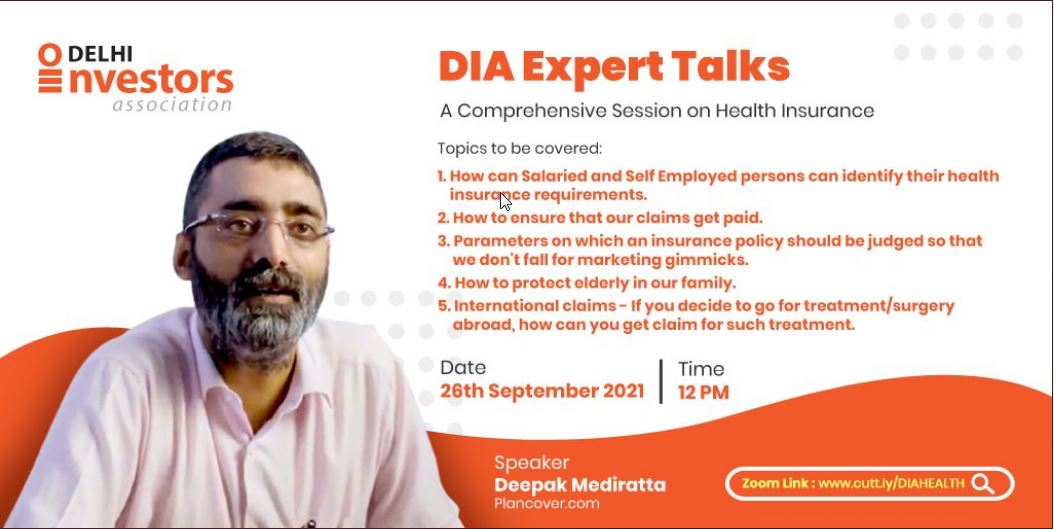

Key takeaways on Health Insurance from @Delhi_Investors DIA Expert Talk by:

Deepak Mendiratta @DeepakMendirtta, Founder @PlanCover

organised by

Delhi Investors Association's Brajesh Rawat @BrajeshRawat, Utkarsh Pandey @cautkarshpandey & other members.

A 🧵

#healthinsurance

Deepak Mendiratta @DeepakMendirtta, Founder @PlanCover

organised by

Delhi Investors Association's Brajesh Rawat @BrajeshRawat, Utkarsh Pandey @cautkarshpandey & other members.

A 🧵

#healthinsurance

Why health insurance?

To protect savings in case of health issues.

Access to quality health care is easy when you don't need to:

~ Dip into your savings

~ Withdraw your investments

~ Borrow from friends or bank

Health Insurance is thus a planning for tomorrow!

To protect savings in case of health issues.

Access to quality health care is easy when you don't need to:

~ Dip into your savings

~ Withdraw your investments

~ Borrow from friends or bank

Health Insurance is thus a planning for tomorrow!

What is Health Insurance?

Health Insurance covers cost of treatment of any:

~ Illness

~ Injury

~ Disease

which requires hospitalisation of a minimum of 24hrs.

Hospitalisation is not required in cases where due to technology advancement,treatment is done in less than 24hrs now.

Health Insurance covers cost of treatment of any:

~ Illness

~ Injury

~ Disease

which requires hospitalisation of a minimum of 24hrs.

Hospitalisation is not required in cases where due to technology advancement,treatment is done in less than 24hrs now.

Do you need health insurance inspite of employer's corporate insurance?

If you are sure that:

~ You would never leave the job

~ You won't lose the job

~ Employer won't change insurance terms

However there are chances that:

~ You will change employer

~ You may start on your own

If you are sure that:

~ You would never leave the job

~ You won't lose the job

~ Employer won't change insurance terms

However there are chances that:

~ You will change employer

~ You may start on your own

Do you need separate cover inspite of a CGHS cover?

CGHS treatment rates are hugely negotiated!

At these low rates:

~ Good doctors don't want to be remunerated

~ Good hospitals don't offer treatments

Thus, it might hinder access to proper health care.

Have a standalone cover.

CGHS treatment rates are hugely negotiated!

At these low rates:

~ Good doctors don't want to be remunerated

~ Good hospitals don't offer treatments

Thus, it might hinder access to proper health care.

Have a standalone cover.

3 pillars of healthcare:

~ Cost of healthcare

~ Quality

~ Waiting period to access healthcare

Private insurance solves issues of cost & quality without waiting periods.

In govt scheme e.g. CGHS:

~ Cost is taken care

~ But, quality is impacted.

~ There is waiting period too..

~ Cost of healthcare

~ Quality

~ Waiting period to access healthcare

Private insurance solves issues of cost & quality without waiting periods.

In govt scheme e.g. CGHS:

~ Cost is taken care

~ But, quality is impacted.

~ There is waiting period too..

A fact about healthcare:

Hospitals follow fee for service model.

More service then more ways to make money.

Hence, a patient is often recommended multiple diagnosis tests & undergoes various treatments. It's a way for the hospitals to earn money.

Hospitals follow fee for service model.

More service then more ways to make money.

Hence, a patient is often recommended multiple diagnosis tests & undergoes various treatments. It's a way for the hospitals to earn money.

Factors when buying a health insurance?

~ Life stage

~ Geography e.g. having corporate insurance or cghs

~ Morbidity history

~ Insurer

~ Intermediary with the insurer

~ Pre-existing disease

~ Family composition

~ Sum insured required

~ Type of policy, base / super top-up

~ Life stage

~ Geography e.g. having corporate insurance or cghs

~ Morbidity history

~ Insurer

~ Intermediary with the insurer

~ Pre-existing disease

~ Family composition

~ Sum insured required

~ Type of policy, base / super top-up

Best option for those who'll be in a job forever:

Super top-up with voluntary deductible.

e.g. For 10L super top-up,

first 5L: Paid by you thru corporate insurance

Remaining: By super-top up

Once you retire, stop voluntary deductible & pay higher premium for full cover.

Super top-up with voluntary deductible.

e.g. For 10L super top-up,

first 5L: Paid by you thru corporate insurance

Remaining: By super-top up

Once you retire, stop voluntary deductible & pay higher premium for full cover.

Should you take top up from same insurer or different one?

Pros of top-up from same company:

~ You don't have to deal with 2 stakeholders.

~ Easier documentation: Documents for base & top-up policy are same

However, if it's cheaper why go for the same company?

Pros of top-up from same company:

~ You don't have to deal with 2 stakeholders.

~ Easier documentation: Documents for base & top-up policy are same

However, if it's cheaper why go for the same company?

Comparing policies, with same cover but different premiums?

Criterias:

~ Check terms & conditions of policies

~ Premium escalation over the years

~ Credibility of insurer in payment of claims

~ Historical evidence of enhancement of premiums

Criterias:

~ Check terms & conditions of policies

~ Premium escalation over the years

~ Credibility of insurer in payment of claims

~ Historical evidence of enhancement of premiums

Here's a wrong mindset:

Looking for insurance when you have to undergo costly medical treatment for a health condition!

No company will give.

If they give, then:

~ Health condition will be under pre-existing disease with 4 yr waiting clause.

~ It'll have a co-pay clause

Looking for insurance when you have to undergo costly medical treatment for a health condition!

No company will give.

If they give, then:

~ Health condition will be under pre-existing disease with 4 yr waiting clause.

~ It'll have a co-pay clause

How much policy cover?

Depends on affordability!

Get max possible cover with combination of base cover & top-up.

If can't afford have: Lower base cover + top-up.

Over years increase sum-insured with no-claim bonus.

Once affordability rises, enhance base cover completely.

Depends on affordability!

Get max possible cover with combination of base cover & top-up.

If can't afford have: Lower base cover + top-up.

Over years increase sum-insured with no-claim bonus.

Once affordability rises, enhance base cover completely.

No treatment, no claim payment

You get admitted due to some sudden issue.

You undergo various tests for 2 days, but aren't diagnosed with any illness, injury or disease.

The claim will not be paid.

Health Insurance does not pay only for diagnosis tests. There must be treatment

You get admitted due to some sudden issue.

You undergo various tests for 2 days, but aren't diagnosed with any illness, injury or disease.

The claim will not be paid.

Health Insurance does not pay only for diagnosis tests. There must be treatment

Don't get a policy for:

~ Vector borne disease : Dengue, Malaria

~ Other standalone, disease specific policies

~ Critical illness plans

Why?

Because,

Your a regular health insurance covers it. These disease specific policies are often just marketing gimmicks.

~ Vector borne disease : Dengue, Malaria

~ Other standalone, disease specific policies

~ Critical illness plans

Why?

Because,

Your a regular health insurance covers it. These disease specific policies are often just marketing gimmicks.

Two types of policy:

Indemnity policies:

Money paid by insurer is based on expenses in claim

Benefit policy:

Money paid by insurer is a fixed amount, after the pre-decided illness or condition is detected.

Use it if an illness can compromise your earning capacity in future.

Indemnity policies:

Money paid by insurer is based on expenses in claim

Benefit policy:

Money paid by insurer is a fixed amount, after the pre-decided illness or condition is detected.

Use it if an illness can compromise your earning capacity in future.

Should you buy critical illness rider?

Avoid

They are mostly rare e.g.

~ Multiple sclerosis

~ 3rd degree burns

Take as a benefit policy, rather than an indemnity.

Take only if you are in danger of losing job, on detection of disease.

It Can provide income during the emergency

Avoid

They are mostly rare e.g.

~ Multiple sclerosis

~ 3rd degree burns

Take as a benefit policy, rather than an indemnity.

Take only if you are in danger of losing job, on detection of disease.

It Can provide income during the emergency

Is there a platform that tells which policy is good?

No.

~ Reviews get managed

~ Happy & contented people rarely write

~ Unhappy & disatisfied people mostly write

Claim settlement ratio is also misleading.

It doesn't reveal which claims were honoured & which were rejected!

No.

~ Reviews get managed

~ Happy & contented people rarely write

~ Unhappy & disatisfied people mostly write

Claim settlement ratio is also misleading.

It doesn't reveal which claims were honoured & which were rejected!

What is restriction for health insurance?

Age of entry is a restriction, the renewal of existing policy can happen lifelong

Above 65 to 70 years age, entry to a policy is difficult. If you enter, there would be pre-existing diseases, waiting period & co-pay!

Age of entry is a restriction, the renewal of existing policy can happen lifelong

Above 65 to 70 years age, entry to a policy is difficult. If you enter, there would be pre-existing diseases, waiting period & co-pay!

Do health insurance providers re-imburse money for health checkup?

Yes!

There are many companies that provide medical vouchers for an annual health checkup.

Yes!

There are many companies that provide medical vouchers for an annual health checkup.

Is that health checkup really free?

Nothing comes free, what looks free isn't free!

Insurer will analyse the results based on your condition, at your age.

Based on the study, premium for all the people in that risk category might be revised.

Nothing comes free, what looks free isn't free!

Insurer will analyse the results based on your condition, at your age.

Based on the study, premium for all the people in that risk category might be revised.

Should you buy health cover early, due to low premium?

No.

Health cover premiums rise with age & they aren't locked, unlike term insurance

Right reasons:

~ Rising healthcare cost

~ Lifestyle diseases catching young

~ Insuring at old age is harder, since due to health conditions

No.

Health cover premiums rise with age & they aren't locked, unlike term insurance

Right reasons:

~ Rising healthcare cost

~ Lifestyle diseases catching young

~ Insuring at old age is harder, since due to health conditions

Health insurance portability:

An insured's right!

However,

Not an obligation for insurer to provide policy!

Porting from group to retail policy: Mostly possible with same insurer who provided the group policy.

For retail to retail porting, you can choose a different insurer.

An insured's right!

However,

Not an obligation for insurer to provide policy!

Porting from group to retail policy: Mostly possible with same insurer who provided the group policy.

For retail to retail porting, you can choose a different insurer.

When to port your policy?

~ If policy terms are not good

~ Construct of the product is bad

~ if terms are no longer working for you

~ Premiums are going to rise extraordinary

~ Premiums rise Extraordinary after 60

~ You aren't getting intermeidary support

~ If policy terms are not good

~ Construct of the product is bad

~ if terms are no longer working for you

~ Premiums are going to rise extraordinary

~ Premiums rise Extraordinary after 60

~ You aren't getting intermeidary support

Forcing doctor to hospitalise your to get claim:

A strict no!

Remember, there is a doctor at the other end, with the insurer who studies your claim.

They understand whether a treatment needs hospitalisation or not.

A strict no!

Remember, there is a doctor at the other end, with the insurer who studies your claim.

They understand whether a treatment needs hospitalisation or not.

What is the importance of an intermediary?

~ They help when a claim is denied.

~ They can help you with the documentation

~ They can't guarantee a claim but will help navigate the grey areas in the policy.

~ They help when a claim is denied.

~ They can help you with the documentation

~ They can't guarantee a claim but will help navigate the grey areas in the policy.

Should you go for policy with unlimited ambulance cover:

It's good marketing gimmick

Check:

What is cost that will impact the premium?

What is the incident rate - How many times will you access the ambulance

Riders for ambulance - to nearest hospital or within 5km radius

It's good marketing gimmick

Check:

What is cost that will impact the premium?

What is the incident rate - How many times will you access the ambulance

Riders for ambulance - to nearest hospital or within 5km radius

Should you opt for restoration benefit?

It would be hardly utilised

Companies charge 20-30% higher premium for this.

Check the T&Cs of restoration benefit, mostly you won't use it.

It would be hardly utilised

Companies charge 20-30% higher premium for this.

Check the T&Cs of restoration benefit, mostly you won't use it.

What is room rent capping?

Assume capping is 1% of sum insured

Cover: 5L

Room rent eligibility: 1% of 5L = 5K

Room chosen: 10k

Stay: 3 days

Total bill: 1L

Elegibility= 50% of room rent

Insurer pays all expenses in proportion of 50% i.e. out of 1L,

only 50K will be paid!!

Assume capping is 1% of sum insured

Cover: 5L

Room rent eligibility: 1% of 5L = 5K

Room chosen: 10k

Stay: 3 days

Total bill: 1L

Elegibility= 50% of room rent

Insurer pays all expenses in proportion of 50% i.e. out of 1L,

only 50K will be paid!!

Why room rent cap is not good for you?

~ If you opt for costlier room than eligible, insurer pays the claim in proportion to it!

Remaining amt shall be paid by you!

~ Room rents rise 5-10% every year. Even a 20K room rent eligibility now, will be insufficient 10 years later!!

~ If you opt for costlier room than eligible, insurer pays the claim in proportion to it!

Remaining amt shall be paid by you!

~ Room rents rise 5-10% every year. Even a 20K room rent eligibility now, will be insufficient 10 years later!!

Waiting period:

Why?

Insurance companies don't know a disease is pre-exisiting or not.

To reduce risk of payment of claim, they introduce a waiting period only for named ailments & their treatments

e.g.

Cataract

Hysterectomy

Hernia

Piles

Stones

Why?

Insurance companies don't know a disease is pre-exisiting or not.

To reduce risk of payment of claim, they introduce a waiting period only for named ailments & their treatments

e.g.

Cataract

Hysterectomy

Hernia

Piles

Stones

What is contestibility period?

It's a timeframe of about 4 years or 8 years during which,

Onus, Responsibility, Obligation is on insurer, to eshtablish that policy procured by policy holder is by:

~ Non declaration

~ Mis declaration or

~ Partial declaration

in proposal form

It's a timeframe of about 4 years or 8 years during which,

Onus, Responsibility, Obligation is on insurer, to eshtablish that policy procured by policy holder is by:

~ Non declaration

~ Mis declaration or

~ Partial declaration

in proposal form

Pre-existing disease

Any sign/symptom before 4 yrs of policy purchase date for which you have:

~ Taken or not taken doctor consultation

~ Taken or not taken medicine

~ Been hospitalised

then it is pre-existing.

Disease developed after taking policy is not pre-existing

Any sign/symptom before 4 yrs of policy purchase date for which you have:

~ Taken or not taken doctor consultation

~ Taken or not taken medicine

~ Been hospitalised

then it is pre-existing.

Disease developed after taking policy is not pre-existing

Can a person with genetic disease apply for health insurance?

Yes!

2 types of genetic diseases?

~ External congenital

~ Internal congenital

For internal congenital would be evaluated by underwriter based on probability of future claims.

Yes!

2 types of genetic diseases?

~ External congenital

~ Internal congenital

For internal congenital would be evaluated by underwriter based on probability of future claims.

Avoid this mistake:

People staying in 2-tier cities think:

Health care is cheaper & buy a cover with lower sum insured

However:

All treatments aren't available in such locations.

You may have to move to metro city to get that treatment.

Choose an health insurance accordingly.

People staying in 2-tier cities think:

Health care is cheaper & buy a cover with lower sum insured

However:

All treatments aren't available in such locations.

You may have to move to metro city to get that treatment.

Choose an health insurance accordingly.

Should you buy a policy covering maternity?

Remember these two aspects:

1. Premium charged is higher

2. The cost of maternity treatment is lower since insurer has negotiated a lower rate with hospital.

Evaluate the policy based on these two aspects before taking decision!

Remember these two aspects:

1. Premium charged is higher

2. The cost of maternity treatment is lower since insurer has negotiated a lower rate with hospital.

Evaluate the policy based on these two aspects before taking decision!

Can NRI take health insurance in India?

Yes. However claims should emanate and shall be paid within in India.

Can Foreigner residing in India on residency permit take health Insurance in India?

Yes.

Yes. However claims should emanate and shall be paid within in India.

Can Foreigner residing in India on residency permit take health Insurance in India?

Yes.

Can a undisclosed health condition at the time of taking policy be disclosed after few years?

Yes.

However, the onus lies on insurer to:

~ Do nothing to the existing policy

~ Increase the premium accounting the disclosure

~ Cancel & forfeit the policy entirely

Yes.

However, the onus lies on insurer to:

~ Do nothing to the existing policy

~ Increase the premium accounting the disclosure

~ Cancel & forfeit the policy entirely

Protecting the elderly:

~ Keep renewing the existing policies

~ If not covered try to first cover them in corporate policies

~ If choosing retail policy, explore policies with co-pay option

~ For age below 65 can even explore a top-up /super top-up policy

~ Keep renewing the existing policies

~ If not covered try to first cover them in corporate policies

~ If choosing retail policy, explore policies with co-pay option

~ For age below 65 can even explore a top-up /super top-up policy

If you have found this thread valuable,

make sure you buy an health insurance, if you haven't yet.

Also, re-tweet the first tweet in the thread (link here 👇👇) to spread awareness about health insurance to all!!

make sure you buy an health insurance, if you haven't yet.

Also, re-tweet the first tweet in the thread (link here 👇👇) to spread awareness about health insurance to all!!

https://twitter.com/Finalysis20/status/1464901738750627845?s=20

Watch the entire conversation on Youtube at the following link:

• • •

Missing some Tweet in this thread? You can try to

force a refresh