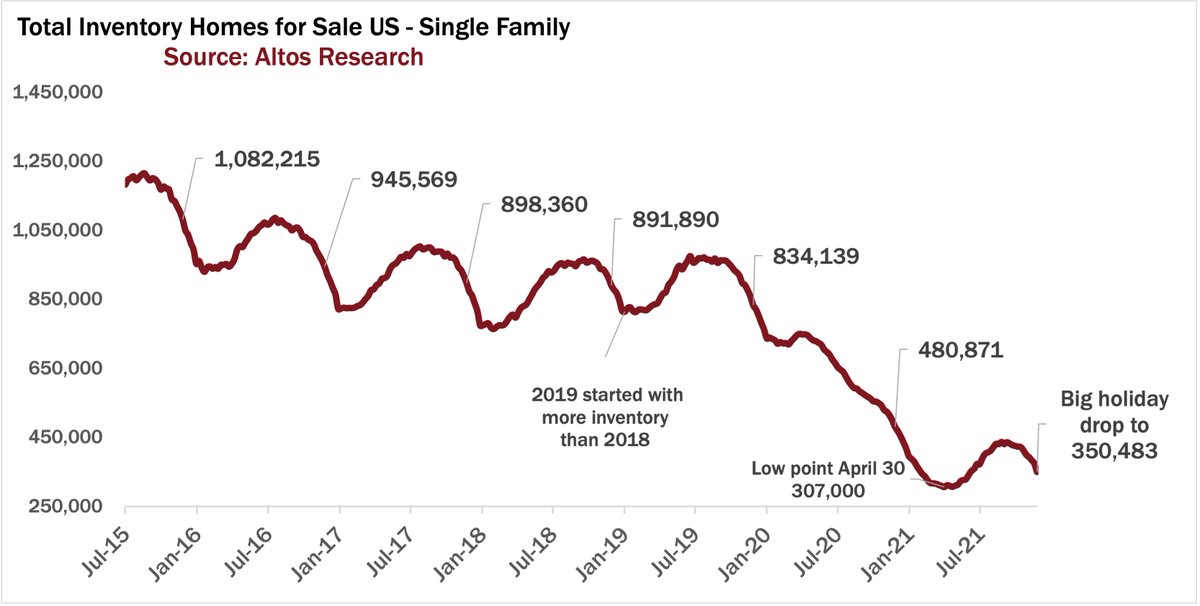

Big drop in available inventory post Thanksgiving holiday. Down to just 350,000 existing single family homes on the market.

Man, 2022 sure is shaping up to be competitive again for buyers. No relief anywhere in sight.

This week's @AltosResearch video has the details🧵📽️👇

1/7

Man, 2022 sure is shaping up to be competitive again for buyers. No relief anywhere in sight.

This week's @AltosResearch video has the details🧵📽️👇

1/7

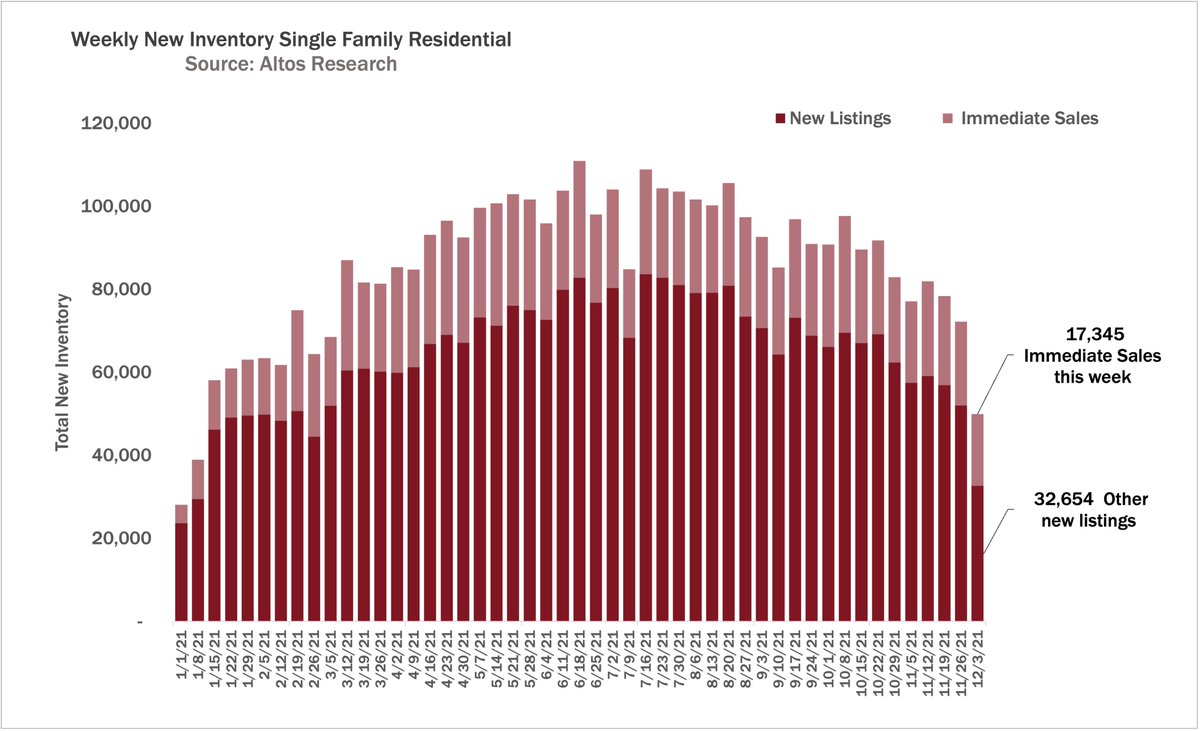

Buyers still gobbling up available homes as quickly as they can. 17,000 immediate sales last week.

The far right end bar in this chart shows our holiday. This week will bounce back a bit, but volumes mostly lower though New Years.

2/7

The far right end bar in this chart shows our holiday. This week will bounce back a bit, but volumes mostly lower though New Years.

2/7

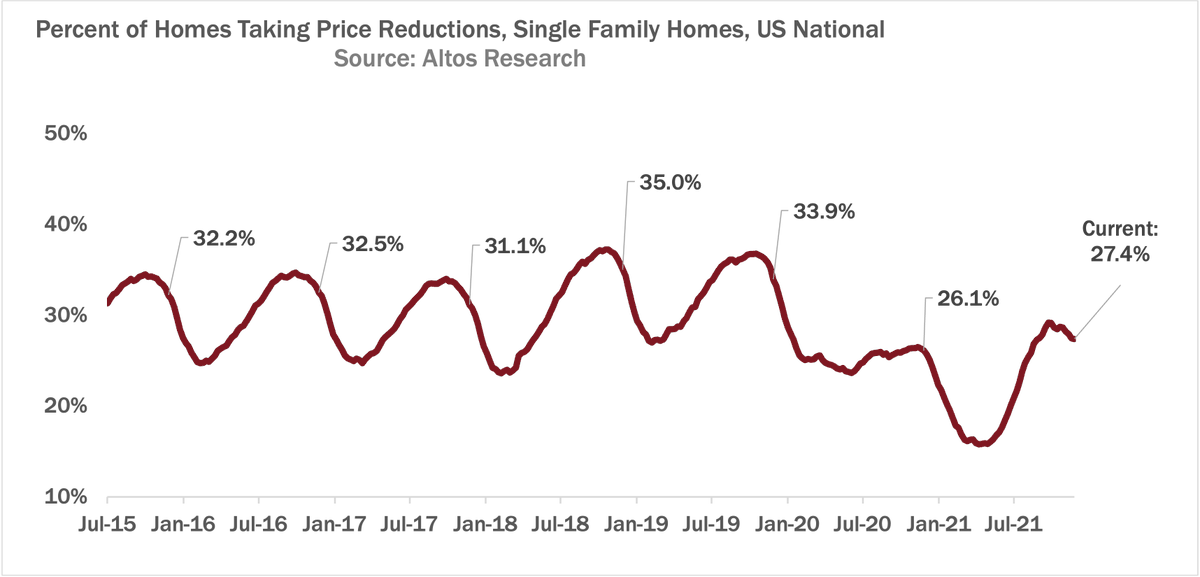

Price reductions are lower than normal because demand is not abating. Still only 27% of homes have had price reductions.

Tight supply / high demand dynamic appears to be with us until something major in the economy changes.

3/7

Tight supply / high demand dynamic appears to be with us until something major in the economy changes.

3/7

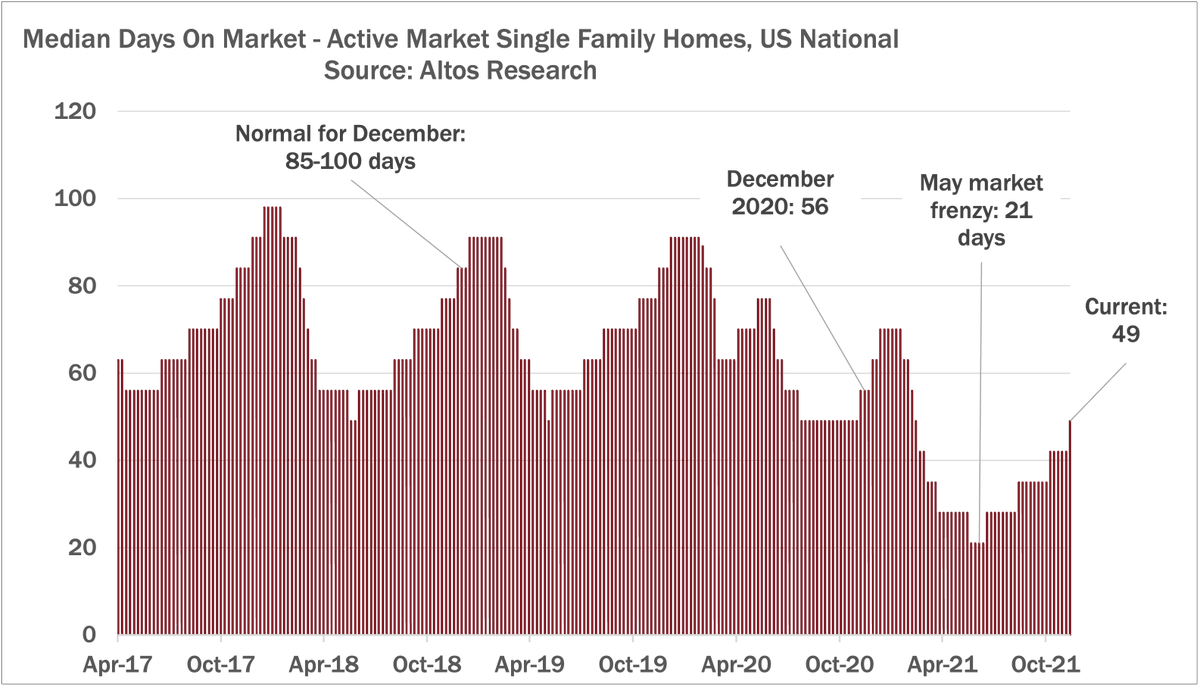

Market time up to just 49 days.

Normally this time of year homes sit for 85-100 days. Since DOM is so strongly seasonal, we can already see how 2022 is going to hit record lows (record fast time to sell) in Q2.

4/7

Normally this time of year homes sit for 85-100 days. Since DOM is so strongly seasonal, we can already see how 2022 is going to hit record lows (record fast time to sell) in Q2.

4/7

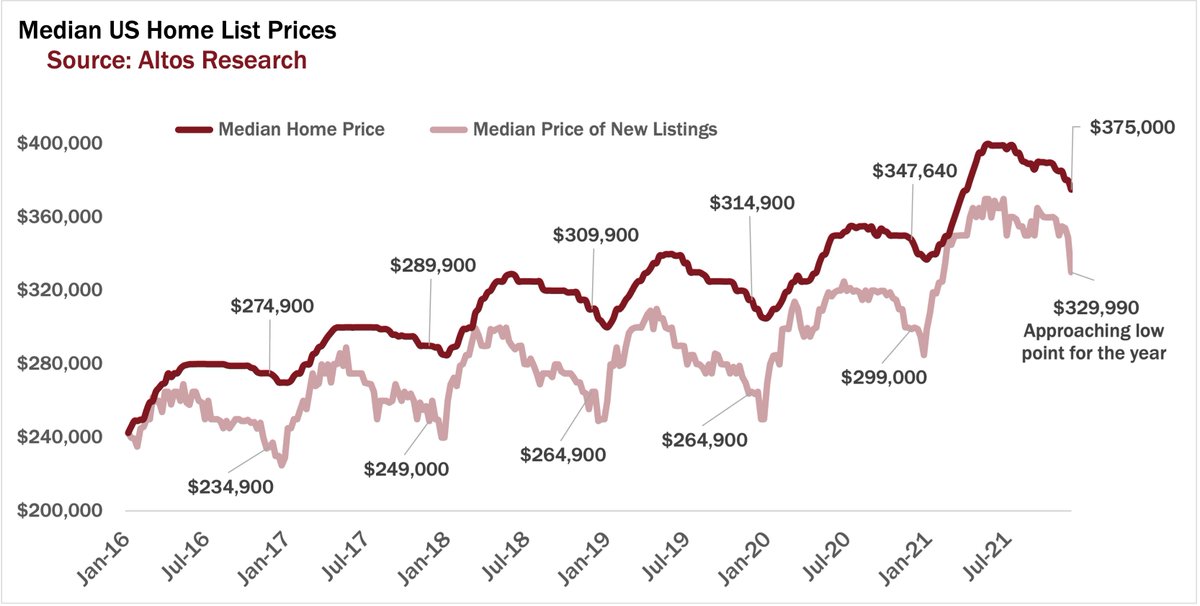

That brings us to prices: Median single family home price in the US dropped to $3750,000 post Thanksgiving.

Totally normal drop and it really highlights how unusual December last year was. One more price drop over Xmas to come.

5/7

Totally normal drop and it really highlights how unusual December last year was. One more price drop over Xmas to come.

5/7

Lots of data in this week's #altosresearch video:

2022 sure is shaping up to be a hot real estate market.

8 minutes, check it out:

6/7

2022 sure is shaping up to be a hot real estate market.

8 minutes, check it out:

6/7

Registration for our December webinar is open. We're going to look at impact potential mortgage rate changes, opportunity for first time buyers

If you need to understand what's likely to happen in the 2022 US real estate market, join us.

12/15 10AM PDT

bit.ly/altos-webinar-…

If you need to understand what's likely to happen in the 2022 US real estate market, join us.

12/15 10AM PDT

bit.ly/altos-webinar-…

If you prefer to read the details - these weekly reports are now available on the Altos blog.

blog.altosresearch.com/insights/2022-…

8/7

blog.altosresearch.com/insights/2022-…

8/7

• • •

Missing some Tweet in this thread? You can try to

force a refresh