#Clean Science - A Thread about the Biz

Why the business deserves such valuations is very clear. There are almost no other business which ever sector having such gross margins . Ignore Chemical sector etc. Any business you take this Margins is exceptional and can do magic

Why the business deserves such valuations is very clear. There are almost no other business which ever sector having such gross margins . Ignore Chemical sector etc. Any business you take this Margins is exceptional and can do magic

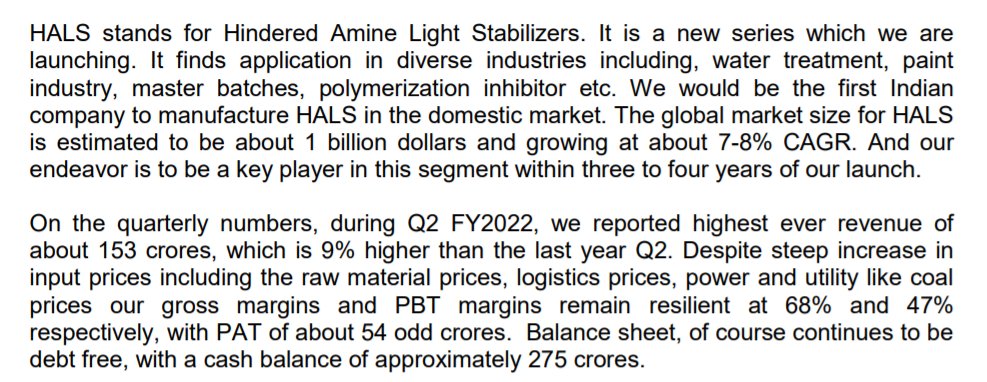

With such increase in the Raw material price they have maintained the margins to a great extend without passing the raw material prices .. Exceptional Work

Strong and Biggest Capex is underway for Clean Science and this will definitely increase the sales and margins will be kept near these 50-60 odd percent which will take the PAT exponentially ( Compounding )

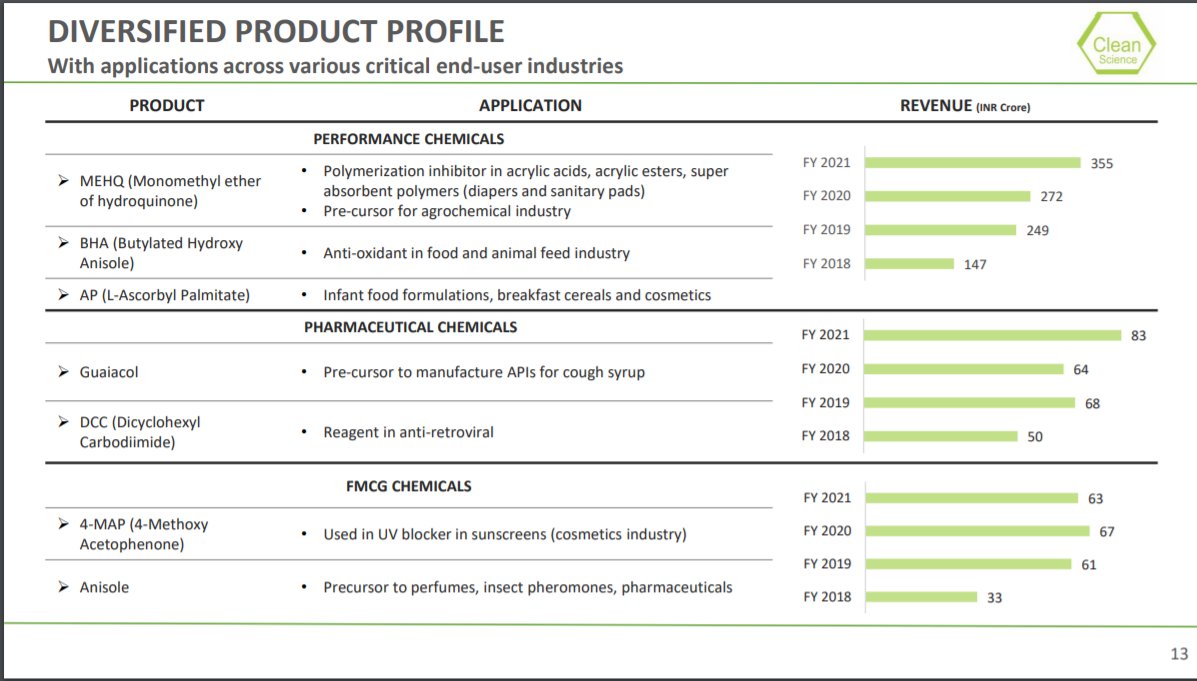

New Product Addition HALS

With such increase in Raw Material Prices the company is able to continue such margins where all other Chemicals felt the pressure some even after passing the cost .. Shows their specialization and management perfection to achieve this

With such increase in Raw Material Prices the company is able to continue such margins where all other Chemicals felt the pressure some even after passing the cost .. Shows their specialization and management perfection to achieve this

Hope you like this thread about Clean Science already made a thread on Tatva Rest will post during the coming times .

Do share retweet and Like if its was worth your time . Would give me some happiness on the other side

Do share retweet and Like if its was worth your time . Would give me some happiness on the other side

Do add if you have any other points respected people @nid_rockz @ishmohit1 @caniravkaria @LuckyInvest_AK @ParveenBhansali on this company if you find interesting

Will add all the products and opportunities in each of the products dealed here in a while thank you do retweet share and show some support 😅😊👍

• • •

Missing some Tweet in this thread? You can try to

force a refresh