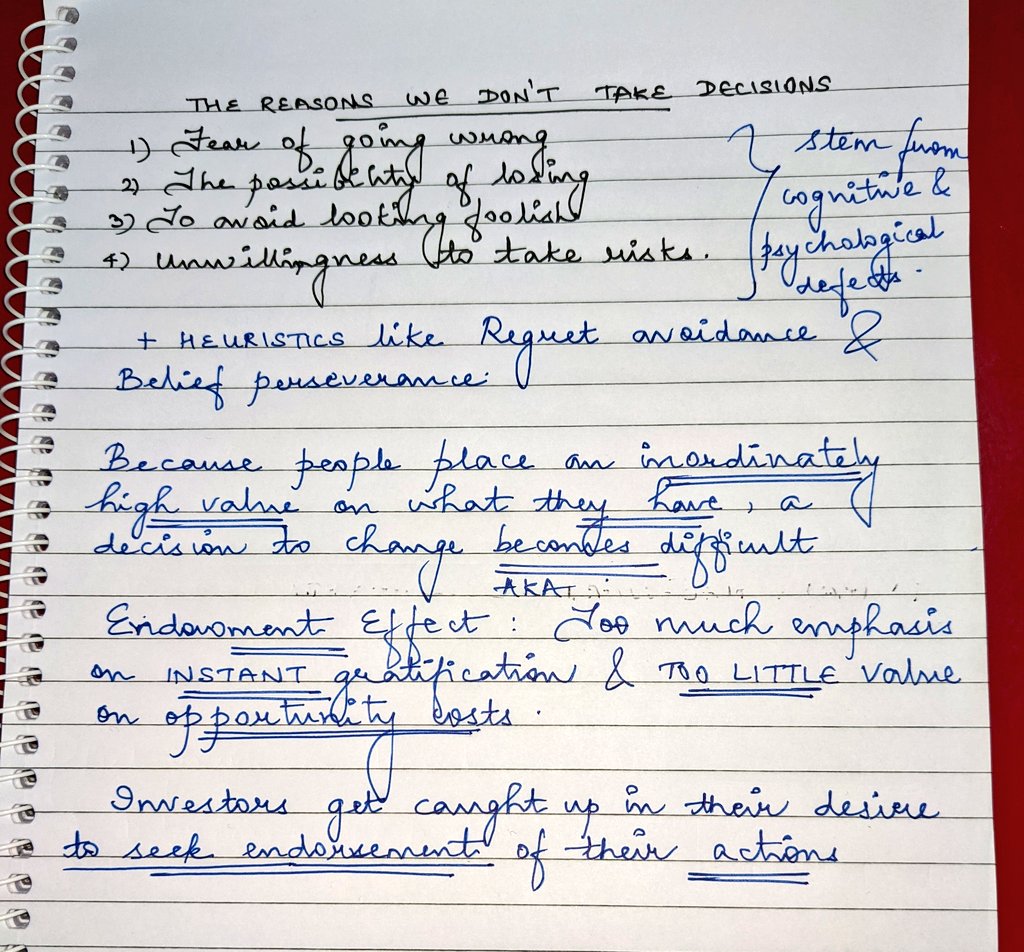

10/22

Deciding not to take a decision is ALSO a decision.

Maintaining a Status Quo in times of continuous change is unwise.

It is a natural tendency to resist change which amplifies Decision Paralysis. ( The book has many examples as illustrations ) 1

More on this here👇

Deciding not to take a decision is ALSO a decision.

Maintaining a Status Quo in times of continuous change is unwise.

It is a natural tendency to resist change which amplifies Decision Paralysis. ( The book has many examples as illustrations ) 1

11/22

V.imp

Mental Accounting affects our behaviour in different ways.

The tendency to place DIFFERENT values to the SAME sum of money depending on HOW it was acquired & the EFFORT needed for this.

Such an underrated concept !

V.imp

Mental Accounting affects our behaviour in different ways.

The tendency to place DIFFERENT values to the SAME sum of money depending on HOW it was acquired & the EFFORT needed for this.

Such an underrated concept !

12/22

Some eg of Mental Accounting errors

🔸Holding onto losers unwilling to accept mistake & believing losses are notional & price will ⬆️

🔸Bonus shares considered as Freebie & bought post announcement ( Eg IEX ) . Stock ⬆️🚀 Companies gives Bonus shares to capitalise reserves.

Some eg of Mental Accounting errors

🔸Holding onto losers unwilling to accept mistake & believing losses are notional & price will ⬆️

🔸Bonus shares considered as Freebie & bought post announcement ( Eg IEX ) . Stock ⬆️🚀 Companies gives Bonus shares to capitalise reserves.

13/22

🔸 Trading repeatedly with narrow spreads failing to consider transaction costs & brokerage.

🔸Being okay with high interest in margin trading & off setting it by a lower interest of bank F.D aka - 2 mental accounts.

Safe money & Risk money for SAME money.

🔸 Trading repeatedly with narrow spreads failing to consider transaction costs & brokerage.

🔸Being okay with high interest in margin trading & off setting it by a lower interest of bank F.D aka - 2 mental accounts.

Safe money & Risk money for SAME money.

14/22

Personal favourite : Mental Heuristics.

We reach conclusions by Trial & Error usually leading us to develop Thumb Rules which aren't always accurate.

Identify the principles underlying these thumb rules & the ERRORS. associated.

The book then discusses various heuristics.

Personal favourite : Mental Heuristics.

We reach conclusions by Trial & Error usually leading us to develop Thumb Rules which aren't always accurate.

Identify the principles underlying these thumb rules & the ERRORS. associated.

The book then discusses various heuristics.

15/22

Investing is a game of patience.

But Keynes is often quoted - " In the long run we are all dead" to justify our speculative urges.

We try to time the markets.

Sometimes we go RIGHT & MAKE a quick buck.

Many times we DON'T & LOSE HEAVILY.

Watch!

👇

bit.ly/3cxLpaH

Investing is a game of patience.

But Keynes is often quoted - " In the long run we are all dead" to justify our speculative urges.

We try to time the markets.

Sometimes we go RIGHT & MAKE a quick buck.

Many times we DON'T & LOSE HEAVILY.

Watch!

👇

bit.ly/3cxLpaH

16/22

The book talks on how Mutual Funds TALK about Long Term investment strategy but most often ONLY look to TIME MARKETS & fund managers being forced to act in a way NON CONFIRMING with basic investment principles owing to competition.

Ahem...RINGS ANY BELLS ? 🤔😁

The book talks on how Mutual Funds TALK about Long Term investment strategy but most often ONLY look to TIME MARKETS & fund managers being forced to act in a way NON CONFIRMING with basic investment principles owing to competition.

Ahem...RINGS ANY BELLS ? 🤔😁

17/22

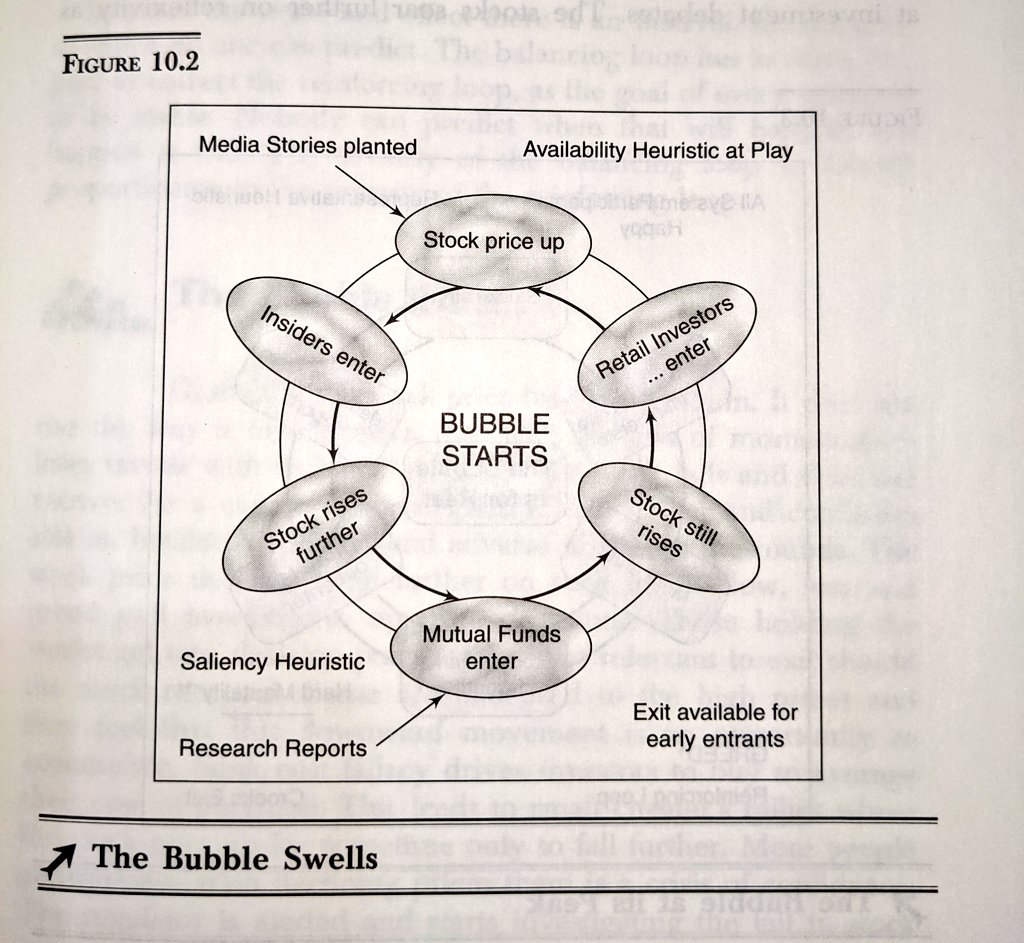

Markets ARE unpredictable.

Intermittent bubbles happen. Burst. Gradually markets pick up.

It's all a circle which repeats as human nature is predictable.

Understanding the psychology of market participants helps.

A video of Parag Sir on this.

👇

Markets ARE unpredictable.

Intermittent bubbles happen. Burst. Gradually markets pick up.

It's all a circle which repeats as human nature is predictable.

Understanding the psychology of market participants helps.

A video of Parag Sir on this.

👇

18/22

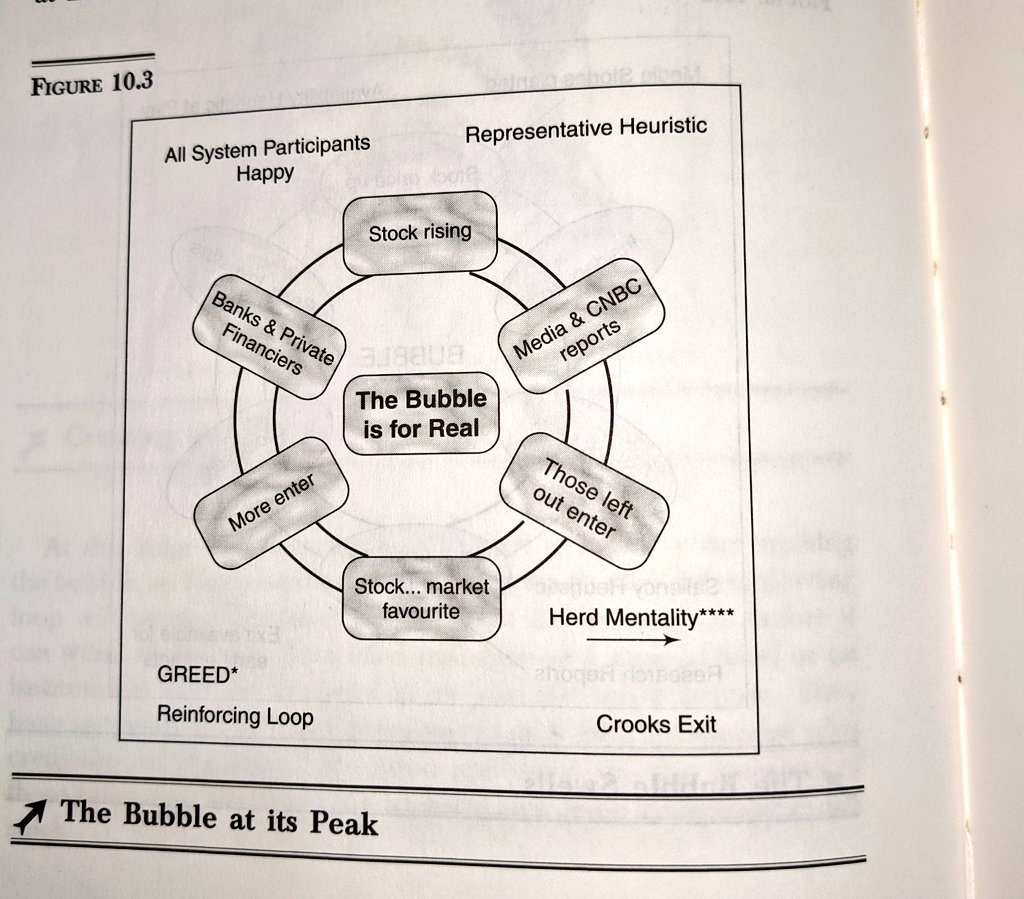

The book then talks about :

1) Create Reinforcing Loop

2) Bubble Swells

3) Bubble at its peak

4) Bubble Pricked

5) Bubble Bursts

I couldn't help but nod for most part of reading this !! 🙂🤷🏻♀️

Sharing just the illustrations here.

The book then talks about :

1) Create Reinforcing Loop

2) Bubble Swells

3) Bubble at its peak

4) Bubble Pricked

5) Bubble Bursts

I couldn't help but nod for most part of reading this !! 🙂🤷🏻♀️

Sharing just the illustrations here.

19/22

Ultimately the Bubble bursts and we realise it only AFTERWARDS.

We pay heavily for our greed.

The govt orders the regulators to conduct an inquiry , and we all know what happens later ..........

:))

Investors must understand the workings & anomalies here.

👇

Ultimately the Bubble bursts and we realise it only AFTERWARDS.

We pay heavily for our greed.

The govt orders the regulators to conduct an inquiry , and we all know what happens later ..........

:))

Investors must understand the workings & anomalies here.

👇

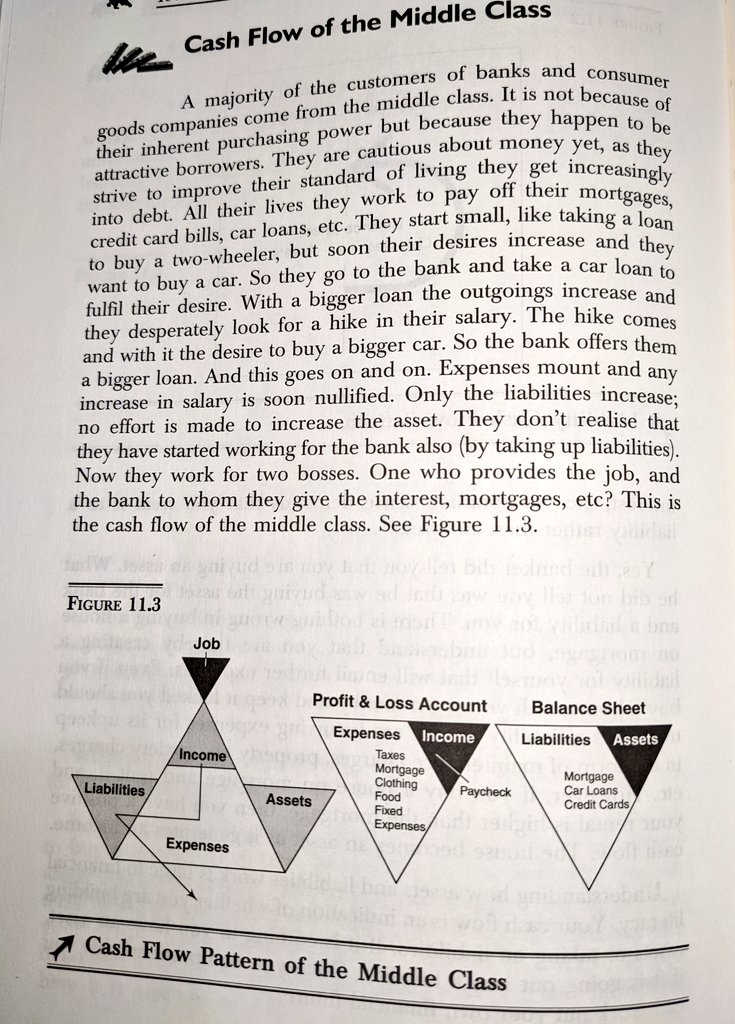

20/22

We need to change our paradigm.

Passion should drive us , not Greed or Fear.

Learn the Money game.

HARNESS THE POWER OF MONEY.

Understand Asset & Liability Cash Flow patterns.

What differenciates middle class from wealthy is the lack of financial literacy.

We need to change our paradigm.

Passion should drive us , not Greed or Fear.

Learn the Money game.

HARNESS THE POWER OF MONEY.

Understand Asset & Liability Cash Flow patterns.

What differenciates middle class from wealthy is the lack of financial literacy.

21/22

Moving onto Why stocks?

🔸Either keep cash in bank F.D which doesn't beat even inflation & erode money.

🔸Or take SOME risk & invest money sensibly in assets that have a reasonable chance of increasing value over time & become FI.

Choice is yours !

Choose wisely.🙂🙏

Moving onto Why stocks?

🔸Either keep cash in bank F.D which doesn't beat even inflation & erode money.

🔸Or take SOME risk & invest money sensibly in assets that have a reasonable chance of increasing value over time & become FI.

Choice is yours !

Choose wisely.🙂🙏

22/22

To sum it all up.

Read this deceptively simple book.

Watch the old videos of late Parag Sir , the founder of @PPFAS on YouTube channel & also their current videos.

The link :

youtube.com/c/ppfasltd

Think in isolation & Learn more about yourself.

Happy investing !

To sum it all up.

Read this deceptively simple book.

Watch the old videos of late Parag Sir , the founder of @PPFAS on YouTube channel & also their current videos.

The link :

youtube.com/c/ppfasltd

Think in isolation & Learn more about yourself.

Happy investing !

• • •

Missing some Tweet in this thread? You can try to

force a refresh