I went down a rabbit hole digging into one of the most successful and secretive hedge funds: Coatue Global Mgmt.

+ 483% since June 2013 with a 50% annualized return.

+ Top 1% of Tech L/S Hedge Funds

+ One of the most successful Tiger Cubs.

A thread on some interesting findings:

+ 483% since June 2013 with a 50% annualized return.

+ Top 1% of Tech L/S Hedge Funds

+ One of the most successful Tiger Cubs.

A thread on some interesting findings:

1/ I expect most people already know Coatue, but brief overview:

Phillipe Laffont (PL) is the Founder of Coatue Global. He worked for Julian Robertson (the legendary founder of the defunct Tiger Mgmt).

To learn more about Tiger, read @mariogabriele piece

Phillipe Laffont (PL) is the Founder of Coatue Global. He worked for Julian Robertson (the legendary founder of the defunct Tiger Mgmt).

To learn more about Tiger, read @mariogabriele piece

https://twitter.com/mariogabriele/status/1459961594344050692?s=20

2/ Phillipe Laffont was born as a rising star:

+ Obsessed with computers from a young age

+ He graduated from MIT with a Computer science degree

+ Worked for Mckinsey in Europe

+ Came back to New York to work for Tiger Global for 3+ yrs until 1999 when Tiger returned capital.

+ Obsessed with computers from a young age

+ He graduated from MIT with a Computer science degree

+ Worked for Mckinsey in Europe

+ Came back to New York to work for Tiger Global for 3+ yrs until 1999 when Tiger returned capital.

3/ Phillipe w/ lessons from the greatest hedge fund manager started Coatue in 1999 before the dot-com crash.

One of the most impressive things of Coatue is they have escaped all Bubbles WITHOUT damage. This is rare for hf's. Risk mgmt is top for Coatue.

Next is a quote from PL

One of the most impressive things of Coatue is they have escaped all Bubbles WITHOUT damage. This is rare for hf's. Risk mgmt is top for Coatue.

Next is a quote from PL

3i/

"I used to think it ws all stock picking. Truth is, risk mgt is half the battle. Portfolio mgt is like poker, yu don’t always get perfect cards and yu need to manage your stack. My risk mgt is broken down between rules I never break and principles that reinforce good habits"

"I used to think it ws all stock picking. Truth is, risk mgt is half the battle. Portfolio mgt is like poker, yu don’t always get perfect cards and yu need to manage your stack. My risk mgt is broken down between rules I never break and principles that reinforce good habits"

3ii/ I read they are extremely good at on the short-side of their fund. They want to know everything about a company (complete bull case) and deep-dive before shorting.

The ability to short effectively has induced their fund returns.

The ability to short effectively has induced their fund returns.

4/ Phillipe started his fund with some capital from his mentor Julian and others.

He started with only $45M in 1999.

By 2003, grew it to over $500M

By 2009: $2.2B!

Today, their combined public (25B) + private AUM is over $55B+.

That's almost more than more 100X; How?

He started with only $45M in 1999.

By 2003, grew it to over $500M

By 2009: $2.2B!

Today, their combined public (25B) + private AUM is over $55B+.

That's almost more than more 100X; How?

5/ Early in 1999's - 2004:

This period can be remembered as the great boom in Asia as these economies opened up.

Coatue bet heavily into the digitization of Asia and was highly successful by being one of the earliest investors into Tencent at around $7, and more Asia names..

This period can be remembered as the great boom in Asia as these economies opened up.

Coatue bet heavily into the digitization of Asia and was highly successful by being one of the earliest investors into Tencent at around $7, and more Asia names..

6/ Into Post 2007:

Phillipe heavily believed in digitization and the mobile era.

Coatue made a heavy bet on Apple around the launch of the iPhone. $AAPL singlehandedly led the firms biggest performance even thru the turbulent 07' crisis including making other smart investments

Phillipe heavily believed in digitization and the mobile era.

Coatue made a heavy bet on Apple around the launch of the iPhone. $AAPL singlehandedly led the firms biggest performance even thru the turbulent 07' crisis including making other smart investments

7/ Post 2011:

As a result of the rise of smartphones, Coatue made heavy bets on the rise of social media and other trends that would result from individuals having phones. They invested into $SNAP at a $1.5B valuation.

Also early into Lyft, Grab in 2015, Afterpay, Doordash, etc

As a result of the rise of smartphones, Coatue made heavy bets on the rise of social media and other trends that would result from individuals having phones. They invested into $SNAP at a $1.5B valuation.

Also early into Lyft, Grab in 2015, Afterpay, Doordash, etc

8/ Today, 2020/21:

What are they doing to differentiate themselves?

How have they been so successful?

They're highly secretive, but the next half of this thread focuses on those key elements:

a) Data Science

b) Rigorous Analysis

c) Index into top deals

Let's break-it-down:

What are they doing to differentiate themselves?

How have they been so successful?

They're highly secretive, but the next half of this thread focuses on those key elements:

a) Data Science

b) Rigorous Analysis

c) Index into top deals

Let's break-it-down:

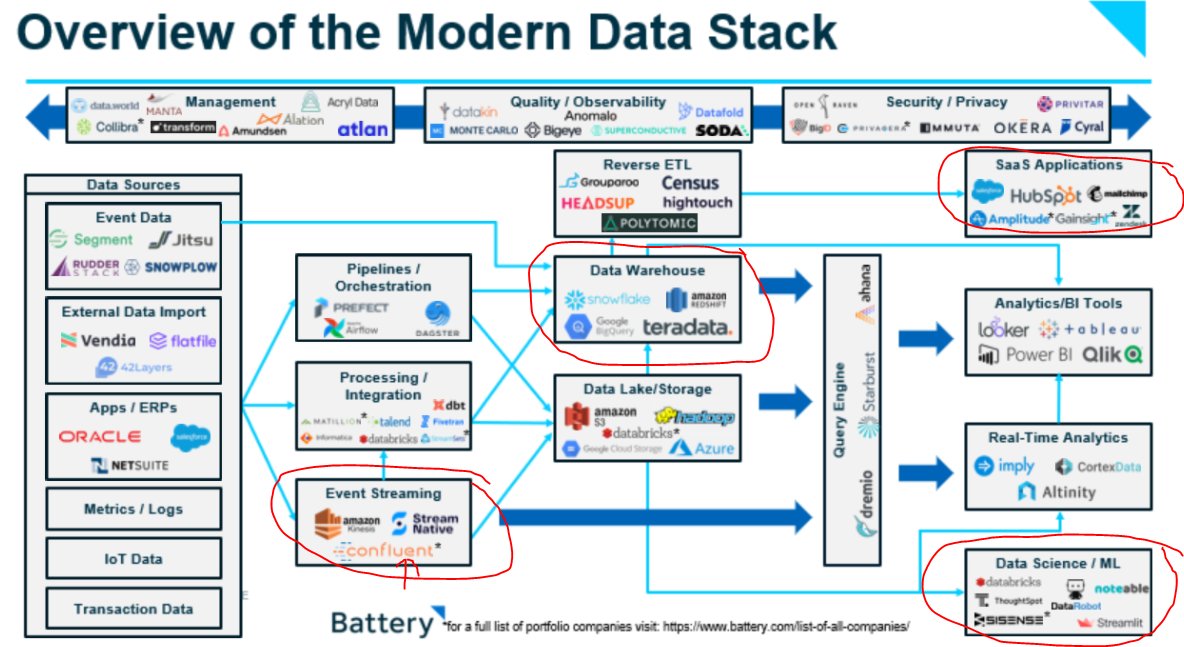

9/ Coatue uses Machine Learning/Data Science on Alternative datasets to inform ALL investment decisions:

Nothing is new with ML but Coatue is known for inventing & holds the most advanced data science hedge fund.

Today, they have 50+ Data Scientists in a fund with <170 staffs.

Nothing is new with ML but Coatue is known for inventing & holds the most advanced data science hedge fund.

Today, they have 50+ Data Scientists in a fund with <170 staffs.

10/ In an interview, their Data Science chief said their Investment team is structured in this format:

a) Data Engineering & Infrastructure Team,

b) Research & Statistical Modelling Team

c) Insights Team: Scientists + Finance + Analysts work.

Unique from a traditional L/S hf.

a) Data Engineering & Infrastructure Team,

b) Research & Statistical Modelling Team

c) Insights Team: Scientists + Finance + Analysts work.

Unique from a traditional L/S hf.

11/ Go on LinkedIn to see Coatue staffs, you'll find almost more Data scientists than Analysts. Their Ex-Head of Data Science said they hire Finance Analyst with backgrounds in Coding/ML/Tech.

They believe combining traditional fundamentals w modeling differentiates Coatue.

They believe combining traditional fundamentals w modeling differentiates Coatue.

12/ What example of Alternative Data do they use?:

+ Satellite data

+ Mobility data trends

+ Invoices & SKU scan

+ Credit Card datasets

+ App Downloads

+ Advanced social media analysis

+ Analysis of large bulk amt of expert calls networks, and expert analysis.

Continued:

+ Satellite data

+ Mobility data trends

+ Invoices & SKU scan

+ Credit Card datasets

+ App Downloads

+ Advanced social media analysis

+ Analysis of large bulk amt of expert calls networks, and expert analysis.

Continued:

13/ A-data (PT 2)

+ Archive library

+ FB Ad Library

+ Industry Reports-Gartner

+ Job Postings

+ Glassdoor/NPS

+ UserID Tracking

+ Google Trends

+ SimilarWeb|Alexa Web

It goes beyond this list. Just an example and it's a systemic process of using ML to analyze all the following.

+ Archive library

+ FB Ad Library

+ Industry Reports-Gartner

+ Job Postings

+ Glassdoor/NPS

+ UserID Tracking

+ Google Trends

+ SimilarWeb|Alexa Web

It goes beyond this list. Just an example and it's a systemic process of using ML to analyze all the following.

14/ Second key trait of Coatue is rigorous & thorough analysis of a company & its industry.

No one knows if they use consulting firms like Bain (similar to Tiger), but it is said they purchase an excessive amt of alternative data. They want to knw a company better than insiders.

No one knows if they use consulting firms like Bain (similar to Tiger), but it is said they purchase an excessive amt of alternative data. They want to knw a company better than insiders.

14/ Third trait I learned is Coatue is known for digging deeper into a TAM for a Co.

They measure and investigate TAM Opportunities/secular trends before using alternative data/machine learning to find who could be the potential winner of that market.

They measure and investigate TAM Opportunities/secular trends before using alternative data/machine learning to find who could be the potential winner of that market.

15/ Phillipe Laffont on TAM:

"What has worked for me is focusing on TAM (market size), earnings, growth and the corresponding P/E multiple 5-7 years out. That means I’m a very mediocre macro and cyclical investor though I need to be reminded of that more than I care to admit."

"What has worked for me is focusing on TAM (market size), earnings, growth and the corresponding P/E multiple 5-7 years out. That means I’m a very mediocre macro and cyclical investor though I need to be reminded of that more than I care to admit."

16/ Fourth trait, as mentioned is that they are bullish on Asia and Chinese tech growth over the next upcoming years. Julian Roberston of Tiger popularized this strategy.

They've been early investors in Meituan, but made a very recent big investment into $BZ Kanzhun.

They've been early investors in Meituan, but made a very recent big investment into $BZ Kanzhun.

17/ Current Bets:

The only reason I paid attention to their portfolio is that I love Investors with concentrated portfolios as it shows conviction

Coatue invests in <80 stocks. This is *fairly* tight for a $50B AUM compared to Blackrock or T-Rowe that have Large bets everywhere

The only reason I paid attention to their portfolio is that I love Investors with concentrated portfolios as it shows conviction

Coatue invests in <80 stocks. This is *fairly* tight for a $50B AUM compared to Blackrock or T-Rowe that have Large bets everywhere

18/ Coatue Portfolio:

They were recent big winners into $MRNA, $TSLA early into the pandemic.

Current key themes; Ride-sharing, Food delivery, AI and Cloud Tech themes.

These are their largest positions today: courtesy of @theTIKR

$SNOW $DASH $FB $SQ $SE

They were recent big winners into $MRNA, $TSLA early into the pandemic.

Current key themes; Ride-sharing, Food delivery, AI and Cloud Tech themes.

These are their largest positions today: courtesy of @theTIKR

$SNOW $DASH $FB $SQ $SE

19/ I spent some time analyzing the transactions btw Tiger and Coatue (Since they live in the same building in NYC!)

I found similarities of buys through Q2/Q3:

i) $DASH (likely allocation from privates)

ii) $SNOW (Likely behind the recent before Oct)

iii) $PATH in Q2

iv) $SE

I found similarities of buys through Q2/Q3:

i) $DASH (likely allocation from privates)

ii) $SNOW (Likely behind the recent before Oct)

iii) $PATH in Q2

iv) $SE

20/ Coatue Portfolio largest buys over the past year:

I dug deeper to do some analysis to see the key similarities. They made an unusually big position in $MQ.

Other Notable New Positions: $CFLT, $JD, $GTLB, $TOST, $AFRM, $ZM, $RBLX

I dug deeper to do some analysis to see the key similarities. They made an unusually big position in $MQ.

Other Notable New Positions: $CFLT, $JD, $GTLB, $TOST, $AFRM, $ZM, $RBLX

21/ I'll wrap up my thread with my best quotes and impressions from reading Phillipe Laffont.

It is said that Phillipe is a brilliant, rigorous, under-the-radar, and tough boss with VERY standards for his analysts.

So here are my best 5 quotes from @plaffont:

It is said that Phillipe is a brilliant, rigorous, under-the-radar, and tough boss with VERY standards for his analysts.

So here are my best 5 quotes from @plaffont:

22/

a/ "To be a good public investor, You don't need to be a genius or own a crystal ball, but you do need to make a few big calls"

a/ "To be a good public investor, You don't need to be a genius or own a crystal ball, but you do need to make a few big calls"

23/

b/ "To be a growth investor, you need a growth mindset: stay curious and flexible. I try to invest 5-10pct in areas i’m not comfortable in. The corollary is less obvious. It’s hard to sell winners but a portfolio is like a sports team and you need to refresh the superstars."

b/ "To be a growth investor, you need a growth mindset: stay curious and flexible. I try to invest 5-10pct in areas i’m not comfortable in. The corollary is less obvious. It’s hard to sell winners but a portfolio is like a sports team and you need to refresh the superstars."

24/

c/ "Imagination is the skill. Uncertainty is the opportunity. Data is important but so is the story. Patience is way underrated."

c/ "Imagination is the skill. Uncertainty is the opportunity. Data is important but so is the story. Patience is way underrated."

25/

d/ "Disclaimer: Growth investing is not momentum investing. The best growth investors find new trends and extraordinary founders but still think of business models and valuation. And they are disciplined risk managers."

d/ "Disclaimer: Growth investing is not momentum investing. The best growth investors find new trends and extraordinary founders but still think of business models and valuation. And they are disciplined risk managers."

26/

e/Last thing from my research is that PF believes evryone can be successful in growth investing. See his YT videos. PF believes it takes hard work, focus, process, data and extending your time horizon.

Also agree on the Growth mindset book(Dec 2021!)

e/Last thing from my research is that PF believes evryone can be successful in growth investing. See his YT videos. PF believes it takes hard work, focus, process, data and extending your time horizon.

Also agree on the Growth mindset book(Dec 2021!)

https://twitter.com/plaffont/status/1363590606254206977?s=20

27/

a/ Private market mindset can help public equity investors - Click:

b/ This is the best thread from PL to learn more from him on how to build long-term performance:

a/ Private market mindset can help public equity investors - Click:

https://twitter.com/plaffont/status/1345795314071040001?s=20

b/ This is the best thread from PL to learn more from him on how to build long-term performance:

https://twitter.com/plaffont/status/1363590596259151872

28/ If you're a retail investor reading this, you don't need to imploy data science to be successful like Coatue.

In the past, I created a thread on Alternative Data that retail investors can easily access to their benefit. Visit this thread:

In the past, I created a thread on Alternative Data that retail investors can easily access to their benefit. Visit this thread:

https://twitter.com/InvestiAnalyst/status/1407388270003200008?s=20XXX

29/ Today Coatue is led by @plaffont, Thomas & Chairman @DanRose999.

Using ML on alternative data is nt new, but Coatue is definitely utilizing it in a unique way and it shows in their returns. The firm appears to be like a tech start-up. This is definitely a fund to watch!

Using ML on alternative data is nt new, but Coatue is definitely utilizing it in a unique way and it shows in their returns. The firm appears to be like a tech start-up. This is definitely a fund to watch!

30/ END:

Thanks for following along. I enjoyed going down this unexpected rabbit hole today. If this was helpful, feel free to share!

As part of this, I also dug into Chase Coleman, another fascinating personality. If people are interested, I could do a future thread.

Thanks!

Thanks for following along. I enjoyed going down this unexpected rabbit hole today. If this was helpful, feel free to share!

As part of this, I also dug into Chase Coleman, another fascinating personality. If people are interested, I could do a future thread.

Thanks!

• • •

Missing some Tweet in this thread? You can try to

force a refresh