After an interesting and volatile start to the Q3 earnings season, we can see where valuation multiples stand for technology companies.

This is the consolidated graph with all the companies comparing EV/GP NTM vs estimates of 3-yr revenue growth:

This is the consolidated graph with all the companies comparing EV/GP NTM vs estimates of 3-yr revenue growth:

E-Commerce

EV/GP NTM

$AMZN 8.1x

$BABA 7.9x

$SE 37.5x

$MELI 22.9x

$JD 4.9x

$W 6.0x

$SHOP 61.2x

$CPNG 10.7x

$ETSY 16.5x

$PDD 10.2x

$OZON 7.1x

$BIGC 18x

$GLBE 104x

EV/GP NTM

$AMZN 8.1x

$BABA 7.9x

$SE 37.5x

$MELI 22.9x

$JD 4.9x

$W 6.0x

$SHOP 61.2x

$CPNG 10.7x

$ETSY 16.5x

$PDD 10.2x

$OZON 7.1x

$BIGC 18x

$GLBE 104x

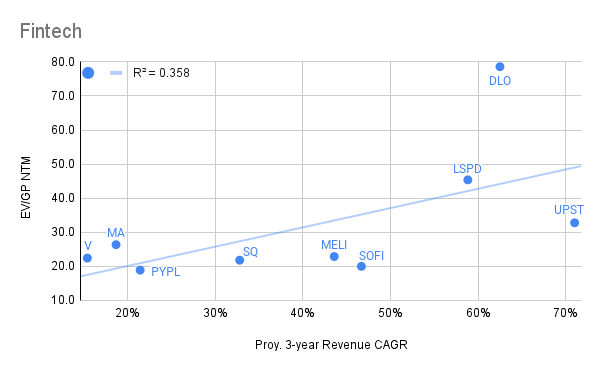

Fintech and Payments

EV/GP NTM

$V 22.4x

$MA 26.4x

$PYPL 18.9x

$SQ 21.8x

$AFRM 137x

$SOFI 20x

$UPST 32.8x

$LSPD 45.4x

$DLO 78.6x

EV/GP NTM

$V 22.4x

$MA 26.4x

$PYPL 18.9x

$SQ 21.8x

$AFRM 137x

$SOFI 20x

$UPST 32.8x

$LSPD 45.4x

$DLO 78.6x

Social Media and Digital Ads

EV/GP NTM

$FB 8.3x

$GOOGL 11.4x

$PINS 15.4x

$SNAP 28.7x

$TWTR 12.8x

$ROKU 24.3

$TTD 32.7

$MTCH 20.8x

$MGNI 9.9x

$PUBM 7.3x

EV/GP NTM

$FB 8.3x

$GOOGL 11.4x

$PINS 15.4x

$SNAP 28.7x

$TWTR 12.8x

$ROKU 24.3

$TTD 32.7

$MTCH 20.8x

$MGNI 9.9x

$PUBM 7.3x

Mega Cap

EV/GP NTM

$AAPL 15.4x

$MSFT 17.5x

$GOOGL 11.4x

$AMZN 8.1x

$FB 8.3x

$TCEHY 14.7x

$BABA 7.9x

$TSLA 53.2x

$NVDA 30.7x

$NFLX 21.6x

EV/GP NTM

$AAPL 15.4x

$MSFT 17.5x

$GOOGL 11.4x

$AMZN 8.1x

$FB 8.3x

$TCEHY 14.7x

$BABA 7.9x

$TSLA 53.2x

$NVDA 30.7x

$NFLX 21.6x

SaaS

$ADBE 19x

$ASAN 67x

$CRM 12.7x

$CRWD 49x

$DCBO 23x

$DDOG 58x

$DOCN 25x

$DOCU 28x

$ESTC 23x

$FSLY 25x

$LSPD 46x

$MDB 49x

$MNDY 55x

$MTTR 60x

$NET 98x

$NTNX 5.9x

$OKTA 34x

$OLO 27x

$PATH 28x

$PD 12.8x

$PLTR 31x

$SNOW 95x

$TEAM 50x

$TWLO 35x

$U 42x

$ZI 27x

$ZM 24x

$ZS 55x

$ADBE 19x

$ASAN 67x

$CRM 12.7x

$CRWD 49x

$DCBO 23x

$DDOG 58x

$DOCN 25x

$DOCU 28x

$ESTC 23x

$FSLY 25x

$LSPD 46x

$MDB 49x

$MNDY 55x

$MTTR 60x

$NET 98x

$NTNX 5.9x

$OKTA 34x

$OLO 27x

$PATH 28x

$PD 12.8x

$PLTR 31x

$SNOW 95x

$TEAM 50x

$TWLO 35x

$U 42x

$ZI 27x

$ZM 24x

$ZS 55x

Some of the biggest changes in this metric since 08/28:

⬆️

$NET 67x to 98x

$UPST 22x to 32x

$DDOG 42x to 58x

⬇️

$DLO 116x to 78.6x

$PYPL 26.3x to 18.9x

$ZM 33x to 24x

$OLO 36x to 27x

$SNAP 43.8x to 28.7x

$DOCU 35x to 28x

⬆️

$NET 67x to 98x

$UPST 22x to 32x

$DDOG 42x to 58x

⬇️

$DLO 116x to 78.6x

$PYPL 26.3x to 18.9x

$ZM 33x to 24x

$OLO 36x to 27x

$SNAP 43.8x to 28.7x

$DOCU 35x to 28x

As we all know, valuation is one of many variables to take into account when investing. And this is only an easy way to visualize all these companies together.

Profitability/margins in lower rows of the income statement can vary widely.

Good luck to all in this Q3 season!! 🔥

Profitability/margins in lower rows of the income statement can vary widely.

Good luck to all in this Q3 season!! 🔥

• • •

Missing some Tweet in this thread? You can try to

force a refresh