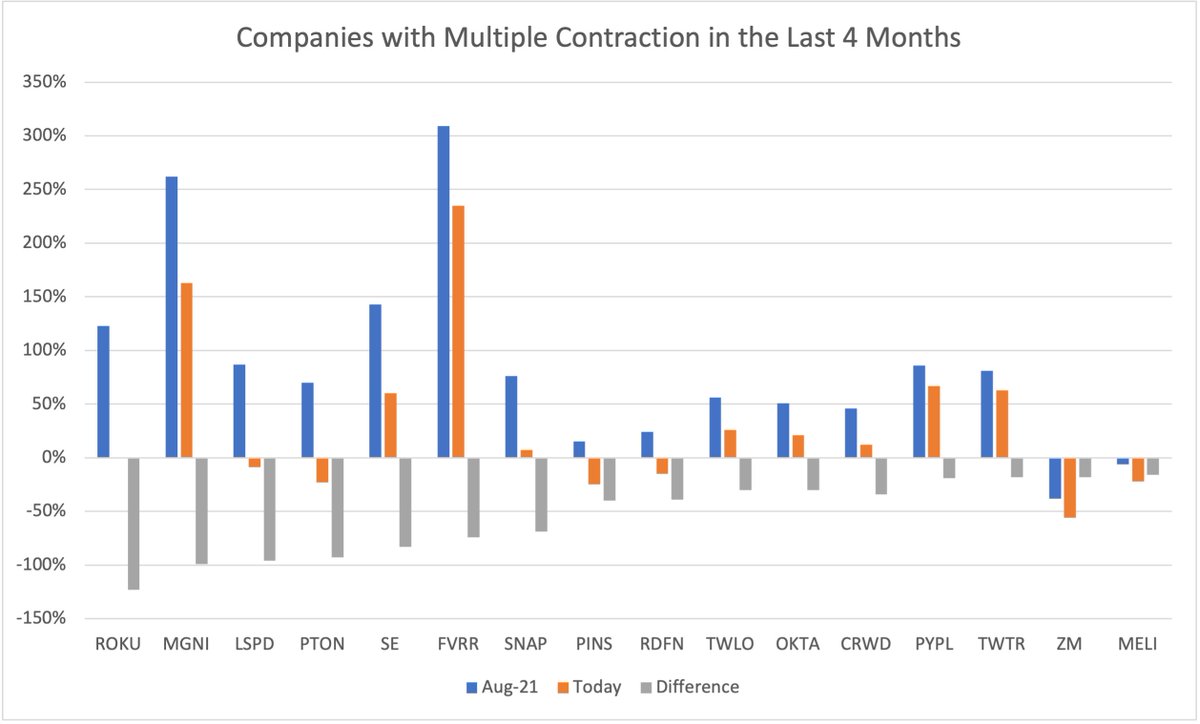

We are seeing a continued evolution of multiples contracting in many companies. Some have come back to pre-covid levels (2018-2019) but there are many that still have significantly higher multiples.

Here is a comparison of the changes in multiples we had in Aug 2021 vs Nov 2021

Here is a comparison of the changes in multiples we had in Aug 2021 vs Nov 2021

The majority of these companies are seeing multiples contracting. These are some of the most severe in the past 4 months:

Difference between Aug2021 and Nov 2021:

$ROKU -123%

$MGNI -99%

$LSPD -96%

$PTON -93%

$SE -83%

$FVRR -74%

$SNAP -69%

$PINS -40%

$RDFN -39%

$CRWD -34%

Difference between Aug2021 and Nov 2021:

$ROKU -123%

$MGNI -99%

$LSPD -96%

$PTON -93%

$SE -83%

$FVRR -74%

$SNAP -69%

$PINS -40%

$RDFN -39%

$CRWD -34%

$TWLO -30%

$OKTA -30%

$PYPL -19%

$TWTR -18%

$ZM -18%

$MELI -16%

There are some that even with their contraction are still trading at a 50% premium versus pre-covid:

$MGNI $SE $FVRR $PYPL $TWTR

$OKTA -30%

$PYPL -19%

$TWTR -18%

$ZM -18%

$MELI -16%

There are some that even with their contraction are still trading at a 50% premium versus pre-covid:

$MGNI $SE $FVRR $PYPL $TWTR

Some are getting closer to pre-covid multiples, although still higher:

$SNAP $TWLO $OKTA $CRWD

And some have now lower multiples vs pre-pandemic:

$ZM $MELI $PINS $RDFN $PTON $LSPD

This are only facts. Business prospects, competition and other factors may have changed.

$SNAP $TWLO $OKTA $CRWD

And some have now lower multiples vs pre-pandemic:

$ZM $MELI $PINS $RDFN $PTON $LSPD

This are only facts. Business prospects, competition and other factors may have changed.

There are some notable companies that have seen an additional expansion in their multiple in the past 4 months:

$NET 136%

$MDB 47%

$TSLA 42%

$W 27%

$NVDA 24%

$ETSY 23%

$MA 14%

$NET 136%

$MDB 47%

$TSLA 42%

$W 27%

$NVDA 24%

$ETSY 23%

$MA 14%

For this analysis, I compared current multiples to the average multiples that each company had in the 8 quarters of 2018-2019 for the following metrics:

EV/GP NTM

EV/FCF NTM

EV/EBITDA NTM

Negative FCF and EBITDA were excluded in unprofitable companies.

EV/GP NTM

EV/FCF NTM

EV/EBITDA NTM

Negative FCF and EBITDA were excluded in unprofitable companies.

Over time, I believe most companies will trade at their historical multiples again.

With some exceptions where business prospects, competition and execution has changed over time, of course.

For reference, 10-year Treasury Yield was between 1.8% and 3.2% in 2018 and 2019.

With some exceptions where business prospects, competition and execution has changed over time, of course.

For reference, 10-year Treasury Yield was between 1.8% and 3.2% in 2018 and 2019.

This thread is a follow up on a previous thread shared the 5th August 2021:

https://twitter.com/Investing_Lion/status/1423299026766737408?s=20

Even with some of them having a severe multiple contraction during 2021, most of these companies have had high returns when we look at the past 3 years.

How much will some of them give back as multiples keep contracting?

What are the best opportunities from here?

Will see.

How much will some of them give back as multiples keep contracting?

What are the best opportunities from here?

Will see.

• • •

Missing some Tweet in this thread? You can try to

force a refresh