This is a phenomenal breakdown of today's Enterprise AI/ML stack (S/O: @BatteryVentures).

I'm constructive on the tailwinds within this space and I'm long: $CFLT, $CRWD, $AMPL, $PLTR.

The report below is a great read for any AI & Enterprise SaaS Enthusiast.

Thread Summary: 1/

I'm constructive on the tailwinds within this space and I'm long: $CFLT, $CRWD, $AMPL, $PLTR.

The report below is a great read for any AI & Enterprise SaaS Enthusiast.

Thread Summary: 1/

2/ Today's Org has a fragmented data and AI environment. Here are the different job roles required to perform certain data tasks.

For example, 1) the ETL process is going to undergo some innovation. 2) More people will become data citizens IMO.

The visual below shows it.

For example, 1) the ETL process is going to undergo some innovation. 2) More people will become data citizens IMO.

The visual below shows it.

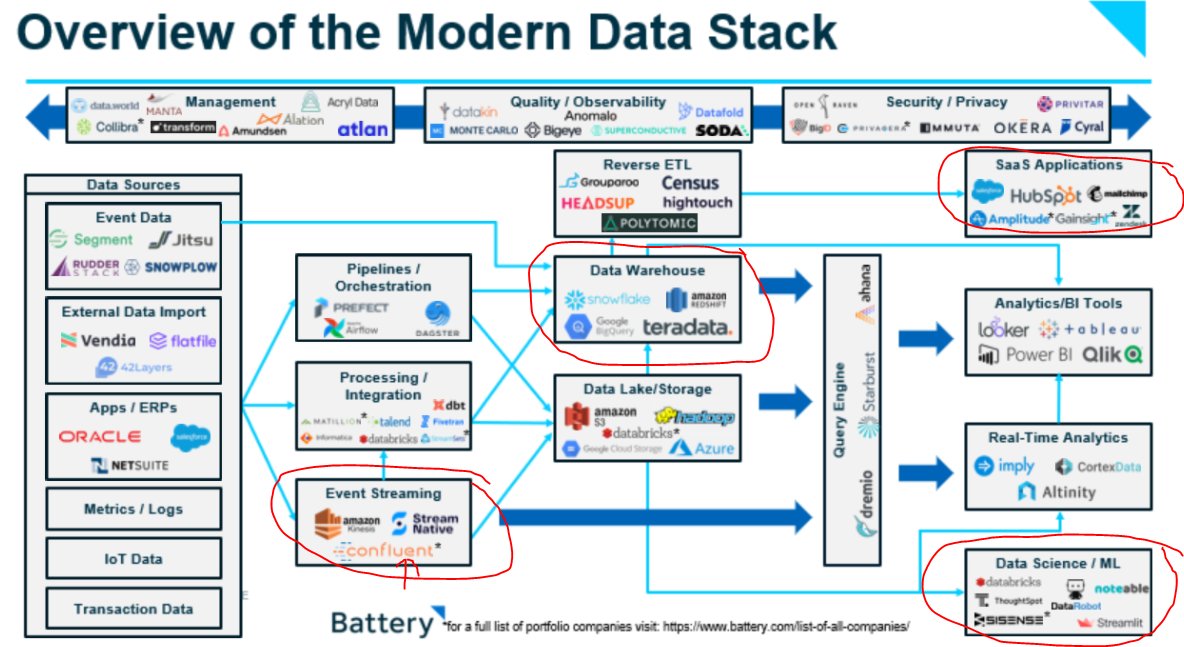

3/ The Data Value Chain:

The picture below explains -

i) the lifecycle of machine learning in an organization,

ii) the different applications required, and

iii) how data flows through the modern organization.

The picture below explains -

i) the lifecycle of machine learning in an organization,

ii) the different applications required, and

iii) how data flows through the modern organization.

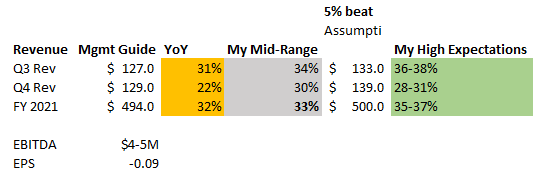

4/ $CFLT: Data Streaming

Hopefully, with the images above, Investors can connect the dots to see how $CFLT plays a foundational role in Data Streaming and Real-time data.

I believe $CFLT is disrupting the data at rest market and soon $SNOW's market.

Hopefully, with the images above, Investors can connect the dots to see how $CFLT plays a foundational role in Data Streaming and Real-time data.

I believe $CFLT is disrupting the data at rest market and soon $SNOW's market.

https://twitter.com/InvestiAnalyst/status/1457081842226532359?s=20

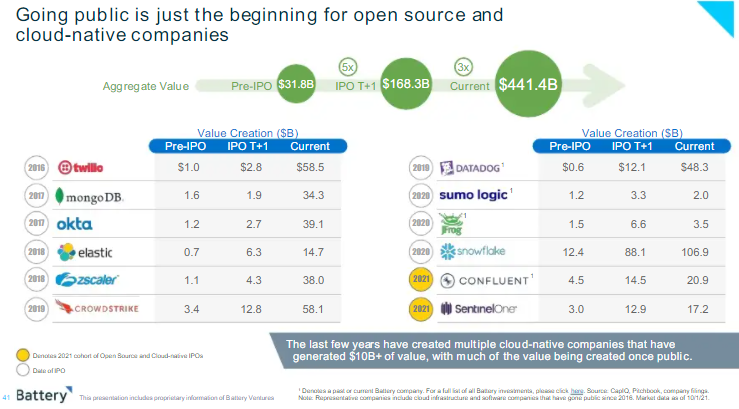

5/ Personally, I believe the Cloud Data Infrastructure companies are where the big money lies within the AI/ML Space. This is why I'm betting on companies like $CFLT. I think $MDB is a great beneficiary.

There are some interesting info below:

There are some interesting info below:

6/ In 2023, I'd eye a possible IPO for Data Robot, SiSense and Thoughtspot. These are HIGH-potential AI Co's riding the next S-curve.

Thanks, @DanelDayan, @chiraag_deora and the battery team!

Here's the report: battery.com/our-take-on-th…

I'll keep sharing intel on the space!

Thanks, @DanelDayan, @chiraag_deora and the battery team!

Here's the report: battery.com/our-take-on-th…

I'll keep sharing intel on the space!

I'll attach this Cloud report:

This Mckinsey Cloud & AI report had a few similar trends that I pointed out too in the thread above.

This Mckinsey Cloud & AI report had a few similar trends that I pointed out too in the thread above.

https://twitter.com/InvestiAnalyst/status/1442299348696641540?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh