1/24

2021 Budget Thread

I refer you back to Cross interview with Trevor. Cross told Mthuli that though he was a brilliant economist he had been away from Zim for too long & needed to understand Zim.

In his 2021 budget presentation, what was conspicuous was lack of gusto!

2021 Budget Thread

I refer you back to Cross interview with Trevor. Cross told Mthuli that though he was a brilliant economist he had been away from Zim for too long & needed to understand Zim.

In his 2021 budget presentation, what was conspicuous was lack of gusto!

2/24

In analyzing the budget I will focus on the four major themes

(i) Zim debt trap

(ii) High insatiable tax regime

(iii) Currency policy rigidity

(iv) Donor funds & remittances anchor the economy

In analyzing the budget I will focus on the four major themes

(i) Zim debt trap

(ii) High insatiable tax regime

(iii) Currency policy rigidity

(iv) Donor funds & remittances anchor the economy

3/24

Asked once,if Zim would abandon the multi-currency system I argued GOZ vehement support of the dollar system & empirical data of countries that had dollarised. It seemed too obvious that Zim was now a regional hub of financial security & economic growth to abandon the system

Asked once,if Zim would abandon the multi-currency system I argued GOZ vehement support of the dollar system & empirical data of countries that had dollarised. It seemed too obvious that Zim was now a regional hub of financial security & economic growth to abandon the system

4/24

I argued corruption was suitably financed in dollars & diamonds. There was no way politicians & GOZ could ditch such a mutually beneficial system.

I was still wet behind the ears.

For that is exactly what the new republic did. It introduced chaos into the system.

I argued corruption was suitably financed in dollars & diamonds. There was no way politicians & GOZ could ditch such a mutually beneficial system.

I was still wet behind the ears.

For that is exactly what the new republic did. It introduced chaos into the system.

5/24

Former Minister Biti soon realized the big elephant in Zim. It’s external debt. He could see that growth wasn’t sustainable in the long term without dealing with the elephant. Unfortunately, the politicians didn’t want to hear of HIPC. He lost the battle.

Former Minister Biti soon realized the big elephant in Zim. It’s external debt. He could see that growth wasn’t sustainable in the long term without dealing with the elephant. Unfortunately, the politicians didn’t want to hear of HIPC. He lost the battle.

6/24

Chinamasa took over. He too soon realized the impossibility of sustainable growth without dealing with the debt crisis. Zim has negative savings for 20 years.

He managed to get consensus around LIMA in 2016. The stumbling block was political reforms.

Chinamasa took over. He too soon realized the impossibility of sustainable growth without dealing with the debt crisis. Zim has negative savings for 20 years.

He managed to get consensus around LIMA in 2016. The stumbling block was political reforms.

7/24

In some regard the international community believed Chinamasa was on the right track & supported the coup on the trust that the final outstanding issue of reforms would be resolved.

When ED entered office, it was a golden opportunity. Not only was it wasted away

In some regard the international community believed Chinamasa was on the right track & supported the coup on the trust that the final outstanding issue of reforms would be resolved.

When ED entered office, it was a golden opportunity. Not only was it wasted away

8/24

ED’s government plunged the country into more debt. Mthuli was meant to be the talisman that could solve the problem. Within a year with gusto he introduced into Zim lexicon a phrase we had never heard of in 40 years. Budget surplus.

It only revealed how naive he was!

ED’s government plunged the country into more debt. Mthuli was meant to be the talisman that could solve the problem. Within a year with gusto he introduced into Zim lexicon a phrase we had never heard of in 40 years. Budget surplus.

It only revealed how naive he was!

9/24

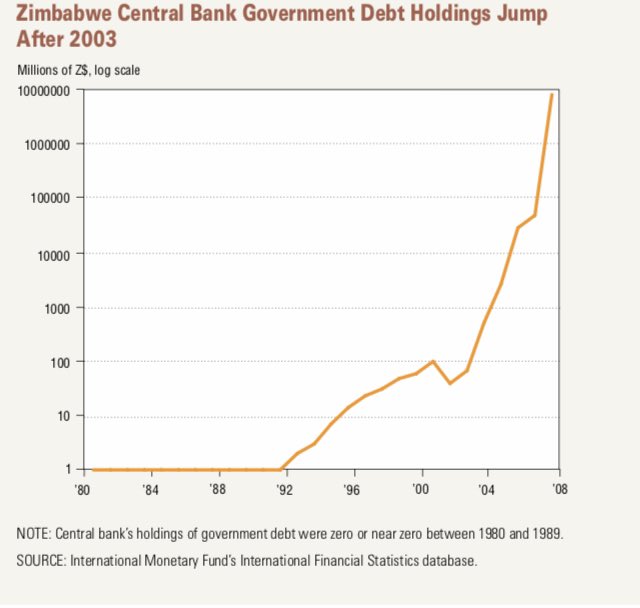

He should’ve followed Cross advice. The RBZ was in massive quasi fiscal activities.

I highlight the above to show that anyone who thinks they can solve Zim crisis without the debt issue solved they’re deceiving themselves & stupid for not listening & learning from our past

He should’ve followed Cross advice. The RBZ was in massive quasi fiscal activities.

I highlight the above to show that anyone who thinks they can solve Zim crisis without the debt issue solved they’re deceiving themselves & stupid for not listening & learning from our past

10/24

Finally the MOF has produced Zim external debt. Inclusive of RBZ debt it’s US$13.2bn. If you include white farmer’s compensation of US$3.5bn it’s US$16.7bn. Excluded are some of China’s debts.

According to WB, Zim economy is US$17bn.

Zim external debt is over 100% of GDP

Finally the MOF has produced Zim external debt. Inclusive of RBZ debt it’s US$13.2bn. If you include white farmer’s compensation of US$3.5bn it’s US$16.7bn. Excluded are some of China’s debts.

According to WB, Zim economy is US$17bn.

Zim external debt is over 100% of GDP

11/24

According to the public finance management act Zim debt shouldn’t exceed 70% of GDP.

Never mind the law.

The real economic problem is that production is now hamstrung. Either towards debt servicing or lack of FDI or new low cost debt into Zim.

According to the public finance management act Zim debt shouldn’t exceed 70% of GDP.

Never mind the law.

The real economic problem is that production is now hamstrung. Either towards debt servicing or lack of FDI or new low cost debt into Zim.

12/24

Production can only happen through new investments.

Investments = savings.

Meaning Zim fails to be globally competitive. And it’s low value commodity exports go to paying off high interest loans.

Production can only happen through new investments.

Investments = savings.

Meaning Zim fails to be globally competitive. And it’s low value commodity exports go to paying off high interest loans.

13/24

Ten years too late the MOF has now acknowledged HIPC as the way out.

Infact this is the only way out.

In August 2019, I articulated on my blog why it was the only way out, using Greece, Egypt, Israel, Nigeria, Ghana, Tanzania as examples

Ten years too late the MOF has now acknowledged HIPC as the way out.

Infact this is the only way out.

In August 2019, I articulated on my blog why it was the only way out, using Greece, Egypt, Israel, Nigeria, Ghana, Tanzania as examples

14/24

To be clear, not only is HIPC the only way out, it is now the single most important GDP stimulant & competitive advantage. Nigeria & Ghana etc saw their economies double.

Zim hasn’t gone through this re-rating that others went through. That’s the opportunity.

To be clear, not only is HIPC the only way out, it is now the single most important GDP stimulant & competitive advantage. Nigeria & Ghana etc saw their economies double.

Zim hasn’t gone through this re-rating that others went through. That’s the opportunity.

15/24

HIPC requires proper, genuine institutional and political reforms.

We have seen sanctions being lifted off Burundi & Sudan recently.

If Zim genuinely follows the course of reforms. Then sanctions will be lifted and HIPC will be successful.

Is GOZ ready for this?

HIPC requires proper, genuine institutional and political reforms.

We have seen sanctions being lifted off Burundi & Sudan recently.

If Zim genuinely follows the course of reforms. Then sanctions will be lifted and HIPC will be successful.

Is GOZ ready for this?

16/24

Tax system

MOF has introduced or increased new taxes despite Zimra exceeding its targets. Why? The 2% money transfer tax now contributes almost 10% of tax revenues. Withholding tax is set to increase from 10% to 30% & affects the informal sector.

Tax system

MOF has introduced or increased new taxes despite Zimra exceeding its targets. Why? The 2% money transfer tax now contributes almost 10% of tax revenues. Withholding tax is set to increase from 10% to 30% & affects the informal sector.

17/24

It’s evidently clear that the economy is NOT growing. An economy growing at 7.8% like gnu days, comes with it increase in taxes. But MOF is playing fast & loose with numbers. What they’re after is USD taxes. ZWL loses value. GOZ gets 20% of every USD electronic transfer

It’s evidently clear that the economy is NOT growing. An economy growing at 7.8% like gnu days, comes with it increase in taxes. But MOF is playing fast & loose with numbers. What they’re after is USD taxes. ZWL loses value. GOZ gets 20% of every USD electronic transfer

18/24

which it changes at 50% of actual value.This is a tax. Mining firms will see royalties & fees increase as MOF changes the way fees are calculated. Its USD they’re after. Not ZWL. GOZ is anchoring itself in USD & not ZWL. It doesn’t trust it’s own currency nor inflation.

which it changes at 50% of actual value.This is a tax. Mining firms will see royalties & fees increase as MOF changes the way fees are calculated. Its USD they’re after. Not ZWL. GOZ is anchoring itself in USD & not ZWL. It doesn’t trust it’s own currency nor inflation.

19/24

Currency policy rigidity.

Despite year on year money supply of ZWL increasing by 220% in August the currency Fx auction hardly moved. This is how GOZ in connivance with RBZ fixes its numbers. It prints ZWL to buy USD at 50% of its true value. This is currency rigging.

Currency policy rigidity.

Despite year on year money supply of ZWL increasing by 220% in August the currency Fx auction hardly moved. This is how GOZ in connivance with RBZ fixes its numbers. It prints ZWL to buy USD at 50% of its true value. This is currency rigging.

20/24

It’s not sustainable. Export viability is the big question for 2022. How many exporters can sustain 40% of expropriation & wave of tax increases in USD? Zimra warning of under-declaring of CD1 points to exporters being unviable with current currency rigidity.

It’s not sustainable. Export viability is the big question for 2022. How many exporters can sustain 40% of expropriation & wave of tax increases in USD? Zimra warning of under-declaring of CD1 points to exporters being unviable with current currency rigidity.

21/24

GOZ currency rigidity is informed by its external debt problem. Any devaluation is an increase in inflation. Hence paramount to solve debt trap. Plus exports & imports of goods is square at US$5.7bn Zero current a/c surplus. What happens when exports fall?

GOZ currency rigidity is informed by its external debt problem. Any devaluation is an increase in inflation. Hence paramount to solve debt trap. Plus exports & imports of goods is square at US$5.7bn Zero current a/c surplus. What happens when exports fall?

22/24

Donor aid & remittances

Zim economy is now anchored by western aid & remittances. Western aid US$850m + SDR $950m + remittances $1.3bn = US$3.1bn.

That is why Zim is now a consumption as opposed to a production economy. US$3.1bn is equal if not more than tax revenues

Donor aid & remittances

Zim economy is now anchored by western aid & remittances. Western aid US$850m + SDR $950m + remittances $1.3bn = US$3.1bn.

That is why Zim is now a consumption as opposed to a production economy. US$3.1bn is equal if not more than tax revenues

23/24

What it means is that production happens outside Zim borders but consumption happens in Zim. This makes Zim even more uncompetitive in terms of production as dollars are not in the financial system. Pvt sector credit is only US$1bn

Being donor dependent is a sugar high.

What it means is that production happens outside Zim borders but consumption happens in Zim. This makes Zim even more uncompetitive in terms of production as dollars are not in the financial system. Pvt sector credit is only US$1bn

Being donor dependent is a sugar high.

24/24

I sort to sure that the 41 years of economic mismanagement culminates in the debt trap.

Biggest challenge but also the biggest opportunity.

Zim is not ready to solve this problem hence the misalignment of policy. Western aid gives sugar highs & delays reforms.

I sort to sure that the 41 years of economic mismanagement culminates in the debt trap.

Biggest challenge but also the biggest opportunity.

Zim is not ready to solve this problem hence the misalignment of policy. Western aid gives sugar highs & delays reforms.

• • •

Missing some Tweet in this thread? You can try to

force a refresh