In light of the announcement of a blockbuster Premier League TV deal with American broadcaster NBC, I thought it might be interesting to look at the growing importance of overseas rights to England’s top flight, especially as the value of domestic rights has seemingly plateaued.

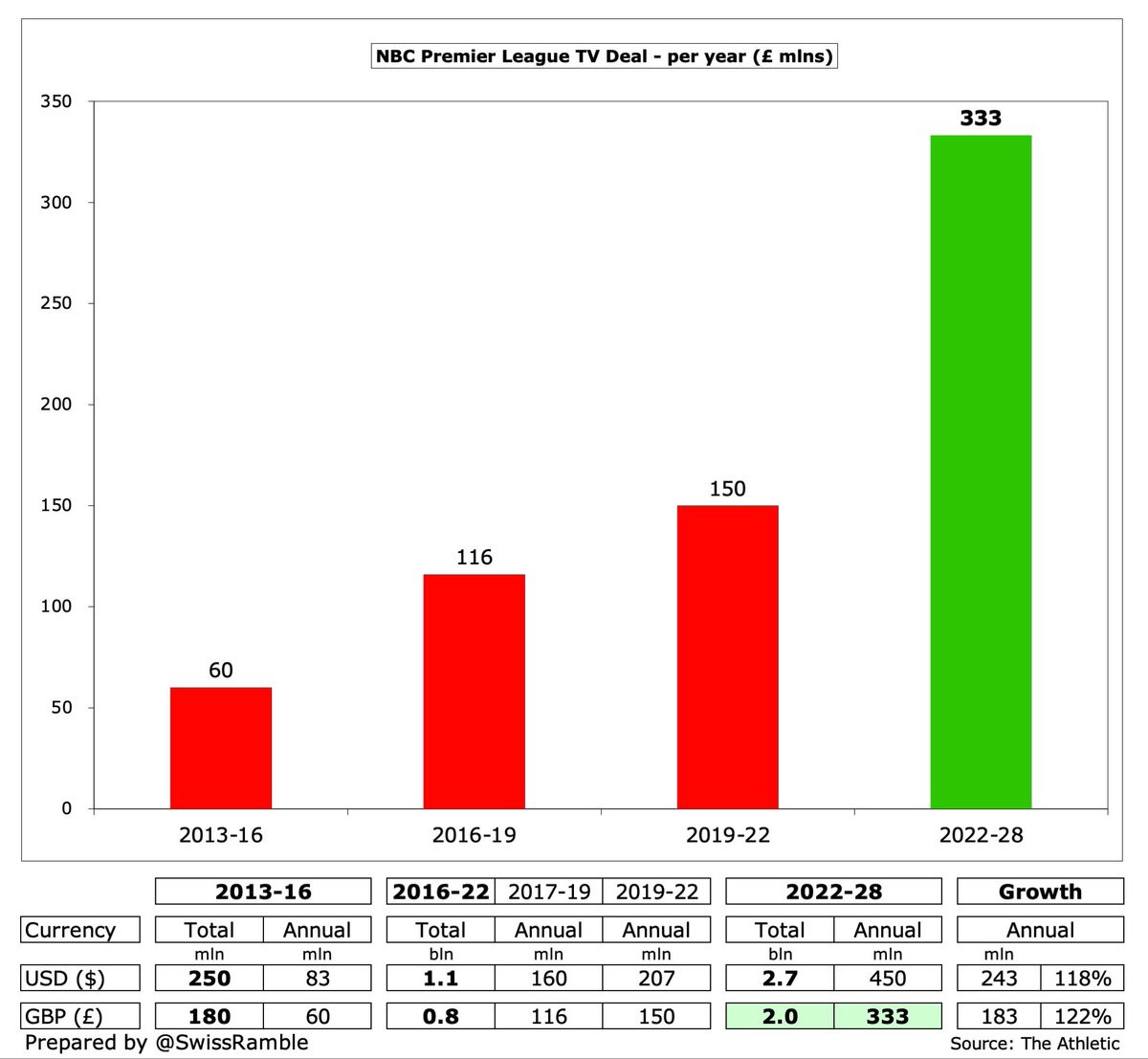

NBC have signed a 6-year deal worth $2.7 bln (£2.0 bln) covering 2022-28, more than doubling the previous agreement, which was worth $1.1 bln (£0.8 bln). The new deal is worth £333m a year, compared to £150m for the last 3 years of the old deal (£116m in the first 3 years).

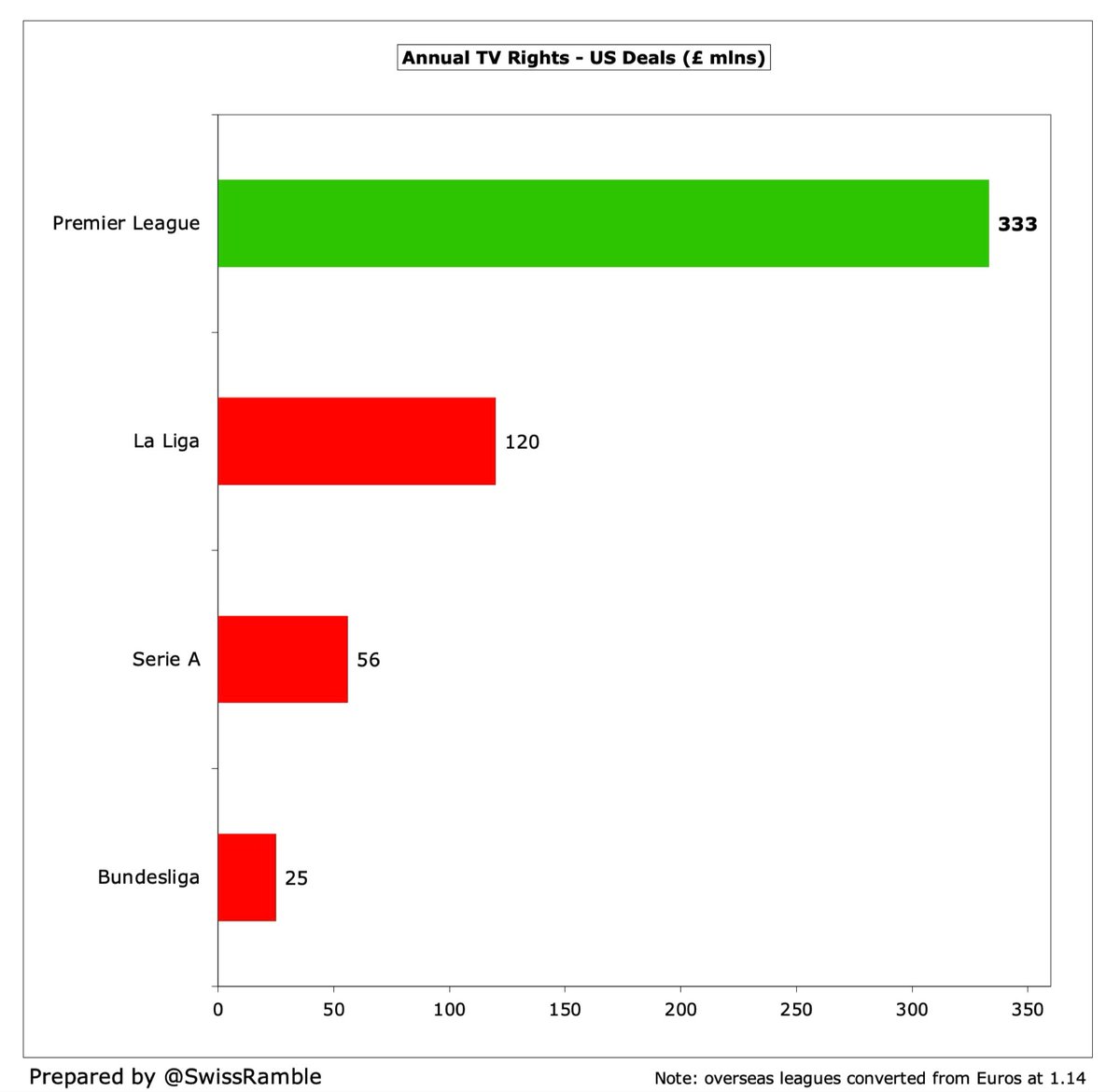

Little wonder that Richard Masters, the Premier League chief executive, described NBC as “brilliant partners”, especially when you compare the PL £333m annual payment to the US deals signed by other leagues, e.g. La Liga £120m, Serie A £56m and the Bundesliga £25m.

The increased deal reflects the growing interest of American sports fans in soccer, as seen by higher viewing figures, which are reportedly up 14% this season to 609,000, the highest audience since 2015-16. The Premier League is now well established in the US, second only to MLS.

Other overseas deals suggest the Premier League is still very much regarded as a premium product. New Nordic £2 bln 6-year deal is double the previous one, while Australia is nearly 60% higher and Serbia 10 times as much. Only China saw a decline after PPTV agreement terminated.

Total Premier League TV rights are forecast to rise by 11% from £9 bln to £10 bln for the new 3-year deal starting in 2022. UK domestic rights have been held at the same level of £5 bln (Sky, BT & Amazon), but overseas rights estimated to increase by 25% from £4 bln to £5 bln.

Even though the cost of UK TV rights decreased in the current 2019-22 deal, the number of games shown live actually increased from 168 to 200 (Sky 128, BT Sport 52 and Amazon 20), which means that the payment per game subsequently dropped from £10.2m to £8.0m.

However, the increase in Premier League overseas TV rights is striking. Based on the estimated of £5 bln, these would average around £1.7 bln a year, up from £1.3 bln in the 2019-22 cycle. As recently as 2007-10, these were worth only £200m a year.

In fact, this forecast means that the new deal would see the overseas rights reach the same amount as domestic rights, thus accounting for 50% of the total payment, compared to 37% in the 20161-9 cycle (or 25% in 2007-10).

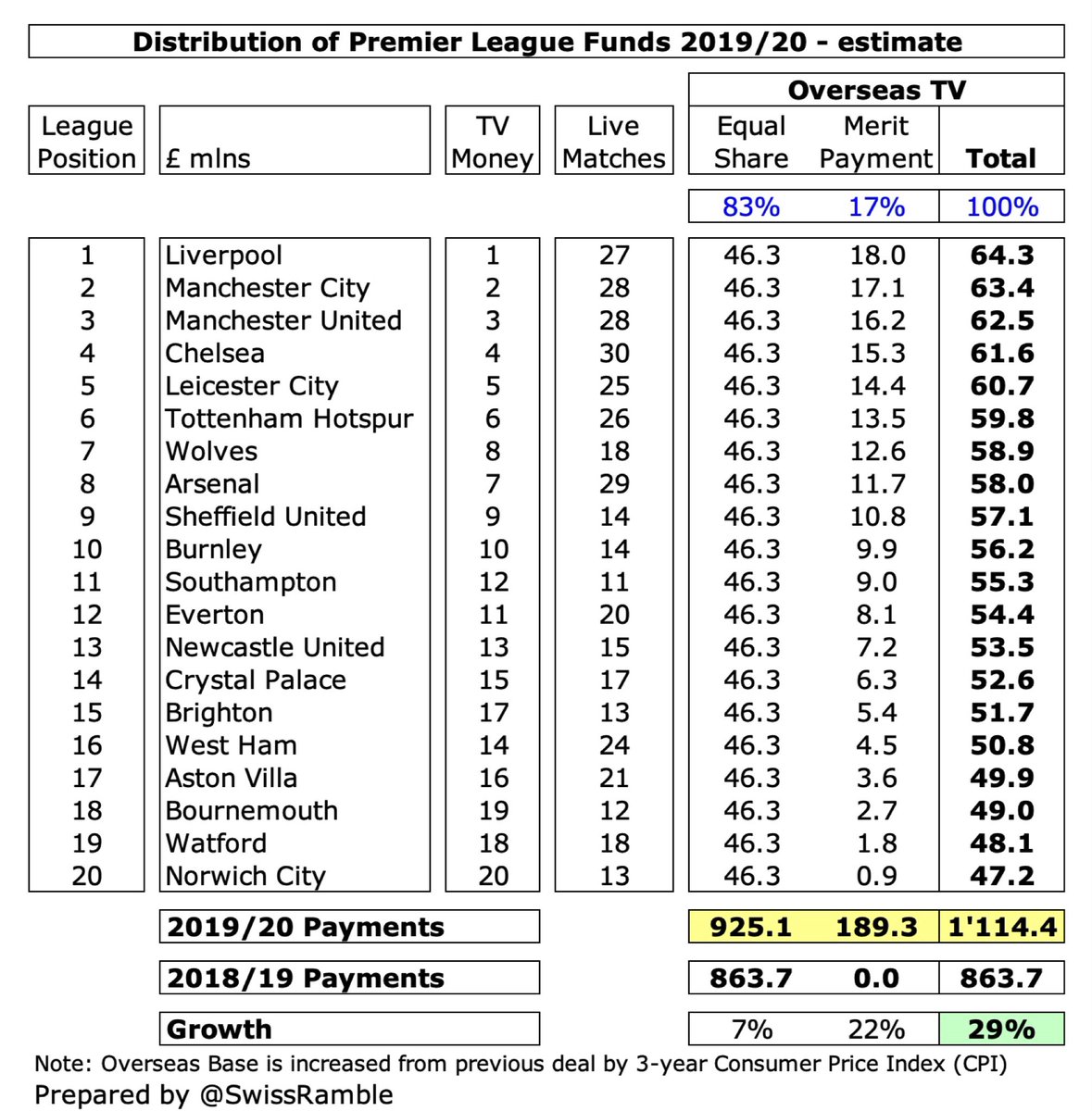

Unfortunately, the Premier League has not published details of distributions by club since the 2018-19 season, so we will have to use a few assumptions to project the impact of the new deals. However, this should still give us a decent indication of the “direction of travel”.

As a reminder, in 2018/19 each club received equal shares for 50% of domestic TV £34m, overseas TV £43m and commercial income £5m. Each match broadcast live was worth £1.1m (on top of £12.2m for a minimum of 10 games), while each league position was worth £1.9m (merit payment).

As a result, #LFC received the highest TV distribution of £152m, even though they finished 2nd, as champions #MCFC were broadcast live on fewer occasions (which meant lower facility fees), so only got £151m. The club that finished last, namely #HTAFC, still earned £97m.

Based on media reports, we can estimate how much each club received in 2019/20. First, we will look at how much the total deal changed and then apply those percentage movements to the individual club distributions.

In the 3-year deal starting in 2019/20 the total domestic rights fell by 6% from £5.3 bln to £5.0 bln, but this was more than offset by the overseas deal rising 29% from £3.1 bln to £4.0 bln, leading to an overall 7% increase from £8.4 bln to £9.0 bln.

As a first step in our calculation, we simply apply the 6% reduction in the domestic deal to each club’s distribution, for equal payment (50% of the deal), facility fees (25%) and merit payment (25%). Note: clubs only received payments for games that would have been shown live.

Overseas TV rights were previously distributed as equal shares by the Premier League, but this was changed in the 2019-22 deal. Clubs continue to share the previous level of overseas revenue equally, but any increase is distributed based on where they finish in the league.

The overseas base for the previous deal is increased in line with 3-year CPI (Customer Price Index), but the remaining growth (up to 29%) is allocated based on league position. The introduction of a merit element for overseas rights clearly benefits the leading clubs.

Combining these assumptions, we can estimate that league winners #LFC 2019/20 distribution was £163m, though this was reduced by £17m to £146m, due to their share of the rebate paid to broadcasters for COVID disruption and delays.

The Premier League agreed to give broadcasters a £330m rebate for the 2019/20 season, split Premier League clubs £264m, relegated clubs £15m and promoted clubs £50m. This was paid in three instalments in 2020, 2021 and 2022. Amounts based on TV money, ranging from £17m to £7m.

We can also estimate club distributions for 2020-21 season, as total revenue is unchanged in the 2nd year of the 3-year cycle 2019-22, though league position (merit payment) and games shown live (facility fees) influence the split. On this basis, champions #MCFC received £161m.

We can apply the same logic to the new 2022-25 deal with the value of the domestic rights unchanged at £5 bln, but overseas rights forecast to increase by 25% from £4 bln to £5 bln, which would give an 11% increase in total rights from £9 bln to £10 bln.

This is where the change in distribution approach for overseas rights really begins to bite with leading clubs receiving the lion’s share of the growth. Based on my assumptions, the first placed club in 2022/23 would receive an incredible £186m.

Compared to the 2020/21 payments, there will be substantial growth in TV money for the elite clubs. My estimate suggests that the top 5 clubs will receive £20m to £25m more in a season, while the last placed club will only see a £3m increase.

There is a notable difference between the new way of distributing overseas rights (any growth paid per league position) and the old system of equal distribution. In this way, the 1st place club gets £19m more than it would have done, while the 20th place club gets £19m less.

In reality, there is a restriction on the amount that the top club can receive called the Fixed Central Funds Distribution Ratio, which is equivalent to 180% of the lowest amount paid. So if the bottom club received £100m, the top club could not receive more than £180m.

The Premier League continues to outperform other major leagues in TV rights, e.g. the Bundesliga’s new domestic rights are 5% lower; Serie A has also had to accept a 5% domestic reduction, while overseas rights are down by around a third.

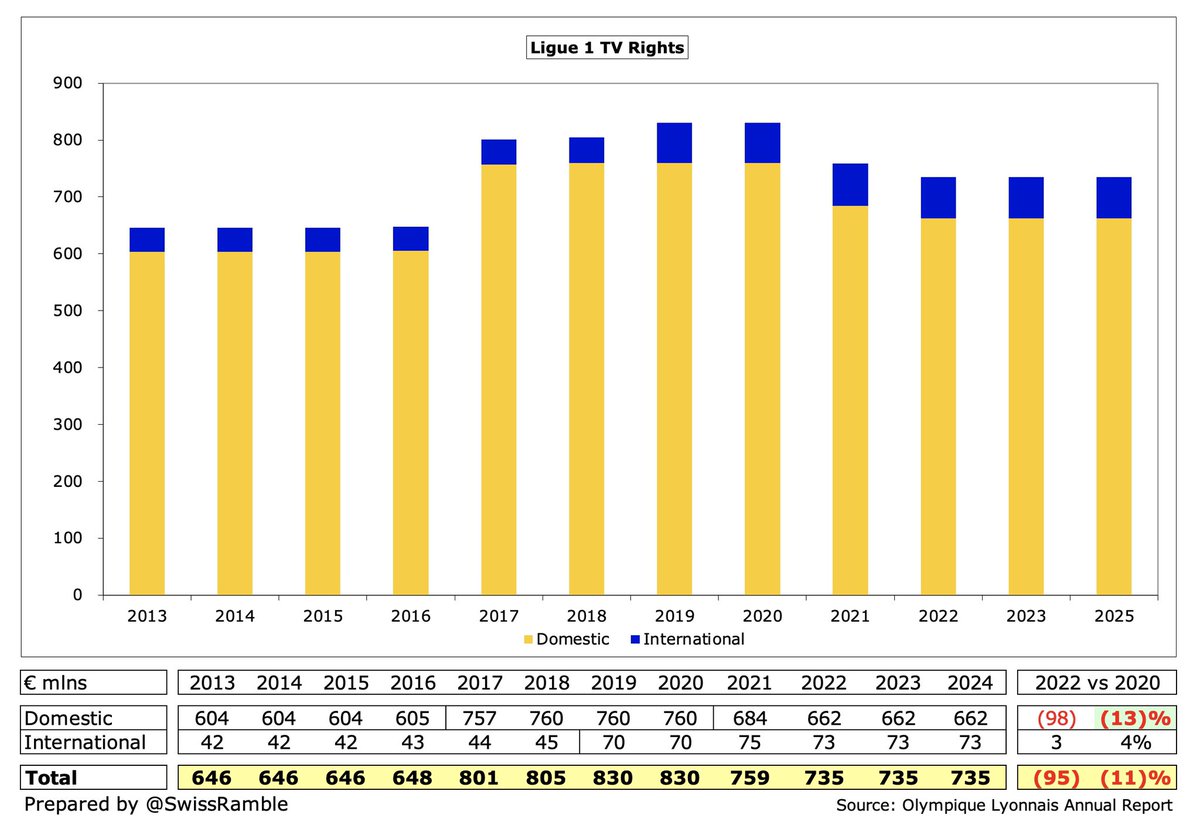

Ligue 1 domestic TV rights should have increased by 60% in 2020/21, but the Mediapro deal collapsed, leading to a revised agreement that is 13% lower than the previous deal. Bids for the new La Liga deal will only be submitted in December.

In other words, not only is the Premier League TV deal well ahead of the other major leagues, but the gap is actually widening. The new deals take the PL at £3.3 bln, compared to La Liga £1.8 bln, Bundesliga £1.2 bln, Serie A £1.0 bln and Ligue 1 £645m.

The main driver of the Premier League’s dominance is overseas TV rights, where the forecast £1.7 bln is more than twice as much as the next highest, La Liga £787m, followed by Bundesliga £246m, Serie A £187m and Ligue 1 £64m.

That said, the gap between the Premier League’s domestic rights and other leagues is also substantial with its £1.7 bln miles ahead of La Liga £1.0 bln, followed by Bundesliga £965m, Serie A £814m and Ligue 1 £581m.

As an example of what this means, the bottom club in the Premier League receives more TV money than all other European clubs with the exception of the top 3 clubs in La Liga. In 2019/20 the top English club got £163m, £71m more than Bundesliga and £89m more than Serie A.

Even after this increase, the Premier League lags behind major US sports’ TV rights, e.g. the new NFL deal is worth £7.5 bln a year, more than twice the PL’s £3.3 bln, while the new NBA deal is expected to be more than £6 bln a year.

What does the new TV deal mean for clubs lower down the football pyramid? Prior to the pandemic, the Premier League had committed to providing £1.5 bln funding (including parachute payments), which it then increased by £100m to £1.6 bln to cover the adverse impacts of COVID.

On the same day the new US deal was announced, the Premier League stated that it would provide an additional £20m to EFL League One and League Two clubs this season plus an extra £5m for the top three National Leagues.

The EFL has pushed for its broadcast revenue distribution from the Premier League to be increased from 16% to 25% in the recent Football Governance review. Also noted that around half of the payments to the lower leagues is in the form of parachute payments to relegated clubs.

Once again, I should emphasise that these figures are only estimates, so will not be the same as the final distributions, but hopefully this analysis gives an idea of how much each club will receive under the new TV deal.

In any case, the impressive new overseas TV deals will help fight off threats from leading clubs (Project Big Picture, European Super League, etc), at least for a while. To paraphrase Mark Twain, reports of the Premier League’s death seem to have been greatly exaggerated.

• • •

Missing some Tweet in this thread? You can try to

force a refresh