1)Portfolio Nov-end -

$ADYEY $AFRM $CRWD $DLO $GLBE $LILM $LSPD $MELI $MNDY $MQ $OKTA $PATH $SE $SHOP $SNOW $TOST $TWLO $U $UPST $ZI #DXY

Short - ARK, $NET

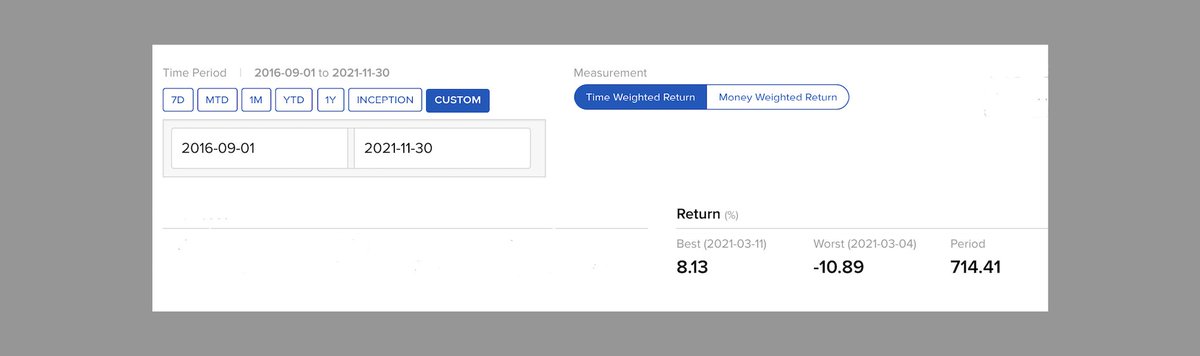

Return since 1 Sept '16 -

Portfolio +714.41% (49.11%pa)

$ACWI +74.08% (11.14%pa)

$SPX +110.40% (15.22%pa)

Contd..

$ADYEY $AFRM $CRWD $DLO $GLBE $LILM $LSPD $MELI $MNDY $MQ $OKTA $PATH $SE $SHOP $SNOW $TOST $TWLO $U $UPST $ZI #DXY

Short - ARK, $NET

Return since 1 Sept '16 -

Portfolio +714.41% (49.11%pa)

$ACWI +74.08% (11.14%pa)

$SPX +110.40% (15.22%pa)

Contd..

2) YTD return -

Portfolio +28.05%

$ACWI +12.42%

$SPX +21.59%

Biggest positions -

1) $SE 2) $GLBE 3) $MELI 4) $SNOW 5) $TWLO

Contd....

Portfolio +28.05%

$ACWI +12.42%

$SPX +21.59%

Biggest positions -

1) $SE 2) $GLBE 3) $MELI 4) $SNOW 5) $TWLO

Contd....

3) Commentary -

November was a brutal month for growth stocks; once the strong CPI print was announced and the Fed began tapering its QE program, ARK ETFs declined by ~20% within 3 weeks!

Fortunately, due to my hedges and shorts in $ARKG and $RIVN, my drawdown...

November was a brutal month for growth stocks; once the strong CPI print was announced and the Fed began tapering its QE program, ARK ETFs declined by ~20% within 3 weeks!

Fortunately, due to my hedges and shorts in $ARKG and $RIVN, my drawdown...

4) ...was mitigated but due to the extreme selling in my stocks, my portfolio still ended up giving back a decent amount of its gains. In this instance, my $ARKK short did not provide a perfect hedge.

During the month, I also sold short $ARKG + $RIVN and both were covered...

During the month, I also sold short $ARKG + $RIVN and both were covered...

5)...with decent gains.

In terms of my stocks, after the business slowdown, I sold shares in $PLTR and took a starter position in $MNDY (which appears to be a promising business).

At month-end, after the Fed announced that it will probably accelerate its tapering and end...

In terms of my stocks, after the business slowdown, I sold shares in $PLTR and took a starter position in $MNDY (which appears to be a promising business).

At month-end, after the Fed announced that it will probably accelerate its tapering and end...

6)...QE a few months before schedule, I decided to drastically reduce my long exposure and raised a significant amount of US Dollar cash in my portfolio.

Under normal circumstances, I don't raise cash but we've just had an epic asset mania due to unprecedented QE and suspect...

Under normal circumstances, I don't raise cash but we've just had an epic asset mania due to unprecedented QE and suspect...

7)...the unwinding of liquidity might not be pretty.

After all, this epic party in risk assets was primarily caused by $120b/month of money creation by the Fed and as the monetary conditions tighten, both history and logic suggest that the hangover might also be equally....

After all, this epic party in risk assets was primarily caused by $120b/month of money creation by the Fed and as the monetary conditions tighten, both history and logic suggest that the hangover might also be equally....

8)...historic.

Apart from my large cash position, currently, I'm net short growth stocks (my ARK short is greater than my long exposure) and am also long US$ futures.

If my assessment is correct, as the Fed stops QE by spring, monetary conditions will tighten and the...

Apart from my large cash position, currently, I'm net short growth stocks (my ARK short is greater than my long exposure) and am also long US$ futures.

If my assessment is correct, as the Fed stops QE by spring, monetary conditions will tighten and the...

9)...world's reserve currency will probably appreciate in value (dollar shortage). Furthermore, risk assets will probably take a hit and if history is any guide, $SPX will decline by 18-20%.

The high-beta stocks will likely decline even more and a number of parabolic charts...

The high-beta stocks will likely decline even more and a number of parabolic charts...

10)...will end up with perfect Bell Curves (which are a hallmark of every broken bubble).

Given these expectations, I've raised a lot of cash and am net short growth stocks. Whilst I continue to feel that the secular compounders in my portfolio are outstanding businesses,...

Given these expectations, I've raised a lot of cash and am net short growth stocks. Whilst I continue to feel that the secular compounders in my portfolio are outstanding businesses,...

11)...they seem to have run ahead of their fundamentals and the withdrawal of liquidity is likely to cause some near-term pain.

Remember, liquidity drives markets and monetary policy trumps everything else.

Hope this has been helpful.

THE END

Remember, liquidity drives markets and monetary policy trumps everything else.

Hope this has been helpful.

THE END

• • •

Missing some Tweet in this thread? You can try to

force a refresh