🧵Macro Outlook for Digital Asset Class

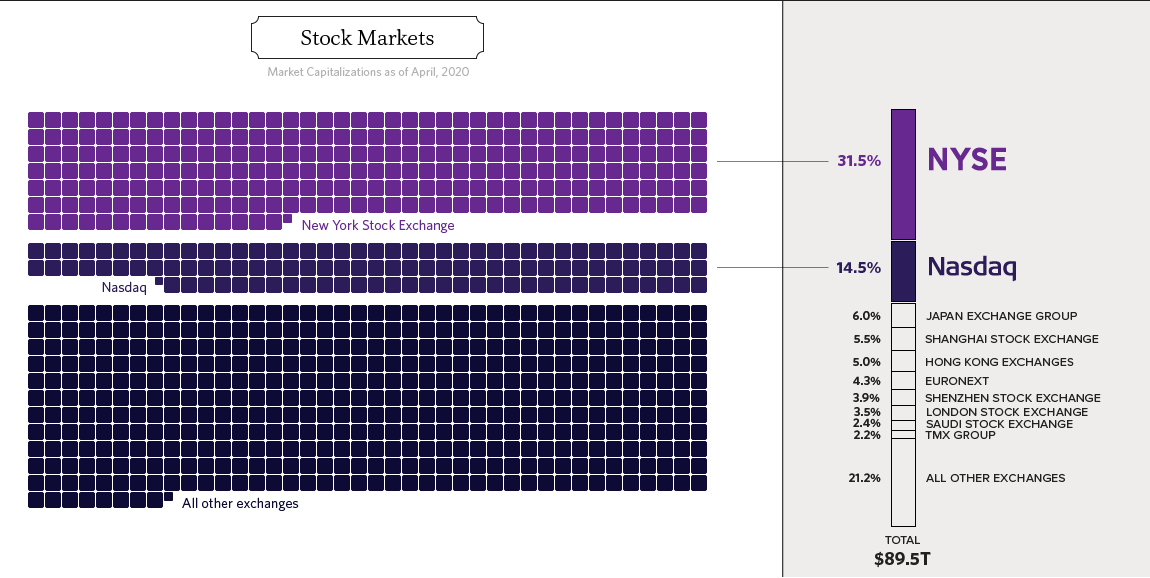

1/ Market Capitalization

Thesis: Digital Asset class market cap will potentially reach $100+ trillion by 2030 yielding an ROI of ~ 50x from current levels of $2+ trillion.

1/ Market Capitalization

Thesis: Digital Asset class market cap will potentially reach $100+ trillion by 2030 yielding an ROI of ~ 50x from current levels of $2+ trillion.

2/ Exponential/Digital Age

During this decade, virtually all assets will be digitized and value will accrue in cyberspace/metaverse.

Like only he can, Raoul Pal does a phenomenal job explaining this via his @RealVision 'Exponential Age' series.

During this decade, virtually all assets will be digitized and value will accrue in cyberspace/metaverse.

Like only he can, Raoul Pal does a phenomenal job explaining this via his @RealVision 'Exponential Age' series.

2a/"We are going through the largest technological advancement in human history at the fastest pace we've ever seen and it's only going to accelerate as we go through this exponential age". - @RaoulGMI

3/ Linear vs Exponential Thinking

The human brain is unable to think in exponential terms. By default, majority will resort to linear thinking and grossly underestimate how this technology adoption, financial disruption, and transfer of wealth will play out over this decade.

The human brain is unable to think in exponential terms. By default, majority will resort to linear thinking and grossly underestimate how this technology adoption, financial disruption, and transfer of wealth will play out over this decade.

3a/ Humans cannot compute exponential increase and they should ponder upon the power of parabolic growth and exponential math.

For example, if you take 20 linear steps you go across the room, while 20 exponential steps take you around the world.....twice.

For example, if you take 20 linear steps you go across the room, while 20 exponential steps take you around the world.....twice.

3b/ #ValueOverInternetProtocol may be the most important #Innovation of this century. Welcome to the #DigitalAge where #MetcalfesLaw rules and Linear thinking is replaced by the power of #Exponential thinking. - @MarkYusko

3c/ Total #Crypto market cap on an arithmetic scale...

3d/ Total #Crypto market cap on a logarithmic scale...(things look more 'normal' on this chart)

3e/ Total crypto market cap fair-value logarithmic regression trendline (via @intocryptoverse)

3f/ To quote from the iconic Apple commercial, "Think Different".

4/ Mathematical Analysis

Attempts to mathematically model digital assets on an linear scale (and linear regression) will continue to incorrectly conclude that the space is 'over-valued' or a 'bubble'.

Attempts to mathematically model digital assets on an linear scale (and linear regression) will continue to incorrectly conclude that the space is 'over-valued' or a 'bubble'.

4a/ There will be peaks and valleys like any other market, but the anticipation is that the macro trend will continue to be to the upside. Those who fail to adapt will likely be left behind.

4b/ On-chain data analyst @woonomic summarizes this very nicely:

Bankers say "Bubble"

Technologist say "Disruption"

Students of history say "Dawn of the Digital Age"

Bankers say "Bubble"

Technologist say "Disruption"

Students of history say "Dawn of the Digital Age"

https://twitter.com/woonomic/status/919418215406505984?s=20

4c/ Risk-adjusted return calculations would be better off using the 'Sortino Ratio' as a measure as opposed to the 'Sharpe Ratio' (never heard anyone complain about volatility to the upside).

investopedia.com/ask/answers/01…

investopedia.com/ask/answers/01…

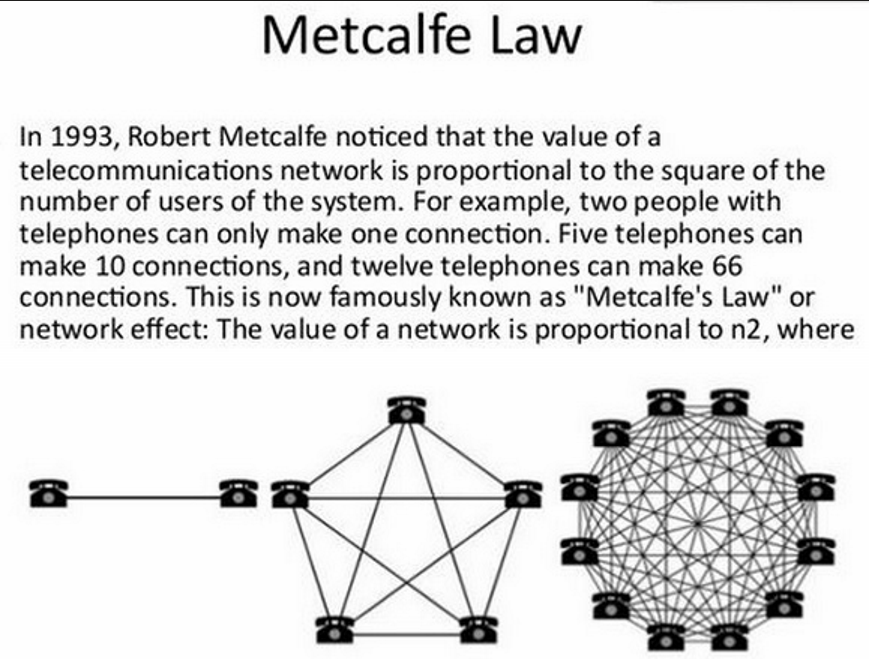

5/ Technology Adoption & Metcalfe's Law (Network Effects)

At its core, value will be derived by user adoption leading to network effects as defined by Metcalfe's Law which states that the value of a network is proportional to the square of the number of users on the system.

At its core, value will be derived by user adoption leading to network effects as defined by Metcalfe's Law which states that the value of a network is proportional to the square of the number of users on the system.

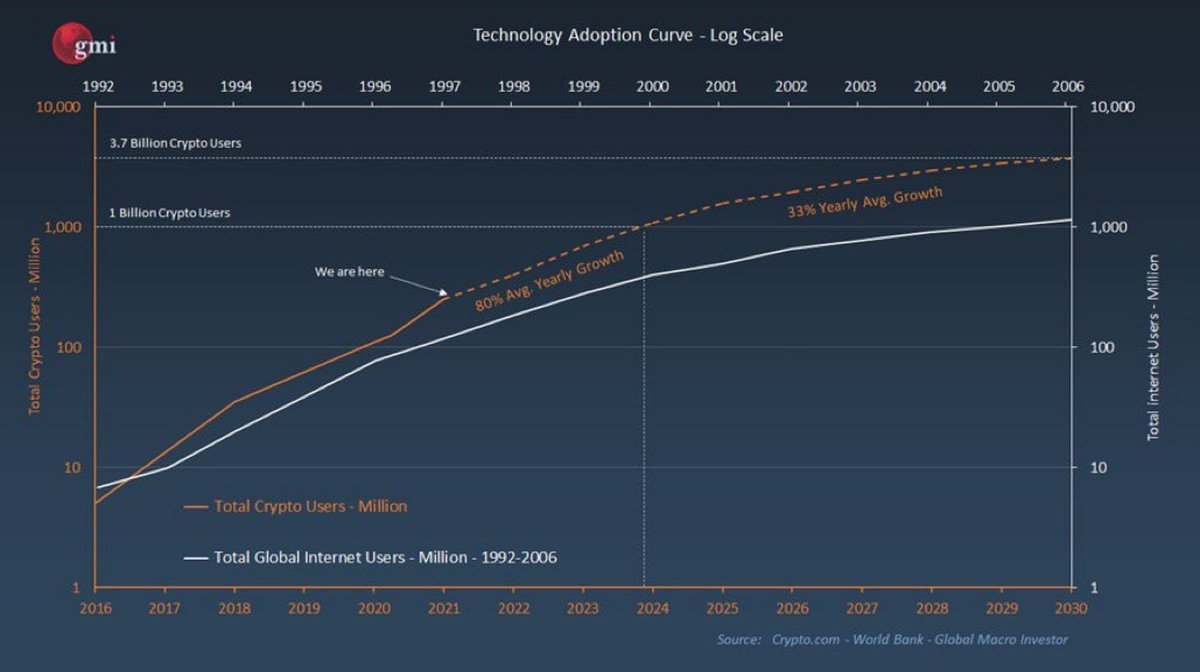

5a/ Graphic of technology adoption curve of total #crypto users vs global internet users (1992-2006). Projected to have 1 billion crypto users by 2024 and 3.7 billion by 2030. Today, there are about 4.66 billion Internet users according to Statista.

5b/ The number of websites on the Internet grew substantially as the Internet and broadband network connectivity matured. The rate of digital wallets should rise faster once proper regulation is established and technology improves for both institutional and retail investors.

5c/ @ARKInvest analysis on the exponential age includes Digital Wallets...

https://twitter.com/ARKInvest/status/1463525664397701131?s=20

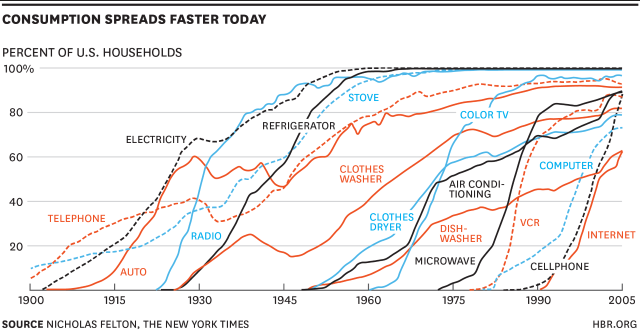

5d/ The Pace of Technology Adoption is Speeding Up

hbr.org/2013/11/the-pa…

hbr.org/2013/11/the-pa…

5e/ Consumption spreads faster today. As you can see from the chart, innovations introduced more recently are being adopted more quickly.

5g/ Technology evolves in a 14 year cycle around advances in computing power

https://twitter.com/MarkYusko/status/1249445890395385857?s=20

6/ Lindy Effect

States that the future life expectancy of a technology is proportional to its current age. The longer something has been around, chances are the longer it will survive.

States that the future life expectancy of a technology is proportional to its current age. The longer something has been around, chances are the longer it will survive.

7/ Hype Cycle and Technology Adoption Lifecycle

It's still early…

It's still early…

https://twitter.com/ColeGarnerXBT/status/1341649223821963266?s=20

8/ Potential Capital In-Flows

Hedge Fund Industry: AUM is around $3-4 trillion and only about $3-4 billion of that is allocated to digital assets (via @RaoulGMI)

Hedge Fund Industry: AUM is around $3-4 trillion and only about $3-4 billion of that is allocated to digital assets (via @RaoulGMI)

8a/ Global Investment Managers: For reference, @BlackRock alone has AUM of close to $10 trillion. This segment has yet to allocate capital towards digital assets in any meaningful way.

8b/ Corporations: Anticipating S&P 500 companies to convert a portion of their balance sheet from cash into #bitcoin following @microstrategy visionary CEO @saylor and author of the book "The Mobile Wave".

8c/ Retail: Research from @fundstrat states that $68 trillion is to be passed down to the younger generation and that Millennials will drive mass adoption in digital assets.

9/ Total Annual Trading Volume

Estimated total cryptocurrency annual trading volume according to @DTAPCAP

- 2021: ~ $60 trillion

- 2020: $10 trillion

- 2019: $4 trillion

For reference, Gold ($10+ trillion market cap) total volume is $50 trillion per year.

Estimated total cryptocurrency annual trading volume according to @DTAPCAP

- 2021: ~ $60 trillion

- 2020: $10 trillion

- 2019: $4 trillion

For reference, Gold ($10+ trillion market cap) total volume is $50 trillion per year.

10/ "Software is eating the world"

The list of 'smart money' entering the digital asset space continues to slowly increase. However, there's no better example than @a16z as their track record for identifying new technology trends is well documented.

a16z.com/crypto/#vertic…

The list of 'smart money' entering the digital asset space continues to slowly increase. However, there's no better example than @a16z as their track record for identifying new technology trends is well documented.

a16z.com/crypto/#vertic…

11/ Global Asset Values (for reference)

Global asset class values from 2020

visualcapitalist.com/all-of-the-wor…

Global asset class values from 2020

visualcapitalist.com/all-of-the-wor…

12/ Conclusion

The anticipation is that capital will flow into digital assets via new money, capital rotation from legacy markets/assets, and value will accrue at an exponential rate due to unprecedented adoption.

The anticipation is that capital will flow into digital assets via new money, capital rotation from legacy markets/assets, and value will accrue at an exponential rate due to unprecedented adoption.

12a/ Ignoring this space would be similar to ignoring the Internet back in the 1990s, but on a far greater scale.

This decade may becoming akin to some playing Checkers while others are playing Chess in terms of capital allocation and ROI.

/The End

This decade may becoming akin to some playing Checkers while others are playing Chess in terms of capital allocation and ROI.

/The End

• • •

Missing some Tweet in this thread? You can try to

force a refresh