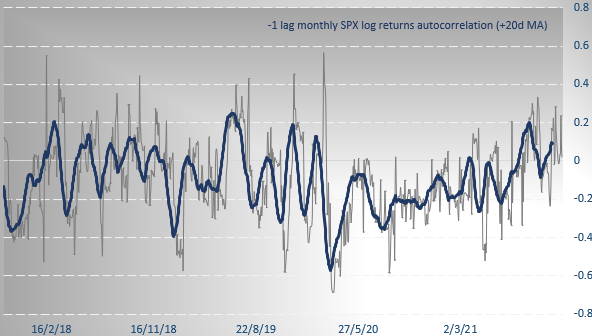

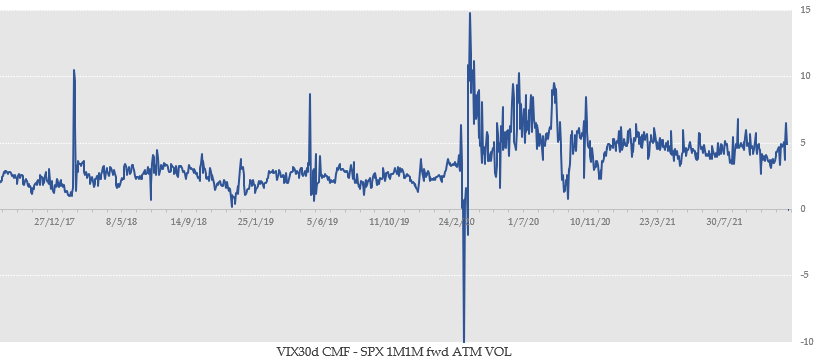

What have you changed in your trading since Mar'20? We saw majority of vol sellers setting a higher bar to enter a trade. But during this period we also found some edge: Despite equity vol finding equilibrium at elevated levels, $SPX autocorrelation averaged < 0. $VIX #ES_F

This means that the gamma portion of index options took out the trend. So you had dealers' hedging requirements selling the upticks and buying the dips.

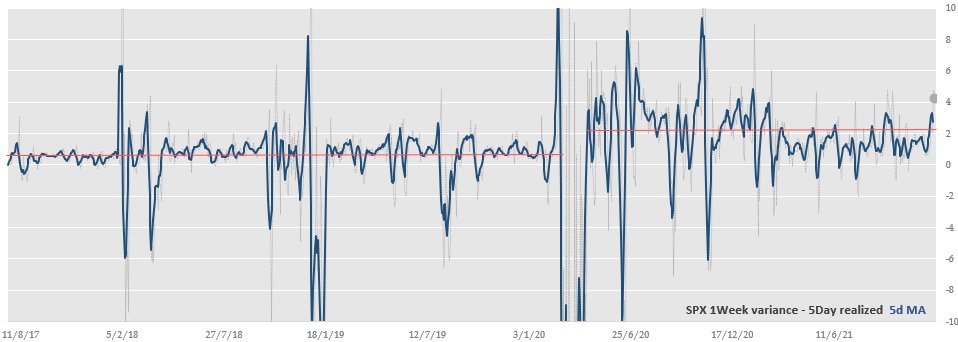

Never in the past had we shorted 1week $SPX variance with such regularity.

Never in the past had we shorted 1week $SPX variance with such regularity.

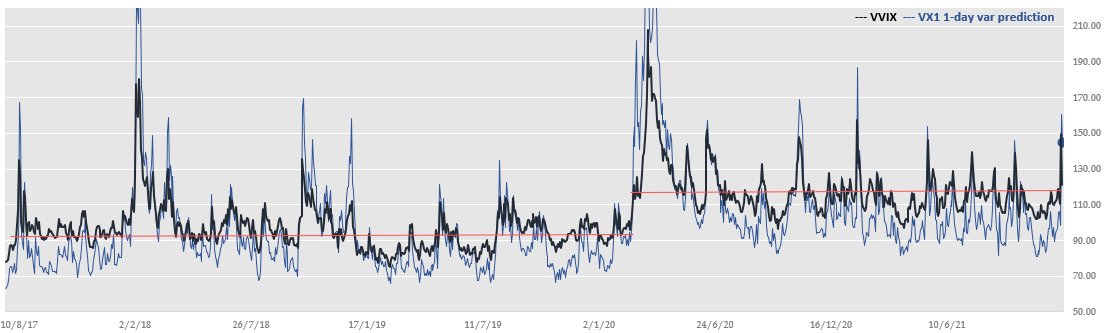

What can end this melt-up in stocks? Mkt ecosystem depends on a Fed put + liquidity. Fed has solved the liquidity issue but not solvency issues. Credit may prove cause of future shocks. And $VIX might follow the credit cycle. We gauge mkt fragility via VIX futures over $SPX IV.

• • •

Missing some Tweet in this thread? You can try to

force a refresh