*Immediate Sales* are dominating the US real estate market.

The team did a new analysis of Days on Market to yield some powerful insights.

Full weekly market data thread via @AltosResearch 👇👇

Also: webinar this week! Link to register follows.

🧵 1/6

The team did a new analysis of Days on Market to yield some powerful insights.

Full weekly market data thread via @AltosResearch 👇👇

Also: webinar this week! Link to register follows.

🧵 1/6

First prices:

Median home price hit $374,000 this week. Prices are, of course, surging each week and will continue through June at least.

Price of the newly listed cohort is showing reassuring signs of normal seasonality. Insane market not getting insanerer.

2/6

Median home price hit $374,000 this week. Prices are, of course, surging each week and will continue through June at least.

Price of the newly listed cohort is showing reassuring signs of normal seasonality. Insane market not getting insanerer.

2/6

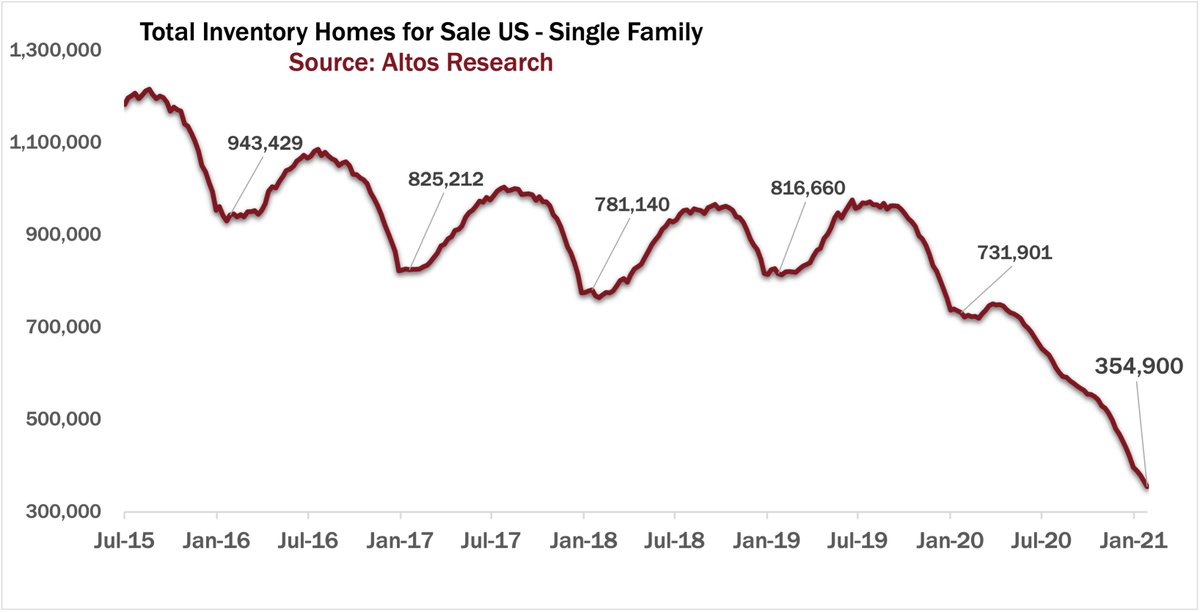

Total unsold inventory down to 310,000 single family homes this week. Ticking down a tad each week, not falling dramatically. A few more weeks before we hopefully see increase in this supply metric (🤞)

3/6

3/6

In addition to the active inventory, there were 27,000+ single family homes this week went into contract essentially "immediately".

List>Take Offers>Select>Contract process in hours or days.

If we include those that made it about one week, it's 64% of the market!

4/6

List>Take Offers>Select>Contract process in hours or days.

If we include those that made it about one week, it's 64% of the market!

4/6

For more commentary on Immediate Sales and the market this week, see this week's video from @AltosResearch

5/6

5/6

If you have the pleasure of working with very worried US home buyers and sellers right now, you should join us on the Thursday webinar. We'll do local data too.

6/6

bit.ly/apr21-altos-we…

6/6

bit.ly/apr21-altos-we…

• • •

Missing some Tweet in this thread? You can try to

force a refresh