MORGAN STANLEY: in a 90-page report, says, “The workforce is about to meaningfully change. ..

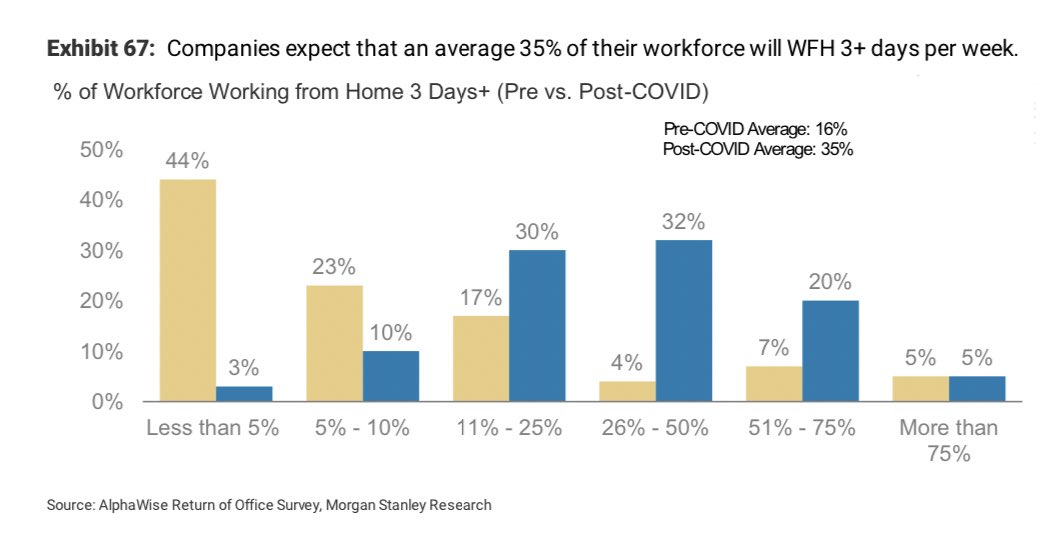

..”Pre-COVID, about ~5% of [office] employees worked from home [3 or more days per week], whereas our survey suggests this number could grow 4-5x.”

(1/x)

..”Pre-COVID, about ~5% of [office] employees worked from home [3 or more days per week], whereas our survey suggests this number could grow 4-5x.”

(1/x)

2.

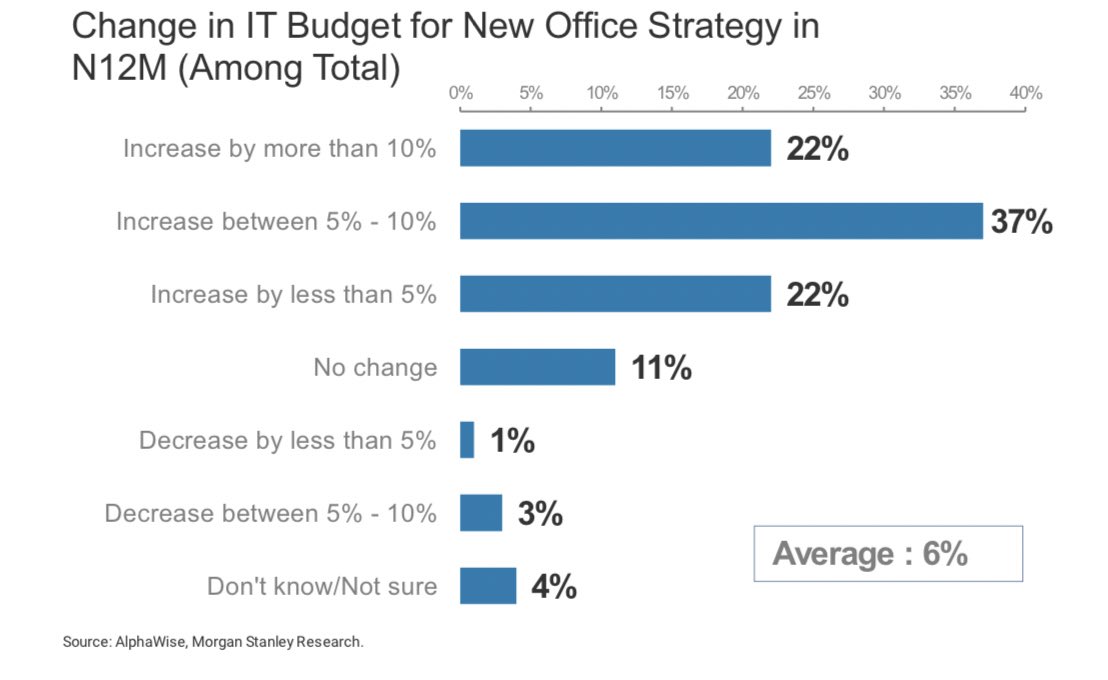

Big implications for IT budgets, as companies reconfigure their networks. Nearly 1/4 say they’ll boost spending by 10%+.

Big implications for IT budgets, as companies reconfigure their networks. Nearly 1/4 say they’ll boost spending by 10%+.

3.

“.. we come away from this survey even more bullish on the PC market as we now see a reopening/return to the office as a clear tailwind to commercial PC demand. As a result, we.. significantly raise our PC market forecast and now estimate PC shipments grow 16.5% Y/Y in 2021”

“.. we come away from this survey even more bullish on the PC market as we now see a reopening/return to the office as a clear tailwind to commercial PC demand. As a result, we.. significantly raise our PC market forecast and now estimate PC shipments grow 16.5% Y/Y in 2021”

5.

“Companies expect that an average 35% of their workforce will [work from home] 3+ days per week.”

Amazing.

(( END ))

“Companies expect that an average 35% of their workforce will [work from home] 3+ days per week.”

Amazing.

(( END ))

• • •

Missing some Tweet in this thread? You can try to

force a refresh