“The S&P GSCI U.S. Commodity Price Index has been declining for more than a month; it has fallen 10% since October 24th—marking its largest drop of the recovery. This has left commodity prices essentially unchanged for the last five months ..” @LeutholdGroup

(2/x)

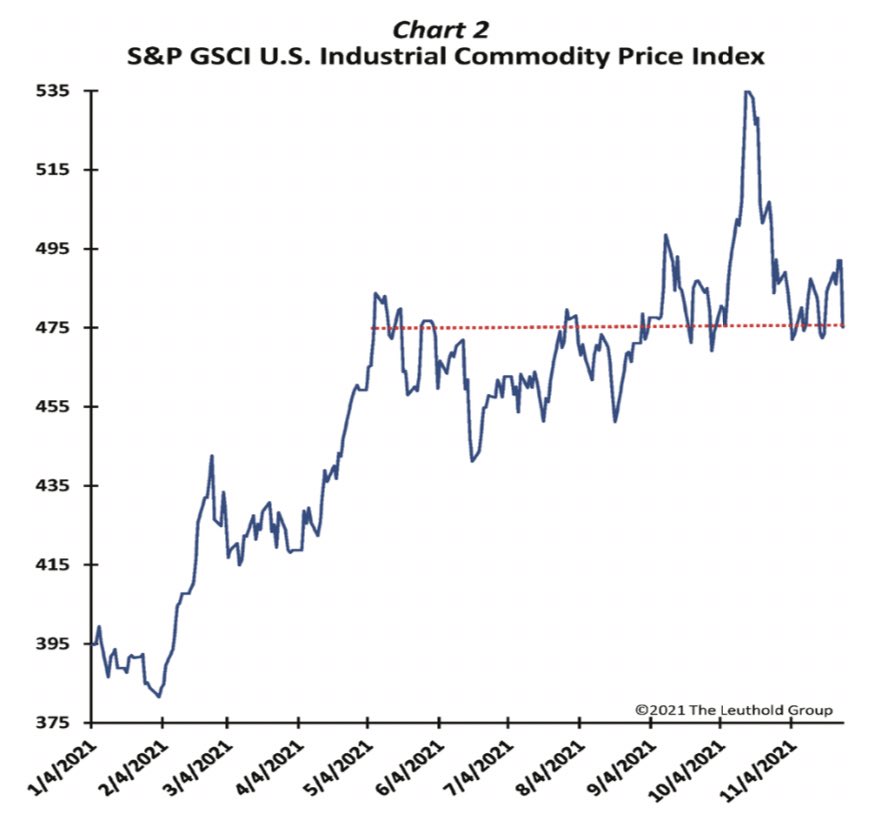

“Industrial prices are off by almost 12% from recovery highs, and rather than surging as they did earlier in the recovery, they have also been trending sideways looking back to early May!”

“Industrial prices are off by almost 12% from recovery highs, and rather than surging as they did earlier in the recovery, they have also been trending sideways looking back to early May!”

(3/x)

“The Baltic Freight Rate Index has collapsed since early October, leaving shipping rates virtually unchanged (like industrial com- modity prices), measured back to May.”

“The Baltic Freight Rate Index has collapsed since early October, leaving shipping rates virtually unchanged (like industrial com- modity prices), measured back to May.”

(4/x)

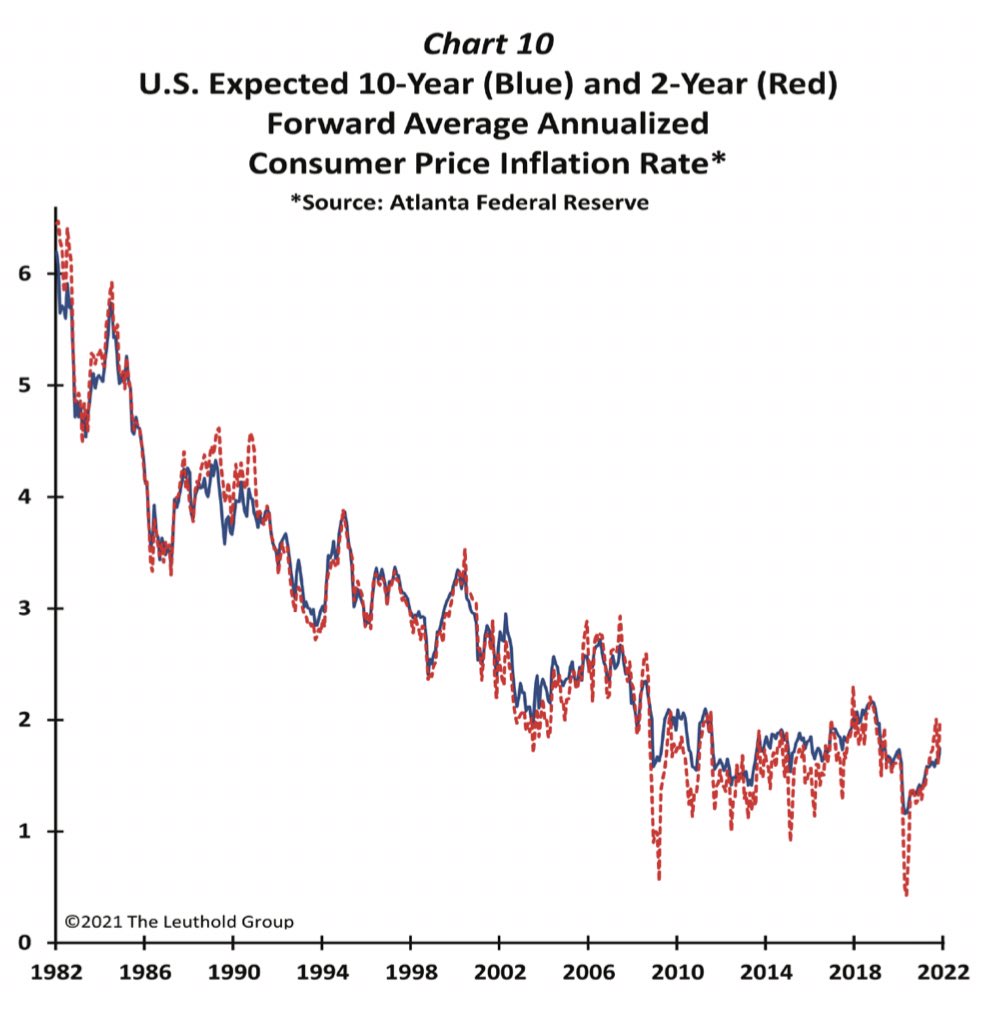

“Are inflation fears really getting out of control? .. The two-year inflation outlook has risen to 1.96%, while ten-year inflation is anticipated to be 1.74%. Neither appears alarming, and both are .. still quite tame compared to much of the post-war era.”

“Are inflation fears really getting out of control? .. The two-year inflation outlook has risen to 1.96%, while ten-year inflation is anticipated to be 1.74%. Neither appears alarming, and both are .. still quite tame compared to much of the post-war era.”

(5/x)

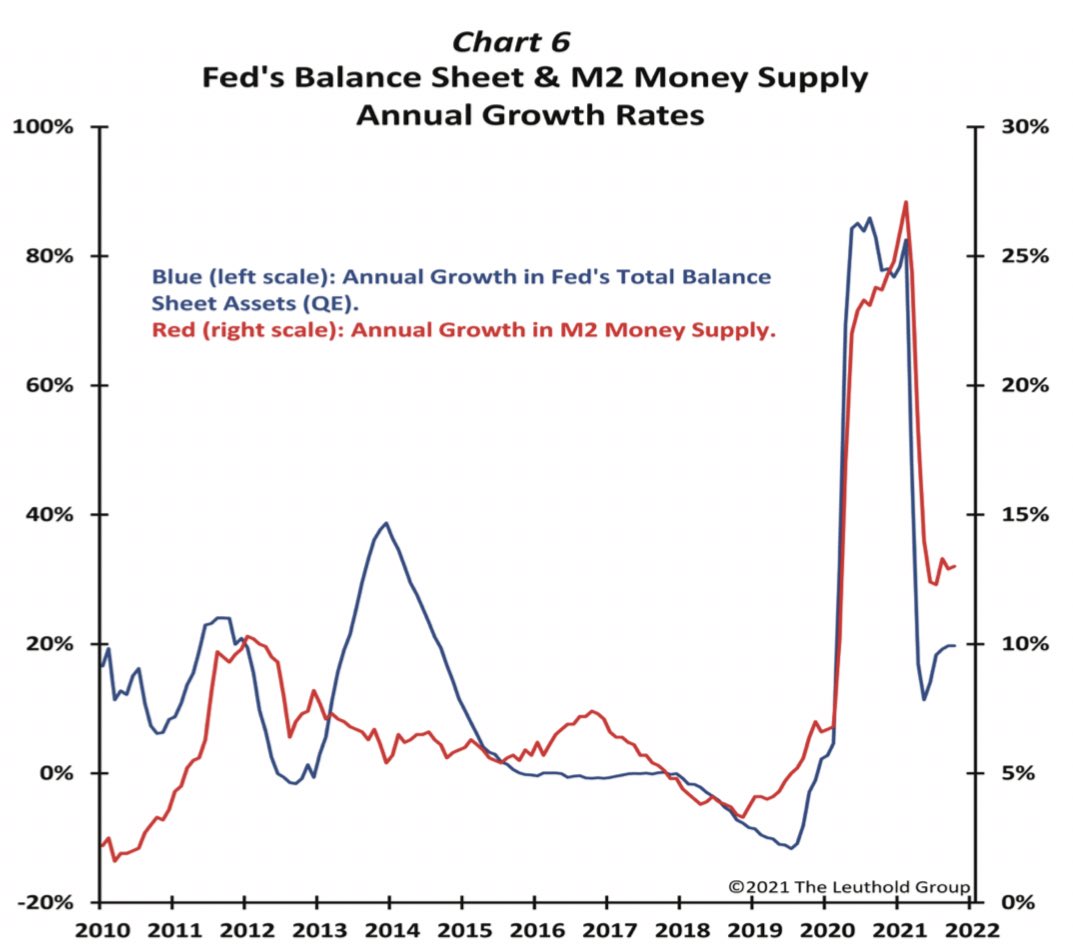

Meanwhile, “annual growth in both the Fed’s balance sheet and the M2 money supply peaked earlier this year, in February.”

Meanwhile, “annual growth in both the Fed’s balance sheet and the M2 money supply peaked earlier this year, in February.”

(6/6)

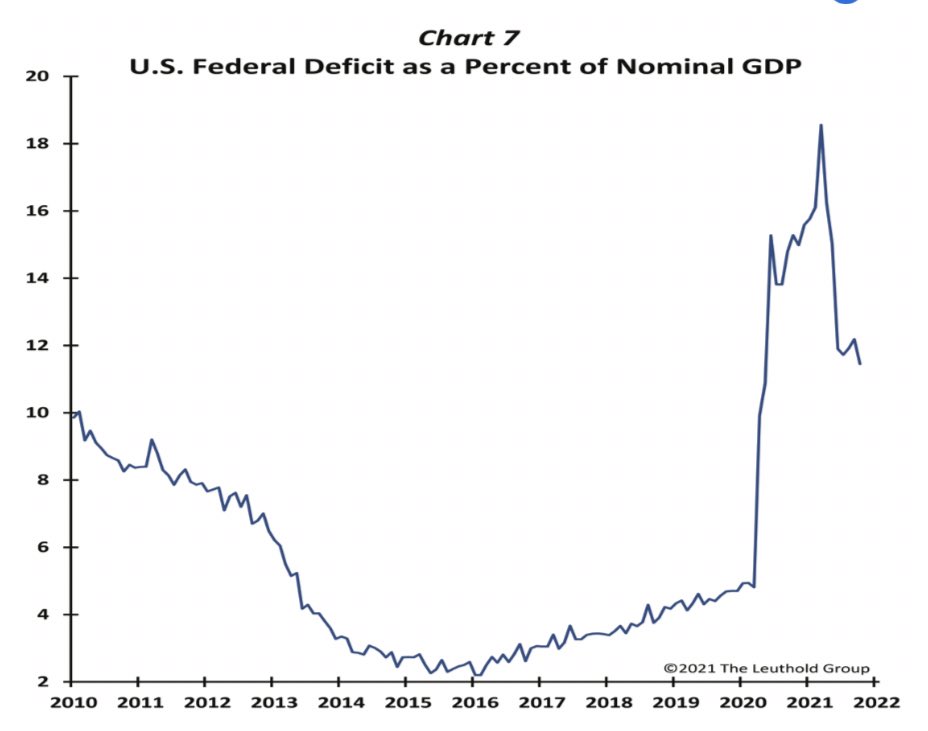

.. and “massive tax receipts due to a booming economy [have] caused the federal deficit to decline by eight percentage points as a percent of nominal GDP!” [Paulsen]

((END))

.. and “massive tax receipts due to a booming economy [have] caused the federal deficit to decline by eight percentage points as a percent of nominal GDP!” [Paulsen]

((END))

• • •

Missing some Tweet in this thread? You can try to

force a refresh