Inflation would probably have been even higher without the rise of the delta variant.

Not open-and-shut: virus has reduced supply (inflationary), reduced demand (deflationary), and shifted demand (ambiguous).

The 2020 virus cut inflation, delta probably is doing so too.

A 🧵.

Not open-and-shut: virus has reduced supply (inflationary), reduced demand (deflationary), and shifted demand (ambiguous).

The 2020 virus cut inflation, delta probably is doing so too.

A 🧵.

In 2020 prices actually fell in April & May when the virus first hit. The price of oil was actually negative! Inflation was low all year.

The conventional wisdom eight months ago was that the rapid reopening of the economy would cause a transitory *increase* in inflation.

The conventional wisdom eight months ago was that the rapid reopening of the economy would cause a transitory *increase* in inflation.

Go back and read the analysis of the high inflation we had in April, May and June. The standard argument was that the vaccines were deployed more quickly and effectively than expected so that was temporarily increasing inflation. NO ONE said vaccines were reducing inflation.

Now that the delta variant has slowed the reopening of the economy the conventional wisdom has reversed and the argument is that a slower reopening of the economy means more inflation not less.

It is possible the old argument was wrong and the new one is right, let's look at it.

It is possible the old argument was wrong and the new one is right, let's look at it.

Let's try to imagine what the economy would have been like if COVID cases had continued to decline as we had hoped. Everything in the following is relative to this counterfactual. (So "decrease" = "decrease relative to the counterfactual" even if it actually increased.)

SUPPLY DECREASE is what gets the most attention, this is the closed factories in Asia and the slow return of workers in the United States. All else equal this means higher inflation, just like the supply decrease in 2020 was inflation.

But all is else is not equal.

But all is else is not equal.

DEMAND DECREASE goes the other way. Delta has lowered labor earnings and lowered business sales in ways that, by themselves, are demand reducing. In 2020 this effect massively dominated the supply effect.

DEMAND SHIFT from services to durables has an ambiguous impact on inflation, increasing goods inflation but reducing services inflation. You can't simply say "absent the shift goods inflation would be lower so overall inflation would be lower."

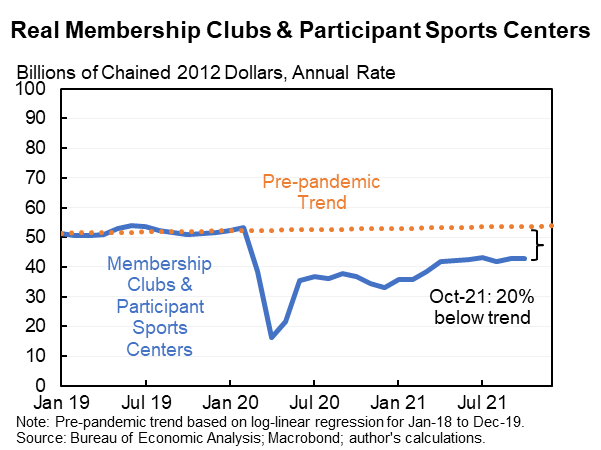

The delta-induced reduction in services inflation has been large. An index of pandemic prices is still 7 percent below its pre-COVID trend and has fallen since the summer as delta slowed the services reopening.

Falling airfares, hotel prices and other pandemic services subtracted from inflation in August, September and October. Relative to the non-delta scenario the subtraction would likely have added.

Note, I'm not saying the net effect of the demand shift is deflationary, would need to know more about relative elasticities for goods and services. What I am saying is analysis can't include one partial effect and ignore another partial effect that is the flip side of it.

(And BTW, the idea that reduced services spending leads dollar for dollar to new goods spending is itself likely not true. It wasn't true in 2020. It could be less true now when people have more durables. Most of the service shortfall is health spending. Etc.)

Let's now step back and talk about the big picture of what this does and does not mean.

First, we should not overstate the magnitude of the economic impact of delta. It has been negative for real GDP/employment and likely negative for inflation but I'm not sure by how much.

First, we should not overstate the magnitude of the economic impact of delta. It has been negative for real GDP/employment and likely negative for inflation but I'm not sure by how much.

Restaurant spending is roughly normal (and very high nominal). Casual empiricism suggests there have been more weddings lately not less (pent up demand!) and most families doing normal travel/gatherings for Thanksgiving. Biggest shortfalls are business travel and health.

And the best estimate is that growth slowed a little in Q3 but not a lot while job growth remained reasonably robust and the unemployment rate fell sharply. (Moreover, growth likely would have slowed in Q3 regardless as initial reopening was over.)

https://twitter.com/jasonfurman/status/1463507544320708610?s=20

Second, to the degree delta has been deflationary it suggests that all-else-equal when the pandemic comes more under control (or people ignore it more or manage it better, may get worse before it gets better) that would be a positive for inflation.

Specifically, goods inflation might cool somewhat but there is a lot more room for services inflation--not just in pandemic services but also in other areas like rent.

On net my best guess is the inflation rate falls but remains in the 3-4% range for 2022 as a whole.

On net my best guess is the inflation rate falls but remains in the 3-4% range for 2022 as a whole.

A broader lesson: confirmation bias is strong, I try to resist it but not always successfully. In this case, unless you were arguing the rapid deployment of the vaccines was temporarily pushing inflation down in Apr, May & Jun then you should ask why you've changed your mind now.

• • •

Missing some Tweet in this thread? You can try to

force a refresh