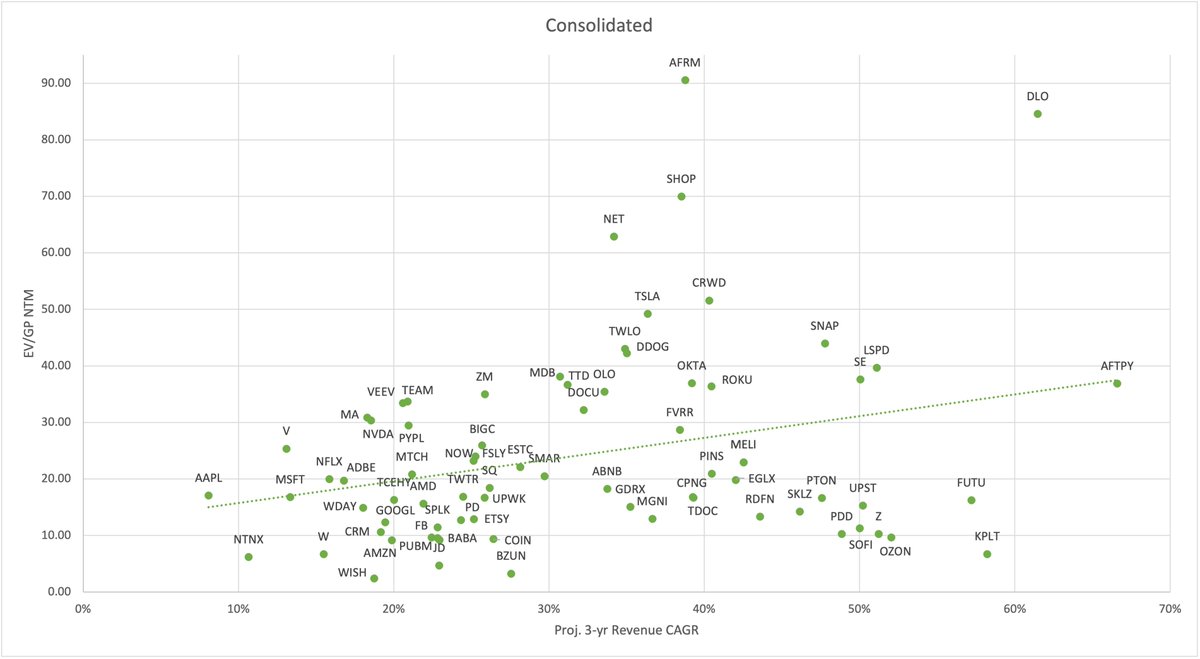

Now that most companies have reported earnings, it is a good time to assess where current valuation multiples stand and the estimates of revenue CAGR for the next few years.

This is the consolidated graph with all the companies:

This is the consolidated graph with all the companies:

In this other one, I included some companies that I had to exclude in the first graph:

$AFRM

$SNOW

$DLO

$GLBE

The next graphs are grouped by industry.

$AFRM

$SNOW

$DLO

$GLBE

The next graphs are grouped by industry.

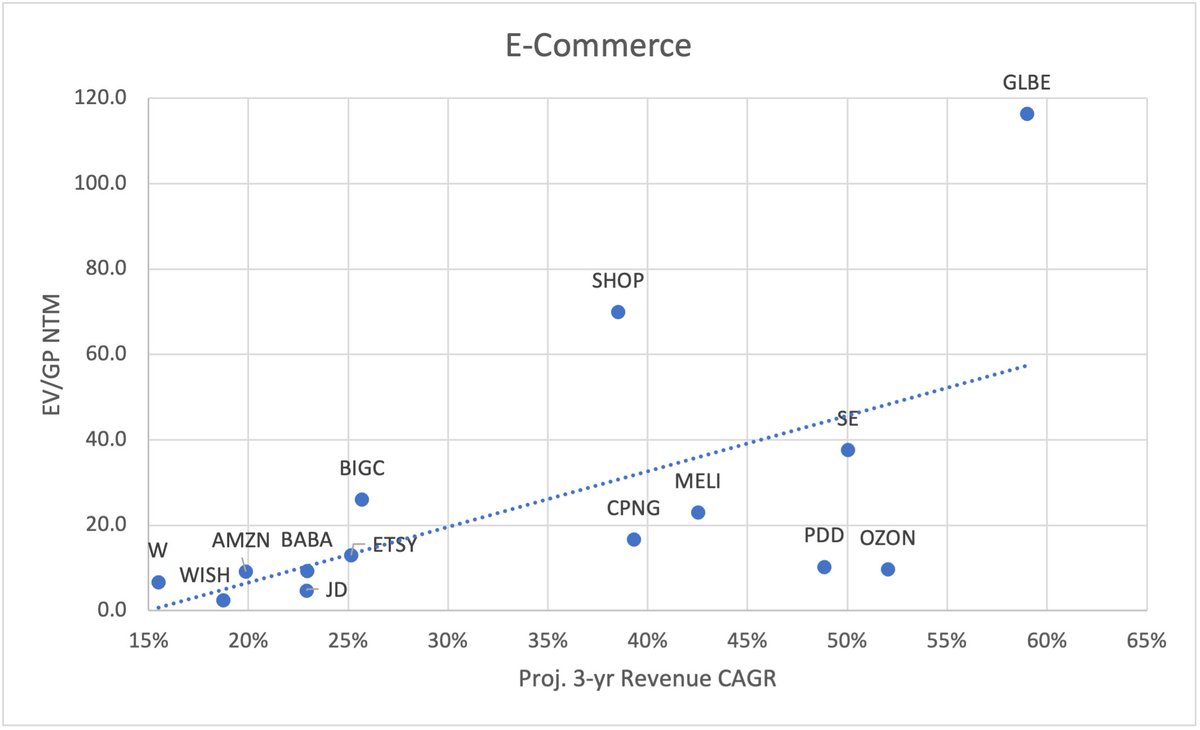

E-Commerce

EV/GP NTM and EV/EBITDA NTM (for profitable Cos)

$AMZN 8.4x / 20.6x

$BABA 6.5x / 12.6

$SE 36.4x

$MELI 24.4x / 123x

$JD 4x / 32x

$W 7.4x / 44x

$SHOP 66x / 266x

$CPNG 10.6x

$ETSY 14.1x / 36.64x

$PDD 9.1x

$OZON 8.1x

$BIGC 21.2x

$GLBE 116x

EV/GP NTM and EV/EBITDA NTM (for profitable Cos)

$AMZN 8.4x / 20.6x

$BABA 6.5x / 12.6

$SE 36.4x

$MELI 24.4x / 123x

$JD 4x / 32x

$W 7.4x / 44x

$SHOP 66x / 266x

$CPNG 10.6x

$ETSY 14.1x / 36.64x

$PDD 9.1x

$OZON 8.1x

$BIGC 21.2x

$GLBE 116x

Fintech and Payments

$V 22.6x / 29x

$MA 26.2x / 28.9x

$PYPL 26.3x / 40x

$SQ 22x / 109x

$COIN 9.7x / 19.3x

$AFRM 117x

$SOFI 20.3x / 94x

$UPST 22.4x / 123x

$LSPD 44x

$DLO 116x

$V 22.6x / 29x

$MA 26.2x / 28.9x

$PYPL 26.3x / 40x

$SQ 22x / 109x

$COIN 9.7x / 19.3x

$AFRM 117x

$SOFI 20.3x / 94x

$UPST 22.4x / 123x

$LSPD 44x

$DLO 116x

Social Media and Digital Ads

$FB 9.7x / 14.4x

$GOOGL 12.3x / 17.2x

$PINS 16.2x / 42.7x

$SNAP 43.8x / 150.7x

$TWTR 13.8x / 30x

$ROKU 28.6x / 124.9x

$TTD 26.9x / 79.2x

$MTCH 17x / 35x

$MGNI 13.4x / 29.2x

$PUBM 7.5x / 18.6x

$FB 9.7x / 14.4x

$GOOGL 12.3x / 17.2x

$PINS 16.2x / 42.7x

$SNAP 43.8x / 150.7x

$TWTR 13.8x / 30x

$ROKU 28.6x / 124.9x

$TTD 26.9x / 79.2x

$MTCH 17x / 35x

$MGNI 13.4x / 29.2x

$PUBM 7.5x / 18.6x

Mega Cap

$AAPL 16x / 20.2x

$MSFT 16.8x / 23.7x

$GOOGL 12.3x / 17.2x

$AMZN 8.4x / 21.6x

$FB 9.7x / 14.6x

$TCEHY 13.4x / 17.4x

$BABA 6.5x / 12.6

$TSLA 50.5x / 55x

$NVDA 32.4x / 50.9x

$NFLX 20x / 37.3x

$AAPL 16x / 20.2x

$MSFT 16.8x / 23.7x

$GOOGL 12.3x / 17.2x

$AMZN 8.4x / 21.6x

$FB 9.7x / 14.6x

$TCEHY 13.4x / 17.4x

$BABA 6.5x / 12.6

$TSLA 50.5x / 55x

$NVDA 32.4x / 50.9x

$NFLX 20x / 37.3x

SAAS

$TWLO 37.6x / 268x

$DOCU 35.2x / 134x

$SPLK 12.7x

$WDAY 16.4x / 46x

$NET 67.8x

$FSLY 23.1x

$PD 13.5x

$ADBE 21.3x / 37.8x

$ZM 33.3x / 63

$TEAM 41.9x

$SNOW 98.4x

$CRM 12.4x / 33x

$VEEV 33x / 65x

$CRWD 52x / 317x

$DDOG 42x / 277x

$OLO 36x

$NOW 24x / 61x

$OKTA 40x

$MDB 44x

$TWLO 37.6x / 268x

$DOCU 35.2x / 134x

$SPLK 12.7x

$WDAY 16.4x / 46x

$NET 67.8x

$FSLY 23.1x

$PD 13.5x

$ADBE 21.3x / 37.8x

$ZM 33.3x / 63

$TEAM 41.9x

$SNOW 98.4x

$CRM 12.4x / 33x

$VEEV 33x / 65x

$CRWD 52x / 317x

$DDOG 42x / 277x

$OLO 36x

$NOW 24x / 61x

$OKTA 40x

$MDB 44x

Real Estate / Healthcare / Gig Economy / Gaming / Other

$FVRR 23.7x / 241x

$UPWK 13.9x / 170x

$Z 6.9x / 44.6x

$ABNB 18.5x / 67x

$RDFN 12.1x

$PTON 14.4x / 101x

$TDOC 15.4x / 72x

$GDRX 17.2x / 50x

$EGLX 15.7x

$SKLZ 8x

$AMD 17.6x / 31.1x

$RBLX 22.2x / 71x

$XPEL 21.7x / 41.4x

$FVRR 23.7x / 241x

$UPWK 13.9x / 170x

$Z 6.9x / 44.6x

$ABNB 18.5x / 67x

$RDFN 12.1x

$PTON 14.4x / 101x

$TDOC 15.4x / 72x

$GDRX 17.2x / 50x

$EGLX 15.7x

$SKLZ 8x

$AMD 17.6x / 31.1x

$RBLX 22.2x / 71x

$XPEL 21.7x / 41.4x

Valuation and growth are just some of the variables to take into account. But once you know a company really well, it can help to add at better valuations over time.

I have a feeling this is going to be an interesting September/October period. Let's keep compounding! 🔥📈

I have a feeling this is going to be an interesting September/October period. Let's keep compounding! 🔥📈

Sharing with some friends:

@BackpackerFI @Invesquotes @caleb_investTML @Couch_Investor @Innovestor_ @7Innovator @IrnestKaplan @InvestmentTalkk @EugeneNg_VCap @StockMarketNerd @Brian_Stoffel_ @NeuroStockDoc @Mayhem4Markets @borrowed_ideas @skaushi @Keith_Wasserman @Badpak

@BackpackerFI @Invesquotes @caleb_investTML @Couch_Investor @Innovestor_ @7Innovator @IrnestKaplan @InvestmentTalkk @EugeneNg_VCap @StockMarketNerd @Brian_Stoffel_ @NeuroStockDoc @Mayhem4Markets @borrowed_ideas @skaushi @Keith_Wasserman @Badpak

• • •

Missing some Tweet in this thread? You can try to

force a refresh